- Washington, DC, Las Vegas, Denver, Miami, and Richmond lead as the most profitable US cities for multifamily investments in 2026.

- Detroit, Jacksonville, Chicago, Baltimore, and Tulsa offer the highest cap rates, with Detroit reaching 11.42%.

- El Paso, Cincinnati, Baltimore, Mesa, and San Antonio present the most affordable average listing prices for multifamily properties.

- Investment ranking methodology weighs financials, inventory, and lifestyle metrics to identify best multifamily markets.

City Rankings Drive Investment Strategy

Multifamily properties will remain a strong asset class in 2026. Select US cities show solid cap rates, reasonable pricing, and steady renter demand. A recent LoopNet analysis reviewed 50 cities nationwide. Washington, DC, Las Vegas, Denver, Miami, and Richmond ranked highest overall. These markets balance income growth, acquisition costs, and lifestyle appeal.

Investors seeking yield will find Detroit at the top. The city posts an 11.42% cap rate. Jacksonville, Chicago, Baltimore, and Tulsa also offer strong returns. Their cap rates range from 8.22% to 8.95%. Meanwhile, El Paso, Cincinnati, Baltimore, Mesa, and San Antonio lead in affordability. Lower listing prices make these markets accessible to more investors.

Data-Driven Ranking Method

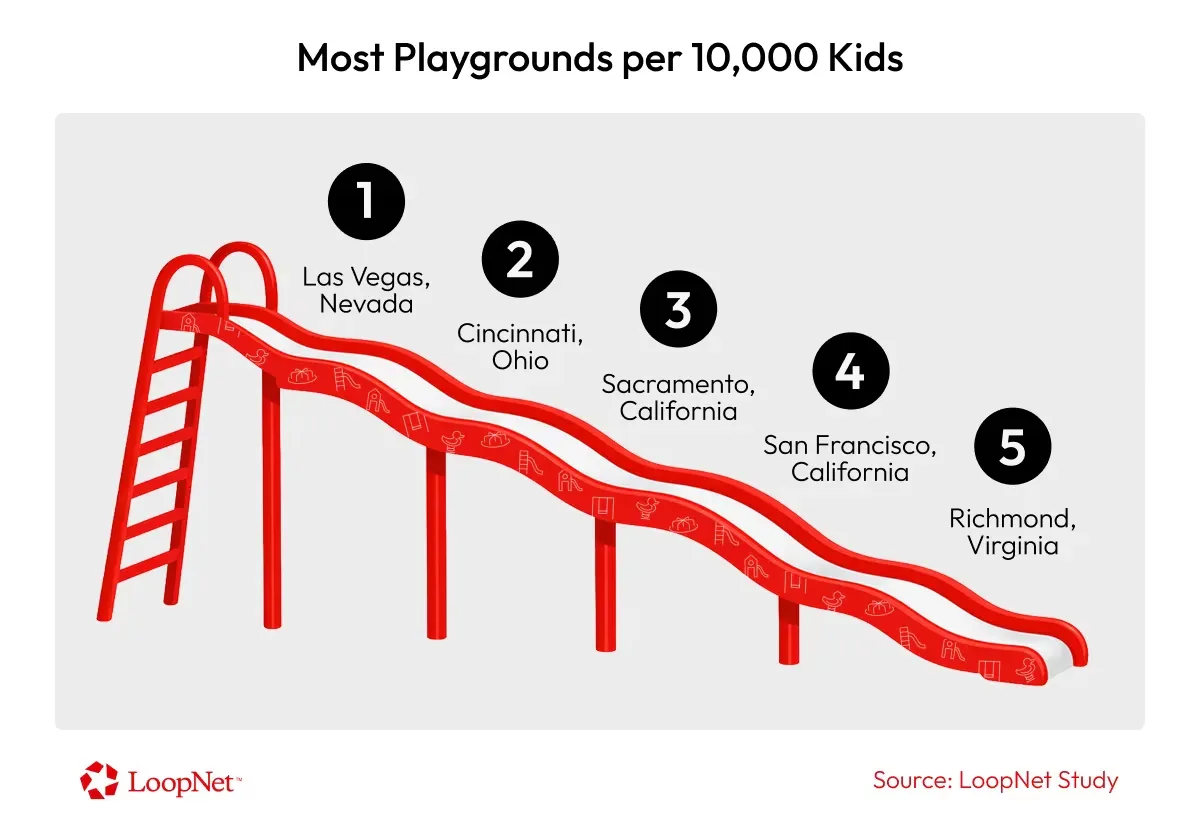

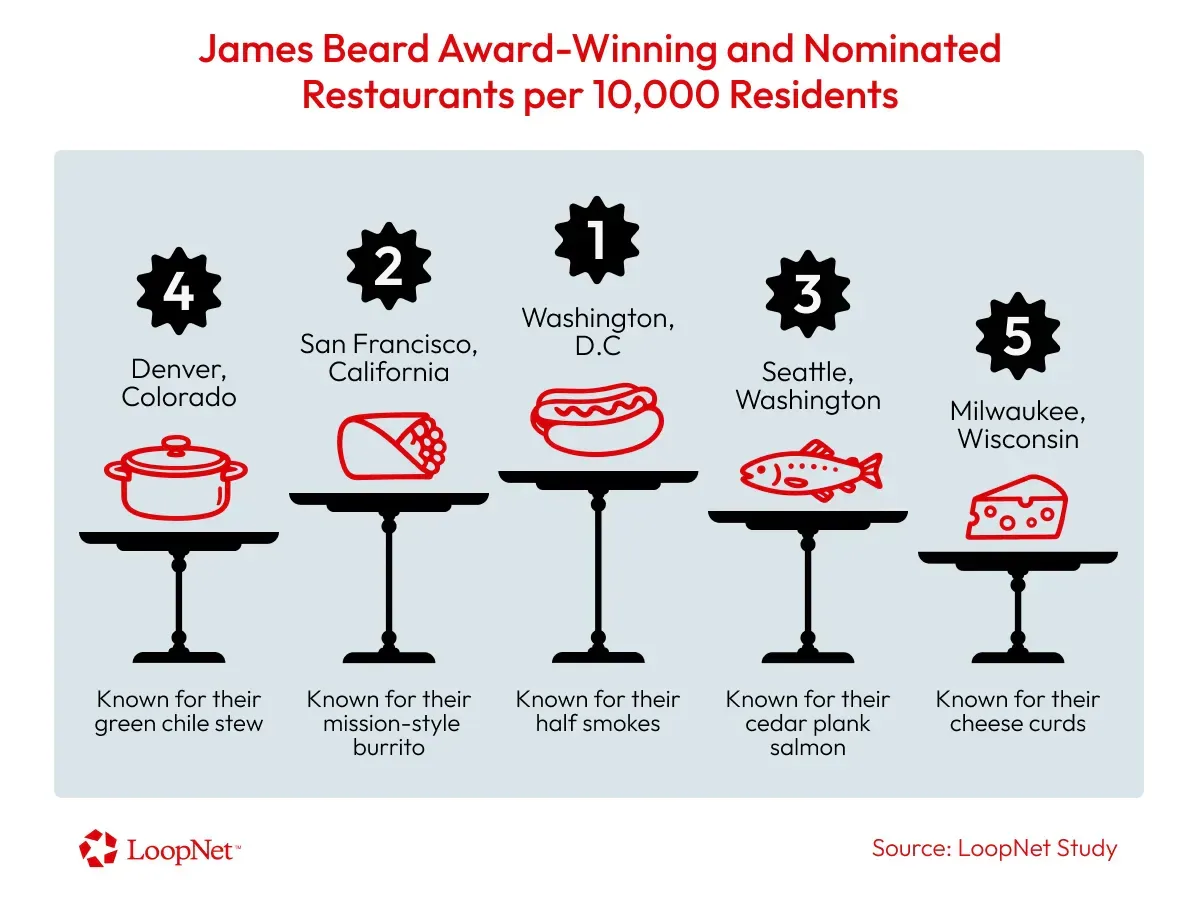

LoopNet built its rankings using financial and market data. The model weighs average cap rates at 20%. It assigns 15% weight to property tax rates. It also considers listing prices, unit counts, property class, and per capita inventory. In addition, lifestyle factors support the financial analysis. Park access and dining options help signal long-term renter demand.

Top cities combine strong cap rates with manageable costs. They also offer efficient tax environments and attractive amenities. Washington, DC, claimed the top position. The city posts a 7.04% cap rate and a 0.58% tax rate. It also shows high listing volume and broad park access. Nearly all residents live within a 10-minute walk of a park. Recent renter engagement rankings also placed Washington, DC at the top nationally, reinforcing the city’s strong tenant demand fundamentals.

Market Features and Investor Appeal

Each of the leading cities brings unique strengths for multifamily investments. Las Vegas excels with the largest property sizes (78,951 SF avg.) and low property taxes (0.5%), while Denver combines a strong Class A inventory share, low tax rate (0.44%), and abundant park proximity. Miami leads in listings per capita, and Richmond’s large median park size supports family-oriented demand. Tulsa and Detroit, with their high cap rates and relatively low acquisition costs, appeal to cash flow creators.

Baltimore stands out for pairing one of the nation’s highest cap rates (8.77%) with among the lowest average prices ($1.03M), reinforcing value for entry-level and yield-driven investors. Boston and San Francisco offer large asset sizes and 100% walkable park access, supporting long-term stability.

What Investors Should Watch

As 2026 approaches, the multifamily investments landscape offers opportunity for both growth and stable income. Rising cap rates and expanded inventory mean buyers can be selective across markets. LoopNet’s data shows that balancing return metrics with cost, inventory trends, and quality-of-life amenities is critical in identifying where to invest for strong multifamily investments outcomes. Investors should closely monitor local cap rate shifts, inventory absorption, and lifestyle trends to capture long-term value.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes