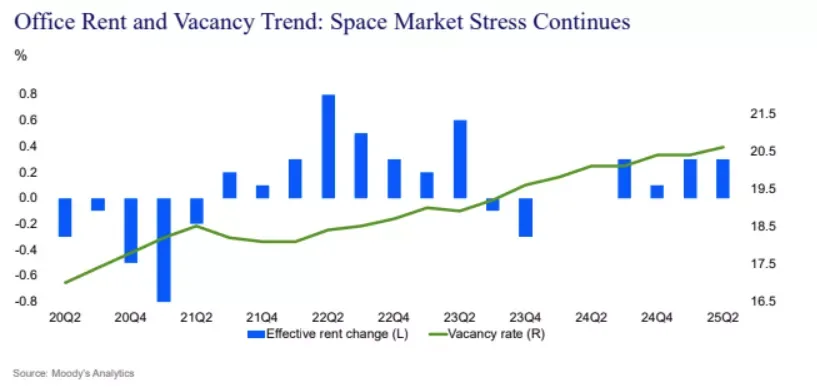

- National office vacancy hit 20.6% in Q2 2025, setting a record for the sixth consecutive quarter.rn

- Return-to-office mandates have had limited impact, and future lease terminations—particularly from the federal government—are expected to increase vacancy further.rn

- Effective office rents rose modestly to $28.45/SF nationally, but the market remains uneven, with notable declines in major metros like Seattle and Denver.rn

- Other sectors—retail, industrial, and multifamily—also saw minor upticks in vacancy, though multifamily rents continued to rise slightly.

Another Quarter, Another Record

According to a Q2 2025 Moody’s Analytics report, US office vacancy has reached 20.6%, marking its sixth straight quarterly high. That’s a sharp climb from the 17% vacancy seen at the onset of the pandemic in 2020, per Bisnow.

Despite growing calls for employees to return to physical offices, Moody’s found that mandates have done little to reverse the trend, as employers continue to rethink long-term office needs.

Federal Footprint Shrinks

The situation is particularly acute in Washington, D.C., where federal downsizing is already hitting hard. According to CBRE, the government has shed 850K SF of office space in the capital through the first half of the year. Moody’s forecasts this federal pullback will continue gradually over the next couple of years.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

A Glimmer of Rent Growth

National effective office rents saw a slight increase, reaching $28.45/SF, up 8 cents from Q1. However, the growth was highly uneven.

- Top performers with falling vacancy and rising rents:

Birmingham, Palm Beach, Miami, Wichita, and Columbia, SC. - Struggling markets with negative rent growth and rising vacancy:

Nashville, Denver, Seattle, Portland, and San Jose.

Other CRE Sectors Show Strain

While office remains the most distressed, other commercial real estate sectors are not immune:

- Retail vacancy ticked up to 10.5% (+10 bps), with rents rising slightly to $19.27/SF.

- Industrial vacancy climbed to 7.5% (+20 bps), with flat average rents at $7.63/SF.

- Multifamily vacancy held steady at 6.5%, with asking rents increasing to $1,832/month (+$0.12).

Outlook: High Risks, Modest Optimism

Despite rising vacancy, Moody’s maintains a baseline forecast that avoids recession, though it warns that the office sector remains especially vulnerable.

Expect continued headwinds as businesses reassess space needs, and federal and corporate downsizing adds more supply to already-saturated markets.