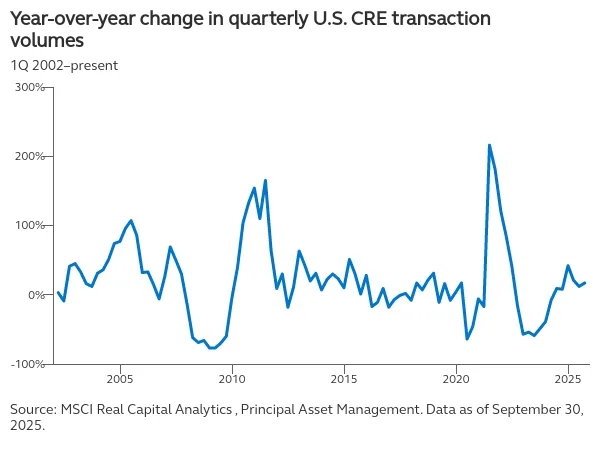

- CRE deal volume rose 17% in Q3 2025, with a revised 12% increase in Q2, putting YTD activity 17% above 2024 levels.

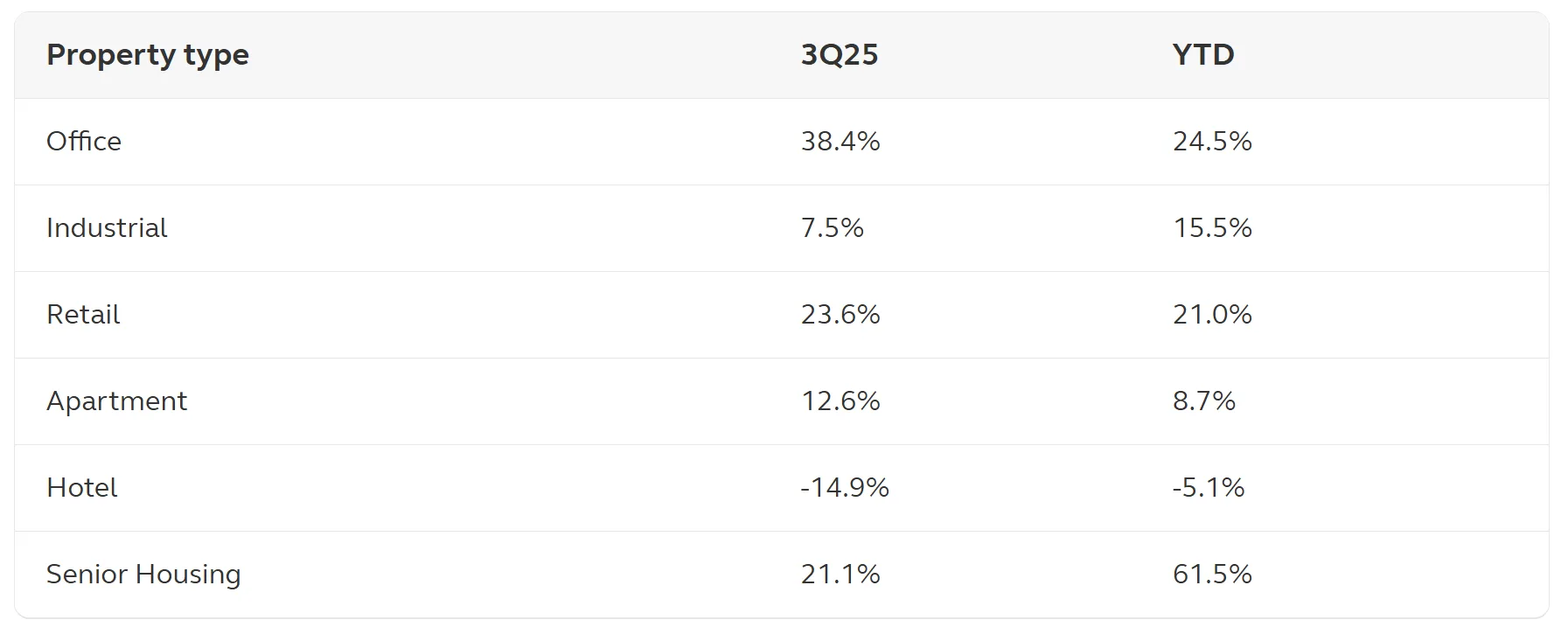

- Office, retail, and senior housing led the rebound, with senior housing transactions up a staggering 61.5% year-to-date.

- Supportive fundamentals and liquid debt markets helped drive the increase, alongside favorable tax treatment for CRE investors.

- Q4 2025 is expected to maintain momentum, though YoY comparisons will be tougher given elevated volumes in late 2024.

A Market Reawakening

According to Principal Asset Management, CRE investment volumes in the US surged 17% in the third quarter of 2025, a jump that continues a positive trend seen throughout the year. The second quarter’s performance was also revised upward to a 12% increase, further solidifying the year’s momentum.

Total volume for the first nine months of the year now stands 17% above the same period in 2024, raising hopes that the market may be entering a new phase of stability and growth.

Sector Snapshot

The transaction rebound was broad-based, with strong showings across most major property types. Office led the quarter with a 38.4% increase, followed by retail (+23.6%) and senior housing (+21.1%). Year-to-date, senior housing is the clear outperformer with a 61.5% increase, reflecting rising investor demand in alternative property types.

What’s Driving the Rebound

Three key factors are fueling the upswing:

- Net operating income (NOI) growth remains above historical averages, particularly in niche sectors.

- Debt markets remain open, with debt originations up 55% YTD as of Q2, per the Mortgage Bankers Association.

- Tax policy changes have preserved or improved the tax advantages of CRE ownership.

This confluence of factors has boosted liquidity and investor sentiment, drawing parallels to the 2014 recovery phase after the Global Financial Crisis.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Outlook: Momentum Intact, Comparisons Tighten

CRE volumes typically rise in the final quarter of the year, and Q4 2025 is expected to follow that seasonal trend. If deal activity matches Q4 2014 levels (~$136B), full-year volumes would finish about 10% above 2024.

Still, year-over-year comparisons may flatten or decline slightly due to the particularly strong finish in 2024—especially December, which marked one of the busiest months since 2001.

Bottom Line

The commercial real estate market is showing resilience few anticipated earlier in the year. Despite macroeconomic uncertainties, 2025 has so far demonstrated solid fundamentals, renewed investor interest, and improved access to capital. Even if Q4 volumes ease slightly YoY, the underlying momentum points to a market that has turned a corner.