- Office CMBS delinquency reached an all-time high of 12.34% in January 2026.

- Large single loans, including in New York City, heavily impacted rates.

- Most new office delinquencies are maturity defaults, not immediate cash flow failures.

- Distress remains concentrated in older, less competitive buildings.

Record Delinquency Signals Sector Stress

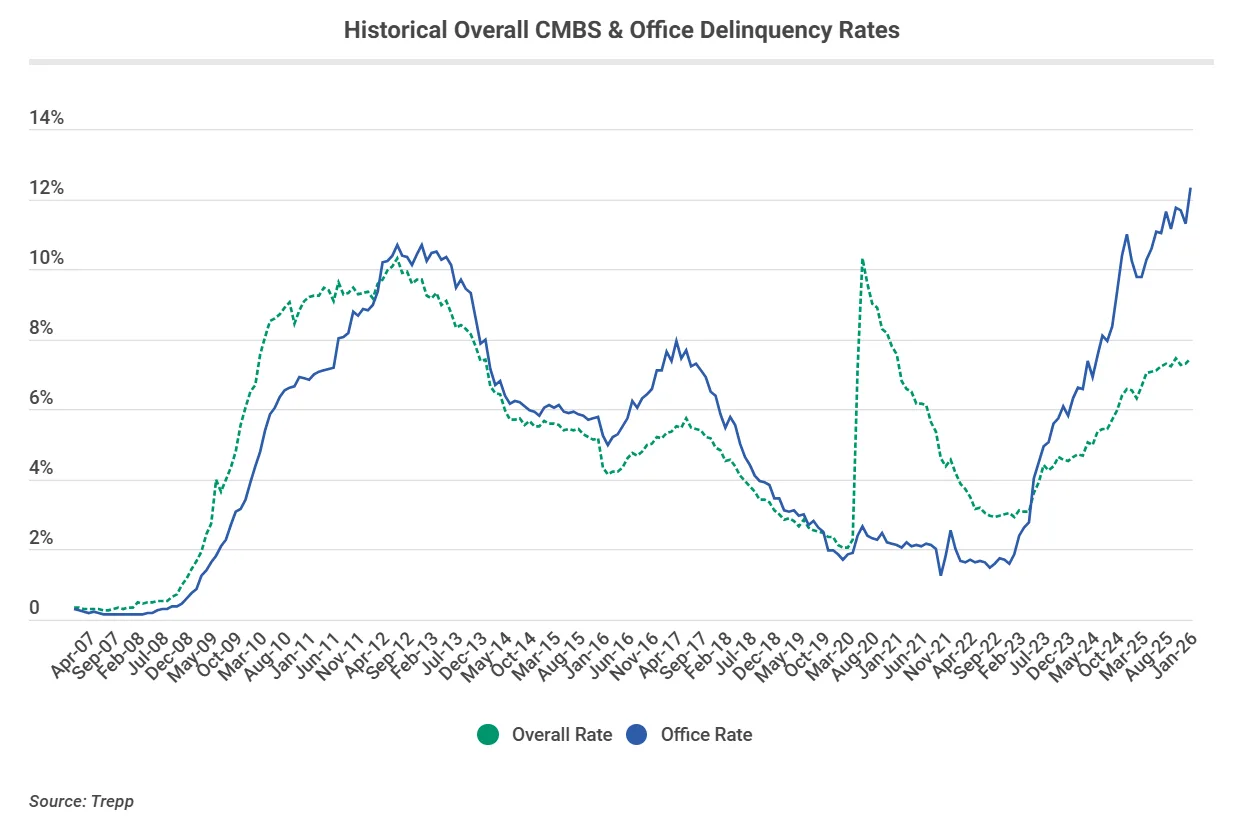

Office CMBS delinquency hit 12.34% in January 2026, exceeding past records and highlighting ongoing challenges for the office sector. According to Trepp, the record was influenced by a few large loans—such as Worldwide Plaza ($940M) and One New York Plaza ($835M)—moving to delinquency, signaling concentrated distress in key markets.

Structural Factors Behind Office Delinquency

The current surge in office delinquency is distinct from prior market cycles. Unlike cyclical downturns, distress now is driven by high interest rates, persistent weak leasing demand, and the adoption of hybrid work. Loans originated during the 2018-2021 period, when optimism was high and underwriting aggressive, are struggling amid a tougher refinancing environment. The rate moved from 1.60% in mid-2022 to over 12% by early 2026, underscoring deep structural change in the office sector. This pressure is also contributing to broader CMBS strain, with both office and multifamily delinquencies pushing overall distress levels higher in recent months.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

What the Numbers Really Mean

The record office delinquency rate does not signal an imminent wave of foreclosures or fire sales. Instead, it reflects mounting refinancing pressure across the sector. Many newly delinquent loans are maturity defaults. Borrowers cannot refinance at today’s higher rates, yet the properties still generate income. Resolution timelines in CMBS often stretch over a year, meaning office assets may stay in limbo for extended periods. Delinquency is also highly uneven: modern, amenitized buildings are faring better, while older properties hold more risk.

Sector Outlook Remains Challenging

Office delinquency rates are expected to remain elevated through 2026, potentially peaking in the 12% to 13% range. Continued maturities and refinancing challenges may keep upward pressure on distress. However, signs show price discovery is returning for higher-quality offices. Conversions in cities like New York also help ease long-term supply pressures. Investors and lenders should recognize that office delinquency reflects structural challenges. Still, outcomes will depend on each asset’s quality, not broad market statistics.