- Industrial upgrades, especially roof-raising, are addressing tenant demand for higher ceiling heights and automation capacity.

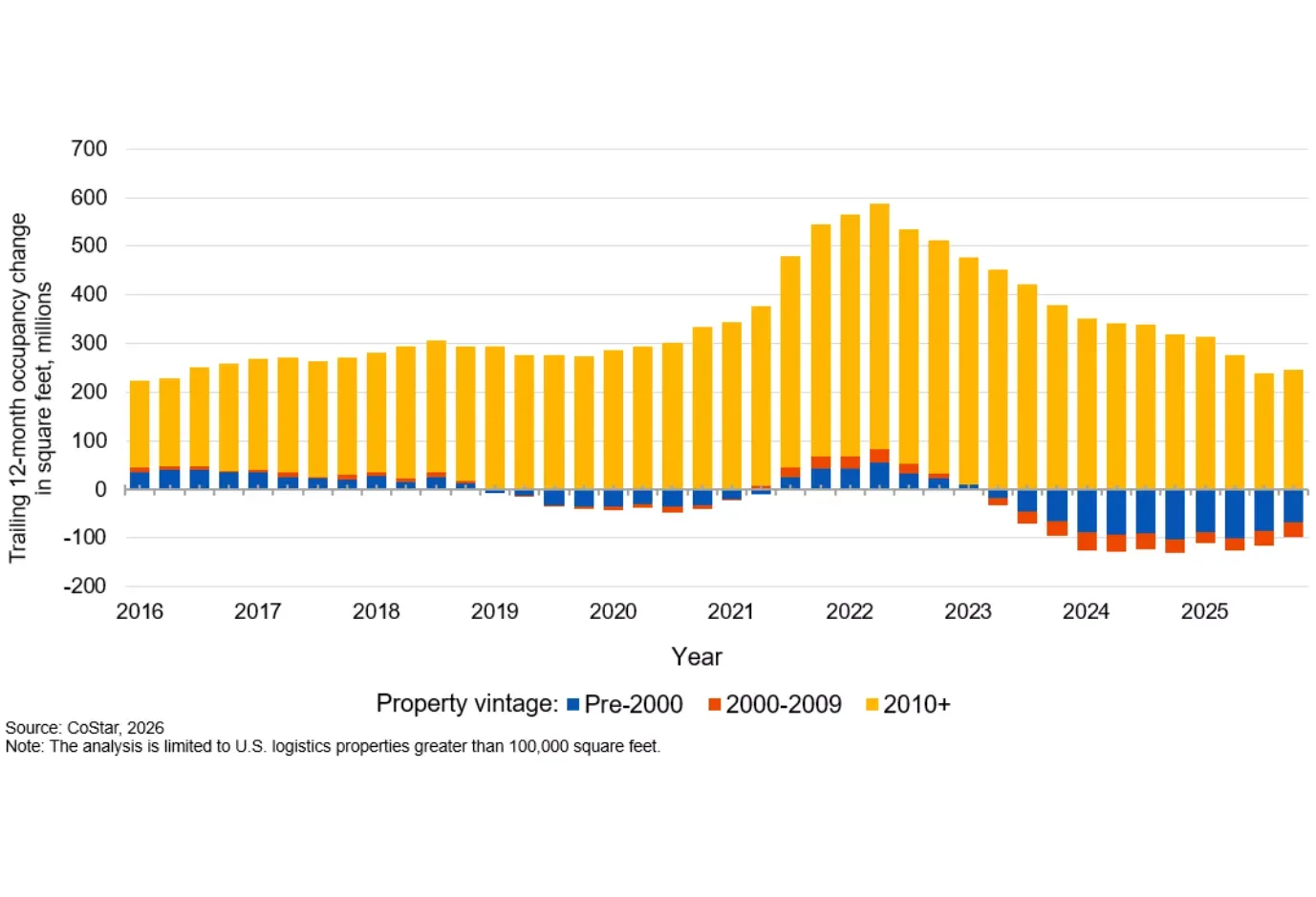

- Older warehouses built before 2010 have lost over 300M SF of occupancy since 2023.

- Roof-raising projects can cost $1.5M to $8M depending on building size and scope.

- Power capacity and location are also key factors for modern warehouse competitiveness.

Tenant Needs Drive Industrial Upgrades

Bisnow reports that automation continues to transform logistics operations. As a result, demand for industrial upgrades has accelerated. Many owners now focus on raising ceiling heights. Firms like Greek Real Estate and contractors such as Liftex retrofit aging warehouses. They respond directly to tenant demand for robotics-ready space. Consequently, older assets must adapt to remain competitive. Two decades ago, standard clear heights ranged from 30 to 32 feet. Today, most tenants expect 36 to 40 feet.

Occupancy Pressures Hit Pre-2010 Warehouses

At the same time, older warehouses face mounting occupancy pressure. CoStar reports that buildings over 100K SF built before 2010 lost 325M SF of occupancy between 2023 and 2025. Properties from the early 2000s account for 86M SF of that decline. Meanwhile, newer facilities attract tenants with taller ceilings and stronger electrical systems. Modern projects now dominate leasing activity in many markets. Investors are also deploying capital into related industrial building systems, including roofing and envelope upgrades, to strengthen long-term asset performance. Therefore, owners of older assets must invest in upgrades to compete.

Roof-Raising: Costs and Considerations

Specialists like Raise the Roof Logistics and Liftex employ hydraulic jacks and segmented columns to elevate ceilings—projects costing between $1.5M for 50KSF to up to $8M for larger sites. Ceiling lifts are often paired with power upgrades; for example, a New Jersey facility increased from 800 amps to 2,500 amps while also raising ceilings by 6 feet. Each project’s feasibility depends on anticipated revenue and alternative options, and not all buildings qualify for such upgrades.

Beyond Ceiling Height: Power and Market Demand

Industrial upgrades alone may not offset challenges from market shifts, such as the post-pandemic freight recession and surging utility needs. While some older buildings—especially those in dense infill markets—retain strong demand, many face competition from new properties boasting higher power capacity, sometimes above 4,000 amps for large logistics sites. In certain regions, power access is now as critical as ceiling height for automated warehouse users.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes