- Lending standards for commercial real estate have loosened for the first time since 2022.

- CRE loan demand is rising and expected to remain robust throughout 2026.

- Banks cite improving credit quality and economic outlook as reasons for easing.

- CRE price growth could accelerate if these trends persist.

CRE Lending Standards Loosen

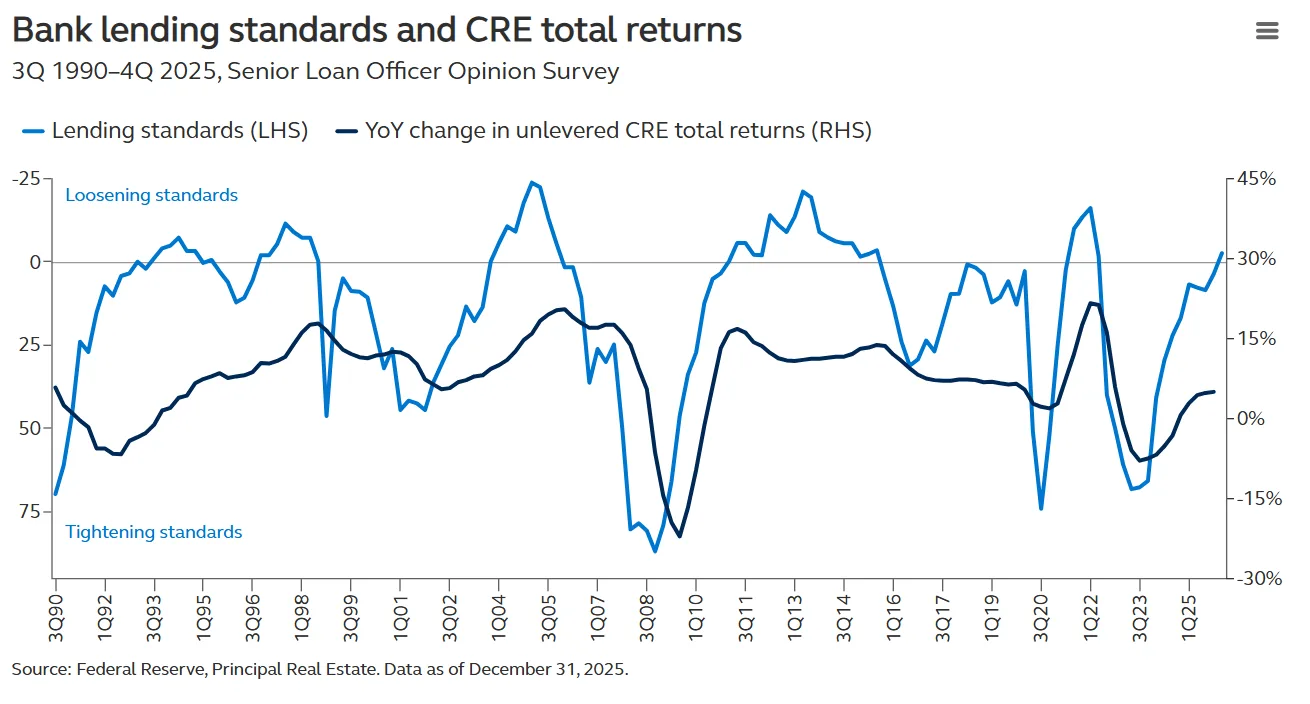

The Federal Reserve’s January 2026 Senior Loan Officer Opinion Survey (SLOOS) marks a notable shift in commercial real estate, reports Principal Asset Management. For the first time since 2Q22, banks are loosening CRE lending standards, while loan demand continues to grow. This comes after more than three years of tightening standards across the sector.

The survey also shows that demand for CRE loans rose for the second consecutive quarter. While corporate lending standards remain tight, banks appear to be redirecting their focus toward commercial real estate.

Market Confidence Builds

Survey responses suggest a constructive outlook for the year ahead. Nearly all large banks (93%) expect CRE lending standards to stay the same or ease further in 2026. A full 100% of large banks and 90% of smaller banks expect loan demand to improve or hold steady.

While general lending is loosening, underwriting for specific refinancing deals—especially those maturing in 2026—continues to tighten, highlighting a nuanced environment where borrower profiles and asset quality remain critical.

Banks point to improving credit quality in current loan portfolios, a better economic environment, and heightened competition as primary factors behind the relaxed lending standards.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Why It Matters for CRE

A looser lending environment and rising loan demand could become significant tailwinds for the commercial real estate market. Historically, easier borrowing terms have translated to growth in CRE values and returns.

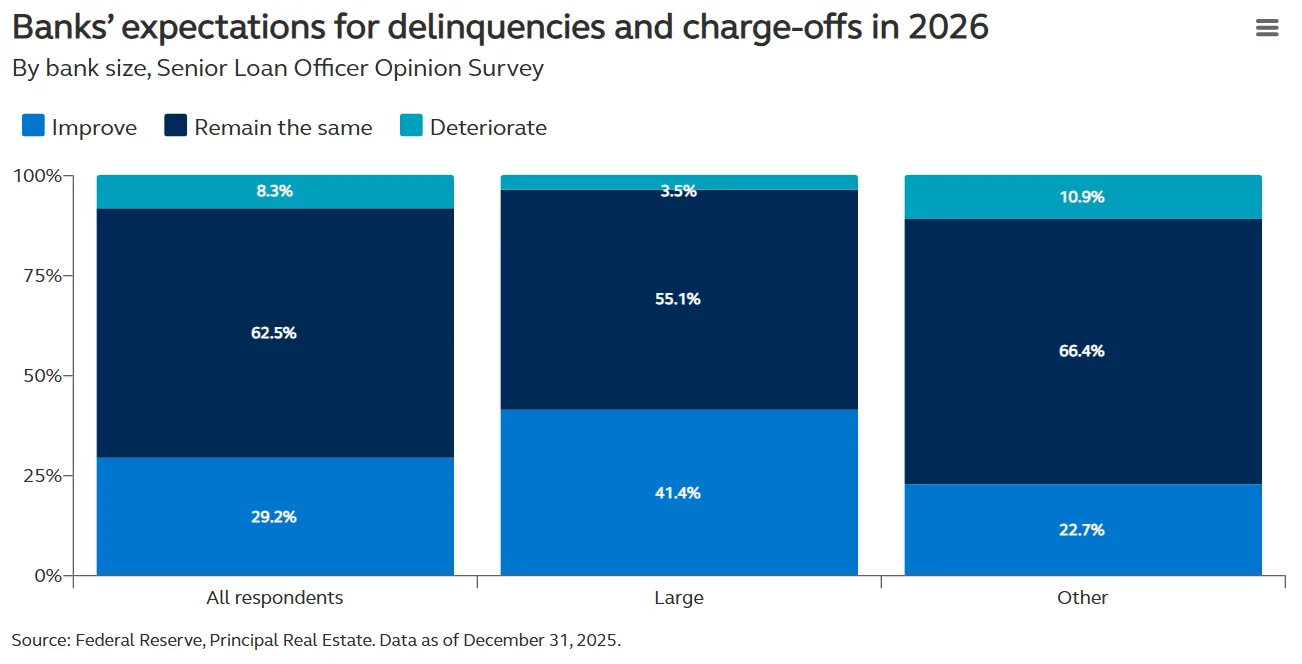

The difference in delinquency outlooks is also meaningful: 41% of large banks expect improved loan performance in 2026 (versus 23% of smaller banks), reflecting shifts in market share and risk appetite since CRE’s most recent peak.

What’s Next

If these lending standards and demand trends continue, commercial real estate could see durable credit-driven support for valuations. This would likely help maintain upward price momentum into the coming year, especially among institutional-quality properties and large-bank portfolios.