U.S. Office Vacancy Ticks Down for First Time Since 2019

Slowing construction and renewed demand may signal the start of a long-awaited market reset.

Good morning. After over six years of rising vacancy, the U.S. office market is finally seeing signs of a rebound. Demand is up, supply is down, and landlords might finally catch a break.

Today’s issue is brought to you by InvestNext—learn how to shorten your investor acquisition cycle.

🎙️ This Week on No Cap: Westmount’s Cliff Booth joins Jack and Alex to share how four decades in industrial real estate taught him to stay ahead of trends and why, even today, relationships matter most.

Market Snapshot

|

|

||||

|

|

*Data as of 10/09/2025 market close.

Recovery Signal

U.S. Office Vacancy Ticks Down for First Time Since 2019

A long-awaited inflection point hit the office sector, with leasing up and vacancy finally heading the other direction.

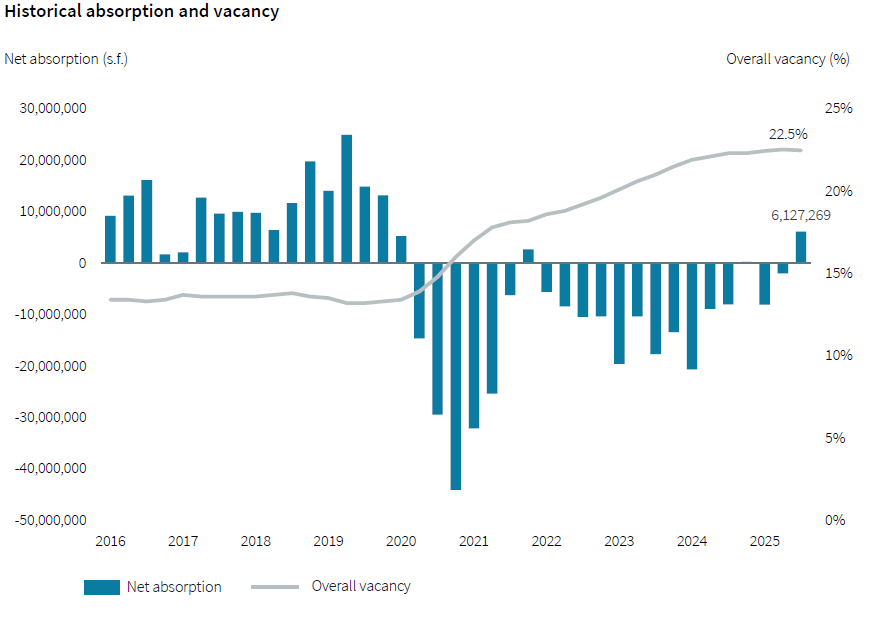

Vacancy eases: National office vacancy dipped 5 bps to 22.5% in Q3—the first decline since before the pandemic, per JLL. The drop is driven by a sharp slowdown in new development, with just under 6M SF under construction versus 50M SF in 2019.

Tenants back in the market: Net absorption hit 6.1M SF in Q3, nearly doubling the previous post-pandemic high set in Q4 2021. This suggests tenant expansion is starting to outpace space givebacks—another bullish indicator for recovery.

Source: JLL

Trophy offices in demand: Post-2000 buildings are leading the recovery, with vacancy down 104 bps over the past year. With limited new product, tenants are competing for quality, pushing Tier 2 rents up amid overall stagnant growth.

Leasing momentum builds: Leasing activity continues to ramp up, reaching 82% of pre-pandemic norms. Gross leasing volume grew 6.5% quarter-over-quarter to 52.4M SF, with 18 major markets surpassing pre-2020 leasing levels. Large deal volume surged by over 50% in Q3, suggesting renewed corporate confidence.

Who’s signing? Tech, finance, insurance, and real estate tenants made up 62% of leasing activity last quarter. Amazon inked the largest deal with a 1M SF prelease in Puget Sound. Goldman Sachs followed with a 700K SF commitment in DFW.

➥ THE TAKEAWAY

Recovery taking shape: Office may finally be bottoming out. With minimal new supply and tenants reactivating large leases, we could be entering a slow but steady period of absorption-led recovery—especially for quality assets in top-tier markets.

TOGETHER WITH INVESTNEXT

The 3-Part Framework to Shorten Your Investor Acquisition Cycle

Fundraising takes time. So does trust.

Get the three-part framework to guide investors from first touch to final commitment with more clarity and confidence.

-

Differentiate your brand

-

Build trust and confidence with content

-

Convert interest to commitment with streamlined processes and automation

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

-

Redefining CRE bridge lending: Get term sheets in under 24 hours and funding in as little as 3 days. Atlas Invest empowers investors, brokers, and developers to get funded faster than ever. (sponsored)

-

Hybrid play: Big investors are leaning into REITs to diversify faster and tap outperforming sectors like healthcare and telecoms.

-

Rate reality: Higher-for-longer rates are reshaping CRE as investors face repricing, tighter lending, and rising refi risks.

-

Economic strain: The federal shutdown is hitting real estate hardest in D.C., Hawaii, and New Mexico, where government jobs, contracts, and leasing activity are deeply tied to local economies.

-

Platform choice: CRE firms are choosing between Google’s Gemini and Microsoft’s Copilot based on how well each tool fits their workflows.

-

Political waters: A FEMA map appeal once hailed as a win for property owners in Livingston ended in regret when the Yellowstone River overflowed.

-

Premium pressure: Soaring insurance costs are triggering bipartisan pushes for price caps, risking a standoff with insurers.

🏘️ MULTIFAMILY

-

Mobility metrics: U.S. household moves hit 12.3M in 2025, driven by preference and family formation, not distress.

-

Sticky nation: While household moves surged to a post-pandemic high, the broader trend of declining mobility rates underscores that today’s churn is driven by lifestyle shifts.

-

Return to normal: Multifamily is returning to pre-pandemic norms, with steady completions, modest rent growth, and a rebalanced market expected by 2027.

-

Housing fraud: Federal authorities have charged two LA developers in separate homeless housing fraud schemes involving false financial records and misused public funds.

-

Damage dispute: The Qatari owners of Miami’s St. Regis Bal Harbour have reached a confidential settlement with condo residents to remediate serious structural concerns.

-

Shvo selloff: Michael Shvo has sold his stalled $2B Miami Beach condo redevelopment at the historic Raleigh Hotel for $270M.

-

Enrollment impact: Fewer international students are straining college town economies and raising student housing vacancies nationwide.

🏭 Industrial

-

Equity takeover: Industrial manufacturer Hillenbrand will go private in a $3.8B acquisition by Lone Star Funds.

-

Circular bet: Nvidia’s $100B investment in OpenAI’s massive AI data center expansion raises questions about circular financing and the sustainability of AI’s costly growth.

-

Power problem: Despite rising demand for AI infrastructure, retrofitting older data centers is largely unfeasible due to extreme power, cooling, and structural needs.

-

Cycle shift: Prologis forecasts steady industrial growth fueled by reshoring, e-commerce, and demand for modern, efficient warehouses.

🏬 RETAIL

-

Midwest moment: Washington Prime Group sold White Oaks Plaza in Springfield, IL for $49.9M, the region’s largest open-air retail deal.

-

Timber deal: Civicap Partners bought a sustainably redeveloped office-retail property in L.A.’s Chinatown from Redcar for $36M.

-

NYC debut: Baby goods retailer Bambi Baby is opening its first NYC store in Chelsea’s historic Ladies’ Mile District.

-

Coastal upgrade: A judge approved Terra Group’s $22.5M bid to redevelop Miami Seaquarium into a modern, marine-themed site without marine mammals.

🏢 OFFICE

-

Tower refi: Related Cos. and two sovereign wealth funds are set to close a $1.1B CMBS refinancing for Manhattan’s Deutsche Bank Center.

-

Steady dose: As traditional offices falter, medical office buildings stand out with lower loan delinquencies, tighter vacancies, and stronger long-term returns.

-

Historic flip: The historic Field Building on LaSalle Street is being transformed into 386 apartments and retail space in Chicago’s largest office-to-residential conversion to date.

-

District revival: Atlanta’s South Downtown is undergoing a sweeping $241.5M adaptive reuse transformation—turning 57 historic buildings into a walkable hub of housing, culture, tech, and retail.

-

Defense deal: Drawbridge Realty bought The HIVE in Costa Mesa for $78M and leased the entire campus to defense tech firm Anduril Industries.

🏨 HOSPITALITY

-

Dumpling dynasty: Din Tai Fung is the top-grossing U.S. restaurant chain by average unit sales, pulling in $27M per location, with a massive Brooklyn flagship set to open in 2027.

-

Micro market: Manhattan’s Dimes Square is thriving as a trendy dining and hospitality hub, attracting steady investment despite rising rents and local pushback.

A MESSAGE FROM AIRGARAGE

How a Baltimore Lot Went Gateless and Transformed Parking Revenue

In the heart of Baltimore’s vibrant Washington Hill, outdated gates and clunky systems once plagued this busy mixed-use lot.

Enter AirGarage: a sleek, gateless setup powered by LPR cameras, mobile payments, and dynamic pricing.

The result? No more broken gates, no cash chaos—just seamless operations, real-time insights, and happier drivers. Revenue’s up, headaches are gone, and the lot’s running smoother than ever.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

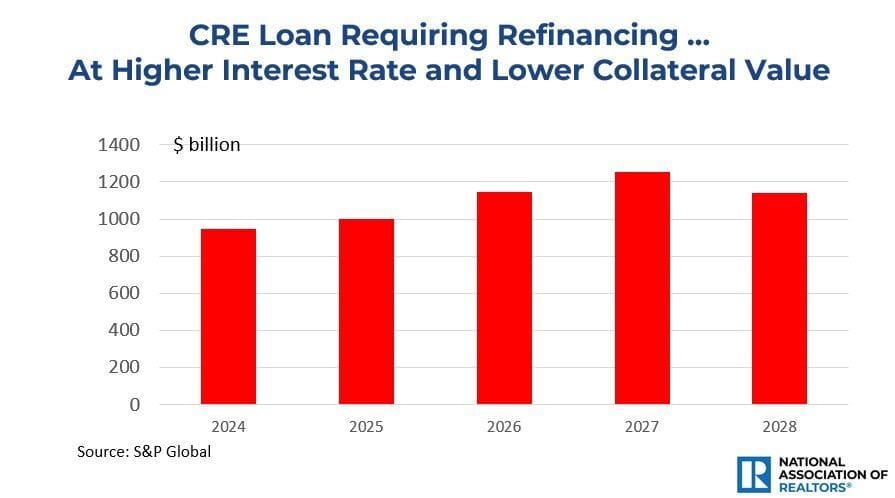

📈 CHART OF THE DAY

A wave of CRE loans now face refinancing at sharply higher interest rates and lower property values, pressuring smaller banks to renegotiate terms or risk defaults.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |