CBRE Profit Drops 56% Amid Ongoing Real Estate Challenges

Plus: This week’s Thesis Driven explores the growing US construction crisis and possible solutions.

Together with

Good morning. CBRE Group’s profits plunged by over 55% due to the struggling CRE market. Meanwhile, the US faces a significant shortage of skilled talent in the construction sector, driving up costs and worsening the problem of rising interest rates.

Today’s issue is sponsored by Paramount Property Tax Appeal—take the first step towards lower property tax payments.

👋 First time reading? Sign up.

🎁 Want free merch? Share this.

EARNINGS REPORT

CBRE Profit Drops 56% Amid Ongoing Real Estate Challenges

Source: (The Dallas Morning News)

CBRE Group Inc., the world’s largest name in commercial property brokerage, is taking measures to curtail its expenses in response to persisting real estate market challenges, marking a 56% tumble in profits in Q3.

Revenue decline: Surging interest rates and prevailing economic doubts are hampering commercial property transactions. CBRE has identified potential cost savings of $150 million in the wake of a steep 55.6% quarterly profit drop. Despite a surprising revenue surge of 4.5%, CBRE witnessed a 4.2% year-over-year quarterly revenue decrease, settling at $4.40B. The hesitancy in offloading development assets due to market uncertainties further weighed down revenues.

Source: CBRE

Adapting to challenges: CEO Bob Sulentic pointed out the difficulties in commercial real estate from rising interest rates and reduced leasing activities, affecting the projected recovery. While sales and financing decelerated, CBRE’s global workplace services expanded. The company has allocated $370 million for co-investments and development, with a keen interest in land related to industrial and multifamily sectors due to their potential profit margins.

➥ THE TAKEAWAY

Revised outlook: Updated Forecast: CBRE now predicts the CRE industry’s rebound in late 2024 or 2025. They anticipate a gradual decrease in property prices, with transaction momentum and investor confidence resurging once rates stabilize and credit accessibility improves. Consequently, CBRE’s 2023 earnings are expected to decrease by over 30%. The firm is actively considering M&A prospects while also reducing expenses.

SPONSORED BY PPTA

Slash Your Property Taxes! Deadline Nov 30th for California.

Attention California commercial property owners. Feel like you’re overpaying on property taxes? With the deadline for most California counties approaching on November 30th, Paramount Property Tax Appeal specializes in helping businesses like yours.

Secure a FREE high-level assessment to discover potential savings on your commercial property taxes. Don’t let excessive taxes affect your bottom line.

THESIS-DRIVEN INSIGHT

America’s Construction Labor Crisis, Explained

The US construction sector grapples with a severe talent gap, escalating costs, and compounding interest rate issues. A projected 546K additional workers are needed in 2023, excluding maintenance roles. With a quarter of workers over 55, the crisis looms larger.

This week’s Thesis Driven delves into this shortage and potential remedies.

Demand-Side Solutions

The construction worker shortage can be tackled from the demand side (decreasing the need for construction workers) or the supply side (increasing the number of workers).

First, we address the tech solutions taking on the demand side:

-

New Construction Methodologies: Modular construction and 3D printing could reduce the need for skilled labor. Automation in manufacturing has led to an 8x productivity increase since 1947, while construction remains stagnant. Companies like ICON and Cuby are spearheading innovations like robotic 3D printing, aiming to automate up to 90% of construction tasks currently done manually.

-

Workflow and Management Tools: New entrants Bridgit and HappyCo are building software that increases workforce utilization and monitoring, making existing construction teams more productive. Yet, the construction sector lags in technology adoption and spends less on tech as a percentage of revenue compared to other sectors.

Supply-Side Solutions

-

Immigration: The U.S. is the most preferred migration destination globally, making it a potential reservoir for skilled labor. Canada’s Express Entry system, for instance, saw a 32% increase in invitations for Federal Skilled Trades candidates from 2019 to 2020. But immigration reform is politically challenging, making this an unlikely short-term solution.

-

Apprenticeship Programs: Registered construction apprenticeships in the U.S. have increased by 60% from 2013 to 2022, according to the U.S. Department of Labor. The Infrastructure Investment and Jobs Act of 2021 supports this with grants for pre-apprenticeship programs.

-

Education: While vocational school enrollment has grown faster than that of traditional colleges and universities over the past few years, there has been little innovation or new entrants in the trade education segment.

-

Skilled Labor’s Marketing Problem: Young people generally aren’t interested in skilled trades despite promises of rising wages and little to no student debt. A YouGov poll showed that “professional streamer,” “e-sports star,” and “activist” ranked higher among U.S. teens’ career aspirations than any skilled trade.

➥ THE TAKEAWAY

Zoom out: Both demand-side and supply-side approaches are essential to address the skilled labor shortage. New construction methodologies and workforce management tools can optimize existing resources. Simultaneously, growth in apprenticeship programs and vocational education can boost the supply of skilled construction labor.

You can read more about the innovators addressing the construction worker shortage on Thesis Driven here.

NEED TO KNOW

-

Accelerated Growth: The US economy grew faster than expected in Q3, with GDP rising at an annualized pace of 4.9% despite headwinds.

-

Regional revolution: Changes in Amazon’s (AMZN) distribution network boosted Q3 profit by cutting costs and delivery times, leading to a 13% increase in sales to over $143B.

-

Rental Riddle: Invitation Homes (INVH), the largest owner of single-family rentals in the US, is struggling to find properties to buy and is turning to homebuilders for help.

-

Settlement Set: DBRS Morningstar, a financial data firm, has agreed to pay an $8M settlement with the SEC over alleged improprieties in its assessment of CMBS loans.

-

Hilton’s Luxurious Vision: Hilton (HLT) teases a new luxury lifestyle brand on its latest earnings call, with strong RevPAR growth and a record development pipeline.

-

Debt Dilemma: New York Community Bank (NYCB) reported a significant increase in bad debts, mostly from office, as charge-offs rose to $26M in Q3.

-

Dallas Default: An NY developer faces trouble at a 1 MSF office complex in Dallas, with debt transferred to special servicing due to imminent monetary default.

-

Moving with the money: Saudi Arabia is maintaining its deadline of Jan. 1st, 2024, for foreign companies to establish regional HQs in the kingdom or risk losing government contracts.

-

Silverstein succession: Larry Silverstein replaces longtime CEO Marty Burger with daughter Lisa, as Silverstein Properties focuses on core business.

-

Foreclosure fallout: Autotrader (ATDRY) vacated its HQ at 3003 Perimeter Summit in Atlanta’s Central Perimeter, which was taken over by Wells Fargo (WFC) in foreclosure.

-

Miami housing hype: Miami’s housing market has become the most overvalued in the US and ranks among the top three globally, with home prices doubling and rising 6% YoY.

-

Breaking bridges: Bridge and event-driven lending are on the rise due to conventional lenders being less involved.

-

Navigating retail: Retail availability in the US fell to an 18-year low of 4.8% in Q3, limiting expansion opportunities for retailers.

TOP 10 HEADLINES OF THE WEEK

-

Reading between the numbers: The index numbers in this article reflect changes in apartment markets based on surveys of NMHC members.

-

Blackstone’s bold strategy: Blackstone (BX), the world’s largest asset manager, plans to focus on alternative assets for future investments.

-

Storage sector stumbles: Softening demand, mirroring migration and home sales trends, leads to negative rent growth in self-storage.

-

Winter freeze: Apartment rents have fallen for 5 straight months. Median asking rents in the 50 largest metros dropped to $1,747, down $29 from July 2022 peak, says Realtor.com.

-

Numbers matter: Analyzing property performance is tricky, which is why NOI is key for informed decisions. It reveals bad investments, default risks, and opportunities.

-

Tech hubs take center stage: The Biden administration designates 31 communities as regional tech hubs, offering up to $75M in federal grants to spur economic growth in key industries.

-

Nation of renters: Since 2018, 1.2M new rental units have emerged in the top zip codes across the country’s 50 biggest metros, making urban living more accessible to many.

-

Missing faces: New York magazine’s list of the “50 most powerful New Yorkers” excludes real estate leaders like Bill Rudin and Scott Rechler.

-

Pickleball paradise: Former grocery store in Plano transformed into Texas’ biggest pickleball facility, with 15 indoor courts, opening in January.

-

The plot thickens: NYC’s biggest office landlord just saw its main man, Andrew Mathias, step down. So what exactly is going on at SL Green (SLG)?

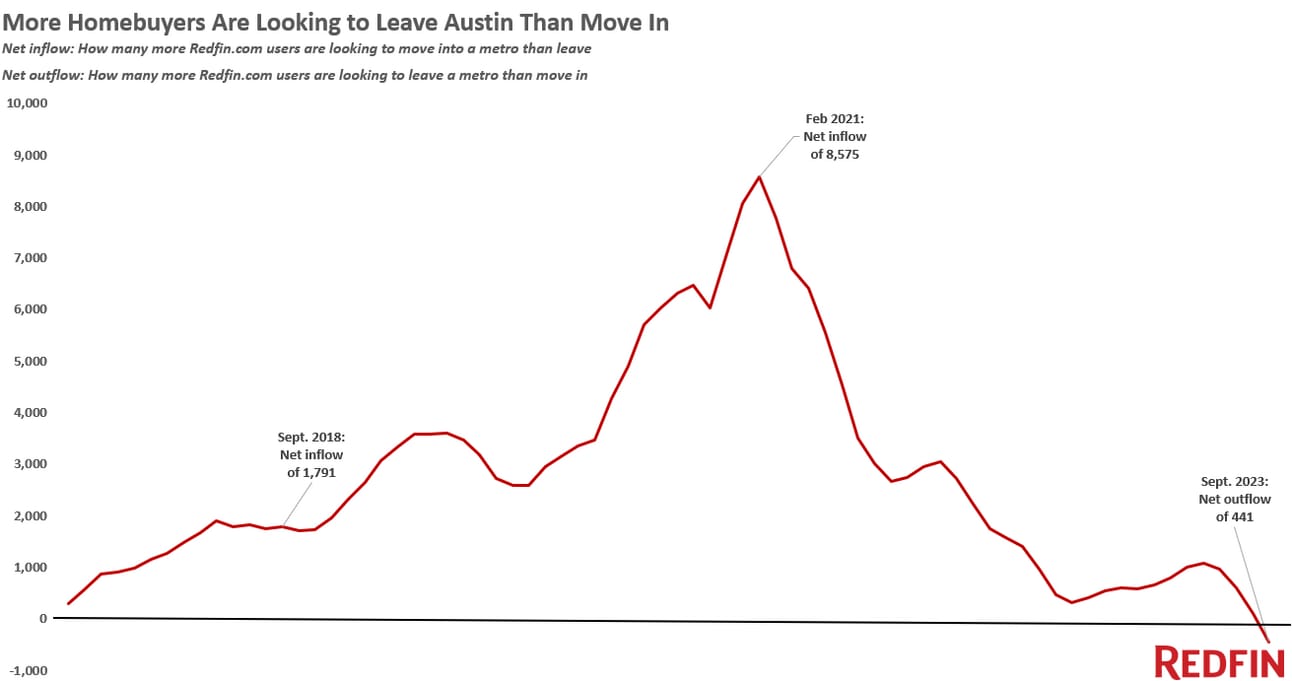

📈 CHART OF THE DAY

For the first time on record, Austin, TX saw more homebuyers leaving than arriving during the third quarter, indicating no net inflow into the Texas capital.

What did you think of today’s newsletter? |