- Paramount Group is considering strategic alternatives, including a full or partial sale, recapitalization, or joint venture.

- The announcement follows disclosure of $4M in previously hidden payments to CEO Albert Behler and affiliated interests.

- Several top executives, including the CFO, general counsel, and head of asset management, have exited the firm in recent weeks.

- Paramount has hired Bank of America and Latham & Watkins to advise on the review, with no guaranteed outcome or timeline.

A Pivotal Moment For The Office Landlord

Paramount Group, one of the largest office landlords in New York City and San Francisco, is at a crossroads, reports WSJ. The company announced Monday it is undertaking a strategic review that could result in a sale of the entire firm or a portion of its assets, signaling mounting internal and external pressure after a tumultuous few months.

Bank of America and Latham & Watkins have been retained to assist with the process. While there is no set timeline, the review follows a period of heightened investor concern and reputational risk.

Uncovering Undisclosed Payments

Paramount disclosed $4M in previously hidden payments tied to CEO Albert Behler’s personal and business-related expenses. The payments included expenses linked to Behler’s private ventures and his wife’s business interests, sparking concern among shareholders.

Revealed transactions include $900K for Behler’s accounting and $3M to his affiliated jet company between 2022 and 2024. These disclosures have drawn scrutiny, given SEC rules requiring public companies to disclose executive perks and related-party transactions.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Executive Departures Raise Eyebrows

Since the financial revelations, several top executives have left the company. Chief Operating Officer and CFO Wilbur Paes, along with General Counsel Gage Johnson, are stepping down. Both were central to the firm’s financial and legal disclosures.

Paramount also cut ties with Goodwin Procter and lost key leaders, including Christopher Brandt and Katharina Otto-Bernstein.

What’s Next

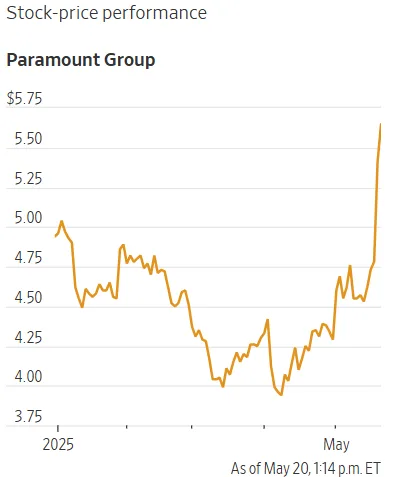

Paramount’s stock jumped 15% Monday, ending the day with a market cap of over $2B. The company is holding an all-hands meeting to address the leadership changes, strategic review, and leasing performance.

While a sale is not guaranteed, the review could reshape the future of a once-stalwart office REIT at a time when the sector continues to grapple with shifting work patterns, investor skepticism, and rising transparency expectations.