TurboTenant Overview

TurboTenant is an all-in-one property management platform built for independent landlords, small-portfolio managers, and residential real estate investors. Founded in 2015 and based in Fort Collins, Colorado, it now serves more than 900,000 landlords and 12 million renters across all 50 states.

The platform covers the full rental lifecycle—marketing, lead management, screening, lease creation, rent collection, maintenance, and financial tracking—and its 4.9-star mobile app allows both landlords and tenants to manage everything on the go. With a free-forever plan and paid options under $200 per year for unlimited properties, TurboTenant is one of the most cost-effective solutions for landlords managing one to 100 doors.

Our Take On TurboTenant

Best for DIY landlords and small portfolio owners who need an intuitive, end-to-end property management platform.

TurboTenant is built for landlords seeking a simple, modern platform that eliminates the operational friction of managing rentals.

Pros

Pros- Free-forever plan with access to core landlord tools

- Paid plans under $200/year for unlimited units

- Advertising workflows take under two minutes to set up

- Rentometer-powered rent estimate calculator

- Screening reports are free for landlords

- 50+ state-specific lease agreements with e-signature

- Rent collection with customizable late fees, autopay, and receipts

- Fully integrated rental accounting (like Quickbooks, but for rentals)

Cons

Cons- Not designed for short-term rental operators

- No same-day rent deposit option

- Phone support is only available for paid plans

Pros Explained

Free-forever plan with access to core landlord tools

Free-forever plan with access to core landlord tools is one of TurboTenant’s strongest advantages. The free tier includes advertising, screening, lead capture, messaging, rent collection, maintenance management, and applications—all without subscription fees. This structure removes financial barriers for new landlords while giving them access to a broad range of essential tools from day one. For landlords managing one to five units, the free plan alone can meaningfully reduce operating costs and simplify day-to-day tasks.

Paid plans under $200/year for unlimited units

Paid plans under $200/year for unlimited units provide landlords with predictable, portfolio-friendly pricing. Because TurboTenant does not charge per unit, landlords can scale from a few doors to dozens or even more than 100 without increasing subscription costs. This creates measurable long-term savings compared to software platforms that charge monthly per-unit fees.

Advertising workflows take under two minutes to set up

Advertising workflows take under two minutes to set up, allowing landlords to quickly create listings, pull Rentometer-powered rent estimates, upload photos or videos, and publish to over 28 syndicated listing sites. The intuitive workflow ensures even first-time landlords can publish professional-quality listings with minimal effort.

Screening reports are free for landlords

Screening reports, which are free for landlords, significantly reduce the costs associated with tenant placement. Through TurboTenant’s partnership with Rent Butter, landlords receive full credit, background, criminal, and eviction data without having to handle sensitive applicant information like Social Security numbers. Reports appear instantly once tenants complete the application.

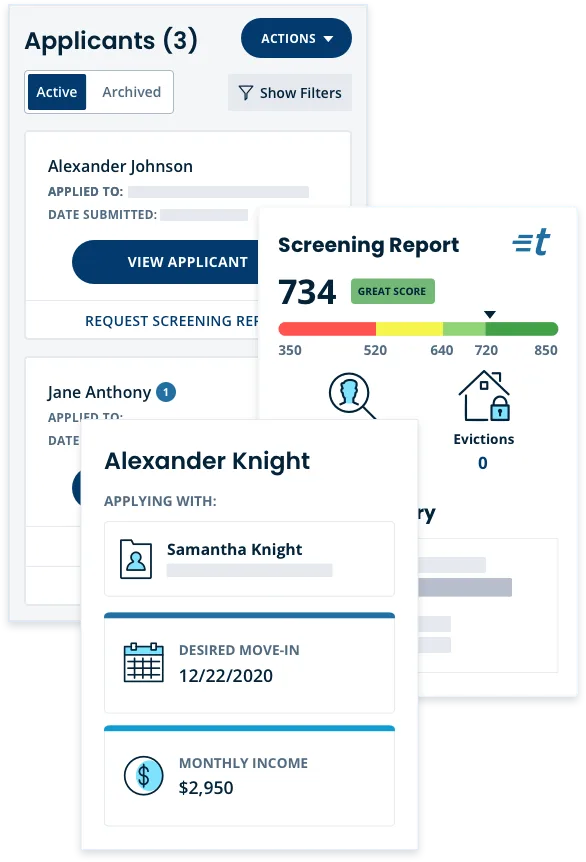

50+ state-specific lease agreements with e-signature

50+ state-specific lease agreements with e-signature give landlords access to legally compliant documents tailored to each state. TurboTenant’s legal team keeps these templates updated, and landlords can customize fields, add addendums, and collect e-signatures without needing external tools like DocuSign. The workflow ensures clarity and compliance for both parties.

Automated rent collection with customizable late fees and autopay

Automated rent collection with customizable late fees and autopay removes friction from landlord–tenant communication. TurboTenant sends payment reminders, manages recurring charges, and automatically applies late fees—whether flat-fee, percentage-based, daily, or capped. Tenants can enable autopay, and TurboTenant issues rent receipts automatically, meeting legal requirements in 18 states.

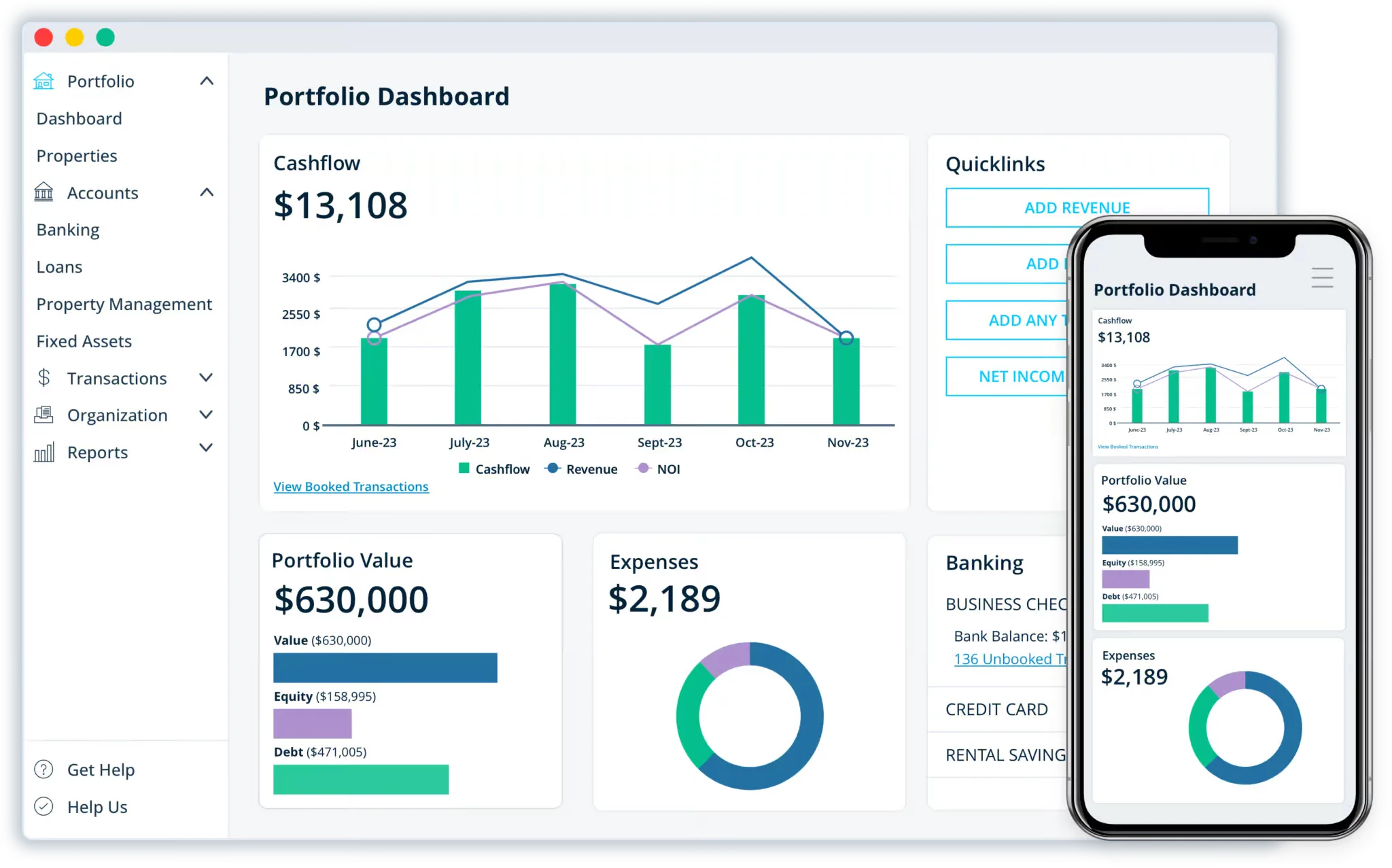

Integrated rental accounting

Integrated rental accounting (like Quickbooks, but made for rental properties) supports landlords with real estate–specific financial reporting. TurboTenant’s accounting system syncs with bank and credit card accounts, auto-categorizes transactions, tracks depreciation, and generates Schedule E and tax packets. This level of automation reduces bookkeeping burdens and simplifies tax preparation.

Cons Explained

Not designed for short-term rental operators

TurboTenant focuses solely on mid-term and long-term leasing, so it is not suited for short-term rentals. The platform does not support nightly pricing, turnover scheduling, or channel management—features essential to Airbnb or vacation rental hosts.

No same-day rent deposit option

Rent deposit timelines can be slower than preferred for landlords expecting same-day or next-day payouts. Depending on weekends, bank processing times, and payment method, transfers may take longer than anticipated. Some landlords note this as an occasional pain point in their cash flow cycle.

Phone support is only available for paid plans

While chat and email are available to all users, 7 days a week, phone support is reserved for paying customers, which can influence plan selection for landlords who value voice support.

TurboTenant Key Features

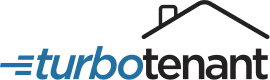

Advertising

TurboTenant’s advertising workflow reflects the first and most crucial stage of the vacancy cycle. Landlords can add a property in roughly 2 minutes by entering key details, including amenities, rent, lease terms, and pet policies. The platform includes a rent estimate tool powered by Rentometer to provide localized market guidance on rental rates. Landlords can write their own listings or use TurboTenant’s AI-assisted tool to generate titles and descriptions. Photos and video tours can be uploaded, and once complete, the listing is syndicated to more than 28 partner sites, including Apartments.com, Redfin, Realtor.com, and Craigslist, at no cost. Most landlords receive around 20 leads per listing, and all leads funnel directly into the TurboTenant dashboard.

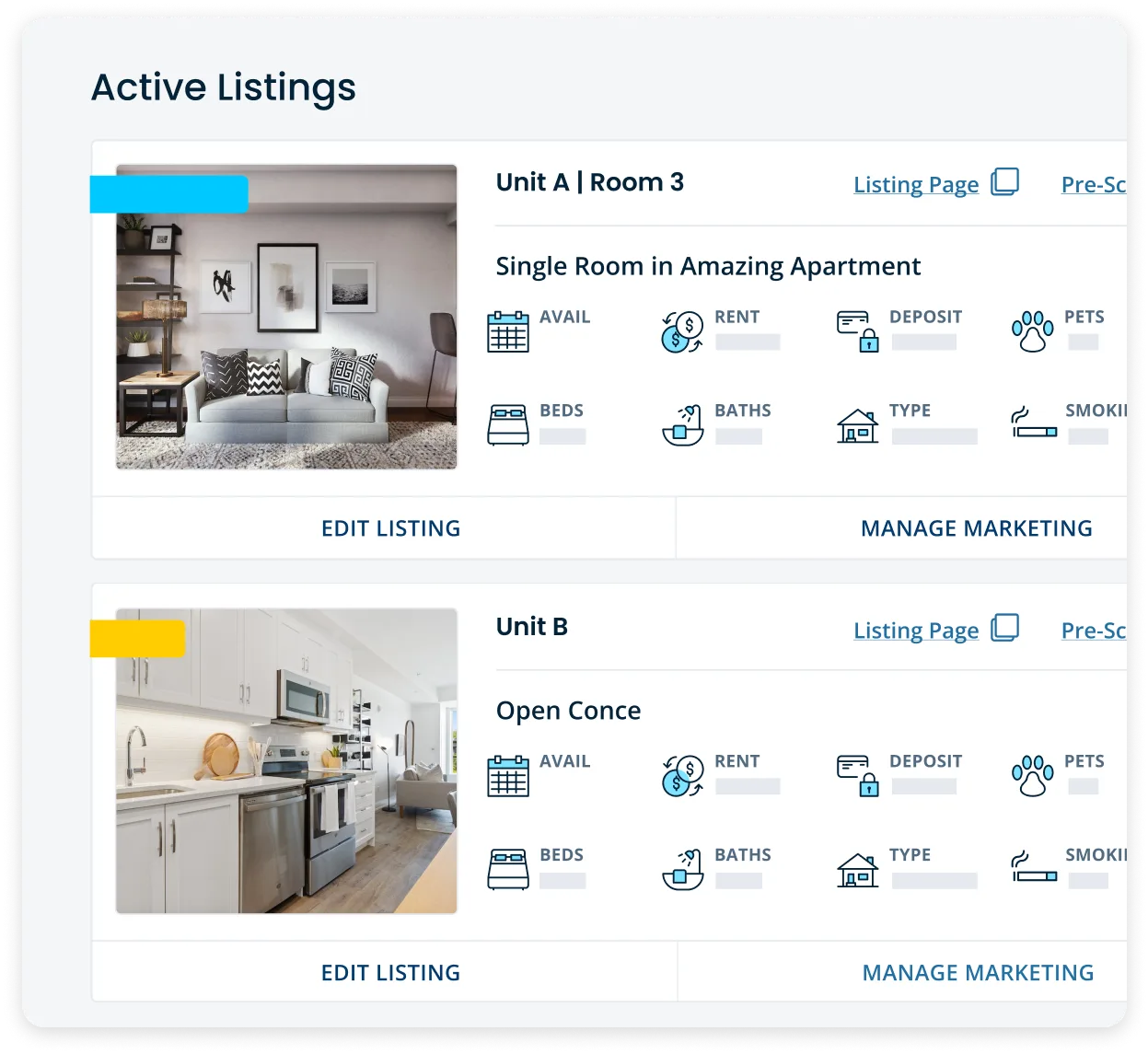

Screening & Applications

Once leads arrive, TurboTenant consolidates them in a single dashboard where landlords can review automated prescreening responses before inviting applicants to apply. The application process is fully digital and state-specific. TurboTenant handles sensitive data, such as Social Security numbers, thereby protecting landlords from compliance risk. Screening reports, including full credit, background, criminal, and eviction history, appear instantly once tenants complete the process. These reports cost tenants $45 – $55 and are completely free for landlords.

Lease Agreements

TurboTenant offers more than 50 state-specific lease agreements, including nuanced distinctions such as differences between New York State and New York City. All lease templates are maintained by an in-house legal team and updated regularly. Landlords select a property, customize terms, add addenda, and send agreements for electronic signature. Tenants can sign from a phone or computer, and TurboTenant handles distribution and storage of final documents. Lease creation and e-signatures are included in paid plans, with the option for free-plan users to purchase leases individually.

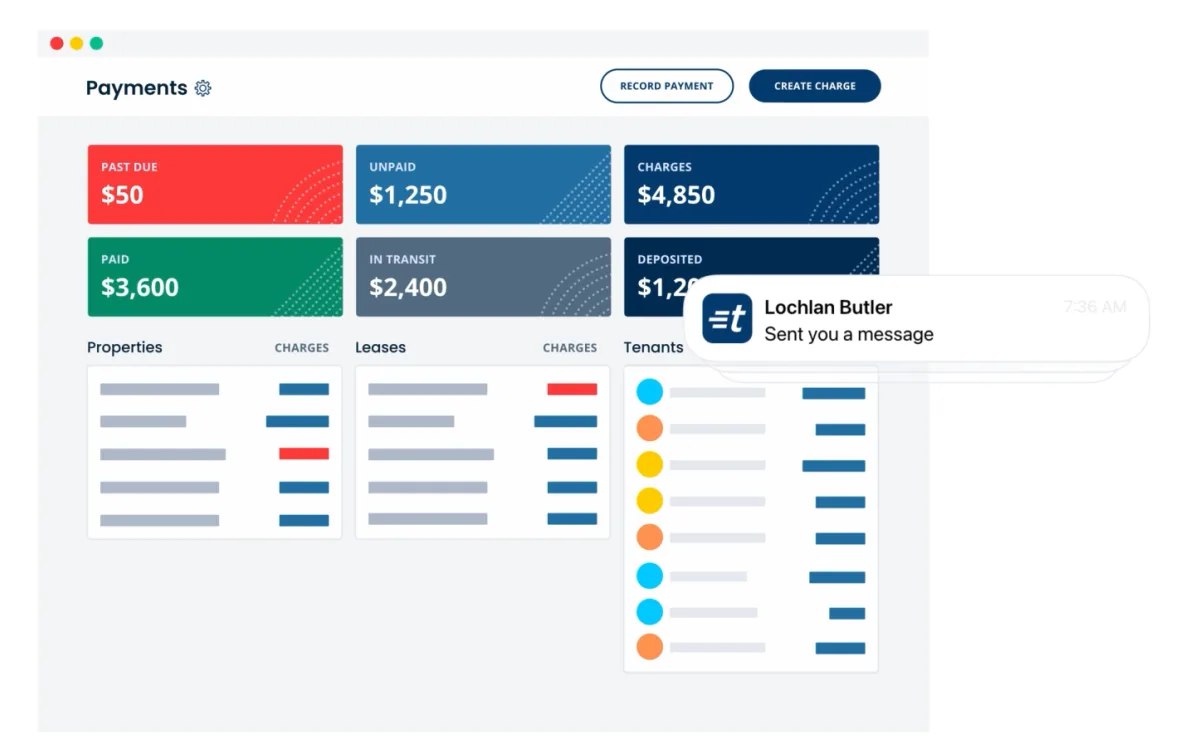

Rent Collection

TurboTenant’s rent collection system automates payment reminders, tracks charges, and manages payments for rent, utilities, and security deposits. Landlords can configure late fees with notable flexibility, including daily fees, percentage-based fees, flat rates, one-time charges, and capped structures. Once configured, the platform applies fees automatically and communicates changes to tenants. Tenants can enable autopay, and TurboTenant issues legally compliant rent receipts each month. The result is a highly automated system that reduces friction in the landlord–tenant relationship.

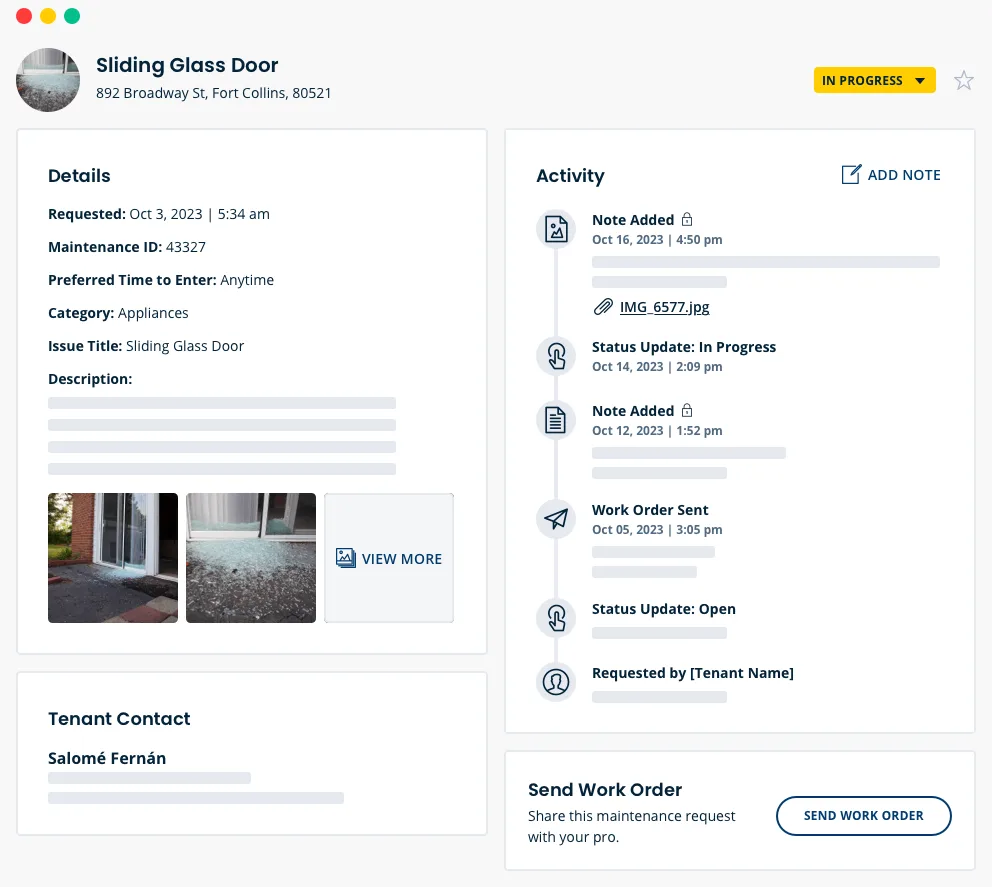

Maintenance Management

Maintenance requests begin with tenants submitting details through the TurboTenant mobile or desktop app. They can attach notes, photos, and preferred access times. Landlords receive instant notifications and can respond with status updates, comments, or attachments. Requests can be forwarded to existing maintenance professionals, complete with all tenant-provided information. TurboTenant’s new AI maintenance assistant helps gather more precise details from tenants—asking diagnostic questions like location, water temperature, and prior troubleshooting steps—to reduce unnecessary service calls and better prepare vendors.

Accounting

TurboTenant’s accounting module operates like a rental-specific version of QuickBooks. After acquiring and expanding the solution in 2024, TurboTenant now offers automated expense categorization, bank and credit card syncing, depreciation tracking, and detailed reporting at the property, unit, and portfolio levels. During tax season, TurboTenant generates a comprehensive package that includes Schedule E. Accounting is an additional subscription outside of the core property management plans, with pricing subject to ongoing updates as the company introduces new tiering options.

User Experience

TurboTenant’s platform is structured around the vacancy cycle, guiding landlords step-by-step from advertising to screening, leasing, rent collection, maintenance, and accounting. The interface is clean and user-friendly, making it approachable for first-time landlords while still offering the depth needed for more experienced owners. Listings can typically be created in just a few minutes, and workflows are designed to minimize friction and reduce the learning curve. The mobile app, available for both tenants and landlords, maintains a 4.9-star rating and supports nearly all web-based functions, enabling seamless management on the go.

Customer Support

TurboTenant’s Colorado-based customer support team operates seven days a week. Phone support is provided for paid-plan subscribers, complemented by email and in-app chat support for all users. The accounting product includes phone support for all accounting subscribers. TurboTenant’s support quality and responsiveness remain a strong part of its overall offering.

Pricing

TurboTenant operates on a freemium model. The free plan includes advertising, lead management, applications, rent collection, maintenance tracking, messaging, and screening tools. Lease agreements and e-signatures are not included and must be purchased individually unless the landlord upgrades to a paid plan.

TurboTenant also offers paid plans. All paid plans are under $200 per year for unlimited properties.

Competitors

Avail

Avail is a rental management software platform offering tools for marketing, applications, screening, rent payments, and maintenance coordination. It caters primarily to small landlords and provides a structured workflow for long-term rentals.

RentRedi

RentRedi is a mobile-focused property management platform that supports rent payments, maintenance requests, screening, and tenant communication. It is designed for landlords who prefer to manage operations primarily through a mobile app.

Zillow Rental Manager

Zillow Rental Manager allows landlords to advertise rental properties on Zillow’s network, collect applications, screen tenants, and handle rent payments. Its primary strength is access to Zillow’s large audience of renters.

FAQs

TurboTenant is an all-in-one property management software for long-term and mid-term rental owners who want to self-manage their properties.

TurboTenant offers a free plan plus paid plans under $200 per year for unlimited properties. Accounting is a separate subscription.

Yes. Its step-by-step workflows and guided vacancy cycle make it especially accessible for first-time rental owners.

No. TurboTenant is designed for long-term and mid-term leases only.

Yes. Tenants can pay via ACH, debit, or credit card and may enroll in autopay. Rent receipts are automatically issued.

TurboTenant is best for small landlords managing 1 to 100 units across single-family rentals or small-to-medium multifamily properties.

How We Evaluated TurboTenant

When evaluating TurboTenant, we examined several factors, including:

- Product and service offerings: We studied TurboTenant’s full suite of features and how they support landlords throughout the vacancy and management cycle.

- Pros and Cons: We identified areas where TurboTenant excels as well as limitations relevant to small and midsize landlords.

- Ease of use: We reviewed onboarding, workflow complexity, and the overall user experience, drawing on insights from a live demo.

- Customer support: We evaluated responsiveness, availability, and support channels, including distinctions between free and paid plans.

- Pricing and transparency: We reviewed TurboTenant’s plan structure, pricing variability, and total value for landlords.

Summary of TurboTenant

TurboTenant offers one of the most complete and accessible rental management solutions for small and midsize landlords. Its vacancy-cycle workflow lets owners manage every key task in one place. With a strong free tier, low-cost premium plans, and an intuitive platform, it delivers exceptional value. Overall, TurboTenant is a highly effective and affordable option for self-managing landlords.

Disclaimer

This page may contain affiliate links. If you make a purchase or investment through these links, CRE Daily LLC may receive a commission at no extra cost to you. These recommendations are based on our direct experience with these companies and are suggested for their usefulness and effectiveness. We advise only purchasing products that you believe will assist in reaching your business objectives and investment goals. Nothing in this message should be regarded as investment advice, either on behalf of a particular security or regarding an overall investment strategy, a recommendation, an offer to sell, or a solicitation of or an offer to buy any security. Advice from a securities professional is strongly advised, and we recommend that you consult with a financial advisor, attorney, accountant, and any other professional who can help you understand and assess the risks associated with any real estate investment. For any questions or assistance, feel free to contact [email protected]. We’re here to help!