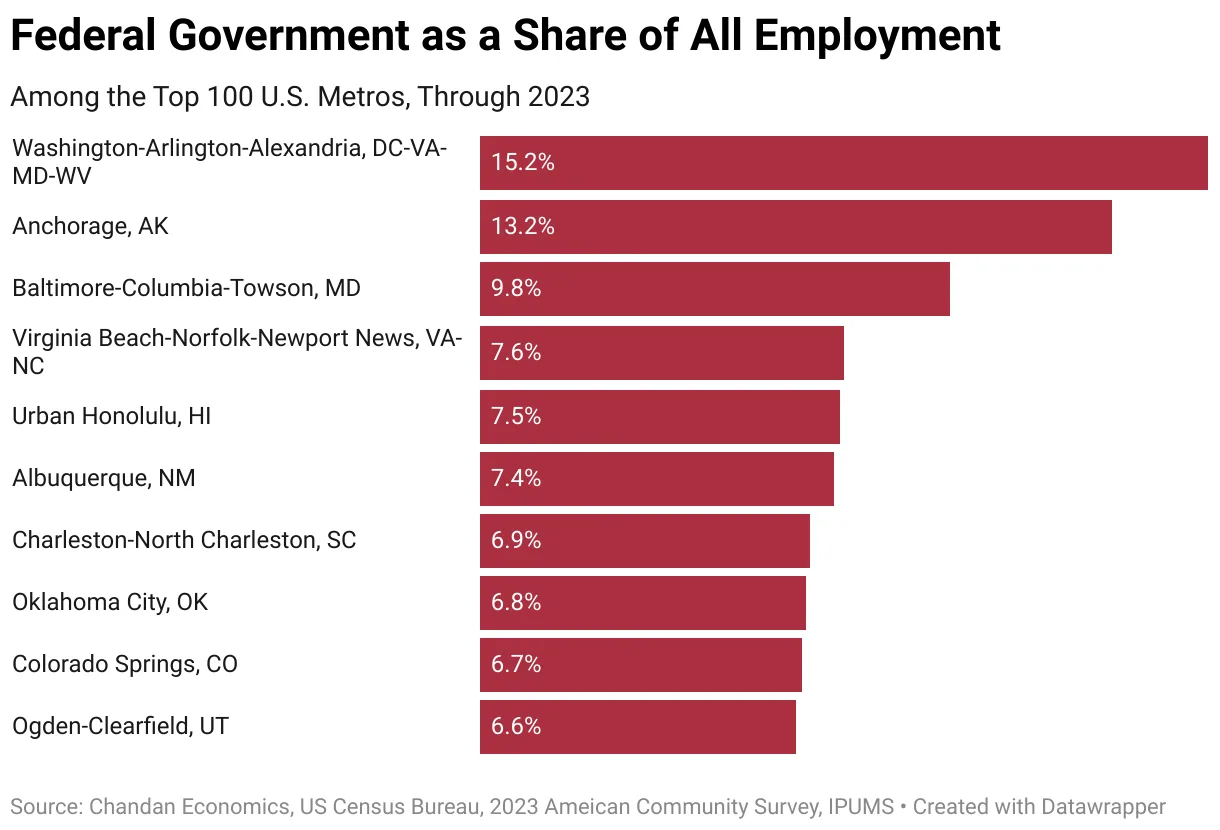

- Washington D.C. is the most exposed metro to federal job cuts, with federal employment accounting for over 15% of the workforce and rising housing inventory signaling early impacts.

- Isolated markets like Anchorage, AK (13.2% federal employment) and Honolulu face higher real estate risk due to limited private-sector job alternatives.

- Mid-sized metros near D.C., such as Baltimore and Virginia Beach, also have elevated federal job shares but could weather cuts better if private investment offsets public sector losses.

Federal Cuts, Local Impact

According to Chandan Economics, the newly formed Department of Government Efficiency (DOGE) and proposed budget cuts are triggering concerns for metros with high federal exposure—that is, a significant concentration of federal jobs. As the federal workforce shrinks, these regions could face declining demand for both housing and commercial real estate.

The Epicenter – Washington, D.C.

No metro stands to be more affected than the nation’s capital. With 15.2% of its workforce in federal jobs, Washington D.C. tops the list for federal exposure, making it the most vulnerable market to job-related demand shifts. So far in 2025, housing inventory in the D.C. metro is up 44.8% year-over-year, according to Altos Research—well above the national average increase of 32.5%—suggesting a possible early market reaction.

Risks in Remote Metros

While D.C. benefits from its strategic location along the Northeast Corridor, other metros aren’t as fortunate. Anchorage, AK, for example, has a similar share of federal jobs (13.2%) but lacks a diverse private sector to absorb displaced workers. Markets like Honolulu, Charleston (SC), and Oklahoma City also have elevated exposure and are more geographically isolated, making real estate demand more vulnerable to federal employment shifts.

The Middle Ground

Markets such as Baltimore (9.8%) and Virginia Beach (7.6%) represent a hybrid case. These cities are among the top five in federal job share but also benefit from proximity to D.C., which could help attract private investment. However, if that investment doesn’t arrive quickly enough, local housing and office markets may still face downward pressure.

What’s Ahead

Though federal job cuts could create near-term headwinds, regions with potential for private-sector growth may recover over time. Still, the real estate outlook in highly federal-dependent metros remains clouded by uncertainty—particularly in places without a strong economic fallback.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Why It Matters

Real estate investors, developers, and lenders should closely watch metros with high federal employment concentrations. As the federal government downsizes, localized job losses could trigger declines in housing demand, office absorption, and economic activity—especially in areas lacking strong private-sector support.