- Nationwide office demand rebounded in Q3 2025 with 19.8M SF of positive net absorption, after a sharp 14.9M SF contraction in Q2.

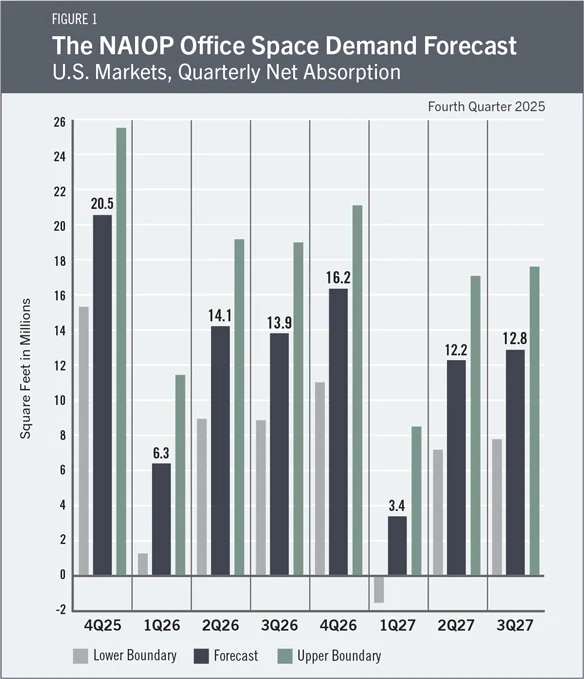

- Forecasts project 20.5M SF of positive absorption in Q4 2025, with 50.5M more expected in 2026—if recovery holds.

- AI-related leasing, easing construction pipelines, and lower interest rates are supporting demand—though risks remain if momentum proves short-lived.

Q3 Brings A Surprise Rebound

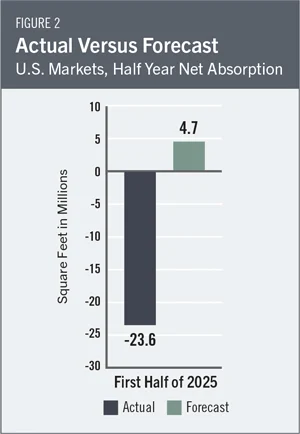

The US office sector showed signs of recovery in Q3 2025, posting 19.8M SF of positive net absorption, reports NAIOP. This marked a sharp turnaround from the 14.9M SF of losses recorded in Q2. This marked the strongest quarter for office demand since 2022. However, year-over-year growth remains nearly flat, with only a 600K SF gain, highlighting how much ground the sector still needs to recover.

Forecasts Signal Cautious Optimism

Looking ahead, the forecast anticipates 20.5M SF of demand in Q4 and 50.5M SF more throughout 2026. The outlook is uncertain, with the model assigning just a 50% chance that this marks the start of a lasting recovery. If Q3’s demand spike proves temporary, absorption could drop sharply—potentially turning negative again in early 2026.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

AI And Class A Buildings Drive Growth

AI investments, especially from tech and finance firms, have been a key driver of recent office leasing activity. This has helped buoy markets like New York and San Francisco. Demand remains focused on Class A+ buildings, which have nearly returned to pre-pandemic utilization levels on peak days. Older buildings, by contrast, continue to struggle and are increasingly being converted for alternative uses such as residential and data centers.

Regional Growth, But Risks Persist

All four US regions saw positive net absorption for the first time since 2021, signaling a potential broader market recovery. Still, headwinds remain. Consumer sentiment hit its second-lowest point since 1978. Uncertainty around policy, tariffs, and remote work continues to weigh on leasing confidence.

Will Momentum Hold?

Tailwinds like declining interest rates and a slowdown in new construction could support further recovery. Lower borrowing costs may help landlords modernize space and offer tenant incentives, boosting leasing. But with demand still well below pre-2020 levels and economic risks looming, whether this rebound proves to be a true turning point or a temporary surge remains an open question.