Top Multifamily Markets See Shifting Momentum

While key permitting markets remain consistent, apartment starts are losing steam across most metros.

Good morning. Multifamily development trends are evolving as permitting remains strong but starts slow across most major markets. A few metros—like Miami and Houston—are breaking away from the pack.

Today’s issue is brought to you by InvestNext—learn how to accelerate your investor acquisition process.

Join James Nelson (Avison Young) and No Cap podcast hosts Jack Stone and Alexander Gornik for a LinkedIn LIVE this Thursday at 12 PM ET as they break down what’s driving commercial real estate investment in 2025.

Market Snapshot

|

|

||||

|

|

*Data as of 07/28/2025 market close.

Momentum Shift

Top Multifamily Markets See Shifting Momentum

A cooling pace of apartment starts reveals diverging trends among top multifamily permitting metros, with only a few showing signs of renewed growth.

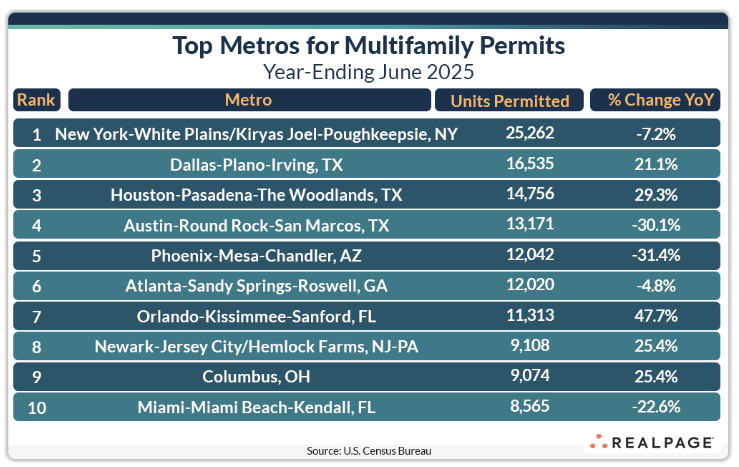

Familiar faces, different directions: Nine of the top 10 metros for multifamily permitting returned in June, with New York, Dallas, Houston, Austin, and Phoenix holding the top five. But year-over-year trends show a shift: Dallas and Houston gained speed, while New York, Austin, and Phoenix slowed sharply.

Starts are slowing–mostly: Despite strong permitting in some metros, apartment construction is losing momentum. Eight of the top 10 permitting metros saw fewer starts in Q2 2025 vs. Q1. Only Miami and Houston posted gains. Year-over-year, starts fell sharply in New York (-8,000 units), Phoenix, and Austin.

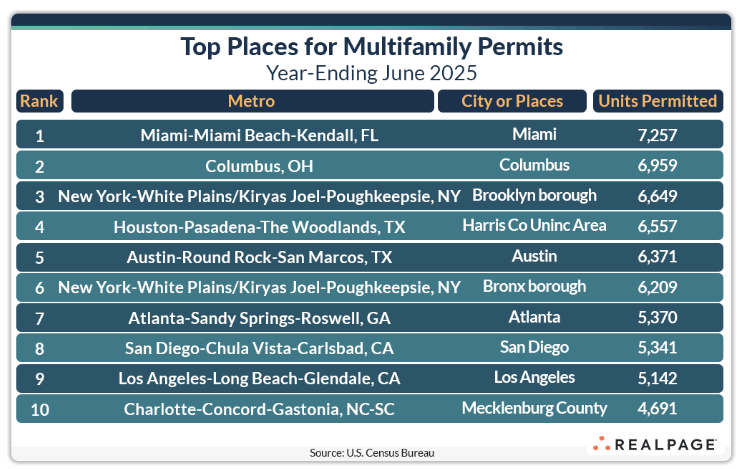

Miami makes a move: Miami stood out with a late permitting surge—up 1,500+ units from May to June—though still down 2,500 units YoY. Starts in the metro jumped by more than 1,100 units QoQ and nearly 2,500 YoY, signaling renewed momentum.

Mixed metro trends: Half of the top 10 permitting metros saw annual gains in June, averaging 2,700 units, while the rest dropped by about 3,250 units. Big declines hit DC, LA, Tampa, San Jose, and Minneapolis, while Chicago, Des Moines, Detroit, and Bridgeport-Stamford-Danbury posted strong increases.

Top cities for permits: At the local level, Miami surged to #1 in June permitting, adding nearly 2,500 units in one month. Brooklyn, Harris County (Houston), Columbus, and Austin rounded out the top five. Despite strong metro totals, cities like Dallas, Phoenix, and Newark didn’t make the top 10, highlighting a gap between metro and city-level activity.

➥ THE TAKEAWAY

Localized cycles ahead: The top markets remain consistent in name but not in pace, while some like Miami and Houston push forward, others are cooling. Expect a more localized development cycle ahead as momentum shifts from coast to coast.

TOGETHER WITH INVESTNEXT

We’re deploying $500M to acquire industrial properties

Learn how to accelerate your investor acquisition process using a proven 3-part framework that covers discovery, diligence, and commitment.

This session dives deep into practical strategies such as ad testing, social proof, and CRM automation, and showcases how strong systems can enhance the investor experience from first impression to onboarding.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

-

1031-eligible farmland available today: Landmark Mandarin Grove, a California citrus orchard from FarmTogether. Targeting 11.1% net IRR and 9.4% net cash yield. Accredited investors only. (sponsored)

-

Tragic loss: Blackstone exec Wesley LePatner was among four killed in a Manhattan HQ shooting Monday night, a devastating loss for CRE.

-

Zone reset: Opportunity Zones are set to become permanent and more lucrative by 2027, but a looming tax bill in 2026 is triggering a short-term dip in investment.

-

Loan momentum: CRE loan volumes are accelerating in 2025 as confidence returns to capital markets, particularly in securitized and agency-backed debt.

-

Market slide: CRE pricing slipped in Q2, dragged down by office and multifamily, though industrial posted the strongest performance.

-

Hiring freeze: Entry-level CRE jobs are down 19% from pre-pandemic levels, leaving young professionals scrambling for fewer roles.

-

Intelligence upgrade: Green Street has acquired College House, expanding its property-level data coverage into the fast-growing US student housing sector.

🏘️ MULTIFAMILY

-

Strong demand: Multifamily demand remained historically strong in Q2, but developers and landlords are pivoting toward stabilized occupancy as new construction slows and rent growth softens.

-

Southern draw: Crow Holdings acquired the 376-unit 33 West apartment complex in Davie, FL for $97.5M, signaling renewed multifamily investment activity in South Florida.

-

Hudson heights: Barings sold its 418-unit Riverbank multifamily and retail tower near Hudson Yards for $243.5M to an unnamed institutional buyer.

-

International pairing: Hines and Japan’s Sumitomo Forestry are teaming up on a 365-unit multifamily project at Potomac Shores, the only rental community planned in the mostly single-family development.

-

Loan lifeline: Rabsky-affiliated Sky Equity secured $340M in fresh capital to finalize one of Brooklyn’s largest new multifamily builds.

🏭 Industrial

-

Global backing: Japan will fund a $550B U.S.-directed investment vehicle to boost American manufacturing, giving Trump control over spending.

-

Pipeline bump: Northeast industrial construction rose 6.1% in Q2 to 25.9M SF, driven by a rebound in starts and slower deliveries.

-

Office-to-industrial: Foundry Commercial is converting outdated suburban offices into modern industrial hubs, starting with a three-building complex in Irving, TX.

-

Climate capital: Tom Steyer’s Galvanize Real Estate acquired a five-property industrial portfolio in Maryland for $112M from Blackstone’s Link Logistics

-

Refi deal: Blackstone secured $805M from Wells Fargo to refinance part of its $3B Miami industrial portfolio, even after selling over $1B in Florida assets over the past year.

-

Chip pact: Tesla and Samsung signed a $16.5B deal to produce next-gen AI chips at Samsung’s under-construction Texas fab, with Elon Musk pledging to personally accelerate production.

🏬 RETAIL

-

Retail wind down: Onyx Partners will acquire Copper Property Trust’s remaining 119-property portfolio for $947M in an all-cash deal.

-

Digital evolution: Walmart is rolling out a unified artificial intelligence framework built around four “super agents” to streamline operations for customers, associates, suppliers, and internal teams.

-

Spending priorities: Despite inflationary pressure and tariffs, US retail sales rose in June as consumers prioritized essentials, dining out, and online deal-hunting.

🏢 OFFICE

-

Downtown downsizing: Redco is set to acquire Wells Fargo’s 409K SF San Francisco HQ, marking a major shift in the bank’s downsizing and relocation strategy.

-

Tech layoffs: AI-driven workforce reductions are accelerating across major US companies, deepening the office market’s woes as employers shed headcount and shrink real estate footprints.

-

Office upgrade: Verizon is relocating its NYC HQ to Vornado’s newly redeveloped Penn 2 tower, leasing over 195K SF.

🏨 HOSPITALITY

-

Disposition plan: Park Hotels & Resorts is selling the rebranded Midland Hotel Chicago as part of a $400M offload of “non-core” assets.

-

Revenue upside: Seaview Investors secured a $55M refinance from Mesa West Capital for the recently renovated Burton House Beverly Hills.

-

Fraud fallout: A federal judge ruled that a class-action fraud suit against LuxUrban Hotels can proceed, citing allegedly false lease claims tied to high-profile properties in NYC and LA.

📈 CHART OF THE DAY

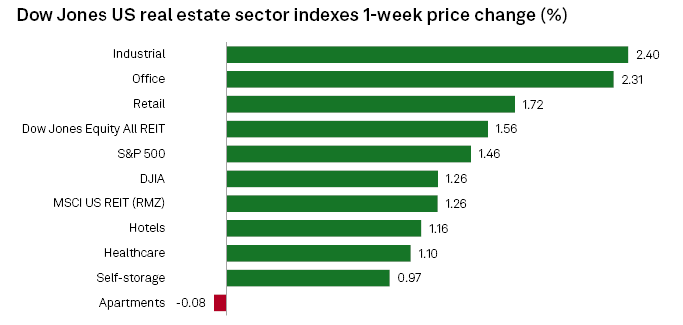

According to S&P Global Market Intellidence, most Dow Jones US real estate sector indexes rose for the week ending July 25, led by industrial REITs (+2.40%), while apartment REITs were the only sector to slip, down 0.08%.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |