- REITs have lagged the broader market, but their discounted valuations now appeal to value-focused investors.

- Though their diversification benefits have diminished, REITs still provide access to income and real assets without direct property ownership.

- Structural risks remain, but select REITs tied to technology and healthcare offer long-term growth potential.

A Sector Left Behind

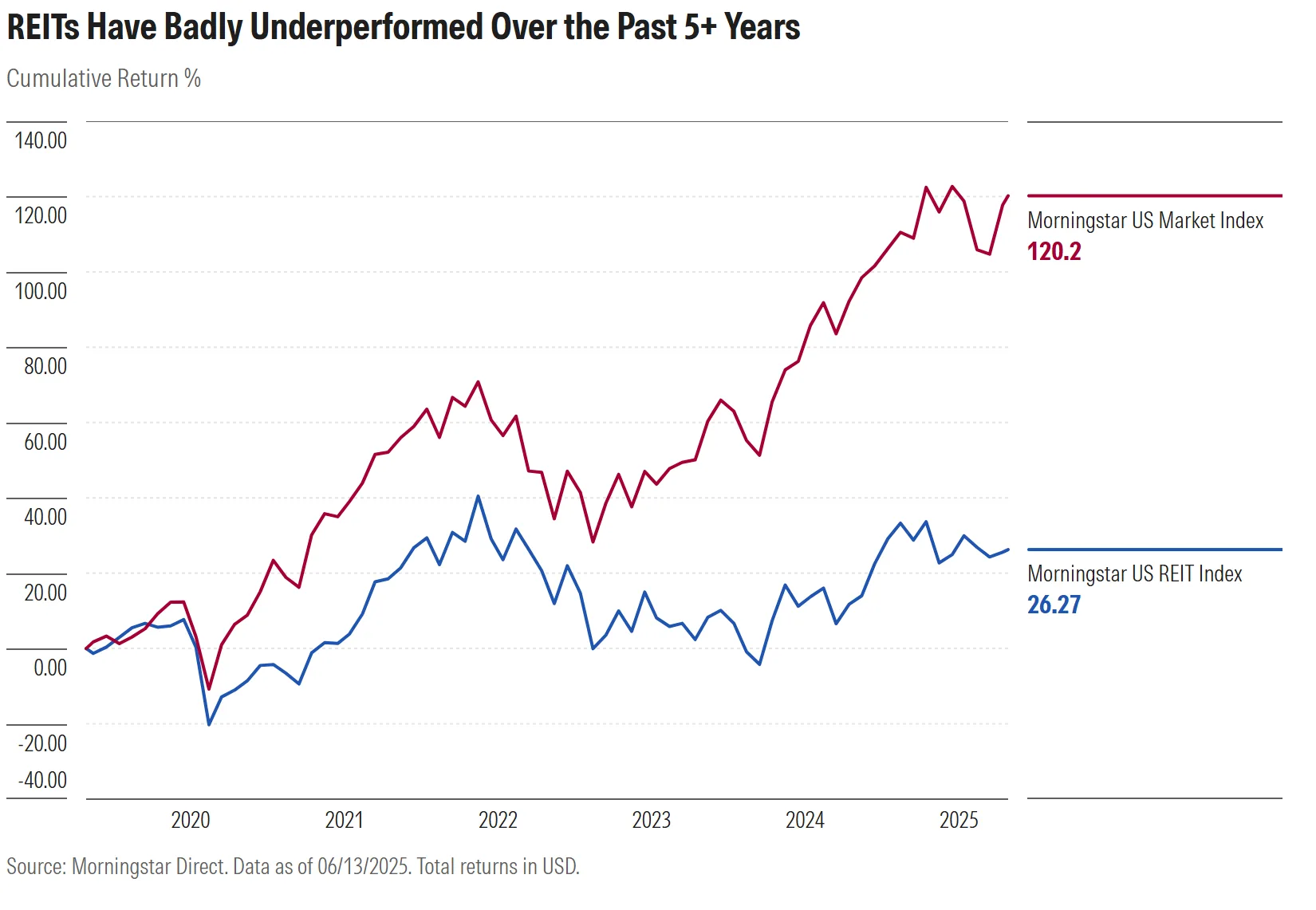

According to Morningstar, over the past five years, real estate has performed worse than any other major sector. US REITs have struggled with high interest rates, remote work, and e-commerce growth. Investors have responded by pulling capital from REIT mutual funds and ETFs. But this negative sentiment could create opportunity. Value investors often find the best returns in beaten-down sectors.

Rising Rates Create Headwinds—and Opportunity

REITs have suffered as bond yields rose. With borrowing costs higher, it’s harder for REITs to grow through acquisitions. At the end of May, the Morningstar US REIT Index showed a 3.8% dividend yield. That’s higher than the broad US equity market’s 1.3%, but still lower than the 4.7% yield from the Morningstar US Core Bond Index.

REIT analyst Kevin Brown warned in 2022 that interest rate hikes would hurt REIT performance. He pointed to two main issues: higher bond yields offer strong competition, and borrowing becomes more expensive. Recent performance trends confirm his analysis. Yet now, many REITs trade at discounts to their intrinsic values, presenting possible upside for value investors seeking underpriced assets.

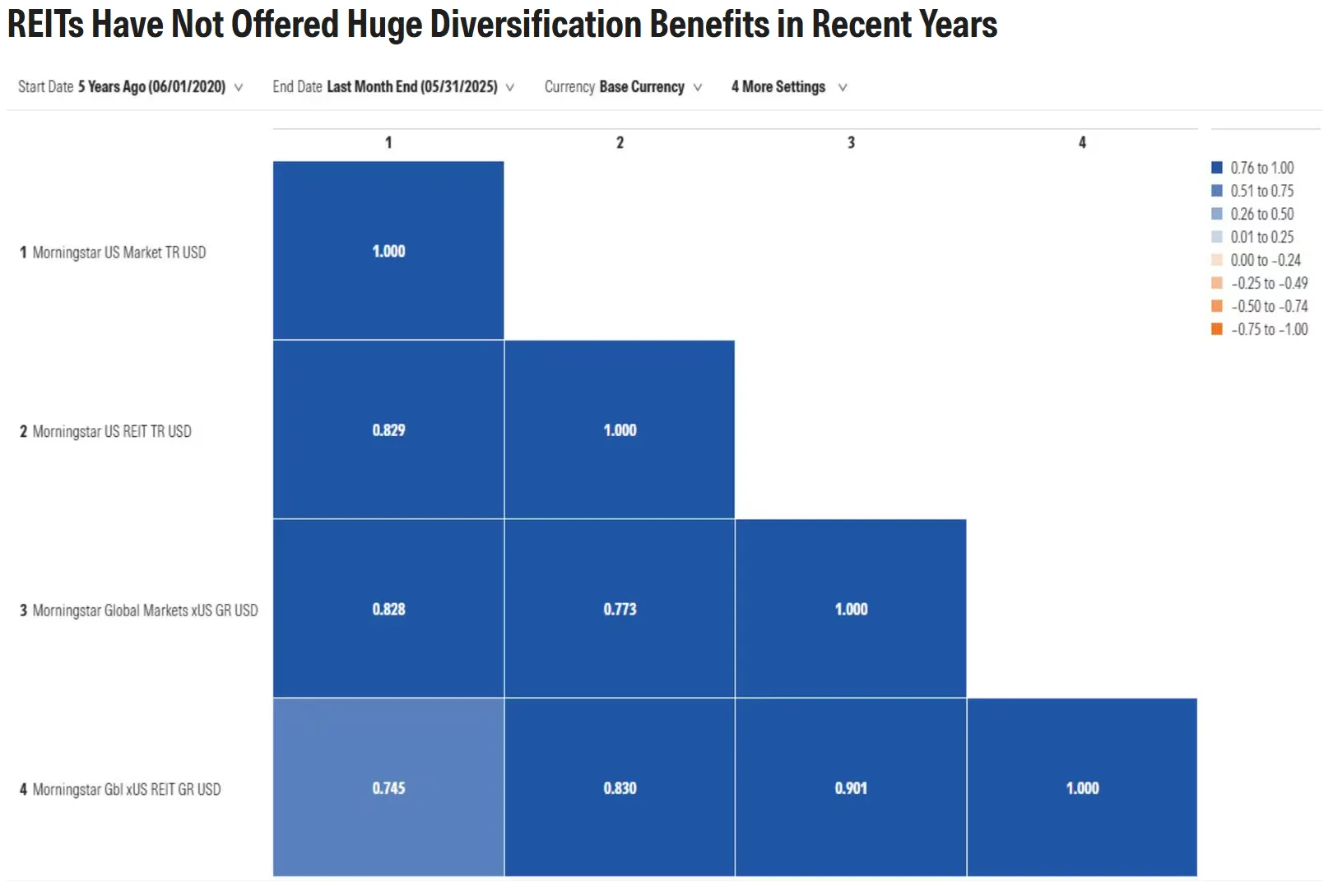

Diversification Benefits Have Faded

REITs once offered strong diversification, but that’s no longer the case. Over the past five years, their correlation with the broad market reached 0.83. In contrast, the US energy sector had a lower correlation of 0.42 during the same period.

Despite this, REITs still provide access to a wide range of real estate. A typical REIT owns many properties across different sectors and geographies, spreading out risk. Investors can gain exposure to residential, office, retail, industrial, healthcare, and tech infrastructure without the burdens of direct property ownership.

Not All REITs Face the Same Risks

The pandemic reshaped real estate demand. Remote work reduced the need for office space. E-commerce pressured traditional retail. Home-sharing platforms affected hotels. But not every REIT suffers from these trends.

Some REITs stand to benefit from long-term shifts:

- American Tower (AMT) owns cell towers needed for 5G and mobile data.

- Digital Realty (DLR) runs data centers in high demand from AI and cloud computing.

- Healthpeak Properties (DOC) focuses on medical facilities that serve aging populations.

Other niche REITs, like Americold Realty Trust (COLD), manage cold-storage warehouses essential for the food supply chain. International players like Mitsui Fudosan (8801.T) also offer real estate exposure with geographic diversification.

What Investors Should Know

REITs won’t appeal to every investor. Their yields no longer beat bonds, and some sectors face real challenges. But undervalued REITs with solid fundamentals could offer both income and price recovery. According to Morningstar, many of these stocks now trade at multi-year lows, despite steady cash flows.

How to Invest

Investors can choose individual REIT stocks or diversify through ETFs. Both passive and active REIT funds are available, with US-only and global options. For those seeking income and potential appreciation, the timing may be right to revisit REITs.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes