- Elliott Investment Management has taken a significant activist stake in Rexford Industrial Realty, becoming one of the company’s top five shareholders.

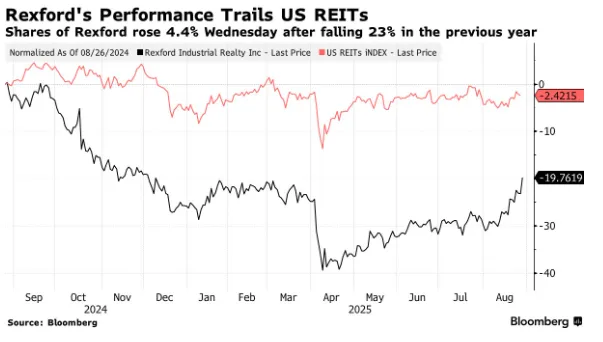

- Rexford’s shares jumped 6.6% intraday and closed up 4.4% following the news, giving the REIT a market cap of $9.9B and an enterprise value of approximately $13.3B.

- Rexford has long been viewed as a potential acquisition target, especially given its concentration in Southern California’s high-demand industrial market.

Elliott Makes A Move

Elliott Investment Management has quietly built an activist position in Rexford Industrial Realty Inc., reports Bloomberg. The move makes the hedge fund one of the largest shareholders in the Southern California-focused REIT. While Elliott’s specific goals are not yet known, its involvement typically signals a push for strategic change—whether through asset sales, management shifts, or outright takeovers.

Neither Elliott nor Rexford has commented publicly on the stake.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Market Reacts

Shares of Rexford (NYSE: REXR) surged as much as 6.6% on Wednesday before closing 4.4% higher at $41.78. That puts the REIT’s market value at $9.9B, though its enterprise value—including debt—sits closer to $13.3B. The rally follows a 23% slide over the past year, compared to a modest 2.4% decline in the broader US REIT index.

Southern California’s Industrial Giant

Rexford specializes exclusively in industrial real estate in Southern California. The region is one of the most valuable and supply-constrained logistics markets in the world. Proximity to the Ports of Los Angeles and Long Beach and limited land availability make it a strategic logistics hub. Measured by SF, Southern California would rank as the world’s fourth-largest industrial market.

In 2024, Rexford acquired $1B in properties from Blackstone Real Estate, further cementing its footprint.

The Takeover Talk

Rexford has long been on analysts’ watchlists as a takeover target. Deutsche Bank note in January highlighted the company’s attractive portfolio. It also pointed to high barriers to entry as reasons why both public and private players might pursue a bid.

Elliott’s interest reignites speculation, particularly as other players in the space—such as Plymouth Industrial REIT—have also attracted unsolicited bids.

Elliott’s REIT Playbook

Elliott has an extensive history in real estate activism. This year, it helped take City Office REIT private and pushed Equinix to unlock shareholder value. It has also influenced strategy at Crown Castle and was involved in the sales of Healthcare Trust of America and Switch Inc.

Its presence in Rexford signals that the REIT could be in for similar pressure.

What’s Next

Given Elliott’s track record, investors will be watching closely for any public demands. Rexford’s valuable portfolio adds to the anticipation of potential strategic announcements in the coming months. Whether through a sale, recapitalization, or operational overhaul, change could be on the horizon for one of Southern California’s largest warehouse owners.