Investors Zero In on Texas' Cooling Attached Home Market

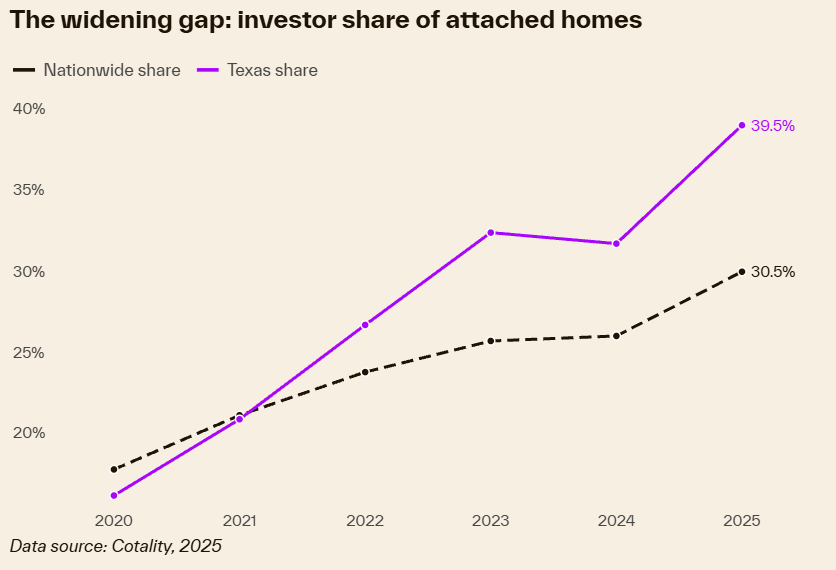

Nearly 40% of Texas' attached home sales went to investors last year, as market dynamics created rare yield opportunities.

Good morning. Investors are zeroing in on Texas, where falling prices and rising rents in the attached home market are creating an unusually strong yield play. The Lone Star State may be signaling where capital heads next.

Today’s issue is brought to you by Mason Joseph Company—the most trusted FHA lender in Texas with 105 construction loans closed since 2016.

Market Snapshot

|

|

||||

|

|

*Data as of 1/14/2026 market close.

Lone Opportunity

Investors Zero In on Texas' Cooling Attached Home Market

Falling prices and rising rents have turned Texas’ condo and townhome sector into a yield-driven magnet for savvy investors.

Bucking the trend: While the broader U.S. housing market is entering a period of relative calm, Texas stands out for its diverging performance—particularly in the attached home segment. Nationwide, attached home prices have plateaued, but in Texas, they’ve fallen 4% YoY, reversing a post-COVID boom that once saw double-digit gains.

Investor-driven demand: The pricing dip is drawing in investors. In 2025, nearly 40% of Texas’ attached home sales went to investors, outpacing the 30.5% national average and the 31.8% share for detached homes in the state.

The rent factor: Strong rent growth is fueling investor interest. Texas rents for attached homes rose 2.56% in 2025, outpacing the 1.58% national rate. With prices back to 2022 levels and rents rising, investors are locking in better yields and stronger cash flow.

Timing the cycle: Cotality expects the dip in attached home pricing to be short-lived, forecasting a return to 3.2% annual growth through 2030. That projected rebound, paired with today’s depressed entry points, is drawing capital seeking strategic timing and long-term upside.

Eyes on other hot spots: Cotality suggests Texas could be a lead indicator for other overheated Sun Belt markets. Florida, Arizona, and the Carolinas may see similar investor momentum as affordability tightens and rental demand stays strong.

➥ THE TAKEAWAY

Investor sweet spot: Texas’ attached home market offers a rare convergence of lower prices and rising rents—an investor sweet spot not widely available elsewhere. With institutional players already moving in, this may be the first domino in a broader Sun Belt strategy shift.

TOGETHER WITH MASON JOSEPH COMPANY

105 FHA Construction Loans Closed Since 2016

Mason Joseph Multifamily Finance has closed 105 FHA-insured construction loans in Texas over the last decade – more than the next three FHA lenders combined.

That's why San Antonio–based Mason Joseph is the most trusted lender for high-leverage, low-interest FHA financing.

Whether your next multifamily development is in Texas, or any of the 49 other States, send us your budget & pro forma and in 24 hours we can tell you how an FHA-insured loan will improve your returns.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

Around Texas

➥ Grocery chains led DFW to a record 95.4% retail occupancy in 2026, driving most new construction and absorption.

➥ Dallas's $460M tower, The National, faces foreclosure as high rates and low occupancy push Todd Interests to relinquish it to Starwood.

➥ Construction has begun on a 727K SF speculative industrial warehouse in Southern Dallas County, led by Krusinski Construction.

➥ Google is planning to open its first Houston retail store at The Galleria, marking its second Texas location after Austin.

➥ Austin-Bergstrom Airport will nearly double its gates with a multibillion-dollar expansion adding 32 gates, two new concourses, and major airline upgrades.

Follow the Money

| MIXED-USESAN ANTONIO San Antonio plans to acquire $30M in federal land to anchor the Spurs-backed Project Marvel, a mixed-use arena district near Hemisfair. |

| LIFE SCIENCESHOUSTON Eli Lilly finalized a $6.5B deal to build a major pharmaceutical plant at Generation Park in Houston. |

| OFFICEDALLAS Cawley Management acquired the foreclosed Harwood No. 1 office tower near Uptown Dallas, expanding its portfolio through a long-standing banking relationship. |

| DATA CENTERSCASTROVILLE Microsoft is planning a $400M data center in Castroville, its fourth in the area, reinforcing San Antonio’s rise as a major data center hub. |

| DATA CENTERSTAYLOR KDC is planning a 220-acre data center campus next to Samsung’s Taylor facility, signaling major tech investment in the Austin suburb. |

| HOSPITALITYDALLAS Cawley Partners and Alamo Manhattan have acquired a 27,456 SF office building in Uptown Dallas with plans to demolish it and replace it with a $55M boutique hotel. |

📈 CHART OF THE WEEK

Dallas and Houston kicked off 2026 with a combined 62M SF of new industrial construction in 2025, accounting for one-fifth of all activity in Texas.

-

📬 Newsletters: Stay ahead of the market with our national CRE Daily newsletter — or get hyper-local insights from CRE Daily New York.

-

🎙️Podcast: No Cap by CRE Daily delivers an unfiltered look at the biggest trends—and the money game behind them.

-

🗓️ CRE Events Calendar: The largest searchable calendar of commercial real estate events—filter by city or sector.

-

📊 Market Reports: A centralized hub for brokerage research and market intelligence, all in one place.

-

📈 Fear & Greed Index: A fully interactive sentiment tracker on the pulse of CRE built in partnership with John Burns Research & Consulting.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |