NYC Family Lists Fifth Avenue ‘Crown Jewel’ Portfolio

The Duell family is seeking buyers for a coveted portfolio of nine properties.

Good morning. A New York real estate family is selling a top-tier portfolio of nine mixed-use properties for $300 million. Meanwhile, rising interest rates may be troubling many commercial sectors. Yet, there is significant capital eagerly lining up to take advantage of market dislocation.

Today’s issue is brought to you by FranBridge Consulting — connecting entrepreneurs with premier non-food franchise opportunities.

Market Snapshot

|

|

||||

|

|

*Data as of 2/28/2024 market close.

TROPHY ASSETS

NYC Family to Sell Premier Residential and Retail Portfolio Near Fifth Avenue for $300M

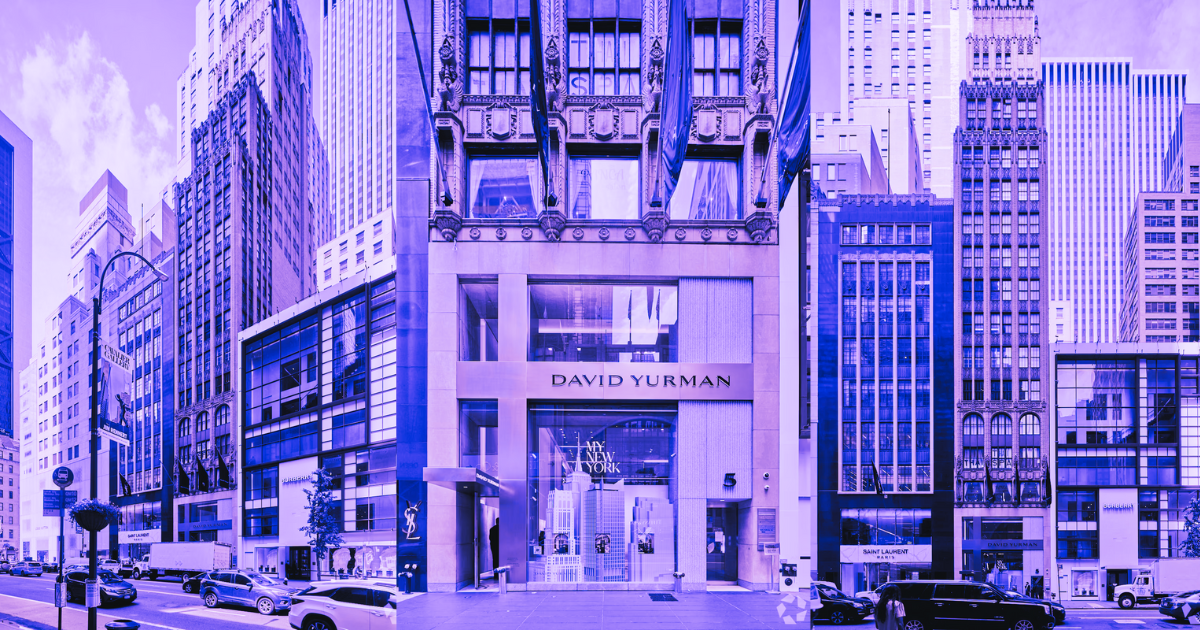

Source: 5 E 57th St via Loopnet

A New York family deeply rooted in the real estate market for generations is seeking buyers for a coveted portfolio of nine retail and residential properties with an asking price of around $300 million.

Prime property: Owned by the Duell family and marketed by Darcy Stacom of CBRE Group Inc., the portfolio encompasses seven properties in Greenwich Village and two in Midtown. The highlight of the sale is the “crown jewel” at 5 E. 57th St., home to a David Yurman boutique, located just steps from Fifth Avenue’s luxury shopping corridor.

Why sell? The decision to offload these properties comes as the Duell family opts to diversify their investment portfolio beyond real estate. With the market showing increased demand for top-tier spaces, the timing seems ripe. Demand is “so strong right now either from a retail or a residential point of view,” said Stacom, who’s leaving CBRE to start her own firm. “They bought beautiful pieces of real estate and sat on them for a really long time.”

➥ THE TAKEAWAY

Why it matters: Despite the broader CRE market facing challenges from rising borrowing costs and declining property values, New York’s prime real estate locations continue to fetch premium prices. The Duell family’s investment near Fifth Avenue, a hotspot for luxury brands like Gucci and Prada, illustrates the enduring demand for top-tier retail and residential spaces in Manhattan.

SPONSORED BY FranBridge

Why ‘Non-Food’ Franchise Opportunities are Thriving

Real estate investors and entrepreneurs are increasingly getting involved in a variety of opportunities in the world of ‘non-food franchising’.

Led by Jon Ostenson, a top .1% franchise consultant, former Inc. 500 franchisor and multi-brand franchisee, FranBridge is hands-down the premier source for the best opportunities in the ‘non-food’ franchise world, including both active and semi- passive opportunities.

From tiny homes to youth soccer, insulation to pets, senior care to concrete paving, and more. And FranBridge’s service is 100% free!

Sign up for a call today – or get a free copy of their bestselling book, “Non-Food Franchising” at FranBridgeConsulting.com!

Please support our sponsors. It helps keep CRE Daily free.

✍️ Editor’s Picks

-

Silicon Valley squeeze: Santa Clara’s housing market near Nvidia (NVDA) is ultra-competitive due to low inventory and affordable prices, not necessarily Nvidia’s success.

-

CLO concerns: U.S. CRE poses limited risks to the banking sector and financial markets, with a cautious outlook from industry experts.

-

Converting the masses: Ex-Silverstein CEO Marty Burger launches Infinity Global Real Estate Partners with a focus on conversions and mixed-use projects.

-

Path to profit: Compass (COMP) anticipates a market rebound, despite a $320M net loss in 2023. The firm anticipates improved cash burn and EBITDA this year.

-

Staffing struggles: Nationwide hotel staff shortages may raise travel costs, and room rates are likely to go up as hospitality struggles to adapt.

🏘️ MULTIFAMILY

-

CRE shake-up: Multifamily and office CRE prices are declining, and low office transactions suggest prices are yet to reflect weak fundamentals.

-

Courtroom chaos: The LeFrak Organization in Queens sues city courts for long delays, alleging owners have been deprived of rights in a rigged housing system.

-

Sky-high connection: VCI plans to build 17-story, 135-unit towers with a sky bridge in San Jose, featuring affordable housing and best-in-class amenities.

-

If you build it, they will rent: Urban Stearns and Forbix secured a $17.5M loan to convert a 12-story office building in San Pedro to 244 apartments.

🏭 Industrial

-

Empowering data: Data center demand surges in the U.S. with AI applications driving up to 500 MW in power needs. Primary data center markets, like Northern VA, still lead the pack.

-

Industrial gem: WestStarPoint Properties is building Point Central Business Park, offering 157.47KSF of industrial space in Denver.

🏬 RETAIL

-

Mixing biz with pleasure: AJ Capital plans Wedgewood Village, a 1.6MSF project in Nashville’s Wedgewood-Houston neighborhood featuring offices, retail, dining, and apartments.

-

Retail revival: The retail sector’s rebound post-pandemic emphasizes experiential strategies blending online and in-person shopping, focusing on positive customer interactions.

-

San Francisco retail: San Francisco’s retail market shows signs of warming up with increasing foot traffic and rising rents in more suburban areas.

🏢 OFFICE

-

But will it blend? As the office market enters increasingly dire straits this year, more owners are considering office-to-home conversions. But at what cost?

-

Wall Street woes: Barings seeks to sell 100 Wall Street for $125M, a steep discount from the $270M purchase price tag back in 2015.

-

Lease shuffle: WeWork adjusts its leases in NYC and Boston to potentially save $1.5B by vacating floors, reducing rents, and altering contracts.

WELL-CAPITALIZED

Opportunistic Funds Take Aim At Looming CRE Distress in North America

According to Preqin, there’s $260B in capital targeting North American real estate today.

The CRE market is at a crossroads, challenged by rising interest rates yet buoyed by $260 billion targeting North American investments, reflecting a keen interest in capitalizing on market shifts despite a recent dip from 2022’s peak.

Manager mega-funds: Major investment firms like Blackstone and Brookfield Asset Management are spearheading the charge, amassing funds aimed at opportunistic real estate ventures. With Brookfield alone targeting a $15 billion raise for its latest fund, and others like SL Green Realty eyeing a $1 billion New York City-focused fund, the race for capitalizing on market upheavals is on. This trend underscores a broader industry sentiment: the readiness to leverage debt, value-add, and opportunistic strategies amidst the current financial climate.

Changing appetites: The lure of high returns in a high-rate environment has shifted investor focus towards strategies promising greater risk-adjusted rewards. This pivot is largely driven by the anticipation of market distress and dislocation, with opportunistic investments emerging as the strategy du jour for the third consecutive year. Yet, despite this enthusiasm, the fundraising landscape remains challenging, underscored by elongated timelines to reach investment targets.

Navigating a sea of maturing loans: The impending maturity of $1.5 trillion in commercial loans presents a fertile ground for opportunistic funds, especially in a market characterized by cautious lending and elevated interest rates. The potential for distress across various sectors, notably in high-profile cases like the FDIC’s sale of Signature Bank’s loan portfolio, hints at both challenges and opportunities in addressing the capital needs of maturing loans.

➥ THE TAKEAWAY

Looking ahead: While office assets dominate distress discussions, the unfolding dynamics across retail, hotel, apartment, and especially the logistics sectors reveal a spectrum of investment prospects. For instance, the evolving needs of modern logistics present a unique niche for funds ready to innovate and reposition assets. However, the abundance of capital raises questions about market saturation and the genuine availability of worthy opportunities.

📈 CHART OF THE DAY

The S&P CoreLogic Case-Shiller 20-city composite home price index is at all-time highs. It’s the seventh month in a row that home prices have gone up, even though mortgage rates remain untenably high for most aspiring homeowners across the country.

SHARE CRE DAILY & EARN REWARDS

You currently have 0 referrals, only 1 away from receiving B.O.T.N Multifamily Deal Screener .

What did you think of today’s newsletter? |