- Housing markets in the South and Southwest—once defined by fierce bidding wars—are now experiencing slower sales and swelling inventories.

- Florida homes now take a median of 73 days to sell, up from 55 days two years ago, as sellers contend with rising insurance premiums and fewer buyers.

- Homebuilders in the Sun Belt are cutting prices and offering incentives to move excess inventory, signaling a broader “normalization” of the housing market.

Shifting Tides in the Sun Belt

Markets that once epitomized the pandemic-era housing boom—like Florida, Texas, and Arizona—are now experiencing a housing slowdown, cooling rapidly from their peak, per Bloomberg. Homes in these regions are sitting unsold for longer periods, upending expectations set during a time of record-low mortgage rates and high migration.

In Florida, the median time on the market has jumped to 73 days, a stark contrast to just 55 days in 2023 and nearly double that of more stable markets like New Jersey and Virginia.

Rising Supply, Falling Demand

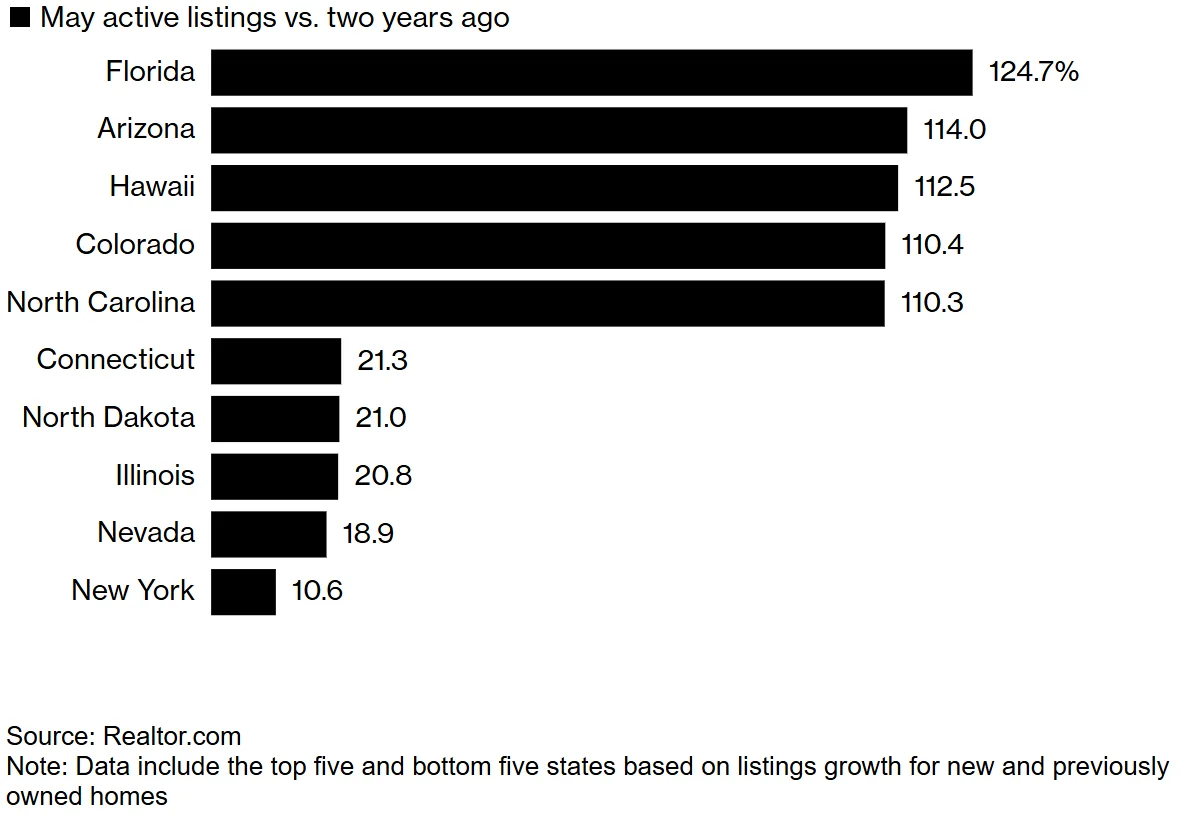

The influx of listings is being driven by multiple forces: homeowners abandoning hopes of a return to 3% mortgage rates, surging insurance costs in hurricane-prone states, and a wave of mom-and-pop investors exiting the rental market. In Colorado, where tenant-friendly laws have taken effect, the number of homes on the market jumped 51% year-over-year in May—and 110% compared to two years ago.

Real estate agents say the mood has shifted amid the ongoing housing slowdown. “It feels like molasses,” said Michael Lauer, a Tampa-based broker, whose county has seen a 14% drop in overall sales even as inventory has more than doubled.

Pandemic Boomtowns Face a Correction

During the pandemic, a combination of remote work, warm weather, and low interest rates made the Sun Belt the epicenter of rapid housing growth. But now, rising mortgage rates—currently hovering near 7%—are dampening buyer enthusiasm. Many homeowners remain locked in at sub-5% rates, unwilling or unable to sell and re-buy in a higher-rate environment.

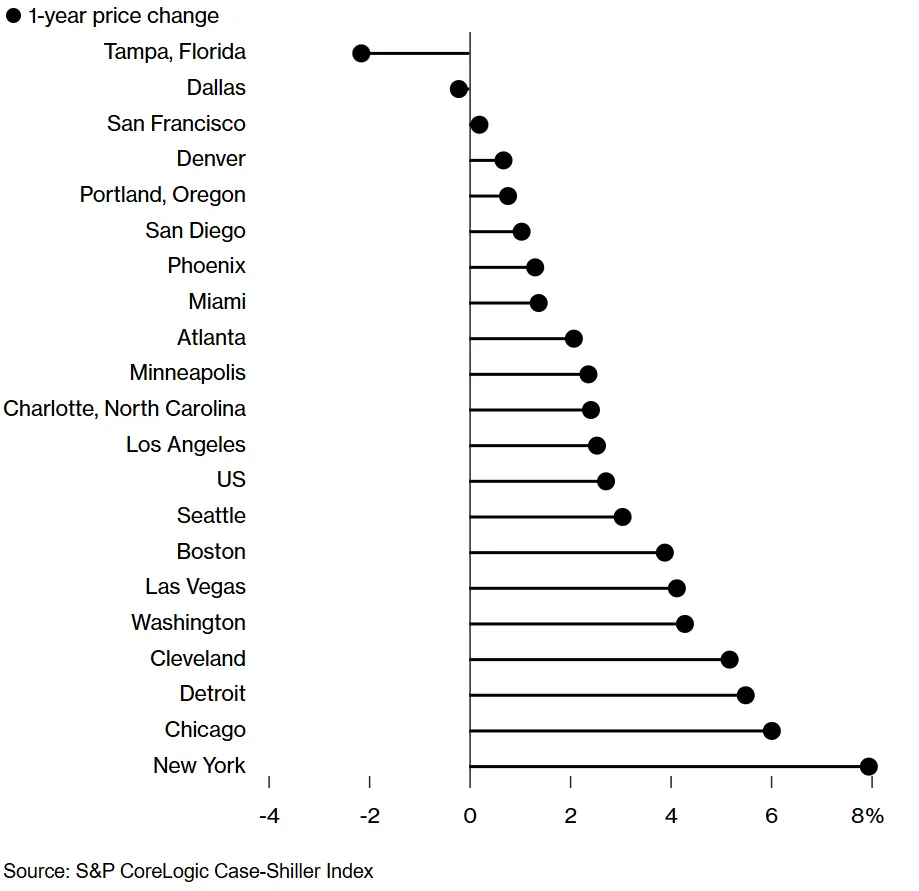

While price declines haven’t been drastic, S&P Case-Shiller data shows softening in key Sun Belt metros such as Dallas and Tampa, reflecting broader signs of a housing slowdown. In contrast, prices in parts of the Midwest and Northeast are now on the rise.

Investor Retreat Adds to Supply

Real estate professionals in cities like Phoenix, Atlanta, and Dallas suspect that institutional investors may be reducing their footprints. Although large landlords aren’t offloading in bulk, small investors appear to be seizing what’s left of strong pricing before a broader correction takes hold.

“The salad days of multiple offers are over,” said Lauer. “Beautiful homes still sell, but everything else is a grind.”

Why It Matters

The current housing shift represents a long-awaited rebalancing of the market. After years of underbuilding and supply constraints, more inventory is a positive development for affordability—though painful in the short term for sellers and developers.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

What’s Next

With interest rates unlikely to return to pandemic lows anytime soon, housing markets in the South and West may face continued headwinds. Meanwhile, affordability pressures and rising costs—especially for insurance—are pushing some buyers and sellers to reconsider where and when they move.

Expect a more balanced but slower-paced housing market in the months ahead, especially in regions that once defined the US housing boom.