- US retail investment rose 13% year-over-year in Q1 2025, reaching $9.8B despite macroeconomic uncertainty.

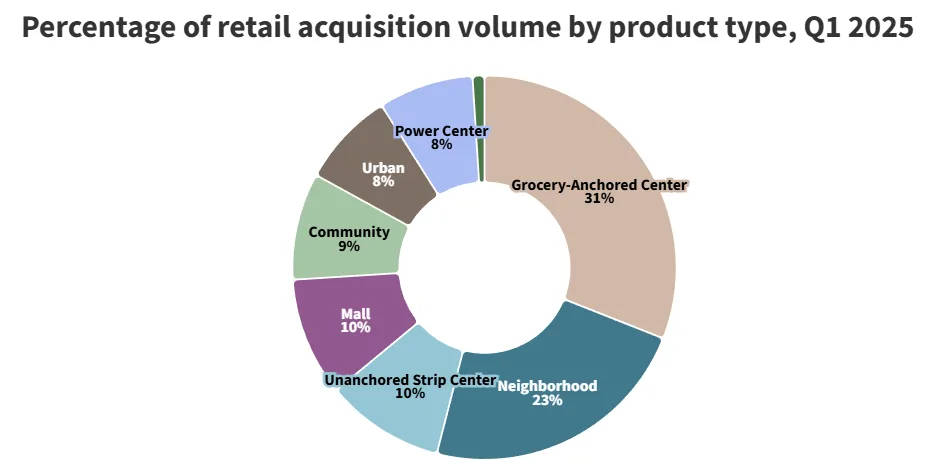

- Grocery-anchored centers led multi-tenant deals, with institutional investment quadrupling from Q1 2024.rn

- Urban retail remained strong with major acquisitions in New York and Boston by brands like Uniqlo and Apple.

- Big-box and mall investments surged 82%, driven by value-add opportunities and private capital activity.

A Solid Start To 2025

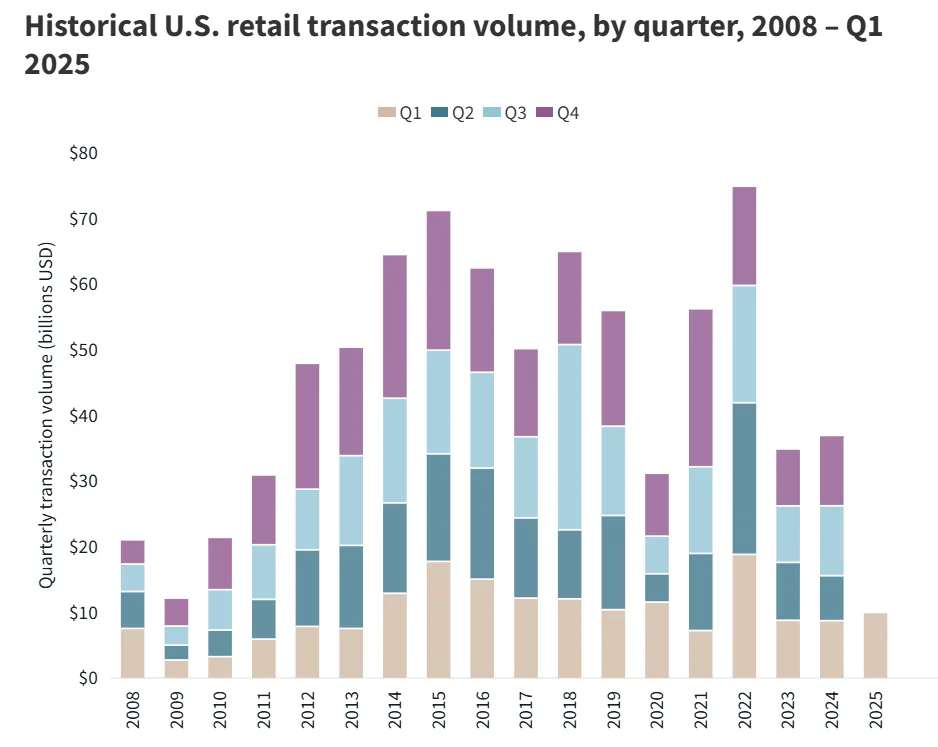

Despite a quarter-over-quarter dip of 7%, the US retail investment market showed resilience in Q1 2025, with $9.8B in transaction volume, reports JLL. This represents a 13% increase over Q1 2024 and a 12% rise compared to 2023. The gain was largely fueled by a higher volume of deals and an increase in average transaction size, as investors navigated a high-interest rate environment and awaited rate cuts signaled by the Federal Reserve.

Regional Shifts In Momentum

The Mid-Atlantic led the country in retail investment growth, jumping 38% year-over-year. The West followed with a 32% increase, and the Southeast rose 17%. The Southwest, however, saw volumes fall 32% due to a high baseline in Q1 2024, which included the $283M sale of Houston’s River Oaks District.

Grocery-Anchored Centers Dominate

Accounting for nearly one-third of all multi-tenant retail deals, grocery-anchored centers remain the most sought-after asset class. These properties attracted $531M in acquisitions by REITs, with institutional interest quadrupling compared to the same period last year. Key transactions included the Del Monte Center, Village Commons, and Westgate North, reflecting ongoing demand for necessity-based retail.

Urban Retail Sees Strategic Plays

Urban high-street retail is back in focus, especially in gateway cities like New York and Boston. Uniqlo’s $352.5M purchase of its Fifth Avenue flagship and Apple’s $88M deal in Boston signal continued demand for prime locations. Moschino also made a notable $25.4M acquisition. Limited inventory in these areas is expected to fuel competition and price escalation.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Big-Box Power Centers And Malls Rebound

Investment in these larger retail formats surged 82% year-over-year, driven by private capital and select institutional players. Many are targeting value-add opportunities as pricing remains favorable. Analysts expect this segment to remain active through 2025 as investors seek discounted entries into high-potential assets.

Outlook

With two fed rate cuts projected in 2025 and additional reductions expected in 2026, investor sentiment is cautiously optimistic. Despite political uncertainty and global trade tensions, stable, income-producing retail assets—especially in grocery-anchored and urban locations—are expected to remain in favor.

Why It Matters

Retail real estate continues to defy broader market volatility, with investors leaning into stability and necessity. As the US heads deeper into 2025, investor appetite appears increasingly strategic—favoring resilient formats, prime locations, and value-add potential.