CenterCheck Overview

CenterCheck is a store-level sales platform purpose-built for retail commercial real estate professionals who need accurate insight into tenant sales performance. Unlike traditional location intelligence tools that rely primarily on foot-traffic or mobile device data, CenterCheck leverages anonymized credit and debit card transaction data to estimate store-level sales performance across the U.S.

Founded by former CRE professionals and data engineers, CenterCheck was built to solve one of retail real estate’s most persistent challenges: understanding tenant sales when that data is rarely disclosed. The platform serves developers, landlords, acquirers, brokers, tenant representatives, lenders, municipalities, and retailers by providing actionable insights into how individual stores, shopping centers, and trade areas are actually performing economically.

By translating card transaction data into intuitive visual dashboards, CenterCheck helps CRE professionals make better-informed decisions on leasing, acquisitions, site selection, underwriting, and negotiations.

Our Take On CenterCheck

Best for retail-focused CRE brokers, landlords, developers, and lenders who want store-level sales intelligence based on actual consumer spend rather than visit estimates.

CenterCheck is a retail analytics platform that uses credit and debit card transaction data to estimate tenant sales performance at both single-tenant and multi-tenant properties nationwide.

Pros

Pros- Uses transaction-based sales data rather than foot traffic proxies

- Store-level and shopping center-level insights nationwide

- Strong trade area and customer origin analysis

- Clean, intuitive interface built for CRE workflows

- Valuable for brokers, landlords, lenders, and municipalities

Cons

Cons- Limited brand coverage compared to legacy platforms

- Retail-only focus (not suited for office or industrial)

- Some advanced analytics tools are still in development

Pros Explained

Transaction-based sales insights: CenterCheck’s biggest differentiator is its reliance on credit and debit card transaction data instead of mobile device location data. This allows users to analyze actual consumer spending behavior rather than inferring performance from visits alone. For retail CRE professionals, this provides a clearer signal of tenant health and revenue trends.

Nationwide store and center coverage: The platform offers coverage across the U.S., including all major markets and U.S. territories. Users can analyze individual store locations, entire shopping centers, or custom-defined trade areas, making the tool applicable for both micro-level and portfolio-wide analysis.

Trade area and customer origin analytics: CenterCheck’s capture-area tools allow users to see where shoppers are coming from, how far they travel, and which nearby tenants complement or compete with one another. This is particularly valuable for tenant mix optimization, site selection, and lease negotiations.

CRE-first design philosophy: Built by founders with CRE experience, CenterCheck’s interface prioritizes workflows that brokers, landlords, and lenders actually use. Features like deal rooms, saved searches, and exportable PDF reports are designed to support underwriting, pitch decks, and offering memorandums.

Cons Explained

Limited brand coverage today: CenterCheck currently covers roughly 600 of the top retail chains nationwide, representing a significant portion of total U.S. retail locations but excluding many small or independent operators. While expansion is planned, users seeking deep mom-and-pop coverage may find gaps in certain markets.

Retail-specific focus: The platform is intentionally built for retail CRE. As a result, it offers little utility for office or industrial professionals, limiting its applicability for firms with diversified asset class portfolios.

Some advanced features are still forthcoming: Compared to established competitors, CenterCheck lacks certain analytics, such as void analysis or relative fit scoring. These features are on the product roadmap but are not yet live, which may matter for users accustomed to more feature-heavy platforms.

CenterCheck Key Features

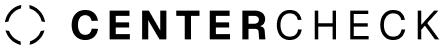

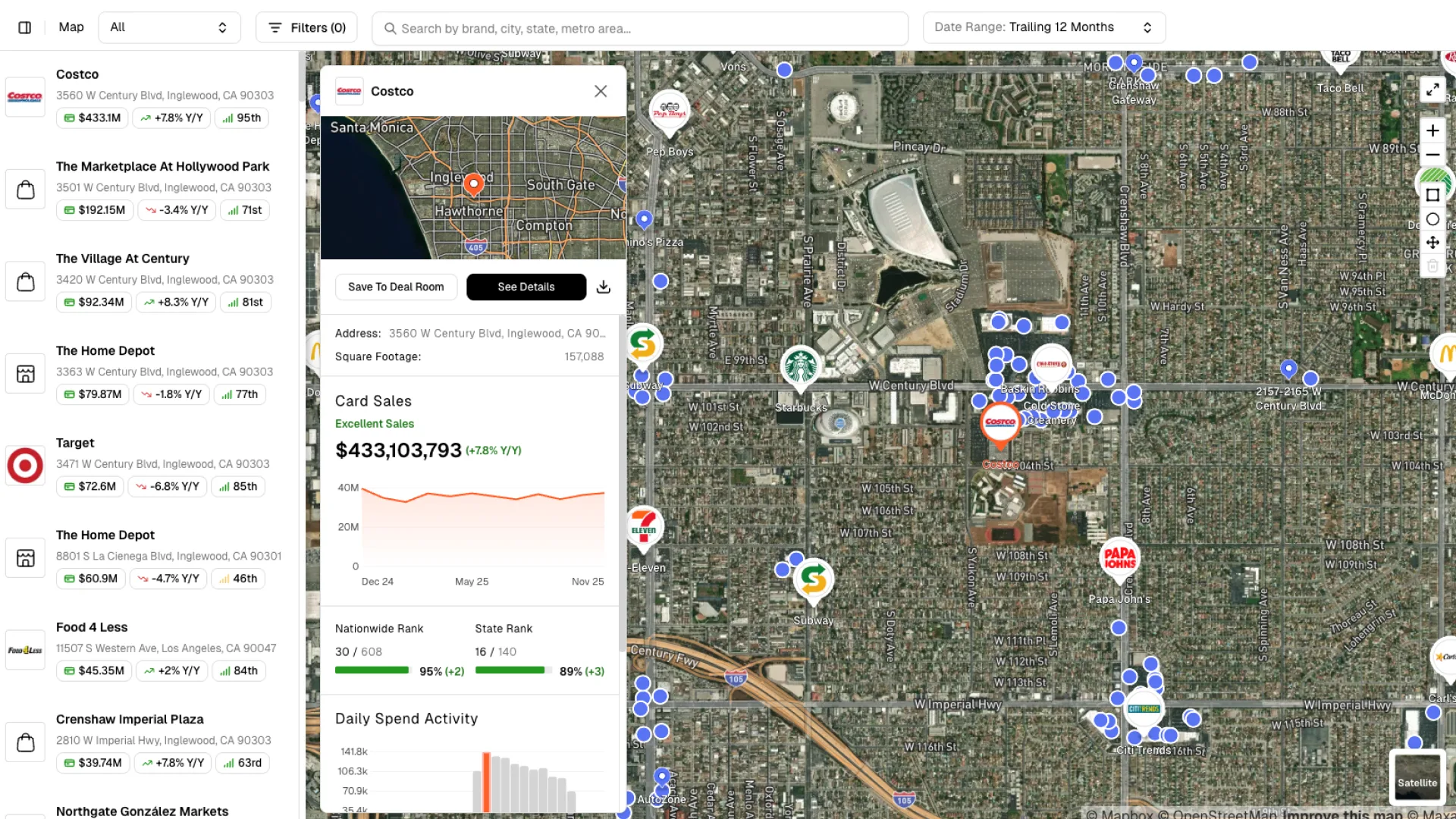

Store-Level Sales Intelligence

At the core of CenterCheck is its ability to estimate store-level sales using anonymized credit and debit card transaction data. Users can view total estimated sales, sales trends over time, transaction counts, and sales-per-square-foot metrics for individual retail locations. Data is refreshed monthly and can be viewed across multiple time horizons, allowing CRE professionals to quickly identify outperforming or underperforming tenants. This feature is particularly valuable during acquisitions, lease negotiations, and underwriting, where tenant sales performance is often the most critical — yet least transparent — data point.

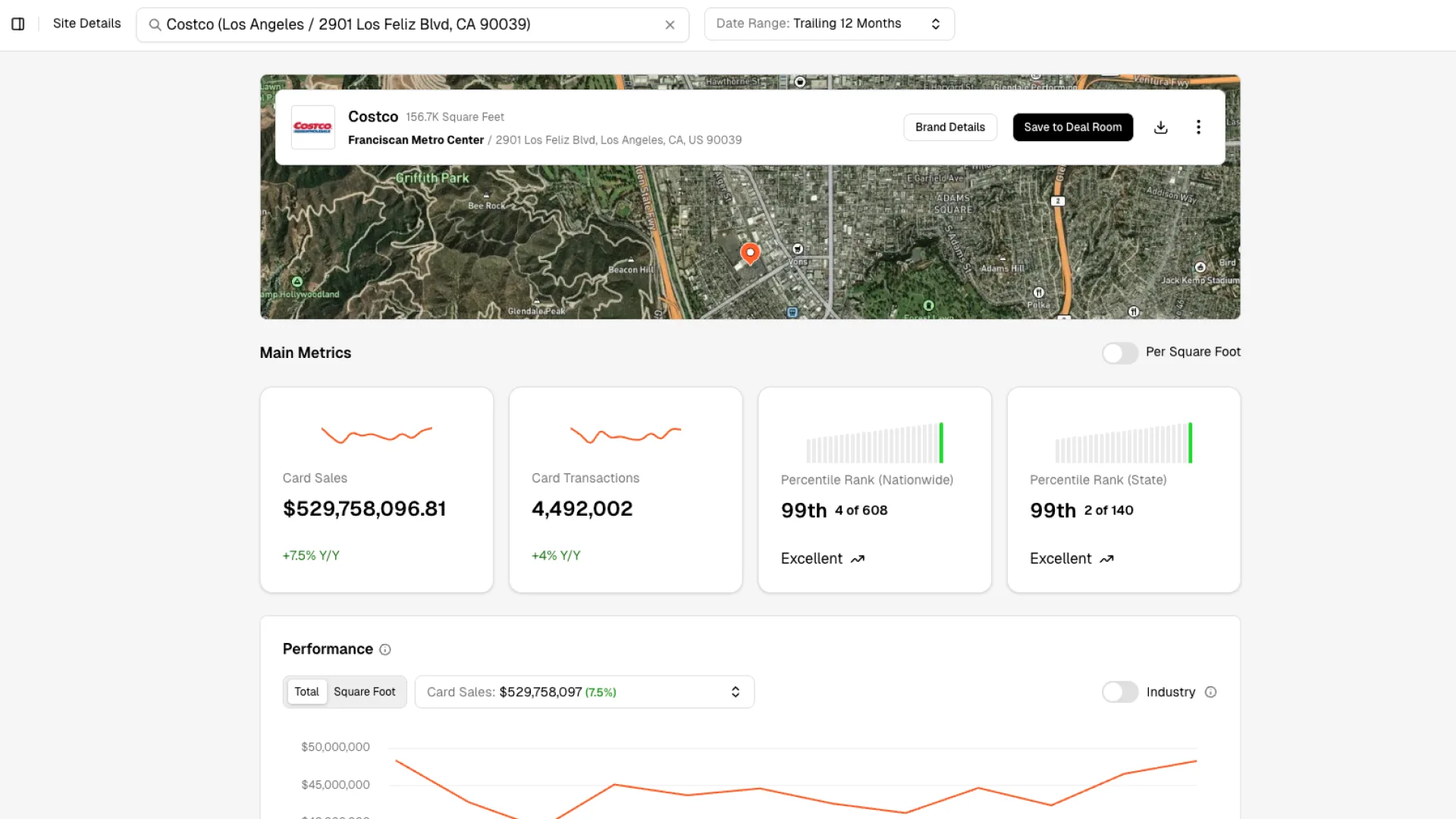

Multi-Tenant Shopping Center Analysis

CenterCheck extends its sales analytics beyond single stores to entire shopping centers. Users can analyze each tenant within a center, compare relative performance, and understand how tenants interact with one another. The platform highlights complementary and competitive tenant relationships, helping landlords and brokers assess whether tenant mixes are strengthening or cannibalizing overall center performance. This is especially useful for repositioning strategies, re-tenanting decisions, and justifying rent adjustments.

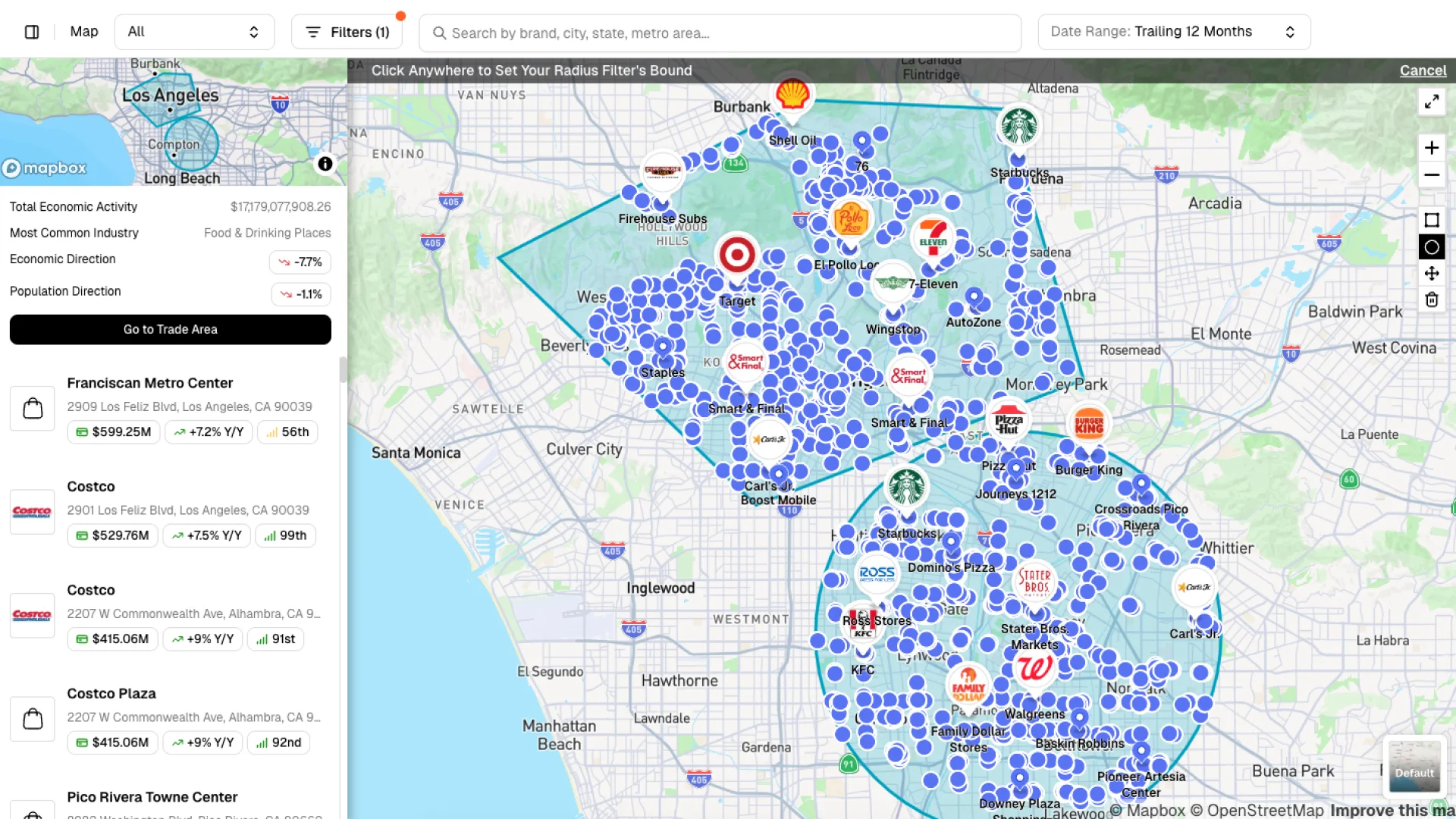

Trade Area & Capture Analysis

Rather than relying solely on radius-based assumptions, CenterCheck uses anonymized cardholder ZIP code data to visualize true customer capture areas. Users can see where shoppers originate, how far they travel, and how trade areas overlap between nearby properties. This provides a more accurate understanding of a site’s real draw and helps brokers and retailers evaluate whether a location is truly serving its intended market.

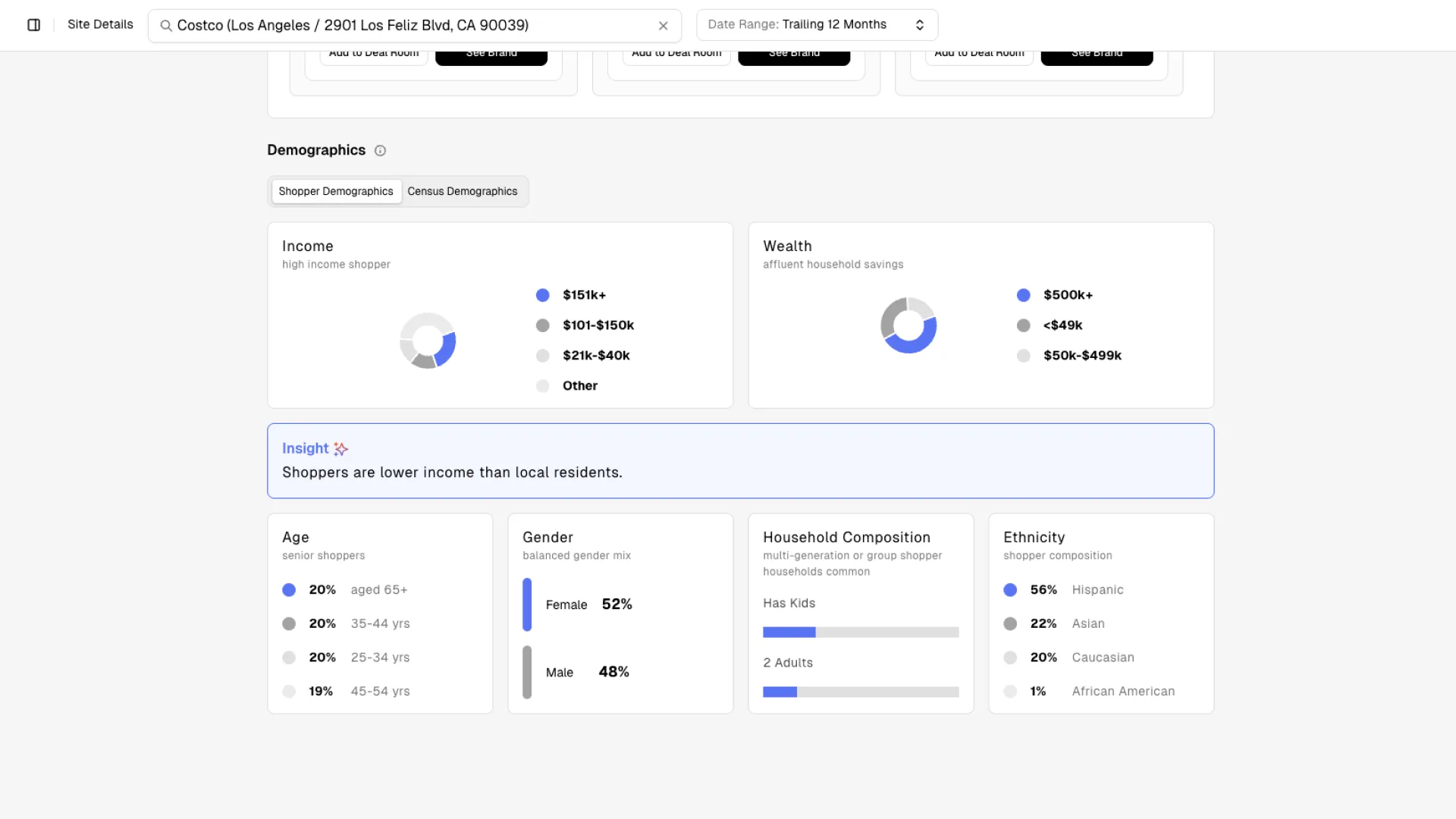

Customer Demographics & Spend Profiles

CenterCheck layers demographic insights on top of transaction data, offering visibility into shopper income ranges, age distribution, household composition, gender split, and other attributes unique to the shoppers who patronize a specific store. These insights help retailers with site selection and allow landlords to align tenant mixes with the demographics that are actually spending money at a given property — not just those who live nearby.

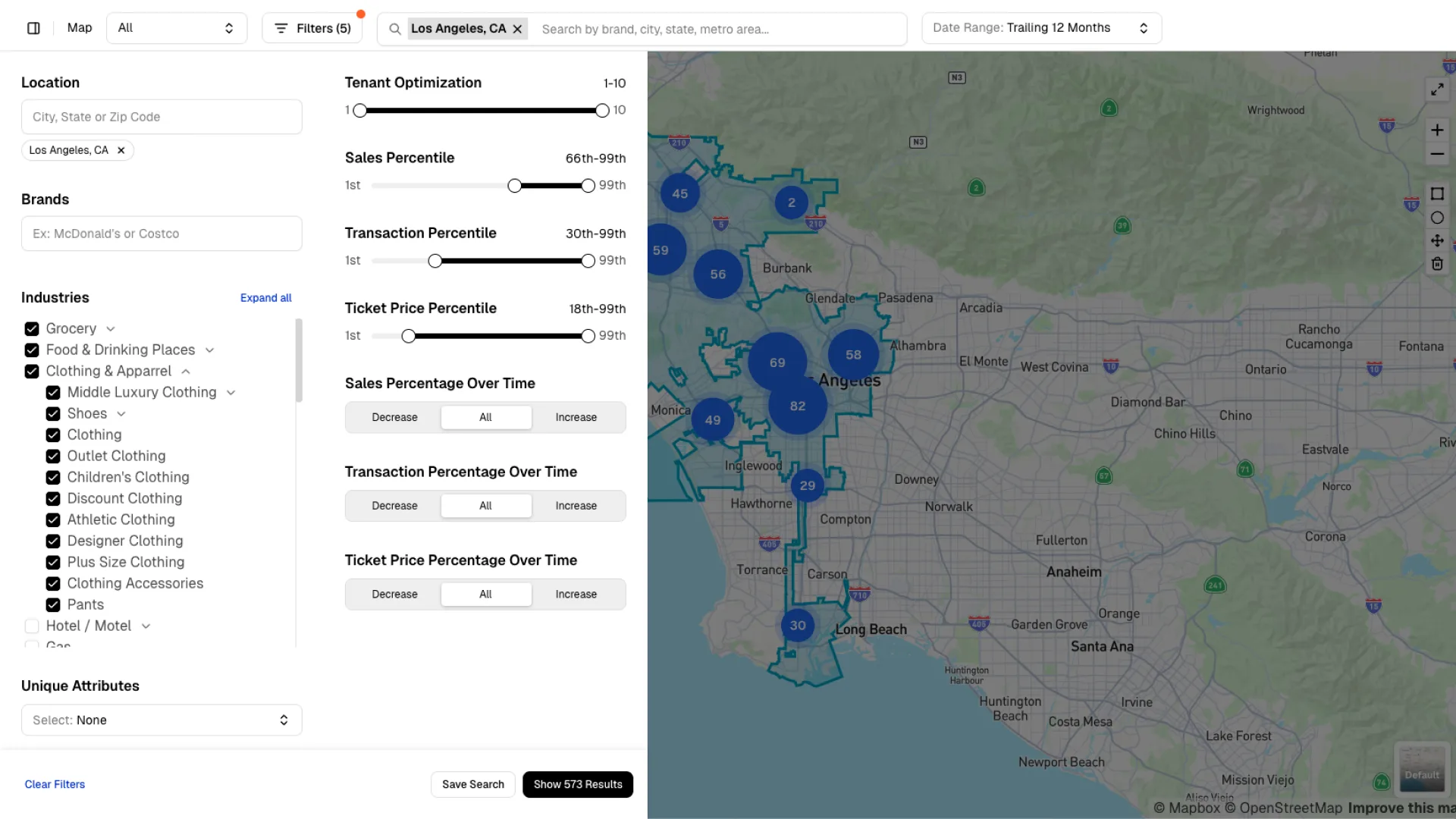

Advanced Search & Filtering Tools

The platform includes robust filtering tools that allow users to search for stores and centers based on category, performance trends, geographic boundaries, and physical attributes such as drive-thru availability. This enables CRE professionals to identify underperforming assets for repositioning, uncover acquisition opportunities, or quickly locate comparable properties during underwriting.

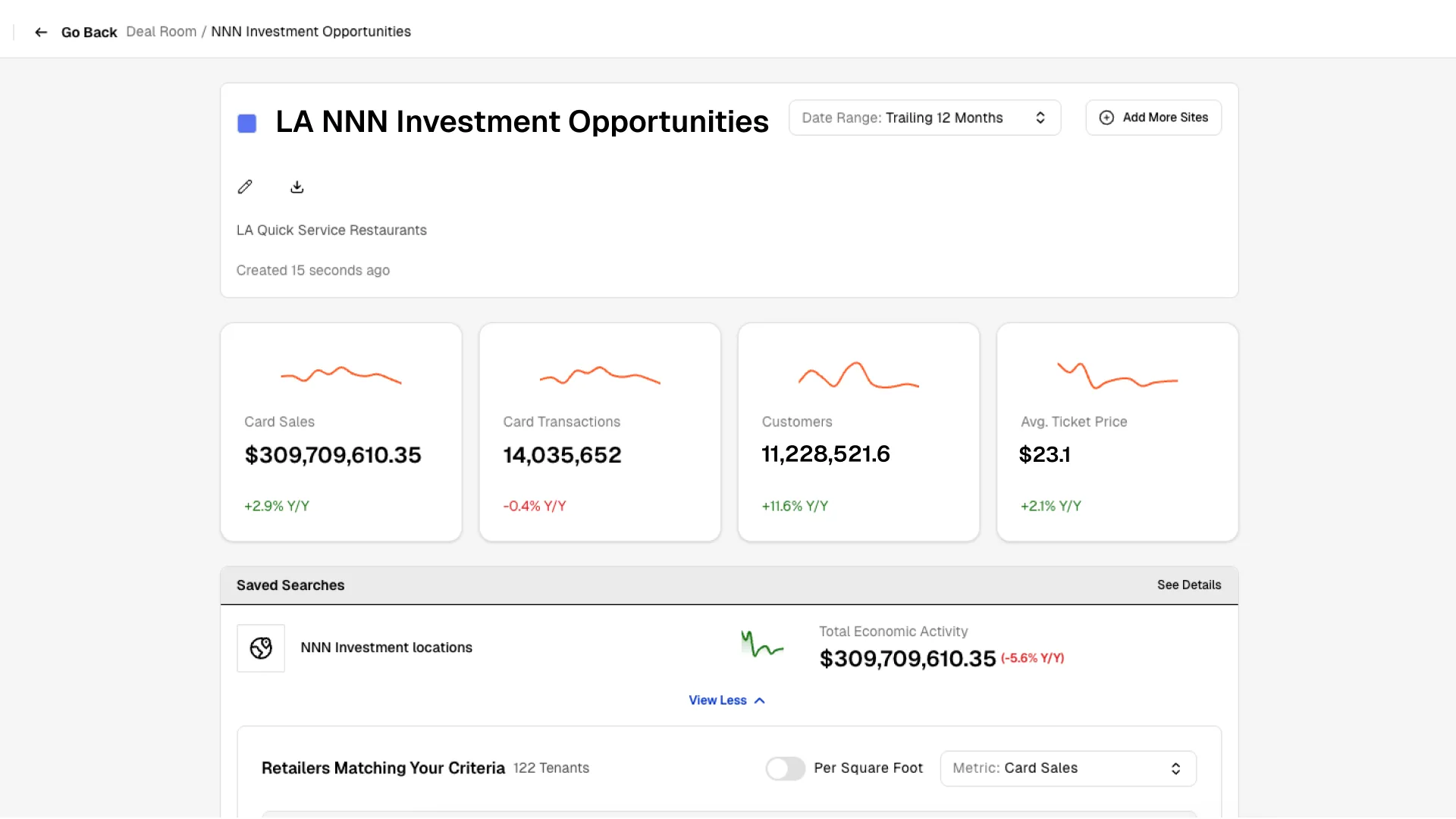

Deal Rooms & Report Exports

CenterCheck allows users to save stores, centers, and analyses into deal rooms that function as centralized workspaces for specific transactions or clients. From these deal rooms, users can generate polished, exportable PDF reports to share with investors, lenders, or tenants, making it easier to incorporate CenterCheck data into offering memorandums and client presentations.

User Experience

CenterCheck offers a clean, modern interface that feels intuitive even for first-time users. Mapping tools, dashboards, and filters are easy to navigate, and the learning curve is relatively short compared to legacy CRE data platforms. The platform balances depth with usability, making it accessible to brokers while still powerful enough for analysts and lenders.

While the feature set is expanding, the current experience remains focused and uncluttered. New users may benefit from guided onboarding, particularly when interpreting modeled sales estimates and demographic data.

Customer Support

Customer support is hands-on and founder-led. Every client receives onboarding and training tailored to their needs, with optional deep-dive sessions. Support tickets can be submitted directly through the platform, and users often communicate directly with their sales or account contact. This high-touch model ensures accountability and responsiveness, particularly for early-stage product enhancements.

Pricing

CenterCheck pricing is based on geographic access and seat count, with annual commitments required:

- Single State Access: $4,000 per year for one seat

- Regional Access (≈15 states): $600 per month per seat (12-month minimum)

- National Access: $1,250 per month per seat (12-month minimum)

Bulk discounts are available for additional seats. API access and custom data exports are offered on a bespoke basis. CenterCheck does not offer a free trial but provides demos and evaluation reports using known store data.

Competitors

Placer.ai

Placer.ai is the most established and widely adopted retail analytics platform in the market. It primarily uses mobile device location data to estimate foot traffic, dwell time, and visitation patterns. While Placer offers a broad feature set — including void analysis and relative fit scoring — it relies on visits as a proxy for performance. CenterCheck differentiates itself by focusing on transaction-based sales data, which many users view as a more direct and reliable indicator of tenant health.

AlphaMap

AlphaMap provides location intelligence tools focused on market analytics, site selection, and demographic overlays. It is commonly used for high-level market research and visualization, but does not offer the same depth of store-level sales insights. Compared to CenterCheck, AlphaMap is more exploratory in nature, while CenterCheck is more transactional and underwriting-focused.

Near / Foursquare (Location Data Providers)

These platforms primarily act as raw location data providers, offering mobile movement and visitation datasets that require additional analysis or third-party tools to be actionable for CRE use cases. Unlike CenterCheck, they are not CRE-native solutions and typically lack built-in workflows, reporting, or deal-specific functionality.

Traditional Broker Estimates & Disclosed Sales

In many markets, brokers and landlords still rely on anecdotal tenant disclosures, outdated sales reports, or informal estimates. CenterCheck replaces this fragmented approach with a standardized, data-driven methodology that can be applied consistently across markets and portfolios.

FAQs

CenterCheck is a retail CRE analytics platform that estimates store-level sales using credit and debit card transaction data.

Retail brokers, landlords, developers, lenders, retailers, and municipalities focused on retail assets.

CenterCheck uses aggregated credit and debit card data combined with proprietary modeling. Customers often validate results against known sales figures during the sales process.

Yes, coverage is nationwide, including U.S. territories.

No. Coverage currently focuses on major retail chains, with expansion planned to thousands more brands over time.

No free trial, but demos and data evaluations are available.

How We Evaluated CenterCheck

When evaluating CenterCheck, we examined several factors, including:

- Product and service offerings: We dug into the depth and breadth of CenterCheck’s features, products, and services, and what sets them apart in the industry.

- Pros and Cons: We checked the boxes on what potential clients are looking for and compared features that make CenterCheck stand out from its competitors.

- Ease of use: We examined how user-friendly CenterCheck’s platform is, how intuitive the onboarding process can be, and how quickly a new user is likely to understand and take advantage of the platform’s full functionality.

- Customer support: We evaluated CenterCheck’s existing customer support network and scored it on response times, training materials, and access to customer service reps.

- Pricing and transparency: We examined the pricing of CenterCheck’s products and services and whether readily available pricing information is available on its website.

Summary of CenterCheck

CenterCheck brings much-needed transparency to retail commercial real estate by focusing on what ultimately matters most: sales performance. By using transaction-based data rather than proxies, the platform provides brokers, landlords, and lenders with a clearer view of tenant health and opportunity.

While the platform is still expanding its brand coverage and feature depth, CenterCheck already offers meaningful value for retail-focused CRE professionals seeking a more accurate view of tenant performance. For teams looking for a modern, sales-driven alternative to traditional location intelligence tools, CenterCheck is a strong contender worth serious consideration.

Disclaimer

This page may contain affiliate links. If you make a purchase or investment through these links, CRE Daily LLC may receive a commission at no extra cost to you. These recommendations are based on our direct experience with these companies and are suggested for their usefulness and effectiveness. We advise only purchasing products that you believe will assist in reaching your business objectives and investment goals. Nothing in this message should be regarded as investment advice, either on behalf of a particular security or regarding an overall investment strategy, a recommendation, an offer to sell, or a solicitation of or an offer to buy any security. Advice from a securities professional is strongly advised, and we recommend that you consult with a financial advisor, attorney, accountant, and any other professional who can help you understand and assess the risks associated with any real estate investment. For any questions or assistance, feel free to contact [email protected]. We’re here to help!