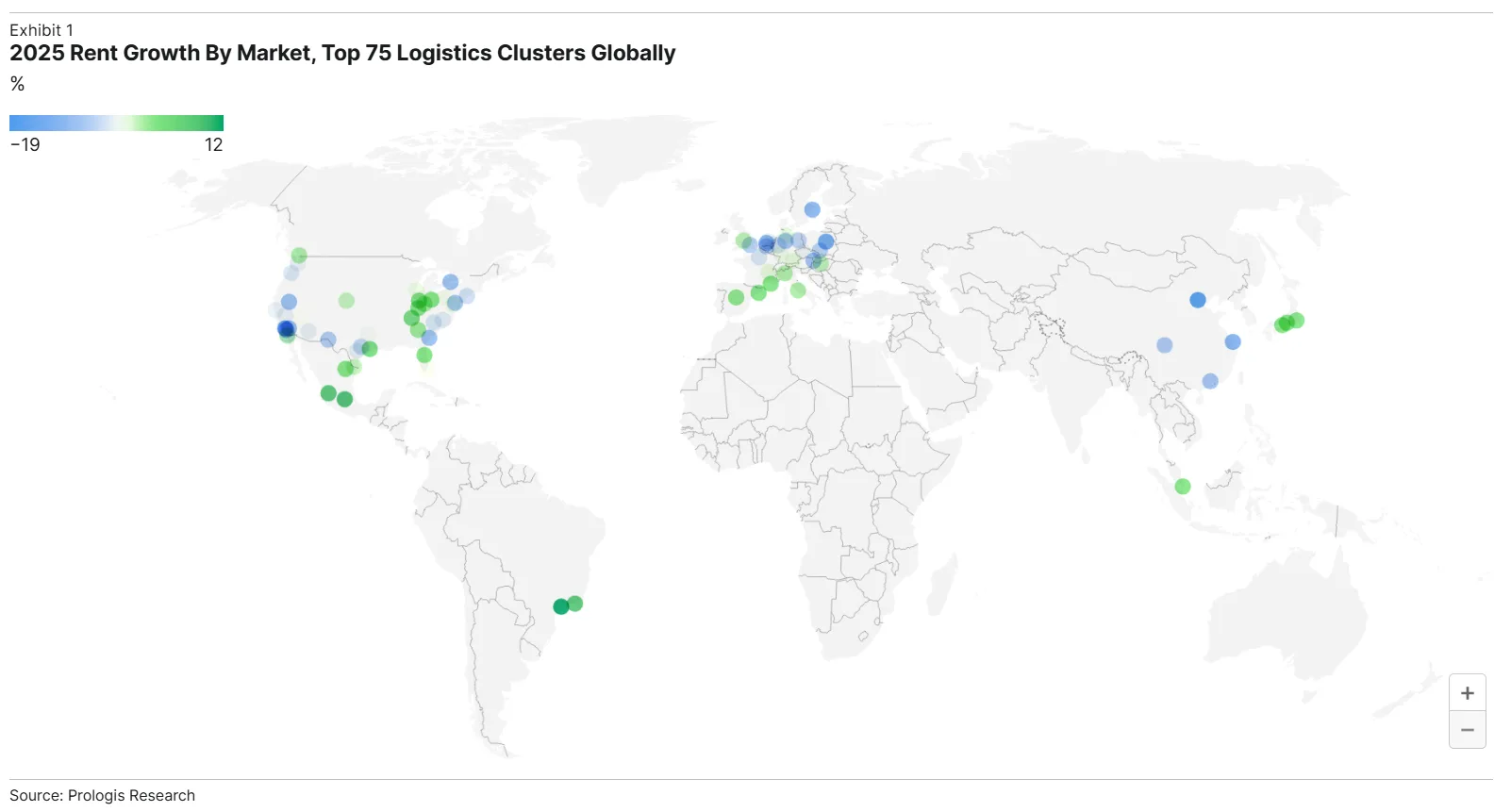

- Global logistics rents declined 3.7% in 2025, led by a 4.9% drop in US/Canada and 2.9% in Europe.

- Rent declines decelerated in the second half as occupiers resumed long-term planning.

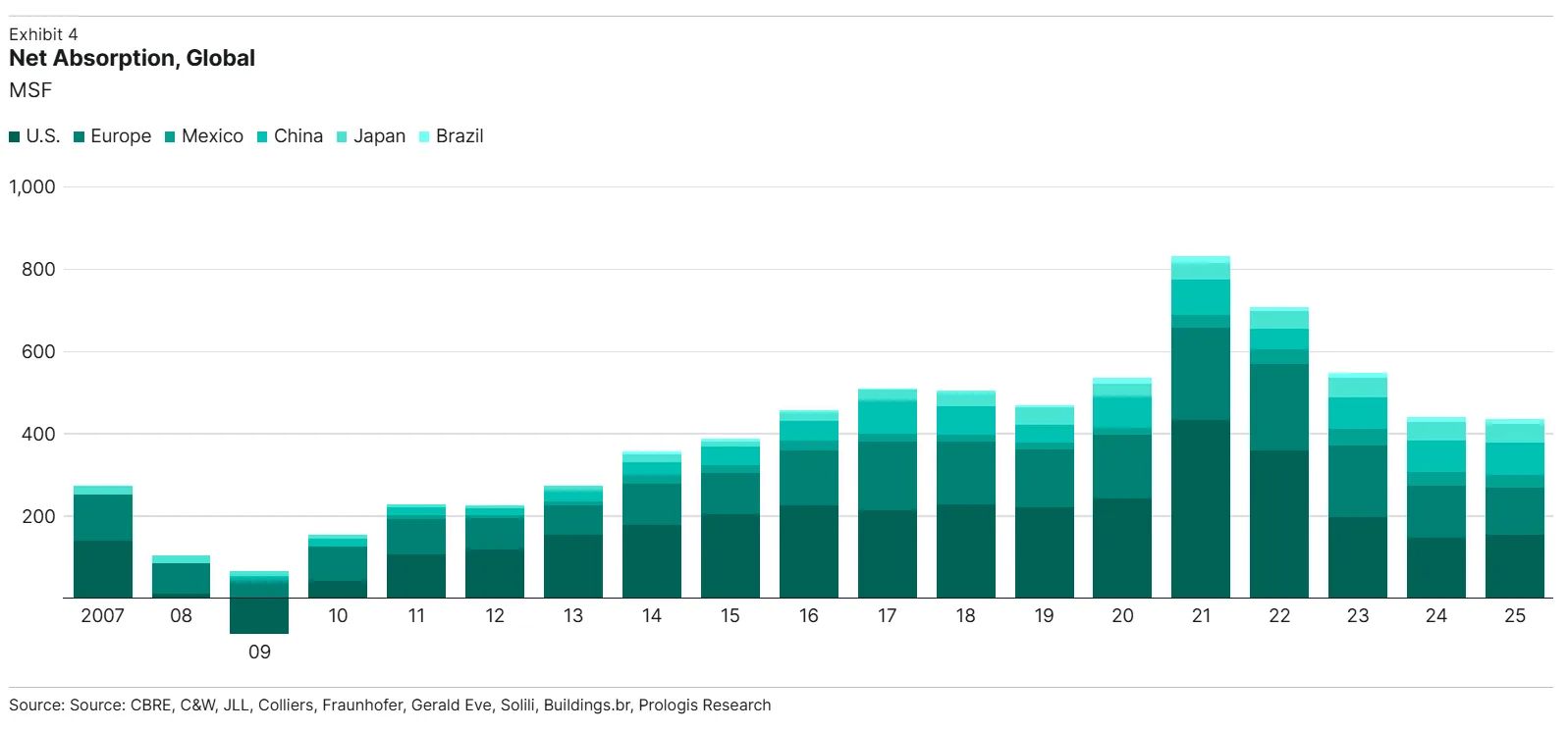

- New supply slowed sharply due to replacement-cost rents outpacing market rents by 20%.

- Prologis expects moderate logistics rent growth in 2026 as demand rebounds and supply tightens.

Early 2025 Weakness Shifts to Stabilization

Prolongis reports that in early 2025, economic uncertainty paused leasing activity and pushed logistics rents lower across global markets. Rents fell 2.3% in the first half, but sentiment improved, drawing large users and e-commerce operators back by Q3.

By year-end, rent declines eased to 1.4%, and 40% of markets posted flat or positive growth. As a result, stabilization spread across the global logistics landscape.

Cost Sensitivity and Supply Dynamics Define Market Activity

Logistics occupiers focused on lower-cost markets and submarkets amid elevated operating expenses. High capital and development costs meant that replacement-cost rents averaged 20% above market levels, constraining new speculative supply and reducing delivery pipelines worldwide.

This supply contraction set the stage for occupancy gains and potential rent growth into 2026, with the effects most pronounced in markets with lower labor and regulatory barriers.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Regional Performance Diverges

- United States: Rents fell 4.5% overall, with coastal markets down 7.6% and inland markets more resilient despite high vacancies.

- Europe: Landlords increased concessions, especially in high-operating-cost regions. Positive rent growth appeared in Southern Europe by year-end.

- Asia: China continued to correct with an 11.8% rent fall, while Japan saw steady 1.8% growth, especially in Inland Osaka.

- Latin America: Brazil led global rent growth at 11.2%. Mexico’s consumption-heavy markets posted strong gains, while manufacturing-led regions lagged.

2026 Outlook: Inflection Point Emerges

The logistics sector appears to be at a pivot point as supply constraints and steady consumption drive renewed demand. Prologis anticipates moderate logistics rent growth in 2026, with variability by region and property type. Recent rent resets in the US have already begun reshaping landlord and occupier expectations, reinforcing the view that the market correction is maturing rather than deepening. The rise in concessions, notably in Europe, has partially offset headline rent declines and reflects a changing balance of power between landlords and tenants.

Looking ahead, occupiers and investors are expected to focus on speed-to-market, total cost considerations, and larger, high-quality logistics facilities as the market transitions from correction to recovery.