- The US has added over 4.1M apartment units since 2015 — 39% of all deliveries over the past 40 years — with major cities like Houston, Dallas, and Austin leading the charge.rn

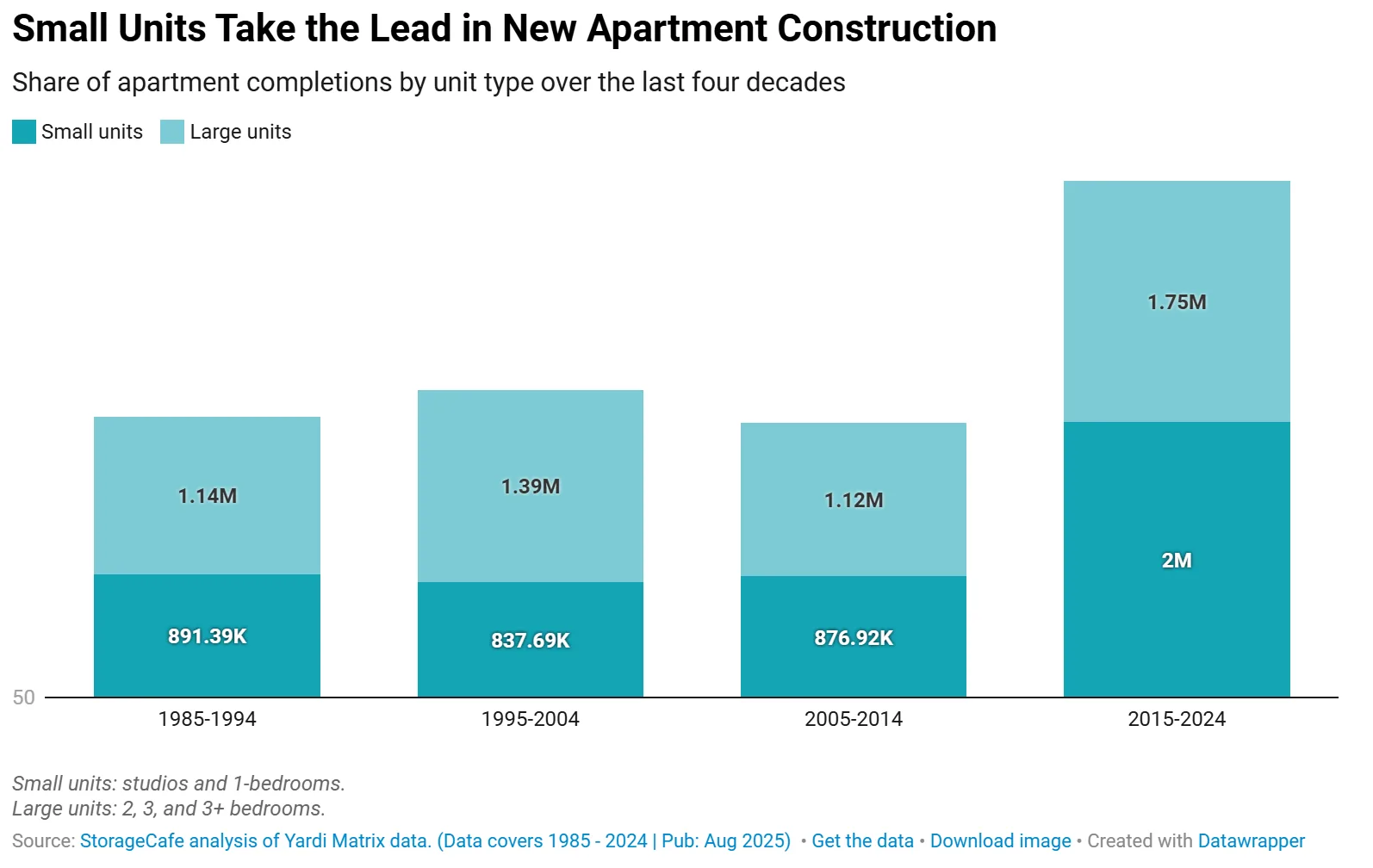

- New apartments are getting smaller, averaging 75 SF less than those built in the early 2000s, prompting renters to rely more on self storage for extra space.rn

- Over 547M SF of storage space has been added in the past decade alone, as the sector now tops 2B SF nationally.rn

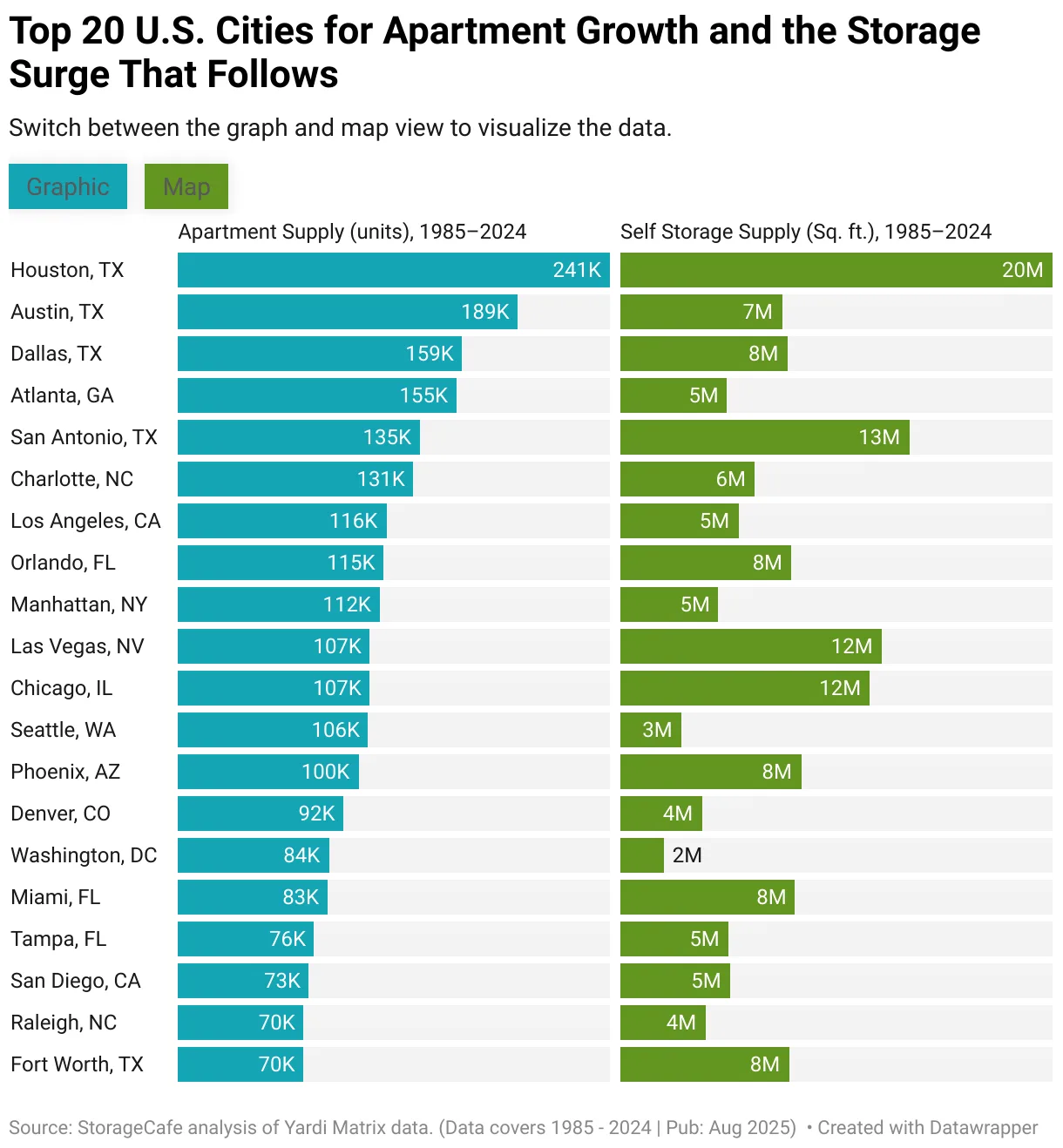

- Houston, Austin, Dallas, San Antonio, and Fort Worth rank among the top US cities for both apartment and storage growth, underscoring Texas’s dominance in urban expansion.rnrnrn

Apartment Boom Reshapes American Cities

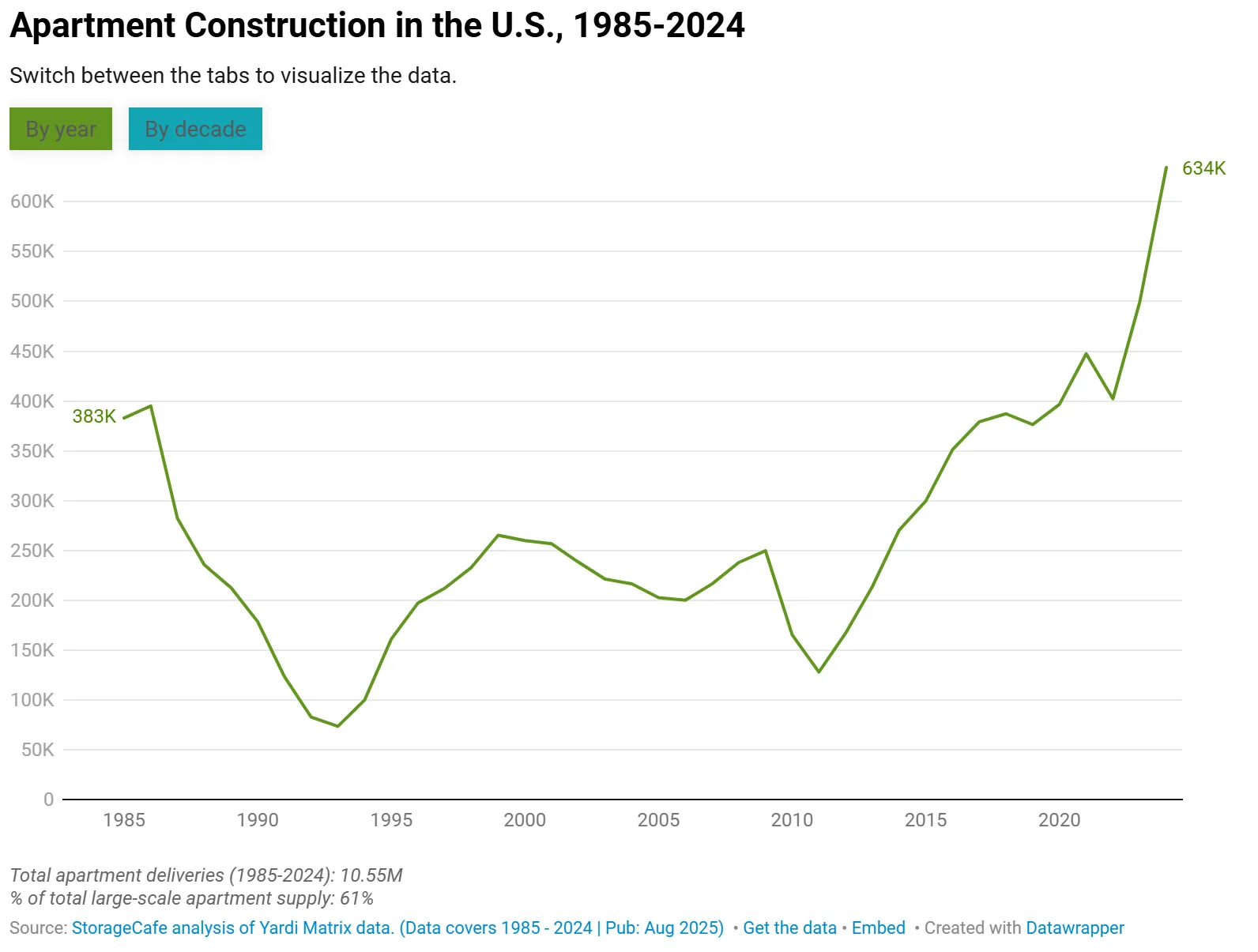

StorageCafe has reported that over the past decade, multifamily construction has transformed US cities at a record pace. Nearly 18M units now exist in large-scale (50+ unit) developments — with more than 4M added since 2015. That’s nearly 40% of all apartment deliveries in the past four decades.

Urban centers like Seattle, Austin, and Frisco have seen their multifamily inventories double — or more. At the same time, average apartment sizes have shrunk, with developers slicing about 30–75 SF off units to meet demand and rising costs. Studios and one-bedrooms now account for 53% of all new completions.

Storage Fills the Gaps — Quietly and Quickly

Smaller apartments and more renters have led to skyrocketing demand for storage. In 2025, Americans are searching for storage online 3.3M times a month — a 14% jump from last year.

To meet this demand, the self storage sector has scaled up in parallel with housing. More than 547M SF of new self storage space has been added in the last decade alone — nearly matching its biggest boom from 1995–2004. Today, the total US inventory exceeds 2B SF.

Texas Cities Are the Growth Engines

No state exemplifies the apartment-storage connection like Texas. Its five largest metro areas — Houston, Austin, Dallas, San Antonio, and Fort Worth — lead the nation in multifamily growth, and their storage sectors have surged accordingly:

- Houston: Added over 240,000 apartments and 20M SF of storage since 1985. In the last decade alone, unit sizes dropped by 44 SF, while 5.3M SF of storage was delivered.

- Austin: Delivered 190,000 apartments and 7.5M SF of storage since 1985. Recent years have seen high-end units and 3.2M SF of storage come online.

- Dallas: Delivered 158,000+ apartments and 2.4M SF of storage in the past decade — triple the previous 10 years.

- San Antonio: Built nearly 135,000 apartments and over 13M SF of storage, with growth sharply accelerating since 2015.

- Fort Worth: With a 21% population jump in the last decade, nearly half of its 7.8M SF of storage inventory was built since 2015.

Southern Cities Continue the Trend

Texas isn’t alone. Southern metros are seeing parallel surges in apartments and storage:

- Atlanta: 155,000+ apartments and nearly 5M SF of storage added since 1985, yet offers just 4.5 SF per capita — well below the 7 SF national benchmark.

- Charlotte: 131,000 apartments and 7.7M SF of storage built since 1985.

- Orlando: Delivered 115,000 apartments and 8M SF of storage — with deliveries 3.5x higher in the last decade than the one prior.

- Miami & Tampa: Driven by high rentership and compact units, both cities are rapidly expanding storage to keep up with dense urban living.

West Coast Markets Face a Space Crunch

While Los Angeles and San Diego rank among the top for apartment construction, their storage supply tells a different story:

- Los Angeles: Delivered 116,000 apartments since 1985, but just over 1M SF of storage in the last decade — a 5% decline from the previous period. Storage costs now average $287/month.

- San Diego: A more balanced story, with 5M SF of storage built overall and a 50% delivery increase in the past decade.

- Seattle: Despite units shrinking to 645 SF on average, the city responded with over 1M SF of storage delivered since 2015 — a 145% increase over the previous decade.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Northeast and Midwest: Mixed Results

- Manhattan: Delivered 112,000 apartments and 4.6M SF of storage since 1985, but per capita storage remains just 1.2 SF — far below average.

- Washington, D.C.: Nearly 64% of new apartments built since 2015, alongside 1.2M SF of new storage space.

- Chicago: 107,000 apartments and 12M SF of storage delivered over the past four decades — but with just 3.5 SF of storage per capita, the market remains underbuilt.

Mountain West Sees Balanced Growth

- Phoenix: One of the strongest alignments, with 65% of apartments and 77% of storage built since 1985.

- Las Vegas: Delivered 86% of storage inventory alongside 107,000 apartments.

- Denver: Built 55,000 apartments in the past decade, but remains undersupplied on storage, with just 3.4 SF per capita.

Why It Matters

As America’s housing landscape continues to densify, self storage is no longer a luxury — it’s infrastructure. It complements smaller living spaces, hybrid work lifestyles, and high mobility, especially in fast-growing metros.

According to StorageCafe, cities that added the most apartments since 1985 also saw the largest expansions in self storage — often exceeding 80% of their current storage supply built during that same period.

What’s Next

As apartment sizes shrink and urban living intensifies, self storage is becoming essential infrastructure. Undersupplied markets like Los Angeles, Denver, and Chicago present growth opportunities, especially as renters seek alternatives to limited in-unit space.

While the self storage sector is cooling after record highs, a slowdown in new supply could restore balance and stabilize fundamentals. Long-term demand remains strong, particularly in dense, high-growth cities where storage is increasingly a necessity, not a luxury.

Bottom Line

The rise of urban living is changing more than skylines — it’s reshaping how Americans manage space. As apartment sizes shrink and rentership rises, self storage is stepping in as an indispensable amenity. And in high-growth cities like Houston and Austin, it’s becoming just as crucial as a kitchen or a closet.