U.S. Industrial Softens as Vacancies Rise and Tax Shifts Reshape Manufacturing

As industrial rents cool and vacancies climb, tax reform and reshoring are quietly redrawing the map of U.S. manufacturing.

Good morning. The industrial market is shifting gears. Rent growth is slowing, vacancies are climbing, and recent tax reforms are steering manufacturing in a new direction.

Today’s issue is brought to you by AirGarage—streamline operations, boost revenue and improve the overall parking experience.

Market Snapshot

|

|

||||

|

|

*Data as of 11/04/2025 market close.

Factory Future

U.S. Industrial Softens as Vacancies Rise and Tax Shifts Reshape Manufacturing

Tax changes, cooling rents, and rising vacancies signal a transitional year for the U.S. industrial market, even as supply chains realign and logistics hubs remain hotbeds of activity.

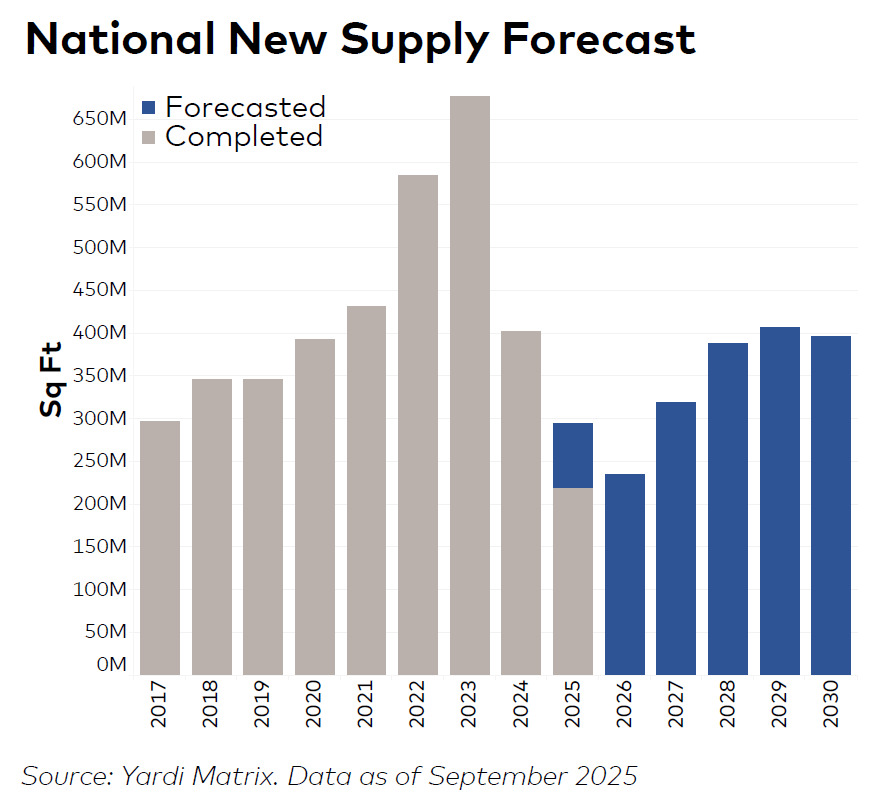

Tax-driven shift: The OBBBA is reshaping U.S. manufacturing with restored bonus depreciation and R&D expensing, fueling the reshoring trend. But early sunsets for EV and solar incentives threaten the growth of green tech. Construction remains nearly 3x 2022 levels as firms rethink supply chains.

Rents cool, vacancies climb: National in-place rents reached $8.72 PSF in September, up 6.1% YoY, though growth is slowing. Vacancy rose to 9.5% as supply increased. Philadelphia, Atlanta, and Miami led gains, while narrowing lease premiums show tenants gaining leverage—though Bridgeport and Tampa are still seeing steep premiums.

Pipeline still manageable: Around 340M SF of industrial space is under construction, or 1.7% of the national stock. While some markets show elevated activity, much is tied to owner-occupied or delayed projects. Rising vacancies remain manageable thanks to localized demand and targeted development.

Economic data on pause: Producer prices dipped 0.1% in August, easing from July’s spike. Year-over-year, they’re up 2.6%. However, a government shutdown has stalled key data releases, limiting visibility for the Fed and investors during a critical economic period.

Sales activity picks up: Industrial sales reached $52.5B through Q3 2025, averaging $142 PSF. Atlanta saw a 31% jump in pricing, driven by steady logistics park sales and its strategic transportation network. Rate cuts have helped lift overall volume, setting up 2025 to be the strongest sales year since 2022.

➥ THE TAKEAWAY

Transition underway: Industrial is transitioning into a more balanced phase. With policy changes altering investment priorities and tenant demand moderating, markets with strong logistics advantages and population growth remain best positioned for long-term gains.

TOGETHER WITH AIRGARAGE

How a Baltimore Lot Went Gateless and Transformed Parking Revenue

In Baltimore’s lively Washington Hill neighborhood, an aging gated system was slowing down a high-traffic mixed-use parking lot. AirGarage transformed it with a modern, gateless setup powered by LPR cameras, mobile payments, and dynamic pricing.

The outcome: no more broken gates or cash hassles—just seamless operations, real-time visibility, and a better experience for drivers. Revenue increased, frustration disappeared, and the lot now runs smoothly day-to-day.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

-

BTR breakdown: Multifamily pros are leading the BTR surge. Register now to learn how they’re scaling, financing, and winning in this fast-growing sector. (sponsored)

-

Market split: U.S. commercial real estate is showing a growing gap as big-city deals rebound and smaller properties lose value.

-

Bank divide: Big banks are avoiding CRE trouble with diversified loan books, while smaller lenders face rising risks from maturing loans and higher rates.

-

Mega merger: Singapore’s CapitaLand and Mapletree are in early talks to merge, potentially creating a $150B real estate powerhouse.

-

Firing phase: U.S. layoffs have surged to their highest level since 2020, signaling a shift from the “low hire, low fire” era.

-

Selective growth: CRE investment surged 15% in Q3 to $111.7B, with office and retail leading growth and single-asset deals driving momentum across asset classes.

-

Progressive upset: Zohran Mamdani won the NYC mayoral race, defeating CRE-backed Cuomo and signaling a sharp left turn in city politics.

-

Trade turmoil: A Supreme Court ruling on Trump’s emergency tariffs could reshape trade policy, bringing major cost and supply chain impacts to CRE.

-

Developer departure: MAG Partners and CEO MaryAnne Gilmartin have exited the 235-acre Baltimore Peninsula project, leaving its future uncertain.

🏘️ MULTIFAMILY

-

Bond backing: A new $350M fund from NewPoint Real Estate Capital and Morgan Properties is reviving municipal bond financing for affordable housing.

-

Cautious optimism: Multifamily operators report improved stability heading into 2025, but rising costs, tighter lending, and economic uncertainty are keeping the sector on edge.

-

Solar stack: Ytech secured a $565M loan from JPMorgan and Sculptor Real Estate to complete a 70-story, solar-powered luxury condo tower in Miami’s Brickell.

-

Soft stress: A fractional uptick in Class C multifamily delinquencies is likely statistical noise, not a warning sign, according to Cushman & Wakefield.

-

Tenant tensions: Developer Bruce Teitelbaum is seeking to evict Rev. Al Sharpton’s nonprofit from its longtime Harlem HQ to advance the 1,000-unit One45 project.

-

Mission capital: CIM Group and Bryant Group Ventures have launched a $1B impact fund backed by Flagstar and Truist to invest in affordable housing nationwide.

🏭 Industrial

-

Prologis power: Prologis just dropped $314.5M on 11 fully leased industrial buildings in Brisbane’s Crocker Industrial Park, marking 2025’s largest Bay Area warehouse deal.

-

Tech backlash: Amazon’s data center boom is reshaping rural Oregon with jobs and investment, alongside rising costs and growing fears that the prosperity may not last.

-

Cold rush: With near-zero vacancy and rising food demand, Greater Philly is heating up for cold storage despite high costs and limited investor appetite.

-

Industrial imbalance: West Inland Empire is stabilizing, but the East faces rising vacancies, weak demand, and falling rents.

-

Solo strategy: Core Scientific ditched a $9B CoreWeave deal, boosting its stock as investors back its solo AI data center push.

🏬 RETAIL

-

Fulfillment future: Amazon CEO Andy Jassy says AI will accelerate the shift to e-commerce, even as the company expands its grocery delivery services and relies on AWS for growth.

-

Breakfast buyout: Denny’s will go private in a $620M all-cash acquisition by a group including TriArtisan Capital, Treville Capital, and major franchisee Yadav Enterprises.

-

Local vibes: Urban Outfitters is expanding a new store concept tailored to Gen Z with localized merchandising and sleek redesigns.

-

Whole makeover: Whole Foods is testing Amazon app orders for mainstream brands like Pepsi and Tide as part of a deeper integration of tech and grocery services.

🏢 OFFICE

-

Shrinking deals: Office leasing volume is rebounding, but average lease sizes are down 15–20% as large tenants trim footprints and smaller occupiers dominate.

-

Buyer bargain: Lincoln Property Co. sold Portland’s PacWest tower at a 65% discount, reflecting ongoing struggles in the downtown office market.

-

Call center comeback: AT&T is close to leasing 166K SF in Atlanta’s Central Perimeter, marking a boost for a high-vacancy market and signaling renewed office demand.

-

Urban flavor: Yum Brands is relocating its global HQ in downtown Louisville’s PNC Tower, a high-profile move that bucks the area’s leasing slowdown.

🏨 HOSPITALITY

-

Curated growth: The Curator Hotel & Resort Collection is expanding into new California and Colorado markets with the addition of three historic, design-forward independent hotels.

-

Talent pipeline: NYU’s new hospitality apprenticeship offers college credit and real-world experience to help students and workers advance faster in hotel careers.

📈 CHART OF THE DAY

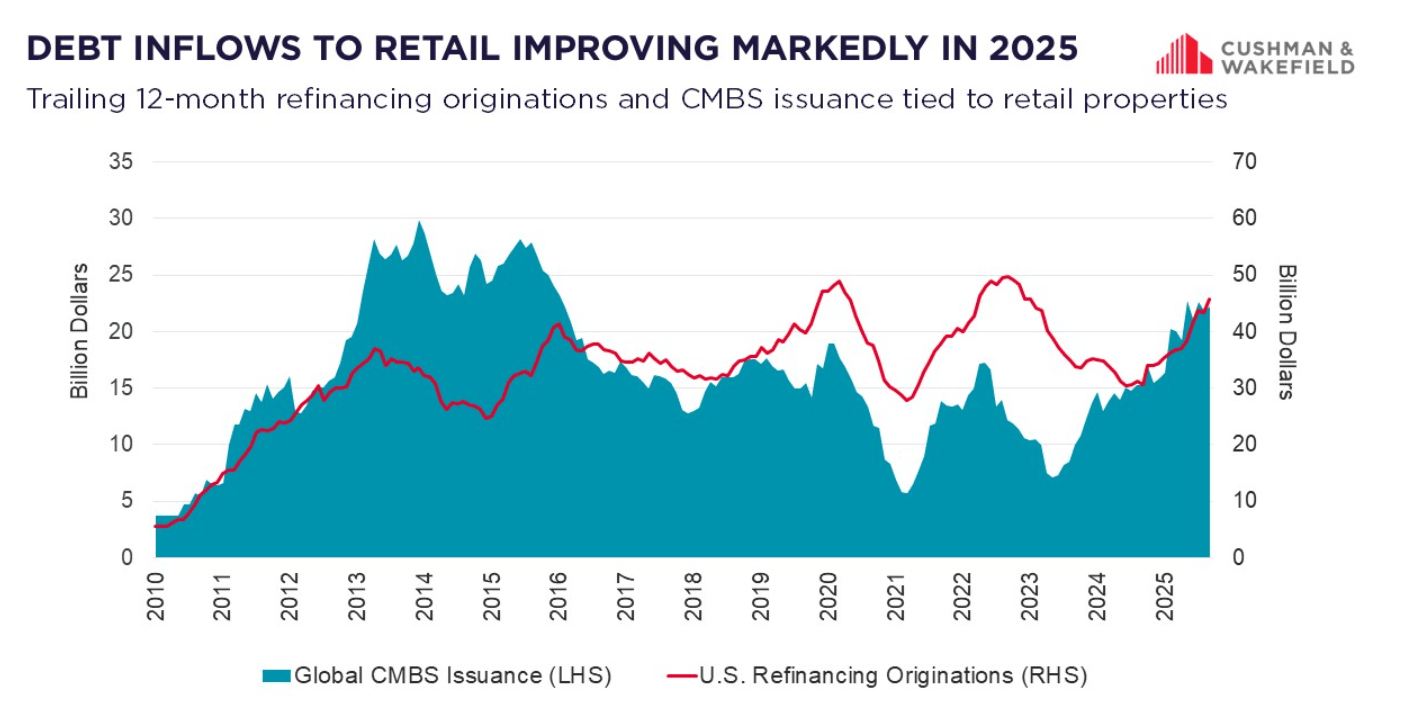

Retail refinancing is quietly surging, with 2025 on track to break records as lenders compete for low-risk deals and volumes near the all-time high set in 2019.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |