NYC Landlords Warn of Affordable Housing Defaults Without $1B Lifeline

Landlords of subsidized housing in NYC warn that without $1B in city aid, rising costs and a potential rent freeze could trigger widespread defaults.

Good morning. Landlords of subsidized housing in NYC warn that without $1B in city aid, rising costs and a potential rent freeze could trigger widespread defaults.

Bad diligence kills good deals. That’s why leading CRE teams rely on Blew & Associates, P.A. for nationwide surveying, environmental, and property assessments—so surprises don’t show up at closing.

🎙️This Week No Cap: Jon Schultz, Co-Founder and Managing Principal of Onyx Equities, sits down with Jack and Alex to break down the art of value creation, the future of office, and why adaptability is real estate’s most underrated skill.

CRE Trivia 🧠

What major U.S. port is seeing warehouse demand surge again as imports hit their highest level in nearly two years?

(Answer at the bottom of the newsletter)

Market Snapshot

|

|

||||

|

|

*Data as of 11/28/2025 market close.

Crisis in the Making

NYC Affordable Housing Faces $1B Default Threat

As costs soar and rents remain capped, landlords of New York City's affordable housing warn that without $1 billion in aid, a wave of defaults may be unavoidable.

Mounting pressure: Tens of thousands of New York City’s 213,000 affordable housing units are in distress, per the New York Housing Conference. These units—tied to tenant incomes and regulated by the Rent Guidelines Board—face soaring costs in insurance, utilities, and maintenance that outpace rent growth. In eight of the past 12 years, rent hikes were under 2%, while insurance costs have spiked an average of 25% annually.

What’s at risk? Mayor-elect Zohran Mamdani’s plan to freeze rents across 1 million rent-stabilized apartments could deepen the crisis. While private landlords can offset rent-stabilized losses with market-rate units, about 20% of rent-stabilized homes—those publicly financed—have no such cushion. Landlords are already cutting back on maintenance, raising concerns about deteriorating living conditions.

The bigger picture: Defaults could ripple through the NYC Housing Development Corporation, which relies on loan repayments from affordable housing owners to meet bond obligations. Disruption here could stall future affordable housing efforts and raise borrowing costs across the system.

One possible fix: The Housing Conference urges the city to allocate $1B in 2026 for debt restructuring and calls for relief measures: backing a captive insurance model, expanding rental assistance, freezing water rates, and allowing rent resets on long-vacant units. Most fully affordable buildings are already exempt from property taxes, limiting flexibility there.

➥ THE TAKEAWAY

Looking ahead: As New York enters a new mayoral era, the city must confront whether its affordable housing model can survive without structural reform. Stopgap funding may buy time, but long-term stability will require rethinking how affordability is financed, regulated, and sustained.

TOGETHER WITH BLEW

The nation’s leading provider of ALTA Surveys

With the 2026 ALTA/NSPS standards update approaching, we will ensure your surveys meet the latest requirements and closing deadlines through our unmatched in-house network of professionals.

Our integrated approach provides clients with reliable due diligence support across every asset type and market.

Accurate, consistent, and transaction-ready solutions every time, Blew is your one-stop shop for CRE transaction services nationwide.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

-

Multifamily insurance rates just dropped: Strategic Insurance Group’s 2026 schedule is live. Get an instant quote now to lock in reduced pricing before 12/15 deadline. Submission window closes soon. (sponsored)

-

Library landfight: A blocked land transfer for Donald Trump’s proposed presidential library in Downtown Miami is getting a second vote after a lawsuit forced Miami Dade College to redo the process with public input.

-

The investment arena: Join the Deal Room, a live pitch event where operators and panelists present deals so you can compare opportunities, ask questions, and get facts fast. (sponsored)

-

Bribery blitz: The DOJ has convicted 70 NYCHA employees in a sweeping bribery scheme involving $2.1M in kickbacks for $15M in no-bid repair contracts across nearly a third of NYC’s public housing developments.

-

Down the drain: Blackstone, Ares, and Fortress are poised to lose a combined $1.4B after their high-stakes bet on a portable toilet company fell apart amid rising rates and stalled construction demand.

-

Buying spree: Spanish billionaire Amancio Ortega is on a $1B+ real estate shopping spree in Miami, snapping up trophy office, multifamily, and retail properties—underscoring the region’s rise as a magnet for global investors.

🏘️ MULTIFAMILY

-

Mixed momentum: Multifamily REITs reported steady 3Q 2025 apartment demand and record-high retention, but persistent rent softness, cost pressures, and regional supply challenges left half of the sector lowering their full-year earnings outlook.

-

Fast-tracked: Gavin Newsom is accelerating the conversion of six surplus state-owned properties into affordable housing developments—adding at least 850 units with a streamlined approval process.

-

Family feudclosure: Peter Hungerford and Arthur Haruvi face foreclosure on $173M in loans across 31 NYC buildings, as refinancing efforts stall amid a revived family lawsuit.

🏭 Industrial

-

All in on AI: Foxconn is investing $569M to expand its Wisconsin factory and ramp up U.S. AI hardware production following a collaboration with OpenAI, aiming to meet surging demand for data server infrastructure.

-

Orders up: U.S. industrial new orders rose 2% year-over-year in August 2025, led by a 12.3% jump in transportation equipment, signaling steady but uneven growth across manufacturing sectors.

-

Locked in: Global shipping firm DSV has leased the entire 219K SF Crossroads Industrial building in Stafford, VA, fueling landlord Matan Companies' next planned 250K SF industrial development nearby.

-

Data development: Equinix is investing $836M in its ninth Dallas-Fort Worth data center, a 4-story, 372K SF facility set to break ground in early 2026, as demand for colocation and AI-ready infrastructure surges.

🏬 RETAIL

-

Click frenzy: Black Friday 2025 set a new record for U.S. online sales, hitting $8.6B by early evening—a 9.4% jump from last year—as shoppers favored digital deals over in-store crowds amid economic uncertainty.

-

More chicken, please: Raising Cane’s will open 14 new U.S. locations in December—bringing its total to over 950—as it accelerates nationwide expansion amid a sizzling chicken-focused fast-food market.

-

Mall makeover: Southern California mall owners are driving a retail reinvention, pouring nine-figure investments into redevelopments as evolving consumer habits breathe new life into once-declining centers.

🏢 OFFICE

-

Boardroom battle: Struggling office REIT Orion Properties has rejected board nominations from major shareholder Kawa Capital, escalating tensions after spurning its $141M takeover offer.

-

Canary commitment: JPMorganChase is set to build a 3M SF headquarters at London’s Canary Wharf, marking the UK’s largest office project and a major vote of confidence in the capital’s role as a global financial hub.

-

Misleading: A shareholder lawsuit accuses Alexandria Real Estate Equities of overstating leasing prospects and tenant demand, particularly for a struggling Long Island City property, ahead of a steep Q3 earnings miss.

🏨 HOSPITALITY

-

Offloaded: Pebblebrook sold its West Hollywood hotel for $44M as part of a broader strategy to shed assets and repurchase stock, while LA’s office and hotel sectors continue to face mounting distress.

CYBER MONDAY

CRE Daily’s Holiday Merch Collection is Live

CRE Daily’s Winter Collection is officially live — built for holiday parties, office gift swaps, and end-of-year client drops.

For Black Friday only, take 20% OFF your order.

Use code SHOPCRE20 at checkout.

|

|

|

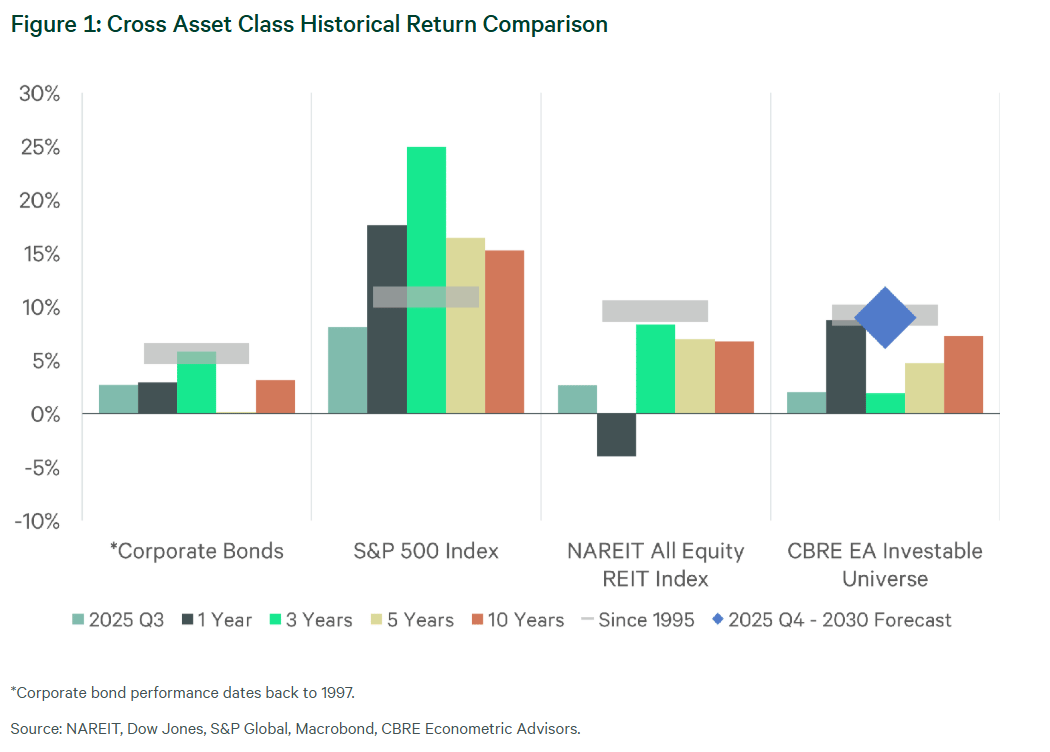

📈 CHART OF THE DAY

Private real estate returns, long lagging behind public equities, are now rebounding with CBRE projecting a 9% annual average through 2030.

CRE Trivia (Answer)🧠

The Port of Los Angeles reported its strongest import month since 2022, driving renewed demand for nearby industrial space as cargo volume jumped 19% year-over-year. (Source: Port of Los Angeles October 2025 Cargo Report)

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |