Q4 2025 Burns + CRE Daily Fear and Greed Index

Investor sentiment stayed positive in Q4, but the outlook for 2026 is dimming even as capital access improves.

Good morning. Thank you to everyone who contributed to the Q4 2025 Burns + CRE Daily Fear and Greed Index. This quarter’s report reveals cooling investor optimism as near-term outlooks dimmed across most CRE sectors, despite signs of easing capital constraints.

Today's issue is sponsored by AirGarage—helping owners unlock NOI with demand-based parking pricing.

🚨Join CRE Daily + JBREC for a free webinar tomorrow, 12/17, breaking down the 4Q25 Fear and Greed Survey. We’ll unpack what’s driving investor sentiment, where capital’s flowing, and what to watch next.

CRE Trivia 🧠

Which region outside the U.S. is trending as a top international travel destination for Americans in 2026?

(Answer at the bottom of the newsletter)

Market Snapshot

|

|

||||

|

|

*Data as of 12/15/2025 market close.

Investor Sentiment

Q4 2025 Burns + CRE Daily Fear and Greed Index

The latest Q4 2025 JBREC + CRE Daily Fear and Greed Index is in, offering a fresh look at investor sentiment across 450+ sector responses.

By the numbers: The Fear & Greed Index edged up to 58, signaling mild expansion. Still, investor optimism waned. Only 39% expect to increase exposure in the next six months—the lowest on record. A quarter of investors boosted exposure in Q4, but many remain cautious despite capital access improving for the first time in survey history.

For context: Index values below 45 indicate a contracting commercial real estate (CRE) market, while those above 55 suggest expansion. Values between 45 and 55 reflect a market that is balanced between buyers and sellers.

Sector check-in:

-

Retail led all sectors with a score of 61, topping investor sentiment.

-

Industrial held steady at 60, continuing its strong performance streak.

-

Office improved to 53, climbing out of contraction territory for the first time.

-

Multifamily rose to 59, but investor sentiment declined for the fourth straight quarter. Confidence is slipping despite signs of stabilization.

Valuations mixed: Multifamily values dropped 6% YoY and are expected to fall another 1% in early 2026. Office values slid 5% but showed signs of leveling out. Retail and industrial posted modest gains and are projected to rise further next year.

Distress on deck: Distress is gaining momentum. Nearly three-quarters of multifamily investors expect more distressed sales ahead, followed by 54% of office investors. Multifamily also leads in rescue capital usage, with 11% actively pursuing preferred equity, signaling rising pressure in the sector.

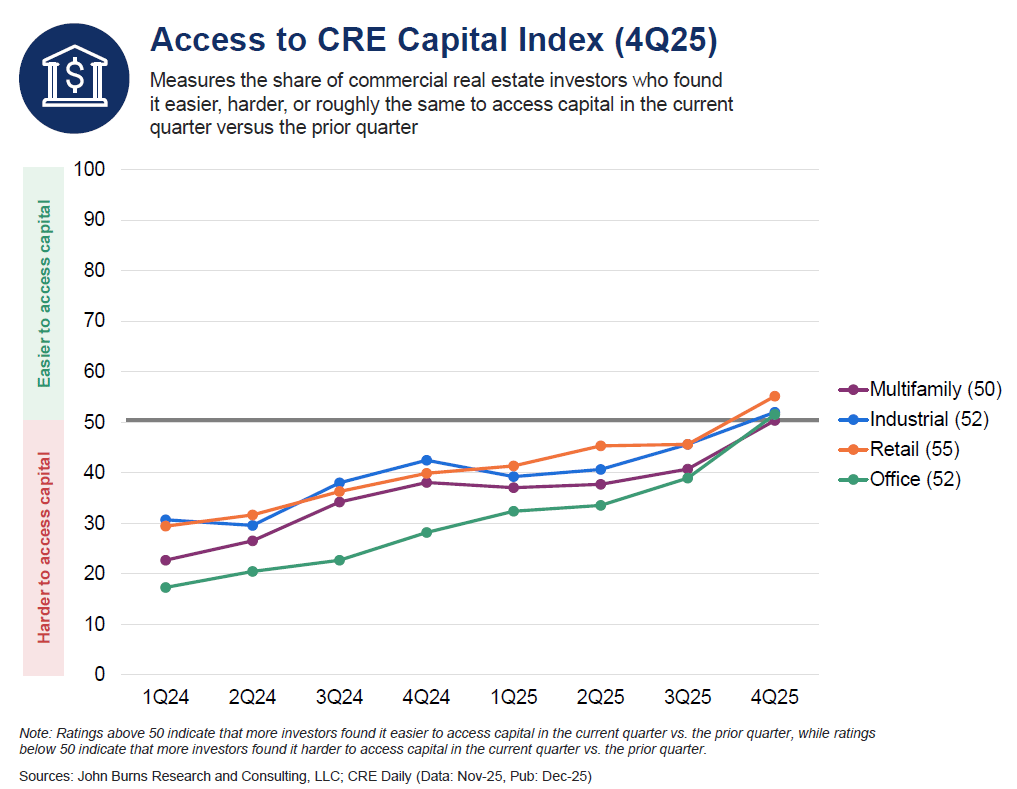

Capital gets easier: Access to capital improved across all sectors, aided by falling interest rates. Still, 64% of investors kept exposure flat in Q4, citing high borrowing costs and economic uncertainty. Even with some relief, many are waiting for the math to work again before making moves.

➥ THE TAKEAWAY

Big picture: CRE markets are inching forward, but conviction is thinning. Capital is thawing, yet most investors are staying sidelined, waiting for distress to surface or rates to fall further before leaning back in.

Want the full breakdown? 📥Download the complete Q4 2025 Fear & Greed Index Report for sector deep dives, sentiment shifts, and exclusive investor insights.

TOGETHER WITH AIRGARAGE

Is parking revenue leaking? Time to rethink pricing.

Parking is often treated as an operational afterthought — but for most properties, it’s one of the simplest levers for improving NOI.

The issue is that pricing usually doesn’t keep up with real demand. Rates stay static while usage patterns and neighborhood activity change, which means revenue quietly gets left on the table.

This playbook outlines a practical approach to demand-based pricing and real-time utilization data, so you can increase revenue without hurting occupancy or guest experience.

If you’re responsible for property performance, it’s a useful way to start treating parking like a financial asset, not just a facility to maintain.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

-

Management made easy: Simplify how you manage your rentals for free with our 2026 deep dive into TurboTenant, the all-in-one platform helping DIY landlords run their portfolios with ease. (sponsored)

-

Tax-funded turnaround: LA' controversial “mansion tax” has quietly jumpstarted nearly 800 affordable housing units and a record $376M funding round.

-

2026 outlook: CRE is set for a major 2026 rebound, driven by lower rates and surging Sunbelt office demand.

-

Too big: Blackstone’s massive real estate empire is proving hard to unwind, as the end of cheap money forces creative exits instead of clean sales.

-

Quiet build: Fannie Mae and Freddie Mac have quietly grown their mortgage-bond holdings by 25%, fueling speculation they’re aiming to lower rates and prep for a long-anticipated IPO.

-

Sky commute: Stephen Ross is teaming with Archer Aviation to bring flying taxis to South Florida by 2026, aiming to ease gridlock with a network of eVTOL vertiports.

-

Grid overload: Data center growth is straining the PJM grid, triggering soaring power costs and a showdown over stricter connection rules.

🏘️ MULTIFAMILY

-

Policy divide: Twin Cities' opposing housing strategies show that rent control can stifle growth, while easing construction rules can boost supply.

-

DFW recap: DFW’s multifamily market stayed steady in 2025, with flat rents, modest job growth, and strong absorption keeping pace with new supply.

-

Multifamily mastery: The Solomon Organization surpassed $1B in 2025 transactions, expanding strategically into the Midwest while reaffirming its long-term, value-driven approach to multifamily ownership.

-

Discount spike: Apartment concessions surged in November, with the South and West markets leading the nation in both frequency and depth of discounts.

-

Affordable transformation: Fairstead has acquired and will renovate the 700-unit Haverstock Hills Apartments in Houston for $242M.

🏭 Industrial

-

Factory fever: Onshoring is driving renewed optimism in U.S. industrial real estate, with billions in new manufacturing projects announced.

-

Cold capital: Slate Asset Management and Hamilton Lane have acquired a majority stake in Cold-Link Logistics, expanding their footprint in the fast-growing cold storage sector.

-

Brewing exit: Anheuser-Busch is closing three breweries in New Jersey, California, and New Hampshire—including its iconic Newark facility—to cut costs and shift production.

-

Prime pickup: Amazon bought a Pasadena flex industrial building for $79M, more than doubling its value since 2021.

-

Small bay boost: Basis Industrial acquired a 42-building small-bay industrial portfolio in Hialeah, FL, for $85M, becoming one of the area's largest industrial landlords.

-

Fresh expansion: Kroger will invest $391M in a new automated distribution center in Franklin, Kentucky, as it reshapes its supply chain strategy.

🏬 RETAIL

-

ICSC says: Despite store closures and rising costs, retail real estate remains resilient as strong tenant demand drives competition for limited quality space.

-

Boom outlook: Retail real estate professionals say this is the most exciting time to be an owner, as tight supply, strong tenant demand, and strategic expansions fuel confidence.

-

Center sale: JRE Partners and Anastacia AG acquired Chesterfield Towne Center, Richmond’s largest enclosed mall, for $80M.

-

Texas trade: Sterling sold San Antonio’s Park North Shopping Center for $115M after boosting its occupancy and traffic.

🏢 OFFICE

-

Legal anchor: BXP is set to develop a new D.C. office tower for Sidley Austin, marking the city’s largest private-sector lease of the year.

-

Booking upgrade: Event firm Leading Authorities is relocating to a larger 17.7K SF HQ at J.P. Morgan’s recently acquired and renovated 1875 K Street NW in Washington, D.C.

-

Pedal push: Giant Group USA is relocating its U.S. headquarters from California to Boulder in 2026, bringing 125 jobs to the cycling-friendly city.

-

Lab slowdown: Life sciences leasing remains sluggish heading into 2026 as funding cuts, oversupply, and cautious tenant behavior keep pressure on landlords.

🏨 HOSPITALITY

-

Course capital: Trump aims to take control of D.C.’s public golf courses, starting with East Potomac, sparking debate over access and redevelopment.

-

Event spike: Major sporting events like the FIFA World Cup and Winter Olympics are set to drive hotel demand in 2026.

-

Palace deal: Lotte Hotels & Resorts has acquired the land beneath its Lotte New York Palace for $490M, ending a long-term lease with the Archdiocese.

A MESSAGE FROM HINES

The Real Estate Recovery May Be Here After All, But It Could Look Different This Time.

Why does Hines Research think it’s ‘wheels up’ for real estate in 2026?

Hines' 2026 Global Investment Outlook says the real estate recovery is here – but this time looks different.

-

Deglobalization and AI are shaping new investment geographies and fueling demand around the world.

-

We see high-conviction opportunities forming in living, industrial, and retail, with notable regional variations.

-

Investors who remain measured and strategic should be positioned to navigate this evolving landscape and ascend.

Subscribe to Market Moves, your source for the latest news and updates from Hines, to receive our detailed analysis and prepare for the year ahead.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

📈 CHART OF THE DAY

According to the Q4 2025 Fear & Greed Index, Industrial and Retail investors are the most optimistic about future net operating income (NOI) growth, with 63% and 41% respectively, underwriting NOI increases above 2%.

CRE Trivia (Answer)🧠

Eastern Europe is trending as a top international travel destination for Americans in 2026, according to 2025 data from Kayak shared with Axios.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |

1