U.S. CRE Prices Tick Up Again, Signaling Continued Market Recovery

October data shows continued momentum in CRE pricing, thanks to falling interest rates and renewed investor confidence.

Good morning. CRE prices are climbing again, posting a fifth straight month of gains. Falling interest rates and rising investor activity are helping to stabilize a market that’s been on shaky ground since 2022.

🎙️This Week No Cap: Jon Schultz, Co-Founder and Managing Principal of Onyx Equities, sits down with Jack and Alex to break down the art of value creation, the future of office, and why adaptability is real estate’s most underrated skill.

CRE Trivia 🧠

Which city just became the world’s largest by population, according to the latest U.N. “World Urbanization Prospects” report?

(Answer at the bottom of the newsletter)

Market Snapshot

|

|

||||

|

|

*Data as of 12/01/2025 market close.

Pricing Momentum

U.S. CRE Prices Tick Up Again, Signaling Continued Market Recovery

October marked the fifth straight month of price gains for commercial real estate, buoyed by falling interest rates and stronger investor activity.

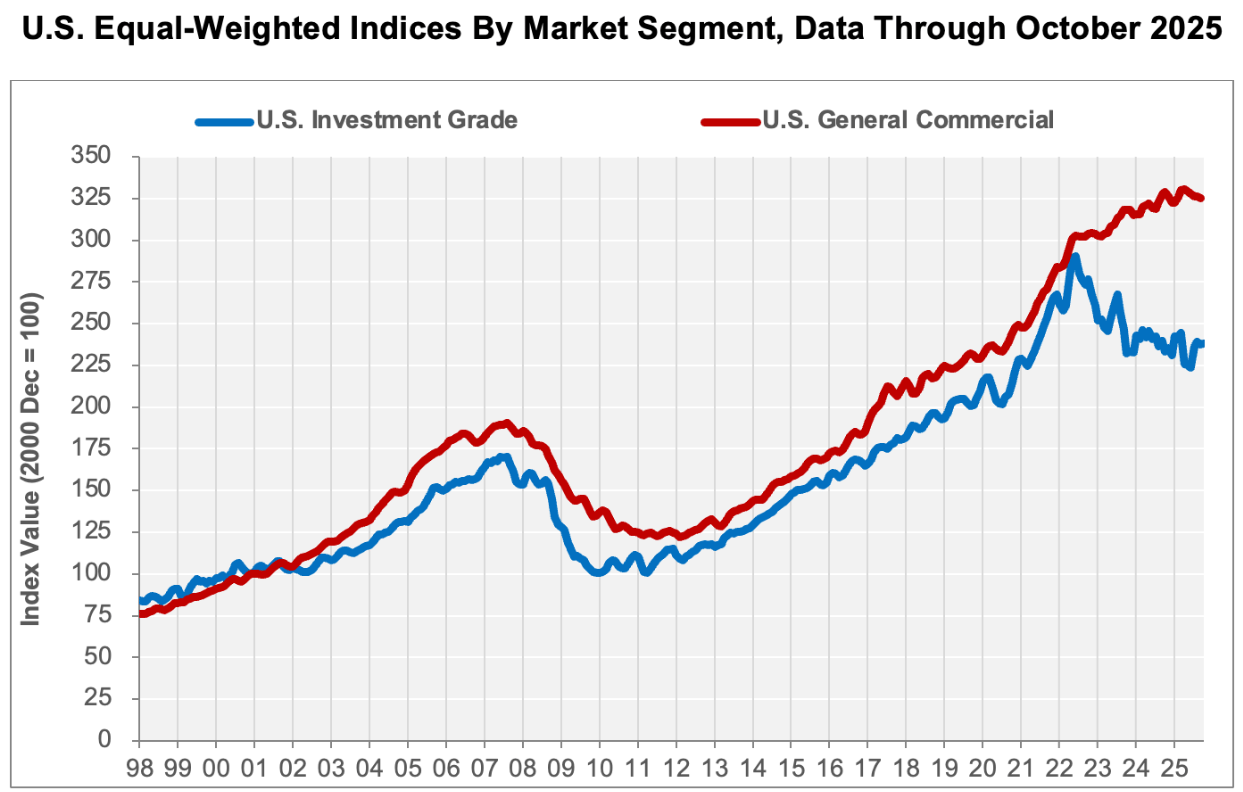

Stabilization signals: CoStar’s latest Commercial Repeat-Sale Indices (CCRSI) show U.S. CRE prices rising again in October, with the value-weighted index up 0.5% and the equal-weighted index up 0.9%. The gains reflect growing market confidence, especially for high-value assets in major urban areas.

Rate cuts drive activity: The Fed’s two interest rate cuts since September have lowered borrowing costs to their lowest level since 2022, an important catalyst for increased transaction volume. Lower capital costs have begun to lure sidelined investors back into the market.

Investment-grade leads the way: Large, high-quality properties in major and secondary markets are powering the recovery. Prices for these assets rose 2% YoY in October, reversing a three-year slide. They made up 60% of deals over the past year, with October sales up nearly 11% to $8.B.

Sales volume on the rise: Twelve-month trailing sales rose 27% YoY to $138.3B in October. Repeat sales jumped 16% to $13.5B, with overall monthly deal volume up 10%. Listings also moved faster, with average time on market down to 173 days—a sign of improving liquidity.

➥ THE TAKEAWAY

Road to recovery: While office and multifamily prices remain below 2022 peaks, steady gains, rising deal flow, and lower borrowing costs suggest CRE may be stabilizing. Investors—especially those eyeing high-grade assets—are stepping back in.

SPONSORED

Invest in Renewable Energy Projects

People across the U.S. can invest in renewable energy projects through Climatize. More than $13.2M has been invested through the platform so far, with over $3.6M returned to investors to date. Returns not guaranteed.

You can explore American clean energy projects raising capital right now.

Climatize is an SEC-registered & FINRA member funding portal. Crowdfunding carries risk, including loss.

✍️ Editor’s Picks

-

Watch here: AirGarage CEO Jonathon Barkl joins The Peel with Turner Novak to unpack how data, transparency, and aligned incentives are changing the economics of parking. (sponsored)

-

Job rush: The AI-fueled data center boom is turning skilled trade jobs into six-figure, perk-filled careers amid a national labor shortage.

-

Flip-flopping: With mixed signals from inflation, hiring, and Fed officials, Wall Street economists now expect an interest rate cut in December.

-

Deal Room returns: Operators pitch live deals while investor panelists press for clarity on risk, structure, and upside, giving you faster comparisons than weeks of calls and decks. (sponsored)

-

Cubicle to condos: Manhattan leads a nationwide boom in office-to-residential conversions, driven by high vacancies, tax breaks, and clever design.

-

Yield edge: With stronger occupancy and more attractive pricing than private real estate, publicly traded REITs are shaping up as a value play for investors seeking income and long-term upside.

-

Fed future: Trump says he’s chosen his next Fed chair, signaling expectations for interest rate cuts—though the nominee’s name remains under wraps.

🏘️ MULTIFAMILY

-

Funding fight: A coalition of 19 states is suing the Trump administration over HUD's shift from long-term homelessness aid to short-term, enforcement-focused programs.

-

Affordable irony: Affordable housing is now often more expensive to build than luxury units, driven by red tape, rising costs, and complex subsidy rules.

-

Renter's market: Boston rents are falling as job losses, fewer students, and economic uncertainty drive vacancies and force landlords to offer steep concessions.

-

Seattle selloff: Clarion Partners has sold Seattle’s 136-unit Walton Lofts in Belltown, nearly a decade after acquiring the high-rise for $76M.

🏭 Industrial

-

Warehouse watch: The U.S. industrial market is stabilizing as demand for efficient, power-ready logistics space grows.

-

Data risk: Massive data center projects in high-risk areas are straining insurers, with rising premiums and limited coverage threatening to disrupt the industry’s rapid growth.

-

Debt refresh: Phelan Development and LaSalle secured a $66.7M refinance for Lathrop II, an 847K SF industrial project in California’s Central Valley.

-

Tempe takeoff: Creation has broken ground on a 120K SF industrial project in Tempe, with one building pre-leased to Pacific Office Automation for its Southwest HQ.

-

Onshore investment: AstraZeneca is investing $2B to expand drug manufacturing in Maryland, boosting capacity, creating jobs, and advancing its U.S. reshoring strategy.

🏬 RETAIL

-

Suburban luxe: Turnberry Associates, led by the Soffer family, has acquired a 219,000 SF open-air retail center next to Aventura Mall for $131M.

-

Renter economy: Soaring housing costs are delaying homeownership, keeping renters in place, and home goods retail is surprisingly resilient.

-

Tight but tepid: Retail space is scarce in Manhattan, but rents are still sliding as tenants push for better deals.

-

Feast mode: Despite the Thanksgiving lull, real estate dealmaking surged with major refinancings, leases, and retail momentum coast to coast.

-

Spending slump: Consumer sentiment hit a four-year low in October as shoppers cut back on discretionary spending.

🏢 OFFICE

-

Ground risk: 1407 Broadway’s value has cratered due to a looming ground lease reset, turning a once-stable CMBS asset into a high-risk workout.

-

HQ magnet: Orange County is attracting corporate headquarters with high-quality office space, lifestyle perks, and strong talent pipelines.

-

Busy again: West Palm Beach is the first major U.S. market to fully restore pre-pandemic office foot traffic.

-

Hybrid divide: As hybrid work cements its role in office culture, vacancy and rent trends are diverging sharply across U.S. metros, creating clear winners and laggards.

-

Bay footprint: First Citizens Bank has acquired a 160,000 SF office building in downtown San Francisco, its second major Bay Area purchase this year.

🏨 HOSPITALITY

-

Casino jackpot: New York State is set to license three NYC casinos, bringing over $19B in planned investment and billions in projected tax revenue.

-

West Hollywood exit: Pebblebrook sold its West Hollywood hotel for $44M amid L.A.'s struggling hospitality market.

-

Thrill gap: Theme parks face falling attendance and weaker spending, prompting big investments in new rides and real estate to stay competitive.

A MESSAGE FROM ARBOR REALTY TRUST

Arbor’s Affordable Housing Trends Report Fall 2025 is available now.

As the U.S. navigates an affordable housing shortfall, Arbor Realty Trust and Chandan Economics document the federal and state initiatives aimed at closing the gap.

Explore how new and long-established investment opportunities are converging within a multifamily real estate sector well known for its strength, stability, and consistency.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

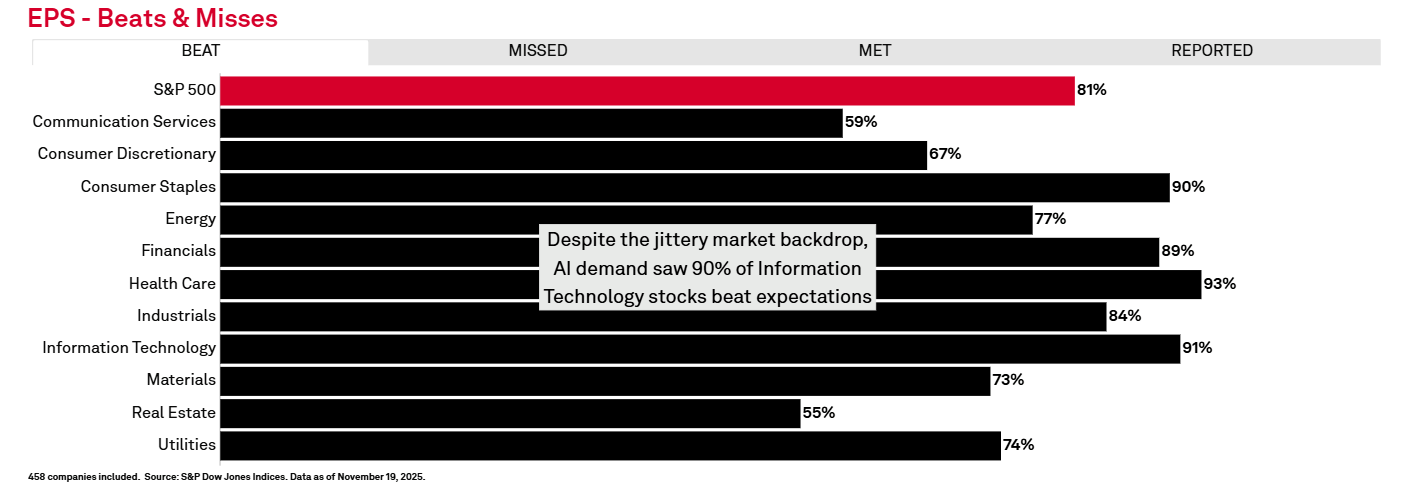

📈 CHART OF THE DAY

A striking 81% of stocks beat earnings expectations in Q3 2025, well above the 73% average since 2013.

CRE Trivia (Answer)🧠

Jakarta is now the world’s largest city with nearly 42 million residents, surpassing Tokyo for the first time. (Source: United Nations)

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |