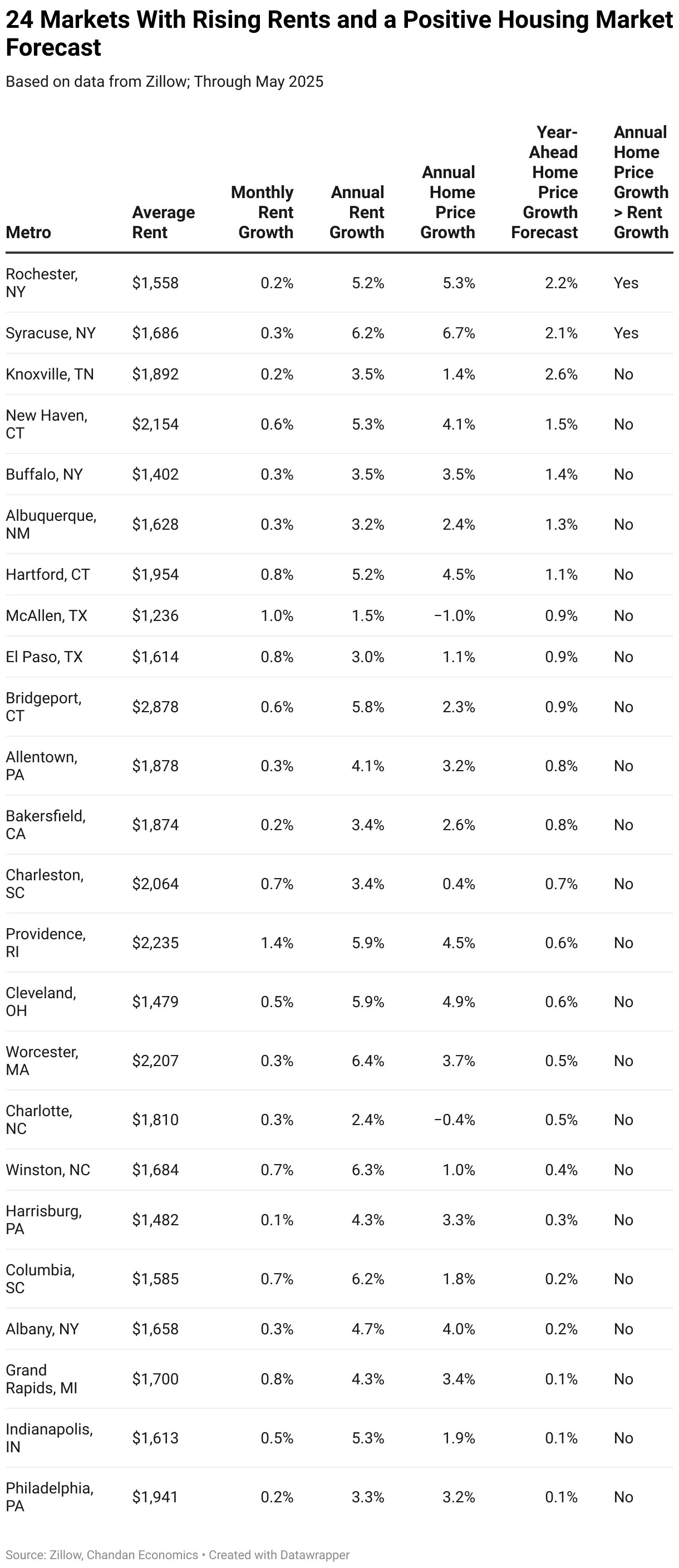

- Rochester and Syracuse lead rent growth forecasts among top 100 US metros, supported by positive home price trends and growing local demand.

- Only 27 of the top 100 metros have positive year-ahead home price forecasts, with Rochester (+2.2%) and Syracuse (+2.1%) ranked second and third, respectively.

- Additional markets to watch include Knoxville, TN; Providence, RI; and Philadelphia, PA — all showing favorable conditions for sustained rent increases.

Market Methodology

According to Chandan Economics, a new analysis from Jonathan O’Kane identifies US rent growth markets primed for expansion. The study uses three key indicators to make its projections:

- Gap between home price and rent growth

- Forecasted home price appreciation (next 12 months)

- Monthly momentum in rent prices

Since 2016, rent growth has shown a strong 82% correlation with home price growth. When home prices outpace rents, it often signals room for rents to rise.

Upstate New York in the Spotlight

Rochester and Syracuse are the only two metros among the top 100 to meet all three of the model’s criteria. Each city combines strong fundamentals — including affordability, limited new supply, and local economic resilience — with short-term rent growth momentum.

- Rochester benefits from constrained supply and a stable employment base in education and healthcare.

- Syracuse is seeing increased investor interest due to the nearby Micron semiconductor facility, expected to drive jobs and housing demand.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Honorable Mentions

When the model relaxes its strictest filter — the home price/rent differential — 22 additional metros also show promising signs. Noteworthy entries include:

- Knoxville, TN: Projected 2.6% home price growth — the highest among all metros in the dataset.

- Providence, RI: Recent 1.4% month-over-month rent jump, suggesting strong near-term demand.

- Philadelphia, PA: Modest growth rates, but notable for being the largest metro to meet the momentum and forecast criteria.

The Big Picture

Despite mortgage rates near 7% and a sluggish national sales market, rent growth potential remains concentrated in select metros. While broad-based rent spikes are unlikely, localized booms — particularly in upstate New York and a handful of secondary markets — may buck the national trend over the next year.

What’s Next

With affordability constraints limiting homebuying activity, rental demand will stay elevated in metros where job growth, supply limitations, and economic investment align. For investors and developers, the data suggest a pivot toward smaller, stable markets may offer the best risk-adjusted returns in the near term.