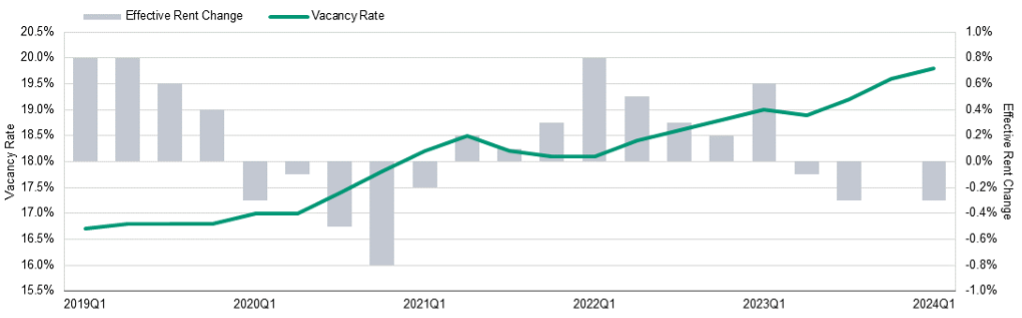

- U.S. office vacancy rates reached a new high of 19.8% in Q1 2024, according to a preliminary report by Moody’s Analytics.

- This increase continues a worrying trend for the office sector, surpassing previous peaks observed in 1986 and 1991.

- Despite these challenges, Moody’s notes some positive economic indicators that could help stabilize the commercial real estate marke.

The office market in the US has hit a new record in vacancy rates, reaching 19.8% in the first quarter of 2024, as reported by Moody’s Analytics.

This marks a slight increase from the 19.6% vacancy rate observed in the last quarter of 2023.

Figure 1: Office Rent and Vacancy Trend: Space Market Stress Continued to Level Up

The rise in vacancies highlights the persistent challenges faced by the office real estate market following the pandemic, particularly in the wake of changing work models and the economic pressures from the Federal Reserve’s interest rate hikes.

The shift towards hybrid work has significantly impacted demand for office space, with many tenants opting to downsize. This trend, along with economic pressures, has pushed vacancy rates to surpass historic highs. Moody’s notes that while there are early signs of a stable quarter for commercial real estate, the office sector is not out of the woods yet.

“The office stress isn’t quite done yet,” Thomas LaSalvia, Moody’s head of commercial real estate economics and an author of the report, said in an interview Tuesday. But, recent positive economic indicators are helping to prevent a perfect storm in the office sector, he said.

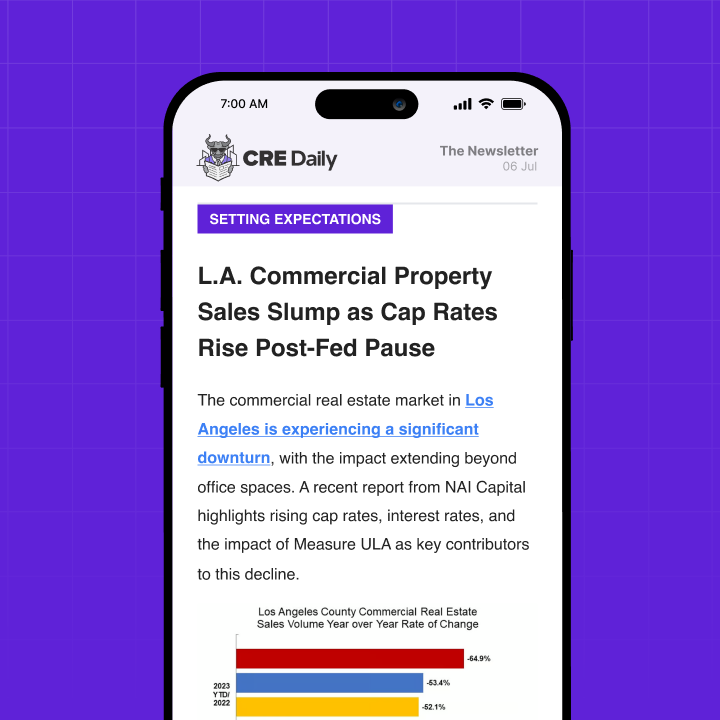

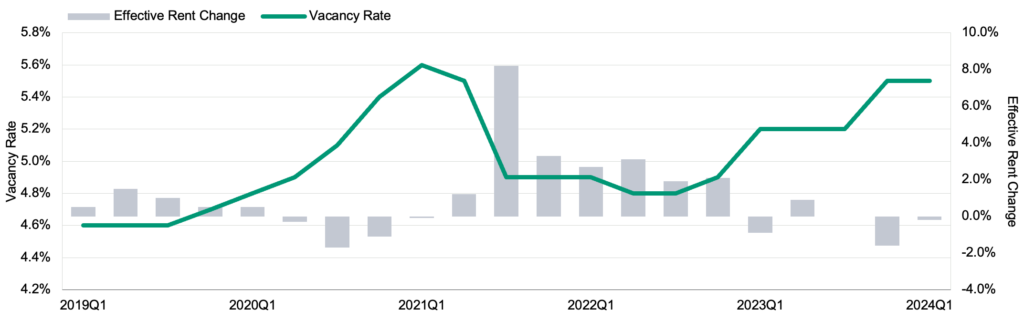

Despite the gloomy outlook for the office sector, Moody’s report points to positive signals in other areas of the commercial real estate market. The multifamily sector, for example, is beginning to see relief from an excess supply issue, indicating a potential stabilization.

Figure 2: Apartment Performance Stayed Mostly Flat in Q1

Similarly, the retail sector has maintained stable vacancy rates, helped by store openings by companies like Macy’s.