Renters Hold the Advantage as Landlords Struggle to Fill Units

A nationwide apartment supply surge and slowing job growth are shifting market dynamics.

Good morning. The rental market is tipping in favor of tenants. With rising vacancies, deepening concessions, and delayed rent growth expectations, landlords may be waiting until 2027 to regain pricing power.

Today’s issue is brought to you by Agora—see how top firms are surviving market volatility.

🎙️This Week on No Cap: We get an insider’s look at multifamily’s policy future with NMHC President Sharon Wilson Géno, covering today’s biggest legislative wins, looming battles, and what’s really at stake for owners and renters.

Market Snapshot

|

|

||||

|

|

*Data as of 10/27/2025 market close.

Renter’s Market

Renters Hold the Advantage as Landlords Struggle to Fill Units

A record wave of new apartment supply, paired with weakening job prospects for young renters, is shifting the rental market firmly in tenants' favor—possibly for years to come.

Rent growth stalls: After years of steady increases, apartment rents are now barely moving. National average rent dropped 0.3% in September—the sharpest decline for that month in over 15 years, according to CoStar. While the Midwest and Northeast saw slight gains, Sunbelt and Mountain West cities like Austin, Denver, and Phoenix are seeing the biggest cuts as landlords race to fill new units.

Young renters struggle: The labor market isn’t helping entry-level renters. Unemployment among 20- to 24-year-olds hit 9.2% in August—twice the national average—prompting many to delay renting, move in with roommates, or return home. That softer demand is pushing landlords to offer even more incentives, including free rent, gift cards, and paid moving costs.

Developers overshot: The post-pandemic building boom—especially in the Sunbelt—has created the biggest apartment supply wave in 40 years. But supply-chain delays pushed delivery timelines, bringing new units to market just as demand weakens. While leasing activity appears strong, it’s largely driven by heavy concessions rather than real pricing power.

Forecasts shift—again: Multifamily owners had hoped 2025 would be the year of equilibrium. Now, many are punting rent growth expectations to late 2026 or even 2027. Yardi Matrix recently revised down its rent growth forecast for 2027, citing ongoing supply momentum and tepid demand.

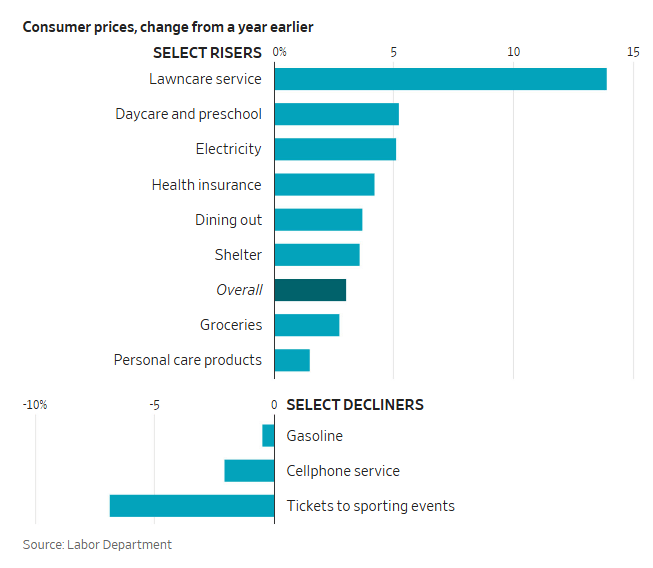

Margins under pressure: Weaker rent growth is helping cool inflation, especially with housing being a major part of the Consumer Price Index. But for landlords, stagnant rents, rising costs, and extended concessions are putting pressure on margins.

➥ THE TAKEAWAY

Soft climb ahead: The power dynamic in the rental market has shifted—and it’s sticking. With more apartments still coming online and job uncertainty clouding the outlook for young renters, landlords may be stuck in deal-making mode longer than anticipated. Until then, tenants should enjoy the rare upper hand—free rent, perks, and all.

TOGETHER WITH AGORA

What 200+ CRE leaders are doing differently in 2025

2025 Real estate market sentiment report: Insights from 200+ CRE leaders

Capital is tighter. Investors are more demanding. Strategies are shifting. Yet some firms are pulling ahead faster, leaner, smarter.

Agora’s latest report uncovers how the most forward-thinking real estate firms are navigating today’s economic pressures and outperforming the market.

What’s inside:

-

44% of firms have already pivoted investment plans

-

58% say raising capital is more difficult in 2025

-

31% of investors are demanding more transparency

-

48% are hunting undervalued or distressed opportunities

See what’s driving real decisions and learn how leading firms are staying ahead.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

-

Inside the lease: In this Dolfin Partners webinar, brokers discuss strategies for funding tenant improvements and structuring capital-efficient leases in today’s market. (sponsored)

-

Optimism builds: CRE climbed 2.6% year-over-year in Q3 2025, driven by retail and office sector gains

-

Defined diversification: Defined contribution plans now hold over $45 billion in private real estate, signaling growing demand for core, diversified exposure through both dedicated and institutional fund vehicles.

-

Future forward: In ten years, Crexi transformed CRE dealmaking with a digital-first platform, and now it's diving into AI with Vault to push the industry even further. (sponsored)

-

Valuation gap: Despite rising borrowing costs, cap rates remain stubbornly sticky as buyers and sellers navigate a fragmented market defined by repricing through negotiation, not distress.

-

Confidence climb: U.S. CRE deal volume jumped 17% in Q3 2025, signaling renewed investor confidence, rising NOI, and improving liquidity across most property types.

-

Inflation eases: Slower CPI and shelter-cost growth in September support Fed rate-cut expectations and signal softer rent pressures ahead.

🏘️ MULTIFAMILY

-

Market patience: Multifamily buyer sentiment improved in Q3 amid Fed rate cuts, though underwriting metrics stayed firm.

-

Luxury leader: Detroit claimed the top spot in Fall 2025’s WSJ/Realtor.com Luxury Market Ranking, driven by strong demand, local affordability, and rising buyer interest.

-

Recovery pockets: Despite oversupply challenges in some regions, multifamily demand is strengthening nationally as high mortgage rates widen the rent-vs-own affordability gap.

-

Rent cuts: San Antonio apartment operators are slashing rents to maintain occupancy amid record supply, making it the most affordable large market in the U.S. with prices under $1,200.

-

Project momentum: Delray Beach’s Savio luxury multifamily project secured $139M in refinancing as its next development phase, Skye, prepares to break ground.

🏭 Industrial

-

Industrial exit: Plymouth Industrial REIT will go private in a $2.1B all-cash deal with Makarora and Ares Management.

-

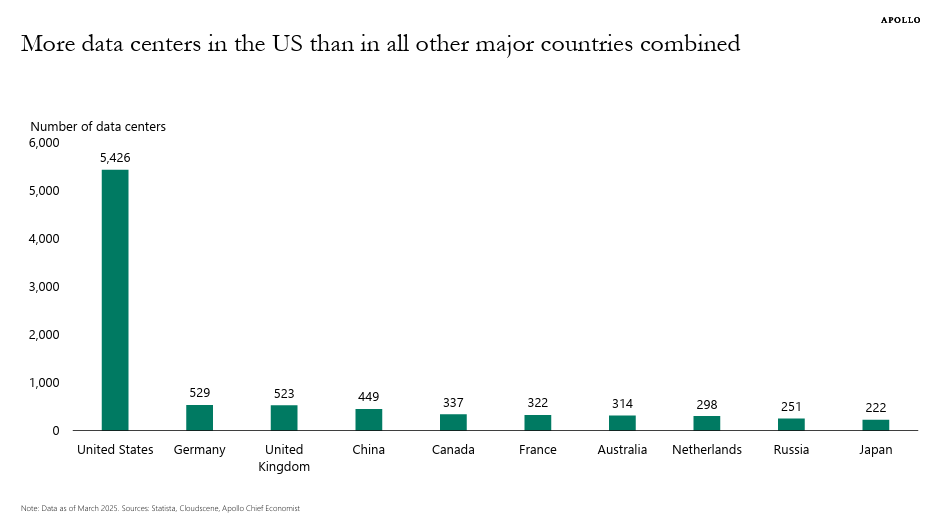

Data fund: BGO closed its $800M U.S. Industrial Strategies I fund, with plans to develop 3.2M square feet of data centers.

-

Data center flip: Chicago developers flipped Cboe’s old HQ into a $40M data center sale after boosting power capacity, netting a $28M profit in just over a year.

-

Chasing capital: Atlanta's industrial sales market is primed for a pickup as rising property values, Fortune 500 tenant demand, and tighter supply lure investors back.

-

Gas grab: Data centers are flocking to U.S. fracking hubs, where behind-the-meter natural gas offers a faster path to power AI campuses.

🏬 RETAIL

-

Boxed potential: Despite a wave of bankruptcies from big-box retailers, savvy investors are eyeing empty stores as redevelopment opportunities.

-

Lease denied: A Canadian court rejected Ruby Liu’s bid to take over 25 Hudson’s Bay leases, backing landlords and pension funds wary of her retail startup.

-

Bigger bet: As rivals shrink, Dick’s is scaling up with massive, experience-packed “House of Sport” stores to drive sales and redefine big-box retail.

🏢 OFFICE

-

Med office optimism: Healthpeak Properties expects over $1B in sales and recapitalizations amid surging demand for outpatient medical assets.

-

Cost squeeze: Construction costs are outpacing tenant allowances, straining office landlords and widening the gap between premium and aging properties.

-

Deal surge: Manhattan commercial sales hit $5B in Q3 2025, driven by major office deals and renewed lender confidence.

-

Iconic exodus: As legacy newspapers like the Richmond Times-Dispatch vacate their landmark buildings amid industry decline, cities are left to repurpose these iconic properties.

🏨 HOSPITALITY

-

District demand: Despite flops among new musicals, Broadway's broader ecosystem—ticket sales, foot traffic, and Times Square retail—continues to thrive.

-

Room to rise: A ground lease for Manhattan’s Hudson Yards Hotel is on the market for $17M, offering investors a rare value-add opportunity with redevelopment potential exceeding $1B.

A MESSAGE FROM REALAI

Real Estate AI – Automated Analysis

RealAI delivers instant analysis grounded in sales comps, rent comps, operating metrics, and market data—so you can underwrite deals in minutes, not days. Adjust assumptions, upload financials, and evaluate stabilized or value-add opportunities with clarity.

Built by the team behind Fundrise, RealAI brings institutional rigor to every property, market, or portfolio—helping you move faster, see risks sooner, and close with confidence.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

📈 CHART OF THE DAY

The U.S. leads the global AI infrastructure race with over 5,400 data centers—more than all other major countries combined.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |