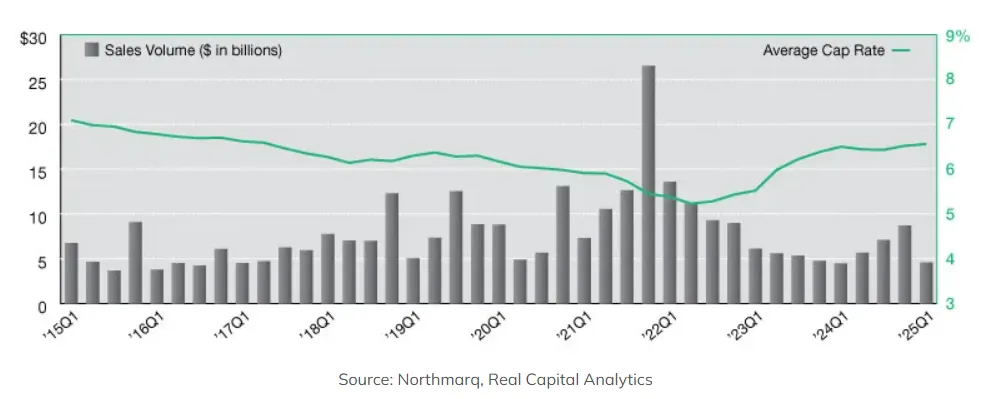

- Industrial net lease sales totaled $4.6B in Q1 2025, showing modest growth year-over-year.

- Cap rates rose to 6.56%, reflecting higher borrowing costs and shifting risk outlooks.

- Private and institutional buyers remained active, while REIT activity declined sharply.

- Strong fundamentals like low vacancies and limited new supply support long-term demand.

A Soft Start With Strong Bones

The single-tenant industrial net lease sector saw $4.6B in sales volume in Q1 2025, reports Commercial Search. A modest year-over-year increase, though momentum slowed compared to the stronger close of 2024. While the quarterly decline in momentum was disappointing, continued buyer interest signals confidence in the sector’s staying power.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Cap Rate Trends

Cap rates averaged 6.56% during the first quarter, up 4 basis points from Q4 2024 and 6 basis points year-over-year. Although they remain below broader net lease averages, cap rates have been trending higher due to persistent interest rate pressure and shifting risk perceptions in the capital markets.

Who’s Buying What

Private buyers led the way in Q1, responsible for over half of all industrial net lease acquisitions. Institutional investors followed with a 26% share, particularly active in acquiring logistics assets near major transportation corridors. REITs, however, continued pulling back—representing only 4% of total buyer activity, signaling a more cautious approach to capital deployment in the sector.

Why It Matters

Despite a cooling in sales activity, the industrial net lease sector remains a top performer among asset classes, buoyed by low vacancies, stable demand from logistics users, and limited new construction. These fundamentals support continued rent growth and investor confidence, even amid a more volatile macroeconomic backdrop.

What’s Next

Looking ahead, investor focus will remain tied to economic signals, interest rate expectations, and broader CRE sentiment. Still, the industrial sector’s long-term resilience, supported by strong logistics demand and disciplined supply pipelines, positions it as a cornerstone of net lease investment strategies in 2025 and beyond.