- Build-to-rent (BTR) has grown into a mature asset class, making up 7% of single-family construction starts as of mid-2025, with 71,000 new units built in the previous year.

- President Trump has called for restrictions on institutional single-family rental purchases, casting uncertainty over how BTR will be regulated.

- BTR operators are targeting affordability-challenged renters, particularly aging millennials and empty nesters, offering a single-family lifestyle without the financial burden of ownership.

- Most new BTR developments are concentrated in the South, with 38,000 units under construction—more than the other US regions combined.

Build-to-Rent Matures

Once a niche idea in the early 2020s, build-to-rent housing has emerged as a major force within the US multifamily landscape, per Bisnow. Often comprising communities of 50 or more homes, BTR blends the scale of multifamily with the lifestyle of single-family housing—offering renters suburban-style living without a mortgage.

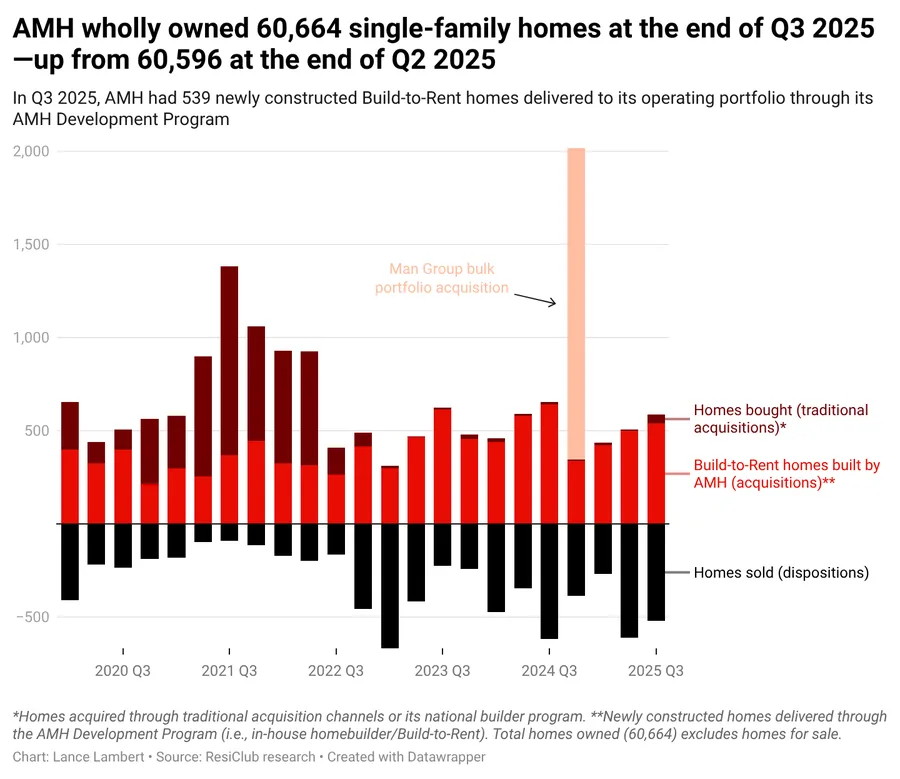

According to Arbor Realty Trust, BTR’s share of new single-family housing starts rose from 4% in the early 2020s to about 7% in 2025. In total, 71,000 BTR units were delivered across the US in the 12 months ending in June.

Some BTR operators are still refining their product mix. Most aim to offer a variety of housing types, from ranch-style homes to two- and three-story detached houses, all within the same community.

Political Pressure Mounts

The sector’s growth now faces new scrutiny from the White House. President Trump recently said he would push for a ban on large institutional investors buying single-family homes. He blamed them for making housing less affordable.

BTR wasn’t specifically mentioned, but the proposed restrictions raise questions about how the sector might be affected. The administration hasn’t clarified how the policies would work or whether build-to-rent—often backed by institutional capital—would fall under the proposed ban.

A Response to Housing Affordability

BTR is increasingly positioned as a solution to America’s affordability crisis. Rising mortgage rates and home prices have pushed many would-be buyers toward rental alternatives. In 2025, mortgage payments exceeded rental costs in all of the 50 largest US metros, and the share of first-time buyers fell to a record low of 21%.

“Build-to-rent communities are a way around the affordability crisis,” said Julie Workman, a real estate attorney at Saul Ewing. “People want the structure of a single-family home, but pricing doesn’t work.”

Redwood Living, one of the largest BTR operators, reports an average resident age of 51.5 years, with 70% being empty nesters. Others, like Core Spaces, see strong demand from young professionals and families.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Geographic and Investment Trends

The South leads the country in BTR construction, with over 38,000 units underway as of September 2025. This total exceeds the combined number of units under construction in the West, Midwest, and Northeast. Developers continue expanding pipelines nationwide, with tens of thousands of build-to-rent homes actively rising across multiple regions.

Investors remain focused on the sector. Family offices, 1031 exchange buyers, and multifamily firms continue to back new projects. Despite challenges, capital keeps flowing into the space. However, rising rates, slowing rent growth, and localized oversupply are making the current climate more complex. Nationwide rent growth in single-family rentals slowed to 3.3% year-over-year through October.

Operators like Redwood maintain a long-term ownership model and haven’t sold any assets in 34 years. Others, like Core Spaces, design flexible communities, some platted for future home-by-home sales as an optional exit strategy.

Looking Ahead

Despite market headwinds and political scrutiny, BTR developers remain confident. Operators expect rent growth and investment to rebound in 12–18 months as oversupply eases and demand stays strong.

“We’re not trying to wait for the all-clear sign,” said Core Spaces President Dan Goldberg. “There’s still a lot of uncapped demand.”