LoanBase Overview

LoanBase is a placement and prospecting platform designed to solve the three biggest pain points for CRE mortgage brokers and lenders: sourcing quality leads, finding active lenders, and managing deals efficiently.

With a database of 25,000+ lenders across 30+ specialties—ranging from multifamily and industrial to niche categories like cannabis facilities and aircraft financing—LoanBase connects users to the right counterparties while automating outreach and packaging deal information.

Its newest product, the Prospects Pipeline, introduces a database of maturing loans over the next 18 months, giving brokers and lenders a first-mover advantage in a market facing a historic refinancing wall. With an estimated $2–$3 trillion in CRE loans set to mature over the next three years, LoanBase positions its users to capitalize on this unprecedented wave of opportunities.

Where LoanBase truly differentiates itself is not just in surfacing leads, but in helping brokers win them. In commercial real estate, the hardest part has never been closing a deal—it’s finding the next one and showing up prepared. With LoanBase, users don’t just get borrower contact details; they arrive to the conversation already equipped with property data, loan terms, and insight into which lenders are active and interested. That level of preparation builds trust with borrowers and gives brokers a head start in converting prospects into closed deals.

Our Take On LoanBase

Best for CRE mortgage brokers and lenders seeking faster, data-driven origination.

LoanBase is an all-in-one CRE lending marketplace that combines lead sourcing, lender matching, and deal workflow management.

Pros

Pros- Prospects Pipeline surfaces refinance opportunities before they hit the market

- Comprehensive database of 25,000+ lenders with verified contacts

- Auto-generated outreach emails and polished loan summaries

- Built-in CRM with pipeline tracking and deal management

- Strong engagement rates, with 55% average lender response in testing

Cons

Cons- Early-stage platform with features still evolving

- CRM integrations currently limited, with expanded options still in development

Pros Explained

Prospects Pipeline: The Prospects Pipeline identifies loans maturing in the next 18 months, giving brokers visibility into refinance opportunities before they appear in the open market. Each record includes property details, loan size, and borrower contacts, enabling users to reach owners at the exact time financing becomes relevant—driving stronger engagement and higher conversion rates. Beyond upcoming maturities, the tool also highlights deals with potential for early refinancing or cash-out opportunities, expanding the pipeline beyond just loans approaching maturity.

Comprehensive lender database: LoanBase maintains a database of more than 25,000 verified lenders across banks, credit unions, debt funds, and specialty finance companies. Each contact is validated for accuracy, reducing wasted outreach and helping brokers get directly to decision-makers. This breadth ensures users can go beyond their personal Rolodex and find capital sources across asset classes and geographies.

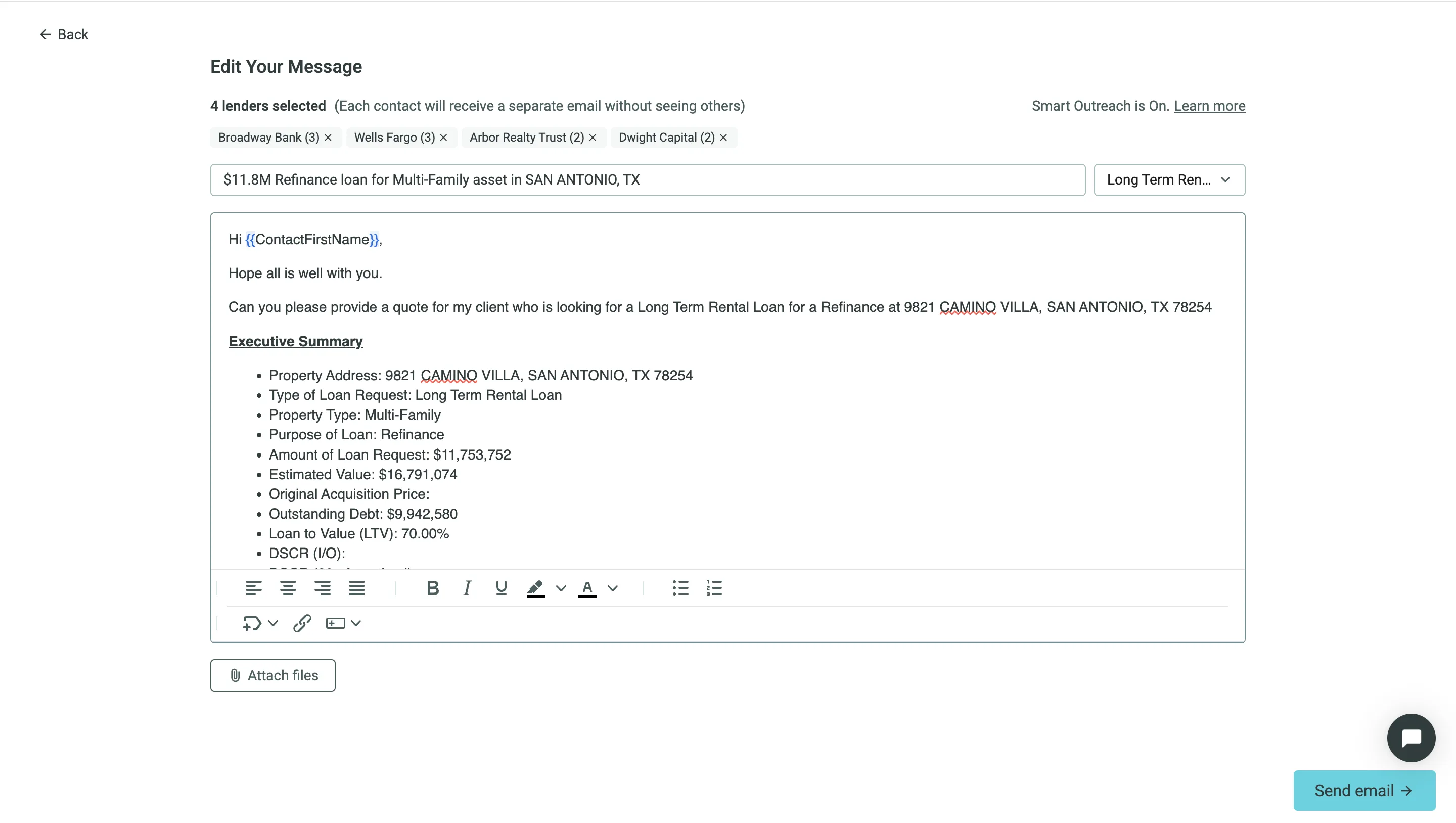

Automated outreach and loan summaries: LoanBase streamlines communication by generating professional loan summaries and customizable outreach emails in just a few clicks. This automation not only saves brokers significant time but also ensures every deal is presented consistently. In early testing, this process yielded a 55% average lender response rate, with a meaningful portion leading to quotes.

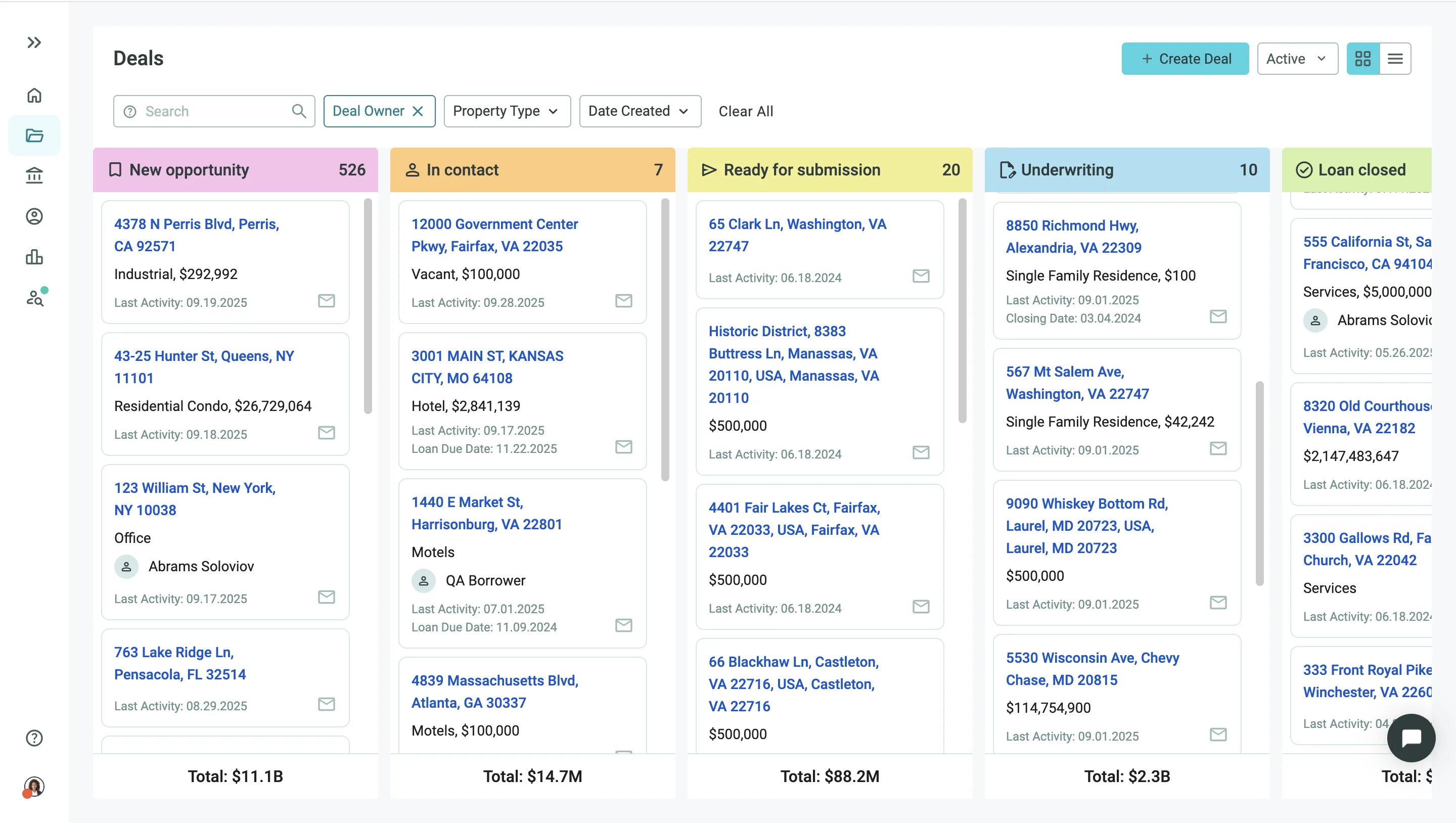

Built-in CRM with pipeline tracking: The platform includes a native CRM that tracks lender responses, organizes term sheets, and centralizes borrower communication. Brokers can see the status of each opportunity without juggling spreadsheets or third-party tools. Smaller firms can run their pipelines entirely within LoanBase, while larger teams can still export data via CSV.

High lender engagement: Engagement data underscores LoanBase’s value. Campaigns launched through the platform averaged a 55% lender response rate—well above traditional cold outreach benchmarks. Even more importantly, 10–15% of contacted lenders provided actionable quotes, demonstrating that the system converts outreach into real deal flow.

Cons Explained

Early-stage company with evolving features: LoanBase is still in its growth phase, and while it offers strong functionality today, its roadmap is evolving. Features like advanced integrations and expanded borrower coverage are still in development, so early adopters may experience changes as the platform scales.

CRM integration currently limited: The built-in CRM is functional for managing prospects, lender responses, and term sheets, but integration with external CRMs remains a work in progress. Currently, data can only be exported via CSV, which may require additional steps for larger firms with established systems. However, LoanBase has indicated that direct CRM integrations are slated for release in upcoming product versions, which will improve workflow flexibility for heavy users.

LoanBase Key Features

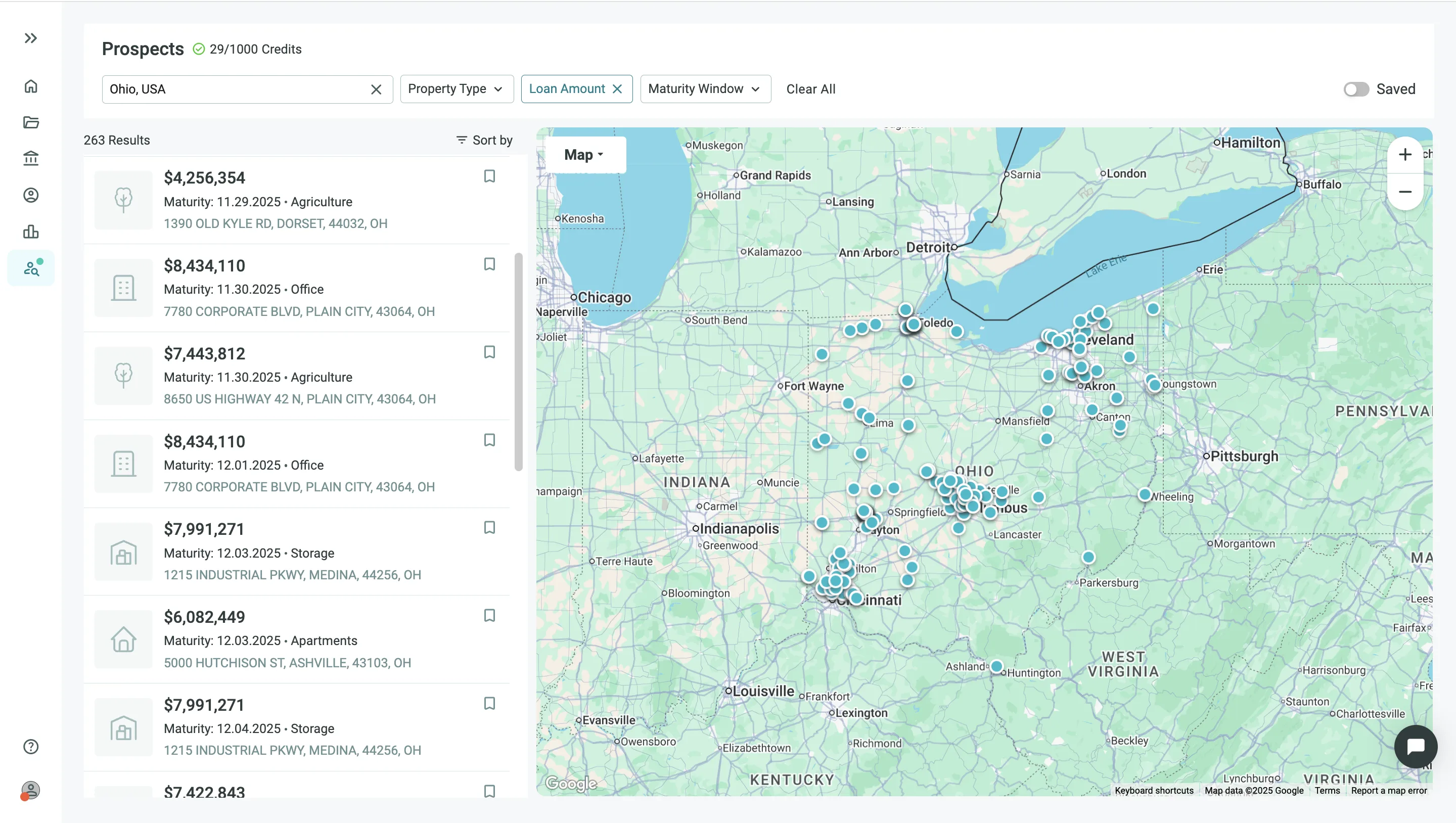

Prospects Pipeline

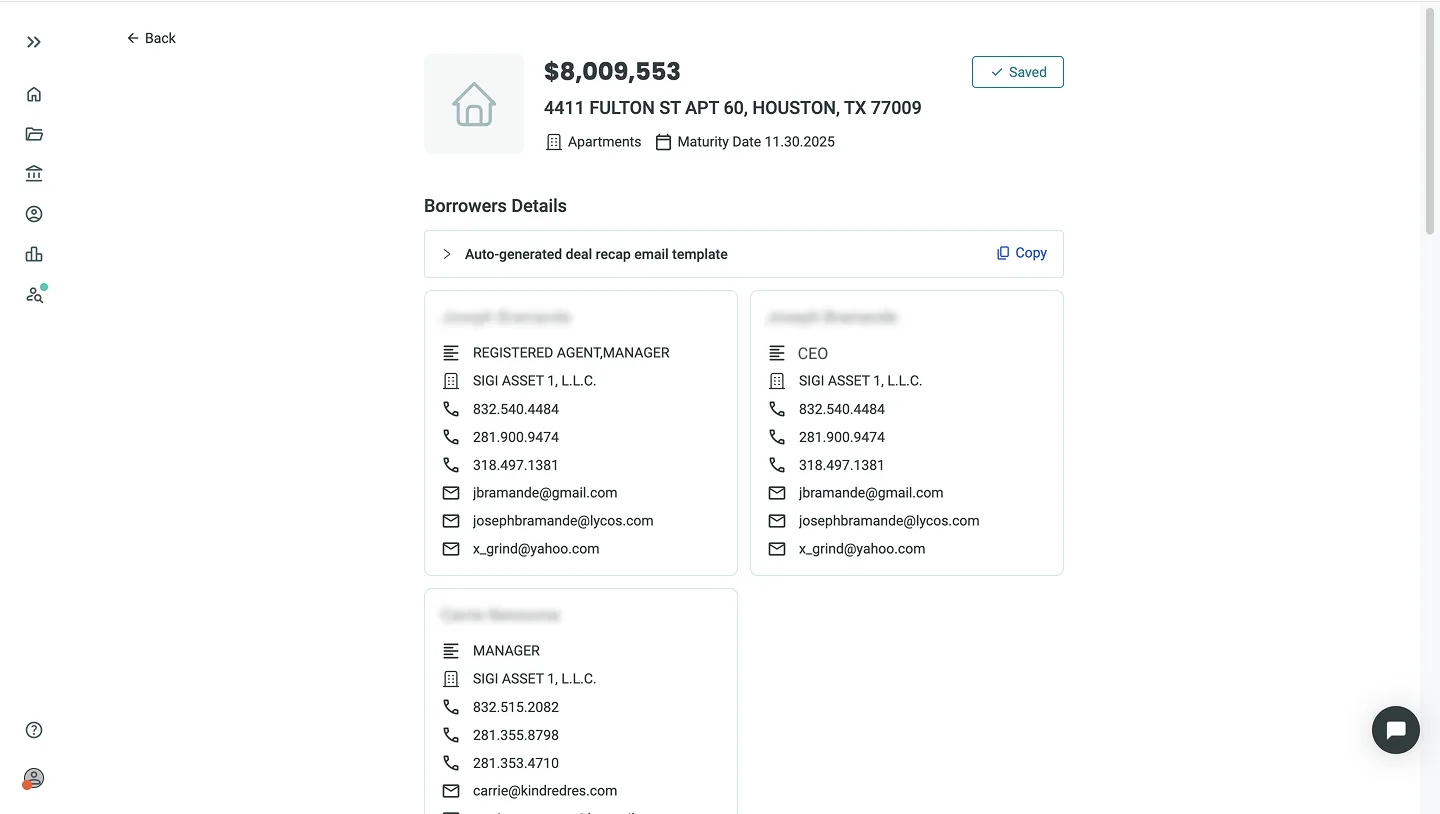

The Prospects Pipeline is one of LoanBase’s most powerful differentiators, designed to give brokers and lenders a first-mover advantage in sourcing deals. The tool tracks thousands of loans set to mature within the next 18 months, surfacing refinance opportunities before they hit the broader market. Each record includes key details such as loan size, maturity date, property type, and borrower contact information, allowing users to identify not just the asset, but also the decision-maker behind it.

Brokers can filter and refine prospects by geography, asset type, or loan parameters to zero in on the most relevant opportunities. Instead of wasting time on cold calls, users can approach borrowers at the exact moment refinancing becomes relevant—when they are most likely to respond. Outreach can be launched directly through the platform using automated emails, professional loan summaries, or even phone calls placed in-app. Once conversations begin, quotes and responses flow directly back into the system, making it easy to track which opportunities are progressing.

By combining predictive loan data with verified borrower contacts and built-in communication tools, LoanBase transforms what has traditionally been a labor-intensive and uncertain process into a structured, proactive pipeline. The result is a steady stream of high-quality leads that help brokers expand their business and close deals more efficiently.

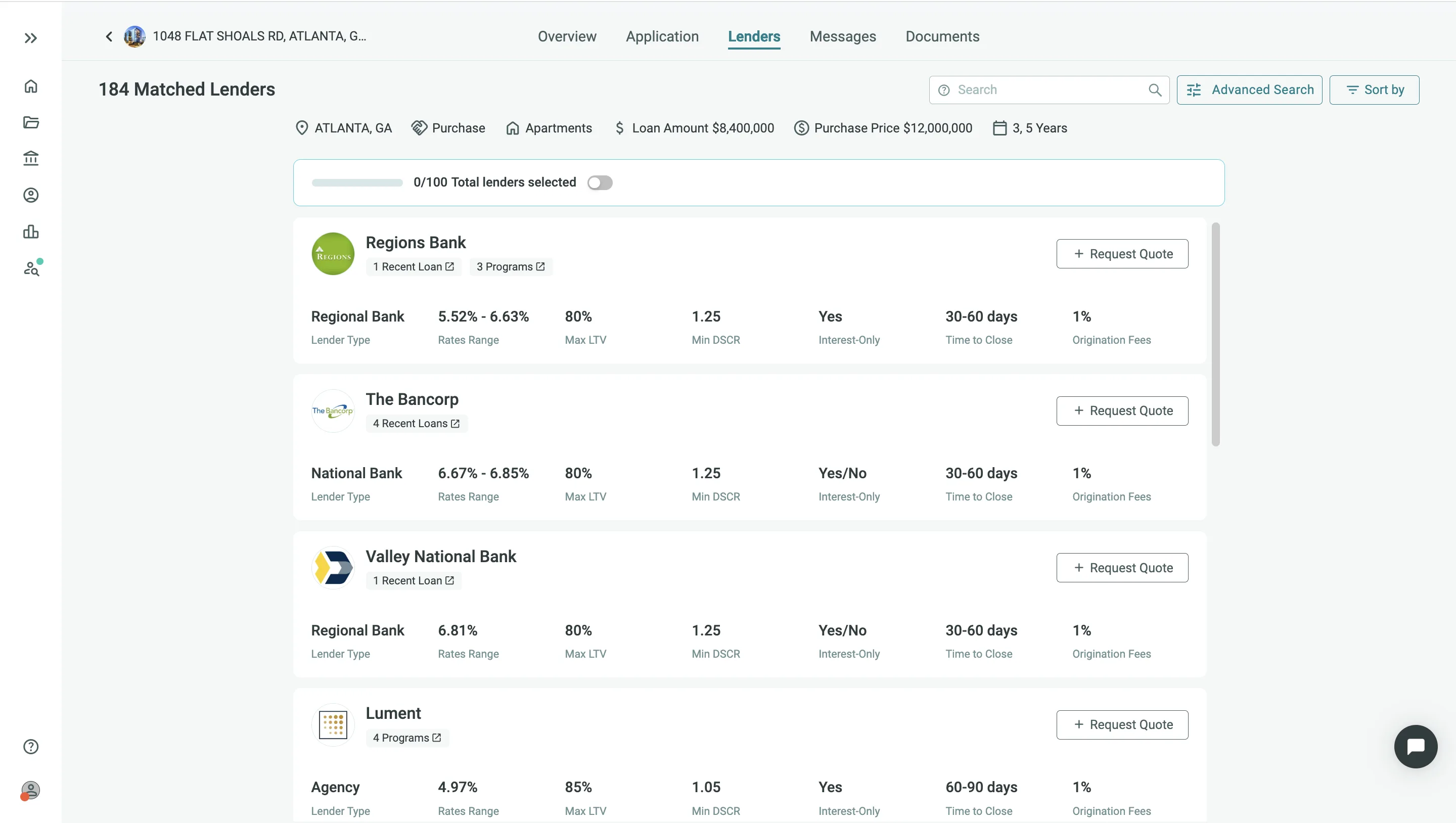

Lender Match

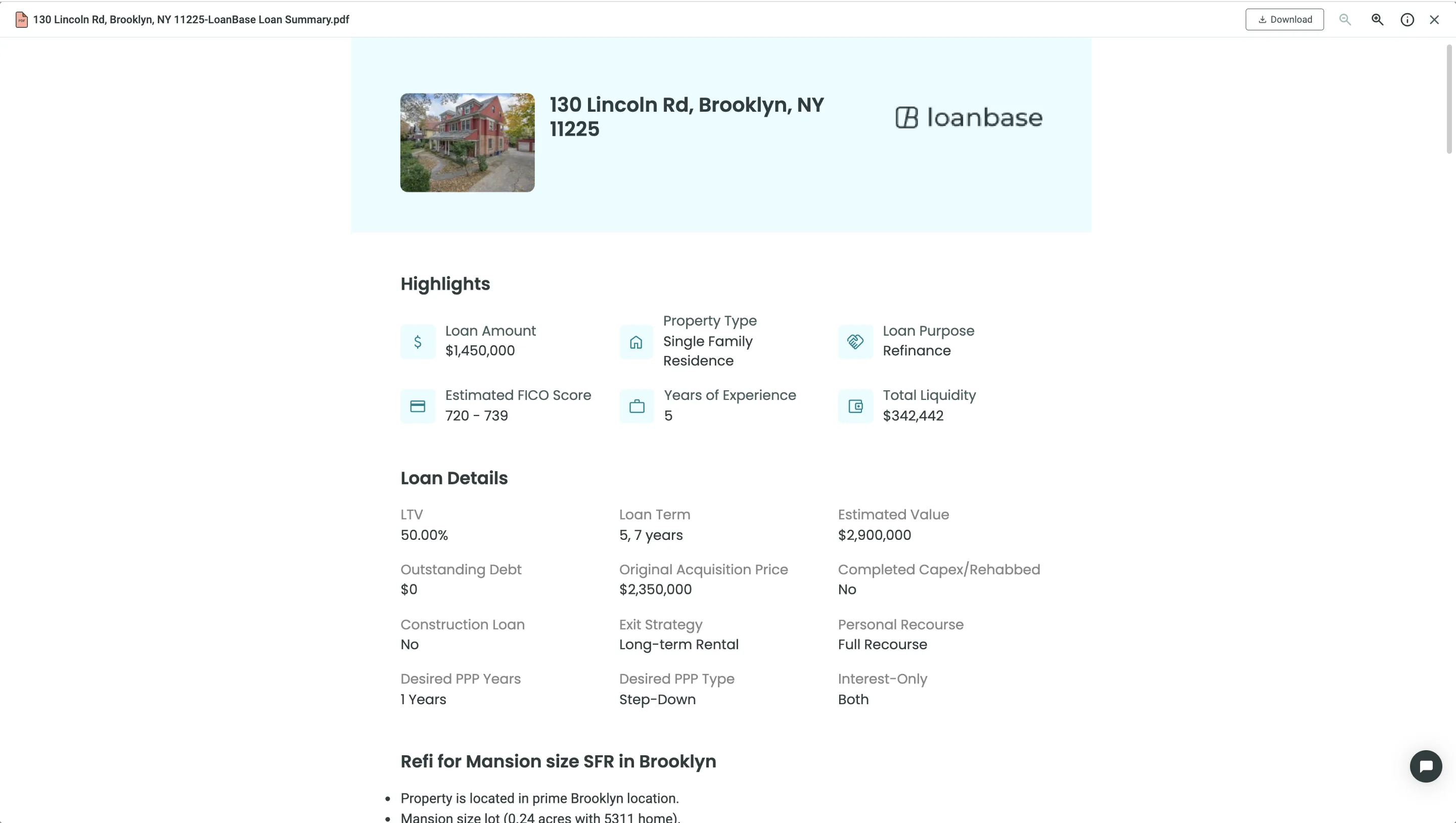

LoanBase’s Lender Match tool uses its database of over 25,000 capital providers to find the lenders most likely to close a deal. The process is simple: users start by entering a property address and filling out the loan application. The more details provided, the better the system can tailor matches. Users can also upload documents and images, which the platform converts into a professional loan summary ready to share.

Once submitted, LoanBase generates a curated list of lenders and indicative quotes based on the deal’s parameters. Filters allow brokers to refine results by geography, loan terms, and lender activity. From there, users can select top lenders, send outreach using ready-made templates or customized messages, and even place direct calls through the app. Quotes flow back into the system, where they can be organized in a comparison table for easy evaluation.

By automating this process, LoanBase eliminates hours of manual research and cold outreach. Brokers expand their lender networks, save time, and close deals faster—all while managing communications and quotes in a single platform.

Verified Contacts

Accurate data is essential for efficient deal-making, and LoanBase invests heavily in contact verification. Every lender and borrower record goes through multiple layers of validation, ensuring phone numbers and emails are current. Borrower details are further cross-checked with ownership filings and industry databases. At present, LoanBase offers verified borrower contact coverage on roughly 55% of loans in its system, with coverage expanding quickly. For brokers, this means fewer bounced emails, faster responses, and more conversations that result in genuine opportunities.

Automated Outreach

LoanBase automates much of the initial lender communication process. Once deal details are entered, the platform generates a professional loan summary that can be shared instantly. It also provides pre-built, customizable email templates that help brokers send polished outreach messages at scale. This automation is paired with verified contact data, which has led to meaningful engagement: LoanBase reports that more than half of lender outreach messages receive a response, and 10–15 percent result in actionable quotes.

Pipeline Management

Managing active deals is simplified through LoanBase’s built-in CRM. The pipeline dashboard tracks every stage of a transaction, from initial prospect to final quotes. Users can monitor lender responses, evaluate term sheets, and keep borrower communications organized within the same platform. For smaller firms, this eliminates the need for a separate CRM. For larger brokerages, deals can be exported via CSV into external systems, providing flexibility without losing visibility.

Market Coverage

LoanBase is designed to cover both mainstream and niche corners of the CRE lending market. It supports more than 30 different property specialties, including multifamily, office, retail, and industrial. Beyond these core asset types, it also covers sectors like cannabis facilities, EV charging infrastructure, marinas, and aviation assets. This breadth allows brokers to confidently pursue opportunities in both established and emerging asset classes, knowing the platform can connect them with capital providers who have relevant experience.

User Experience

LoanBase is built to be intuitive, with most users able to start sourcing prospects and matching lenders without formal training. The Prospects Pipeline feels familiar, like a property database, but distinguishes itself by layering in refinance timelines and borrower contacts, making the data immediately actionable. For brokers, this means less time spent gathering information and more time moving deals forward.

The platform also simplifies communication and deal tracking. Automated loan summaries and outreach emails reduce the time spent drafting correspondence, while the built-in pipeline dashboard provides clear visibility into every deal’s status. While larger firms may prefer CRM integrations, the native dashboard is sufficient for many brokers, offering an efficient and easy-to-use workflow that consolidates sourcing, outreach, and tracking into one place.

Customer Support

LoanBase provides responsive, high-touch support that goes beyond technical troubleshooting. Users can connect with the team through email, in-platform chat, or scheduled calls, and new customers receive hands-on guidance during onboarding to shorten the learning curve. The support team also offers coaching on how to position deals to lenders, making it a valuable resource for smaller brokerage shops that may not have dedicated tech or training staff.

Pricing

LoanBase offers a free 7-day trial with seven free leads, giving new users a chance to test its lender-matching and outreach tools before committing.

For ongoing use, the Pay-per-Deal plan costs $95 per deal plus a 0.15% origination fee, with no long-term commitment. Subscriptions start with the Starter plan at $145 per seat per month (10 deals) and the Pro plan at $295 per seat per month (30 deals), designed for brokers and teams managing regular deal flow.

For high-volume users, LoanBase is introducing a Power Broker plan at $1,000 per month, currently discounted to $795 per month for early-access subscribers. Annual plans also include a 20% discount, making it easier for growing firms to scale affordably.

Competitors

Lev

Lev is a venture-backed CRE financing platform that uses AI to connect borrowers, brokers, and lenders. The platform aggregates real-time and historical data from more than 4,000 lenders, helping users identify optimal loan terms quickly. Lev’s features include its AI-powered Deal Room, automated follow-ups, CRM integration, and proprietary lender-matching algorithm.

StackSource

StackSource is a digital commercial real estate financing platform that connects borrowers with a broad network of lenders. It emphasizes transparency by showing competing loan quotes side by side and is particularly well-suited for sponsors looking to evaluate multiple financing options without relying solely on broker relationships.

GPARENCY

GPARENCY takes a flat-fee approach to CRE financing, offering borrowers direct access to lenders for $5,000 per transaction, regardless of loan size. Its model is designed to eliminate traditional broker fees while still providing data tools and lender introductions.

FAQs

LoanBase is a commercial real estate financing platform that connects brokers, sponsors, and lenders through its lender-matching engine and pipeline prospecting tools. The software leverages a database of more than 25,000 lenders and integrates AI-driven workflows to streamline deal sourcing, lender outreach, and closing.

LoanBase is designed primarily for mortgage brokers, lenders, and CRE sponsors who want to expand their deal pipeline, automate outreach, and gain access to verified lender data. The platform is especially valuable for teams that handle high deal volumes or operate across multiple asset classes and geographies.

Yes. LoanBase offers a 7-day free trial, which includes seven free leads for early-access users. The company also extends discounts to those who commit to annual subscriptions.

Pricing depends on the plan selected. Users can choose a pay-per-deal option at $95/deal plus a 0.15% origination fee, or monthly subscriptions starting with the Starter plan at $145/seat and the Pro plan at $295/seat. For higher-volume users, the Power Broker plan is available at $795 per month (discounted from $1,000).

How We Evaluated LoanBase

When evaluating LoanBase, we examined several factors, including:

- Product and service offerings: We explored the depth and breadth of LoanBase’s features, products, and services, as well as what sets them apart in the industry.

- Pros and Cons: We checked the boxes on what potential clients are looking for and compared features that make LoanBase stand out from its competitors.

- Ease of use: We examined how user-friendly LoanBase’s platform is, how intuitive the onboarding process can be, and how quickly a new user is likely to understand and take advantage of the platform’s full functionality.

- Customer support: We evaluated LoanBase’s existing customer support network and scored it on response times, training materials, and access to customer service reps.

- Pricing and transparency: We examined the pricing of LoanBase products and services and whether readily available pricing information is available on its website.

Summary of LoanBase

LoanBase is an all-in-one financing platform built for CRE brokers, sponsors, and lenders. By combining an extensive verified lender database with automation tools for outreach and deal management, it streamlines the path from lead generation to closing. The new Prospects Pipeline feature sets it apart by surfacing refinancing opportunities before they hit the market, giving users a competitive edge.

LoanBase provides a seamless user experience, reliable support, and flexible pricing that suits both small teams and high-volume brokers. For CRE professionals looking to expand deal flow and improve efficiency, it stands out as a practical and forward-looking solution.

Disclaimer

This page may contain affiliate links. If you make a purchase or investment through these links, CRE Daily LLC may receive a commission at no extra cost to you. These recommendations are based on our direct experience with these companies and are suggested for their usefulness and effectiveness. We advise only purchasing products that you believe will assist in reaching your business objectives and investment goals. Nothing in this message should be regarded as investment advice, either on behalf of a particular security or regarding an overall investment strategy, a recommendation, an offer to sell, or a solicitation of or an offer to buy any security. Advice from a securities professional is strongly advised, and we recommend that you consult with a financial advisor, attorney, accountant, and any other professional who can help you understand and assess the risks associated with any real estate investment. For any questions or assistance, feel free to contact [email protected]. We’re here to help!