Office and Retail Rebound Buoy CRE Credit Ratings—For Now

Despite a sluggish economy, credit ratings in commercial real estate remain surprisingly resilient—thanks in part to a rebound in office and retail leasing.

Good morning. Despite a sluggish economy, credit ratings in commercial real estate remain surprisingly resilient—thanks in part to a rebound in office and retail leasing.

Today’s issue is brought to you by Colony Hills Capital—invest as a GP alongside a $1B+ sponsor.

Market Snapshot

|

|

||||

|

|

*Data as of 09/05/2025 market close.

Economic Activity

CRE Credit Quality Defies Economic Woes, Says S&P

Even as the broader economy shows signs of fatigue, commercial real estate credit quality is holding firm—driven by a rebound in office and retail leasing.

Leasing momentum returns: According to S&P Global Ratings, office and retail sectors are showing renewed strength. Office REITs are posting improved leasing results, with signs that occupancy levels may bottom out in 2025. Meanwhile, retail landlords are successfully backfilling vacancies left by bankrupt tenants earlier in the year.

Case in point: A new Q2 report from Colliers shows that overall office availability in Manhattan has fallen to 81.98 million square feet, marking the lowest level since January 2021. That’s a 17% decline from the February 2024 peak. While still more than 50% above pre-COVID levels, the drop indicates growing tenant demand and shrinking supply.

Ratings boost: Improved leasing and stabilized valuations have shifted sentiment around CRE finance firms and mortgage REITs. Of six CRE lenders S&P tracks, loan loss allowances remained modest—ranging from just 2% to 7%. However, three-quarters of their loan portfolios are tied to pre-2022 vintages, posing refinance risks amid elevated rates.

Economic turbulence still looms: S&P flagged ongoing macro challenges: tariffs pushing up materials costs, a cooled labor market (only 22,000 new jobs in August), and a dip in GDP growth to 1.2% in H1 2025—down from 2.8% in 2024. Yet, analysts remain cautiously optimistic, expecting potential rate cuts to bolster asset values and deal flow.

Multifamily pain and strain: Not all sectors are faring equally. Multifamily and residential markets are under pressure due to high housing costs, elevated mortgage rates, and sluggish demand—symptoms of persistent affordability challenges. Builders are also getting squeezed by tariffs on key materials like lumber and steel.

Speaking of builders: Construction and materials firms face demand and cost pressures. Of the firms S&P monitors, 17% have negative outlooks, double those with positive expectations. The prolonged high rates and Trump-era tariffs continue squeezing margins.

➥ THE TAKEAWAY

Looking ahead: While office and retail show surprising signs of life, other sectors are still struggling under the weight of policy, pricing, and interest rates. Credit quality is holding steady—for now—but much rides on a hoped-for rate cut to sustain CRE’s slow but steady recovery.

TOGETHER WITH COLONY HILLS CAPITAL

Colony Hills Capital Opens GP Access to Stabilized South Carolina Deal

Colony Hills Capital has closed 37 deals since 2008, totaling $1.3B+ in transactions and delivering 20%+ levered IRRs across 13K+ garden-style units.

Their latest offering: Encore at Murrells Inlet — a Class A, newly built townhome community in coastal South Carolina with 92% occupancy, $100+ lease premiums, no major capex, and an assumable 6.21% Fannie Mae loan.

Qualified investors can now invest as a GP in this stabilized, cash-flowing opportunity.

Target returns over a 5-year hold:

-

5.6% cash yield

-

17.75% IRR

-

2.13x equity multiple

This deal delivers strong current income and long-term upside, without lease-up or renovation risk.

This is a paid advertisement. CRE Daily is not a registered broker-dealer or investment adviser. This content is provided for informational purposes only and does not constitute an offer or solicitation to buy or sell any securities. All investments carry risk, including potential loss of principal. Please conduct your own due diligence or consult with a licensed financial professional before making any investment decisions.

✍️ Editor’s Picks

-

Flexible financing: C-PACE is non-recourse, long-term, fixed-rate financing that can fill gaps in the capital stack in any market. Whether for new construction, redevelopment, or recapitalizations, C-PACE offers a creative solution. (sponsored)

-

Price pressures: CRE prices flatlined in Q2 as ongoing tariff negotiations and high interest rates deepened market uncertainty.

-

Tracking trouble: Economists are sounding the alarm again as job cuts, sticky inflation, and tariff pressures push the economy dangerously close to recession.

-

Investor retreat: Investor home purchases hit their lowest spring level since 2020, led by a steep condo decline.

-

Guess who's back: Nomura is relaunching its US CRE platform after a 30-year hiatus, hiring top Barclays execs to lead CMBS and lending.

-

Risky partner: Webstar’s $1.2B Atlanta mega-project faces scrutiny after linking with a developer previously fined by the SEC for fraud.

-

Yield resilient: Life insurers’ CRE mortgages returned 1.9% in Q2, with steady income and loan originations rebounding.

🏘️ MULTIFAMILY

-

Renting redefined: As the US housing shortage persists, BTR communities are gaining traction, with over 8% of new single-family homes now built specifically for renters.

-

Permit pulse: Multifamily permits rose in nearly half of major US metros in early 2025, led by Florida and Midwest markets.

-

Queens greenlight: NYC approved the OneLIC rezoning, adding 14,700 homes—4,300 affordable—plus new commercial space and jobs.

-

Apartment expansion: Greystar partnered with Grand Peaks to add nearly 11K apartments across seven states, strengthening its scale in high-growth markets.

-

Silicon scoop: Calvera Partners has acquired an 88-unit multifamily community in San Jose’s desirable Willow Glen neighborhood, marking its continued expansion in high-demand West Coast markets.

-

Distress divide: Chicago apartments are bouncing back, but troubled properties face uneven outcomes—some refinanced, others stuck in foreclosure.

-

Guardian growth: Guardian closed a $497M deal for 15 multifamily properties in Oregon and New Mexico, with plans to convert a portion into affordable housing.

🏭 Industrial

-

Policy pressure: Uncertainty around U.S. trade policy and tariffs is keeping industrial demand flat even as new supply piles on.

-

Debt reset: Prime Group landed a $156M refinancing on three NYC self-storage sites, extending its lead as the nation’s largest player in the sector.

-

Capacity credit: Blackstone’s QTS is seeking a $600M ABS loan to refinance its fully leased Phoenix data center, part of a 210MW campus under development.

🏬 RETAIL

-

Consumer cooldown: Retail posted rare back-to-back negative absorption in early 2025 as vacancies rose despite record rents.

-

Discount demand: Dollar Tree’s Q2 sales jumped 12% to $4.6B as foot traffic rebounded, signaling fresh momentum for dollar stores.

-

Dividend strength: Retail REITs posted 5% NOI and FFO growth in Q2, with 96.6% occupancy and limited new supply.

-

Foul play: James Harden’s Houston restaurant was locked out by its landlord over $2.2M in unpaid rent, with a lawsuit now seeking damages.

-

Vacancy value: Communities are repurposing dead malls into housing, clinics, green space, and even indoor farms.

🏢 OFFICE

-

Madison markdown: Amancio Ortega’s Pontegadea is offloading 366 Madison Ave. for about $50M, a 57% discount from its 2006 purchase price.

-

Quality flight: Manhattan office availability hit a four-year low as sublet space shrank and tenants flocked to newer buildings.

-

Med momentum: San Diego medical office rents hit record highs as low vacancy, limited supply, and aging-driven demand spark conversions.

-

Rolling revival: San Francisco’s former Rolling Stone HQ is marketing two floors to tenants, with SoMa’s AI boom making tech startups the likely occupants.

-

Citadel sale: Citadel Center is hitting the market at just 56% occupancy, testing buyer appetite as Chicago’s Loop offices face steep value declines.

🏨 HOSPITALITY

-

Travel gap: Luxury hotels are posting gains while mid-tier and economy properties face declines amid softer travel demand.

-

Hotel math: Developers weigh buying versus building as population growth, land costs, and supply-demand dynamics shape where new hotels make sense.

📈 CHART OF THE DAY

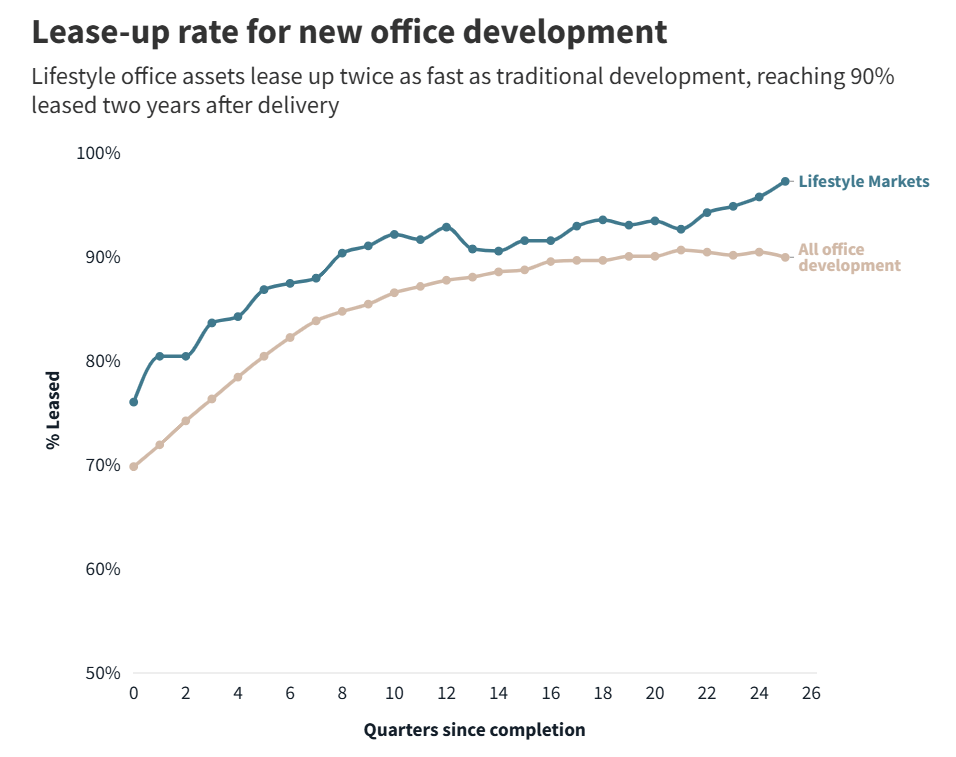

Lifestyle offices lease faster, hitting 90% occupancy twice as quickly and stabilizing 5% higher than traditional projects.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |