RealtyMogul Overview

Founded in 2012, RealtyMogul is an online marketplace for private US-based real estate investments. Real estate companies or sponsors can apply to list their deals on the platform, while accredited investors can use it to find investment opportunities.

Real estate investments listed on RealtyMogul can include equity and debt investments across commercial, residential, and mixed-use property types. They can also follow various investment strategies, such as value-add, core-plus, and development. The minimum investment is typically at least $35,000.

In addition to the marketplace, RealtyMogul offers two non-publicly-traded real estate investment trusts (REITs) available to accredited and non-accredited investors. One holds debt and equity investments across multifamily, office, and retail property and focuses on generating monthly income for investors. The other holds equity and preferred equity investments of value-add multifamily properties, focusing on achieving long-term capital appreciation while providing quarterly income to investors. The minimum investment for both REITs is $5,000.

Anyone can view basic details on private placement deals and full details on REITs on the company’s website. So far, over $1 billion has been invested toward $8 billion in nationwide real estate on the platform.

Our Take On RealtyMogul

Best for diversity among CRE property types and REITs

RealtyMogul is an excellent choice for investors who want an easy way to grow their capital and/or collect regular dividends. Because RealtyMogul investments are private and non-traded, they can also be an effective hedge against the stock market. Users who value a passive investing approach and the potential for high returns should consider checking out RealtyMogul.

Pros

Pros- Strong track record. Investments made on the RealtyMogul platform have one of the longest track records of any real estate crowdfunding platform.

- Diverse investment offerings. RealtyMogul offers investments across a variety of property types and investment strategies. You can invest in equity or debt that supports commercial, residential, and mixed-use properties.

- User-friendly interface. The RealtyMogul platform is easy to use. The top of the website has a navigation bar, from which you can access most features.

- No platform fees. Unlike some real estate investment marketplaces, RealtyMogul doesn’t charge investors any fees to use its platform.

- IRA options available. For those interested in investing for retirement, RealtyMogul supports investing through a self-directed individual retirement account (IRA).

- 24/7 customer support. RealtyMogul offers ample options for contacting its customer support. Users can get in touch by email, chat, and phone 24/7.

Cons

Cons- High minimum investment. Most RealtyMogul investments require a minimum investment of at least $35,000.

- No mobile app. The RealtyMogul platform is only available via web browser. This could be a disadvantage for those who prefer to manage their investments on the go with a mobile app.

RealtyMogul Track Record

According to the company website, as of October 30, 2024, $229,290,450 have been invested in 234 deals that have gone full cycle (i.e., the assets have been sold, and all distributions have been paid). These had an overall target internal rate of return (IRR) of 15.1% and a realized IRR of 18.1%.

The company website also breaks down its track record by investment type:

| Equity syndications | Residential debt |

| 18.7% average realized IRR | 10.2% average realized IRR |

| 16.6% average target IRR | 10.0% average target IRR |

| 86 realized investments | 132 realized investments |

| $155,726,000 realized investment amount | $33,038,500 realized investment amount |

| Equity funds | Fixed income |

| 31.7% average realized IRR | 9.1% average realized IRR |

| 16.9% average target IRR | 9.5% average target IRR |

| 6 realized investments | 10 realized investments |

| $23,341,150 realized investment amount | $17,184,800 realized investment amount |

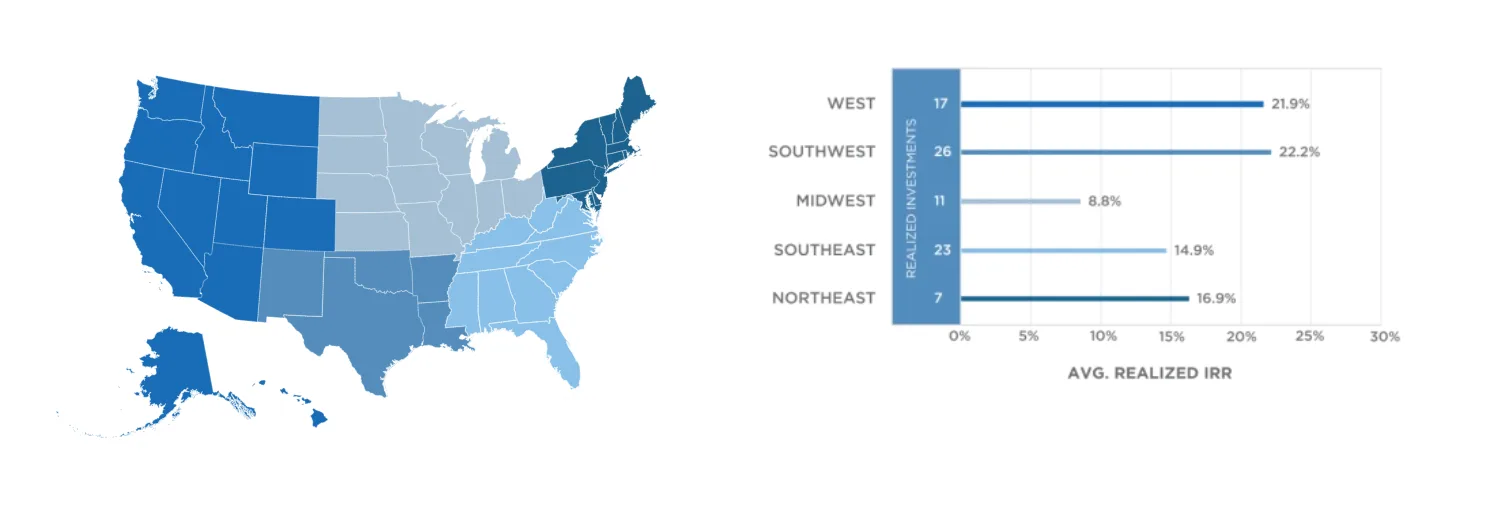

By geography (for equity syndications):

And by investment strategy (for equity syndications):

| Value-add | Core-plus | Development |

| 18.5% average realized IRR | 21.0% average realized IRR | 20.1% average realized IRR |

| 16.6% average target IRR | 15.7% average target IRR | 18.2% average target IRR |

| 76 realized investments | 9 realized investments | 1 realized investments |

| $141,260,000 realized investment amount | $12,991,000 realized investment amount | $1,475,000 realized investment amount |

User Experience

As an investor, signing up to use RealtyMogul is easy and fast. Anyone can create an account by clicking “join” on the homepage or requesting further details on any private placement or REIT investments.

A pop-up window will appear, asking you to enter your name, phone number, email, and a custom password. You’ll also need to indicate whether you are an accredited investor.

RealtyMogul registration window

Once registered, users can view additional details on private placement investments. Investors interested in fully funded deals must get on a waitlist. If an opportunity to invest in a fully-funded deal presents itself, waitlisted users are notified by email.

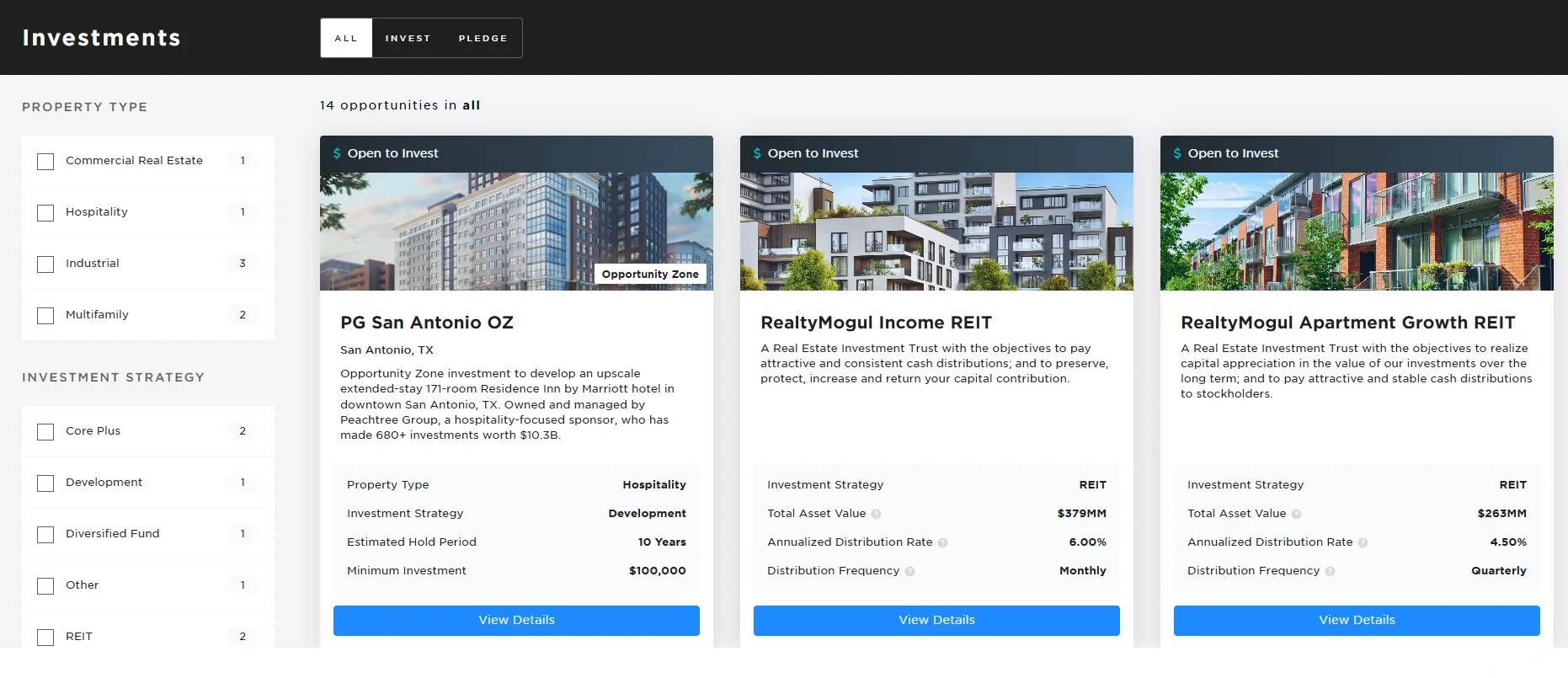

RealtyMogul investments page

Users can filter deal opportunities on the investments page by property type (commercial real estate, mixed-use, multifamily, and residential) and investment strategy (Core Plus, Development, Diversified Fund, REIT, Value-Add).

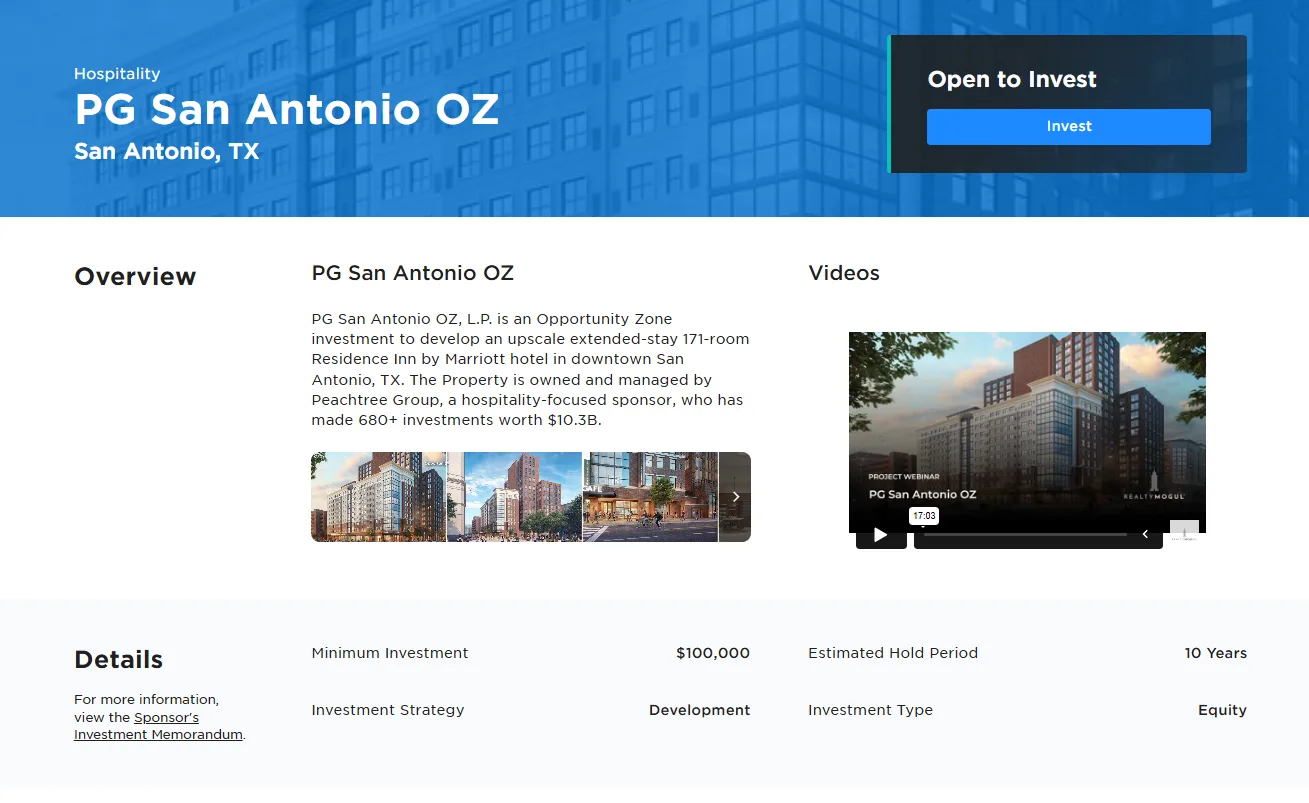

When you click on a specific sponsored investment, you’ll be directed to a dedicated deal page displaying various projected return metrics, such as the deal’s target IRR, average cash-on-cash return, and target equity multiple. You’ll also see the deal’s investment strategy, investment type, estimated hold period, estimated first distribution, and minimum investment. A link to the sponsor’s upcoming webinar introducing and explaining the deal (or a recorded webinar if it has already occurred) is also included.

Furthermore, each deal page has information regarding the deal’s sponsor, business plan, property, financials, documents, and disclaimers. RealtyMogul is transparent about all of its sponsor deals, including past investments. And if users have any questions, they can message or schedule a call with a dedicated investor relations representative.

RealtyMogul deal page example

Once a user has evaluated a deal and decided to invest, they will be led through a workflow to verify their personal information, account type (individual, joint, trust, or entity), investment amount, accreditation status, investment goals and risk tolerance, identity, agreement with legal documents, and payment details. The process for investing in RealtyMogul’s REITs is similar.

From there, users can monitor their investments under their member dashboard, which shows their investments (completed, active, and pending), transactions, messages, tax documents, profile settings, and auto-invest settings (auto-invest is available for REITs only). Users also receive regular email updates on the performance of their investments.

Overall, navigating the RealtyMogul platform is easy and straightforward.

Features

Beyond the private placement marketplace and REIT offerings, RealtyMogul offers other features that make it a dynamic platform for passive real estate investors.

Pledging. After a private placement deal is listed on the platform but before it is open for funding, it enters a “pledging” period. This allows prospective investors to make a non-binding indication of interest in the deal. Once the deal is open for funding, contributions from investors who have pledged are prioritized on a first-come first-served basis. If, after all pledges have been accepted, capacity remains to accept further investment, the deal is opened to all investors on the platform.

IRA option. RealtyMogul lets you invest in its REITs within a tax-advantaged self-directed individual retirement account (SDIRA). Some private deal sponsors may also let you invest via a checkbook IRA or trust. Self-employed individuals with no employees may also have the option to invest with a solo 401(k). These can be good options for those who want to diversify their retirement portfolio with institutional-grade real estate investments and don’t plan to liquidate their position until retirement age.

1031 exchange. A 1031 exchange allows investors to defer paying capital gains tax on a property sale by putting the sale proceeds toward another like-kind property of equal or higher value within a certain timeframe. RealtyMogul’s 1031 exchange offering provides investors with a curated selection of high-quality real estate investment opportunities designed to facilitate tax-deferred exchanges under IRS regulations. The platform features diverse asset classes, including multifamily, industrial, hospitality, and single-tenant retail options, all vetted through a formal due diligence process by its affiliated broker-dealer, RM Securities. RealtyMogul offers personalized service, with a dedicated team of specialists to guide investors through the complexities of 1031 exchanges, including custom acquisition services for transactions over $5 million. With a focus on quality and expert support, RealtyMogul aims to help investors achieve their financial goals while navigating the 1031 exchange process seamlessly.

Customer Support

The RealtyMogul website has a chatbot (powered by Zendesk) that lets users submit questions 24/7 across four categories: “Investing,” “Get Financing,” “Site Related,” and “Other.” Users can attach up to 5 files relevant to their question.

The company also has dedicated phone numbers and email addresses for various departments:

- General inquiries: (877) 977-2776 or [email protected]

- Investor relations: (877) 781-7062 or [email protected]

- Press inquiries: (877) 977-2776 or [email protected]

All phone lines are open 24/7, but they are most likely to be answered during Pacific Time (PT) business hours.

For users who prefer to find answers on their own, the company has an FAQ page with answers to 59 frequently asked questions and a knowledge center with over 360 educational articles across various topics: REITs, building wealth, commercial real estate, investing, passive income, and RealtyMogul news.

Pricing

The RealtyMogul platform is free to use for investors. However, private deal sponsors may charge fees to investors to cover administrative, legal, reporting, and other costs. Typically, these fees are taken directly out of the project, lowering the overall return for investors. You can find an investment’s fee structure disclosed on its deal page. Keep in mind that fee structures can vary widely by investment and sponsor. RealtyMogul’s REITs also have their own fee structures. They charge fees to cover third-party expenses, asset management costs, and other operating expenses. Users can view their offering circulars under the “resource” tab on each REIT’s deal page for a detailed description of both REITs’ fee structures.

Competitors

RealtyMogul’s main competitors are CrowdStreet, Fundrise, and EquityMultiple.

Founded in 2013, CrowdStreet is an online marketplace for commercial and residential real estate deals for accredited investors. The platform offers equity, debt, and hybrid investments across multifamily, retail, office, medical building, self-storage, industrial, and land property types. It also offers a private REIT with over 20 investments and a minimum investment of $25,000.

Compared to RealtyMogul, CrowdStreet has a slightly shorter track record, fewer realized deals (168 compared to 228), and a higher barrier to entry (CrowdStreet’s REIT is only available to accredited investors). It also doesn’t have a customer support phone number.

Founded in 2012, Fundrise is an online real estate crowdfunding platform that offers private REITs that hold equity and debt investments in residential and commercial properties across the U.S. Non-accredited investors can invest for as little as $10. They can also choose between long-term appreciation, supplemental income, and mixed investment strategies. Quarterly dividends can be received as cash or be reinvested, and REIT shares must be held for at least five years to avoid a 1% early withdrawal fee.

Compared to RealtyMogul, Fundrise has a wider range of REIT options. However, it doesn’t offer any private placement deals from outside sponsors or direct investments in property. Consequently, Fundrise gives investors less control. In addition, Fundrise offers less diversification across property types. Its investments mainly hold multifamily apartments, industrial properties, and single-family rentals.

Founded in 2015, EquityMultiple is an online marketplace for equity and debt investments in commercial and residential real estate. It also offers private non-traded REITs. The platform is available to accredited investors only, and the minimum investment typically ranges from $10,000 to $30,000 but can be as low as $5,000. As of June 2022, the company had closed 50+ deals for projects totaling over $4 billion in total capitalization.

Compared to RealtyMogul, EquityMultiple has a shorter track record. It’s completed fewer deals across a smaller amount of real estate (50+ deals vs. 228 deals across $4 billion in capitalization vs. $5.9 billion in real estate). EquityMultiple also charges fees to its investors (and sponsors), while RealtyMogul only charges fees to sponsors.

FAQs

RealtyMogul is an online marketplace for private commercial and residential real estate investments. Real estate companies (aka sponsors) can apply to list and raise funding for their investments on the platform. If a deal passes RealtyMogul’s thorough vetting process, it is opened to accredited investors on the website. The platform is free to use for investors, while RealtyMogul charges sponsors, a cost typically structured into the deal. RealtyMogul also offers two real estate investment trusts (REITs) available to non-accredited and accredited investors for a minimum investment of $5,000.

Private placement real estate deals on RealtyMogul are available to accredited investors only. However, RealtyMogul’s Income REIT and Apartment Growth REIT are also available to non-accredited investors.

Creating an account on RealtyMogul is simple and fast. All it takes is entering a few personal details (your first and last name, email address, phone number, and new password) and indicating whether you are an accredited investor.

RealtyMogul has been in business for nearly 12 years. It was founded in 2012 and welcomed its first investor in 2013.

RealtyMogul offers equity and debt investments across commercial, residential, and mixed-use property types. These can include investments in apartment buildings, offices, retail buildings, industrial buildings, self-storage, cold storage, mobile home parks, and more. RealtyMogul also offers 1031 exchange opportunities across multiple asset classes.

The timing of investment distributions varies by deal and sponsor. Cash-flowing deals typically provide equity investors with quarterly distributions. However, distributions are never guaranteed and are at the discretion of the deal sponsor. Please review the operating agreement of a particular deal before investing in it.

All RealtyMogul investments involve substantial risk and returns are never guaranteed. Prospective investors should do their due diligence before investing in a deal. That said, RealtyMogul has a strong track record. As of October 30, 2024, its overall realized internal rate of return (IRR) across its 234 realized investments is 18.1%. However, past performance is not a guarantee of future results, and investors could lose some or all of their investment.

Minimum investment amounts vary by deal. However, most deals require a minimum investment of at least $35,000, while RealtyMogul’s REITs require only $5,000.

Using the RealtyMogul platform is free to investors. That said, there may be fees associated with particular investments that you directly or indirectly pay to sponsors. These fees typically cover ongoing management, reporting, legal, and communication efforts. Review a deal’s operating agreement for more details on its specific fee structure.

RealtyMogul investments are private, non-traded investments in physical properties across the country. As a result, they aren’t easily sold or traded, and investors should not invest in them with the expectation of getting their money back before the deal is completed. Check an investment’s deal page for an estimated hold period with the understanding that these are only estimates and never guaranteed.

Sponsors of RealtyMogul deals provide investors with K-1s. Those who invest in either of RealtyMogul’s two REITs will get 1099s by the end of January for the previous tax year. Both K-1s and 1099s are posted on investors’ RealtyMogul dashboard.

How We Evaluated RealtyMogul

To evaluate RealtyMogul, we considered the following factors:

- Track record. We studied the past performance of RealtyMogul’s investments and compared them to the returns on other investments.

- Features. We assessed the range of features offered by RealtyMogul, including IRA compatibility, investment waitlisting and pledging, and the potential for 1031 exchanges.

- Pros and cons. We weighed the pros and cons of using RealtyMogul as an investor and highlighted the benefits and potential shortfalls.

- Ease of use/Functionality. We tested how user-friendly the RealtyMogul platform is by creating an account, navigating the dashboard, and observing how easily new users can understand its functionality.

- Customer support options. We explored different ways to contact customer support and their availability.

- Fee structure. We evaluated the cost of using the RealtyMogul platform and the fee structure for its investments.

Summary of RealtyMogul Review

RealtyMogul is a powerful platform for investing in private real estate deals. Users get access to investments across various U.S. locations, property types, and investment strategies. Furthermore, the company makes it easy to sign up and get started. The website is intuitive to navigate, and customer support is always a message or call away.

RealtyMogul is an excellent choice for investors who want an easy way to grow their capital and/or collect regular dividends. Because RealtyMogul investments are private and non-traded, they can also be an effective hedge against the stock market. Users who value a passive investing approach and the potential for high returns should consider checking out RealtyMogul.

Disclaimer

This page may contain affiliate links. If you make a purchase or investment through these links, CRE Daily LLC may receive a commission at no extra cost to you. These recommendations are based on our direct experience with these companies and are suggested for their usefulness and effectiveness. We advise only purchasing products that you believe will assist in reaching your business objectives and investment goals. Nothing in this message should be regarded as investment advice, either on behalf of a particular security or regarding an overall investment strategy, a recommendation, an offer to sell, or a solicitation of or an offer to buy any security. Advice from a securities professional is strongly advised, and we recommend that you consult with a financial advisor, attorney, accountant, and any other professional that can help you to understand and assess the risks associated with any real estate investment. For any questions or assistance with these resources, feel free to contact [email protected]. We’re here to help!