NYC Rent-Stabilized Landlords Squeezed by Soaring Insurance Costs

With costs continuing to climb, many landlords are struggling to keep up with essential building maintenance and operations.

Good morning. Affordable housing in NYC just got another challenge: insurance costs are up 150% for rent-stabilized units. Landlords are cutting back, and the long-term impact could be serious.

Today’s issue is brought to you by Hines—helping occupiers achieve operational efficiency on a global scale.

🎙️This Week on No Cap: Winston Fisher joins to talk about turning a 100-year-old firm into the creative force behind AREA15.

Market Snapshot

|

|

||||

|

|

*Data as of 11/20/2025 market close.

Premium Pressure

NYC Rent-Stabilized Landlords Squeezed by Soaring Insurance Costs

Skyrocketing premiums are putting pressure on New York’s rent-stabilized housing stock, forcing landlords to cut corners and raising concerns over long-term affordability and upkeep.

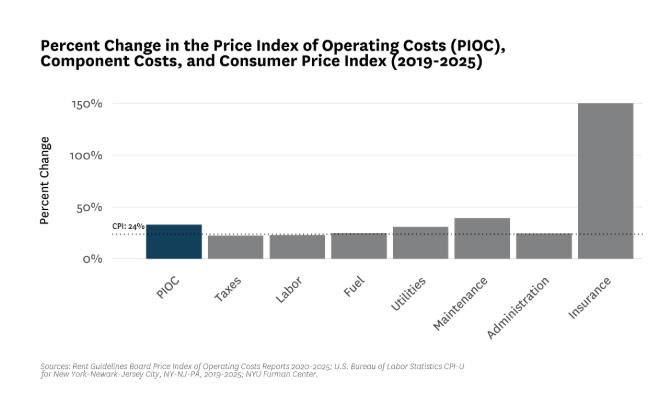

Insurance spike: Insurance premiums for NYC’s rent-stabilized buildings have surged 150% since 2019, according to a new report from NYU’s Furman Center. The more than 450,000 affected units are a key part of the city’s affordable housing stock, but their owners now face fast-rising operating costs outpacing all other expenses.

Why so high? The surge in costs stems from rising climate risks and fewer insurers covering multifamily housing, with some reportedly discriminating against affordable units based on income and subsidies. JPMorgan Chase’s Jane Silverman said these properties are being treated “very differently” by insurers.

Landlords cut elsewhere: Despite rising costs, inflation-adjusted operating expenses fell just over 3%, suggesting landlords are cutting back elsewhere. The result: a 47% rise in housing-code violations since 2021, well above rates in less regulated buildings.

Crucial housing stock: Most of these pre-1974 buildings rent for under $1,344, affordable to households earning 40% of the area median income. With over a million such units citywide, preserving them is key to Mayor Mamdani’s housing-focused agenda.

➥ THE TAKEAWAY

Affordability at risk: Rising insurance costs aren’t just a landlord problem. They’re a silent threat to NYC’s affordable housing infrastructure. Without intervention, the city could see a steady erosion of its rent-stabilized stock.

TOGETHER WITH HINES

Beyond Square Footage: Building Resilient Portfolios Through Consolidation and Integration

In a new article, Whitney Burns, Global Head of Client Partnerships at Hines, explains how successful occupiers are choosing integration over fragmentation to achieve global scale, efficiency, and long-term value.

Highlights include:

-

Fewer partners mean shorter decision cycles and compressed timelines.

-

Multi-market deals drive cost efficiencies across portfolios.

-

Global occupiers gain operational efficiency with centralized billing, unified reporting, and consistent service.

Learn how Hines is reimagining partnerships and transforming portfolios into platforms.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

-

Multifamily insights: 25% ownership premium is reshaping rental demand and occupancy trends, setting the stage for growth and strategic investment opportunities across multifamily markets. (Sponsored)

-

Cut uncertainty: Fed officials remain split on further rate cuts, casting doubt on a December move amid mixed signals on inflation and labor.

-

Capital flow: REIT M&A activity is rising after a quiet period, with $3B in deals since September.

-

Power premium: CRE winners in 2025 are assets with utility, entitlements, and scarcity driven by necessity and pricing power.

-

Capital divide: CRE is slowly recovering post-shutdown, with capital favoring industrial and data centers.

-

CLO crack: A BlackRock private credit CLO failed key tests amid rising bad loans, highlighting growing stress in the booming private credit market.

-

Crime signal: NYC's incoming mayor is keeping top cop Jessica Tisch, signaling a pro-safety stance that reassures CRE leaders.

-

Related reshuffle: Bill Witte is stepping down as Related California CEO, passing leadership to veteran execs after nearly 40 years.

🏘️ MULTIFAMILY

-

Supply slowdown: Texas apartment completions are projected to fall by half in 2026, easing pressure from recent oversupply.

-

Delayed independence: In 2024, 32.5% of U.S. adults aged 18–34 lived with their parents, up from 2023.

-

Software probe: Greystar will pay $7M and limit its rent-setting practices to settle with nine states over alleged rent collusion using RealPage software.

-

Rent cap: Massachusetts rent control advocates submitted over 124,000 signatures for a 2026 ballot measure to cap annual rent hikes at 5%.

-

Workforce housing: Target Hospitality is launching a new strategy to provide modular workforce housing near AI-driven data center megaprojects in rural areas.

-

Housing scandal: NYC landlord Steve Croman faces foreclosure on 35 properties after defaulting on nearly $170M in loans, following a past conviction for mortgage fraud.

🏭 Industrial

-

Storage shield: Self-storage real estate stands out with near-zero economic correlation, offering steady demand and strong margins.

-

Expansion plans: Flexential plans to buy and convert a neighboring 48K SF flex office in Peachtree Corners into a new data hall.

-

Factory uptick: U.S. factory orders rose 1.4% in August, though business investment remained weak.

-

Investor pressure: Rexford Industrial named COO Laura Clark as its next CEO and plans asset sales as part of a strategic overhaul.

-

Zoning vote: Bessemer City Council approved rezoning for a $14B, 18-building data center campus, one of Alabama’s largest private investments.

🏬 RETAIL

-

Retail vision: Comras Co. secured a $117M loan to redevelop five Lincoln Road properties into NoLi, a 150K SF retail “micro-district.”

-

Penn pickup: O5 Group purchased a three-story retail building at 425 Seventh Avenue across from Penn Station for $30M.

-

Target tune-up: Target is ramping up store upgrades and openings with a $5B investment in 2026, aiming to reverse sagging sales.

-

Tenant strategy: With record-low vacancies, developers are boosting value through smart re-tenanting and local-market redevelopment in high-barrier retail markets.

-

Temporary reprieve: Saks will keep Neiman Marcus’ downtown Dallas store open past the holidays, but its long-term future remains uncertain.

-

Elite status: Luxury wellness clubs are booming across the U.S., offering elite fitness, recovery, and social experiences, with memberships costing up to $100K annually.

🏢 OFFICE

-

Wellness workplace: Activewear brand Alo bought the landmark La Peer Building in Beverly Hills for $90M to establish its new HQ.

-

Empty empire: A failed Brazilian bank ditched Miami’s priciest office after paying record rent, leaving the space unused and its CEO under arrest.

-

Healthy refi: Davis refinanced 19 medical office properties for $171M and secured a $250M credit line to bolster its portfolio and fuel future acquisitions.

-

Bay bet: First Citizens Bank acquired a 160K SF San Francisco office at 667 Mission St., its second Bay Area buy this year.

-

Default deal: Brookfield's 1.4M SF DTLA office tower at 333 S. Grand hit the market after defaulting on $506M in debt.

-

Downtown boost: Shamrock Trading subleased 24.8K SF in Chicago’s Loop and plans to hire 130 locally, countering the downtown downsizing trend.

🏨 HOSPITALITY

-

Hostile exit: Marriott claims Sonder threatened guest safety during its chaotic bankruptcy wind-down to pressure the hotel giant into funding its $50M shutdown.

-

Safari controversy: Maasai leaders are suing to demolish a new Ritz-Carlton safari camp they say disrupts key Serengeti migration routes.

-

Split outlook: Hotel companies delivered mixed earnings and forecasts, with economic uncertainty clouding outlooks and the 2026 World Cup offering a rare bright spot.

A MESSAGE FROM AIRGARAGE

How a Baltimore Lot Went Gateless and Transformed Parking Revenue

In the heart of Baltimore’s vibrant Washington Hill, outdated gates and clunky systems once plagued this busy mixed-use lot.

Enter AirGarage: a sleek, gateless setup powered by LPR cameras, mobile payments, and dynamic pricing.

The result? No more broken gates, no cash chaos—just seamless operations, real-time insights, and happier drivers. Revenue’s up, headaches are gone, and the lot’s running smoother than ever.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

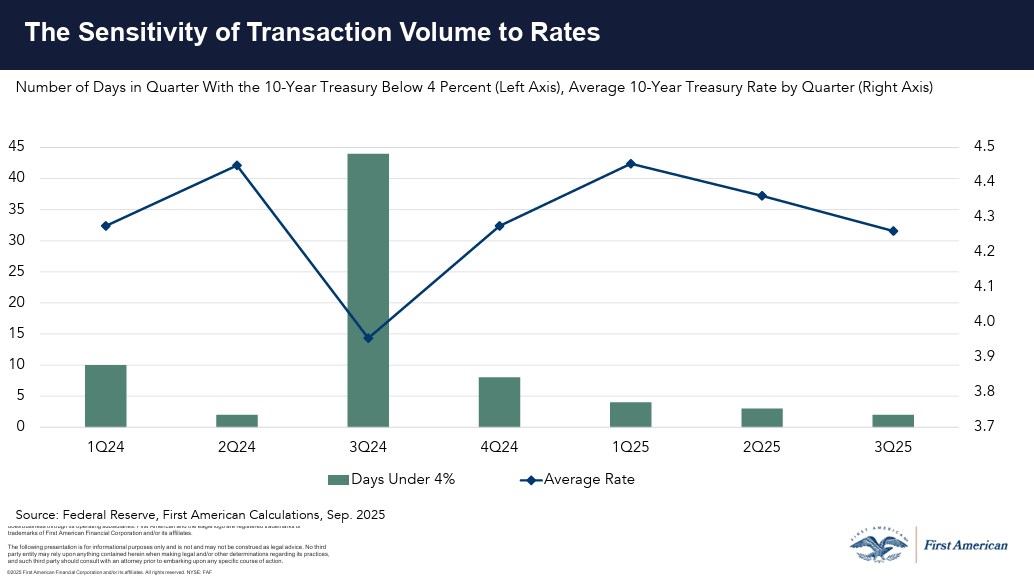

📈 CHART OF THE DAY

CRE deal volume is highly sensitive to rate shifts, with 4Q24’s surge driven by a rare dip in long-term yields—an environment unlikely to repeat in 4Q25 despite modest year-over-year gains.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |