Bronx Housing Court Buckles Under Mounting Delays

A surge in eviction filings and lagging rental aid have turned Bronx Housing Court into a bottleneck.

Good morning. Housing court was never fast. In the Bronx, it’s now a bottleneck reshaping the city’s rental landscape.

Today’s issue is sponsored by Covercy—eliminating manual exports by keeping property and investor data perfectly in sync.

Market Snapshot

|

|

||||

|

|

||||

|

|

*Office metrics courtesy of CompStak; data from 10/31/25 to 12/31/25. Sales metrics courtesy of Actovia; NYC properties reported sold during the week of 2/6/26–2/12/26.

Housing Backlog

Bronx Housing Court Buckles Under Mounting Delays

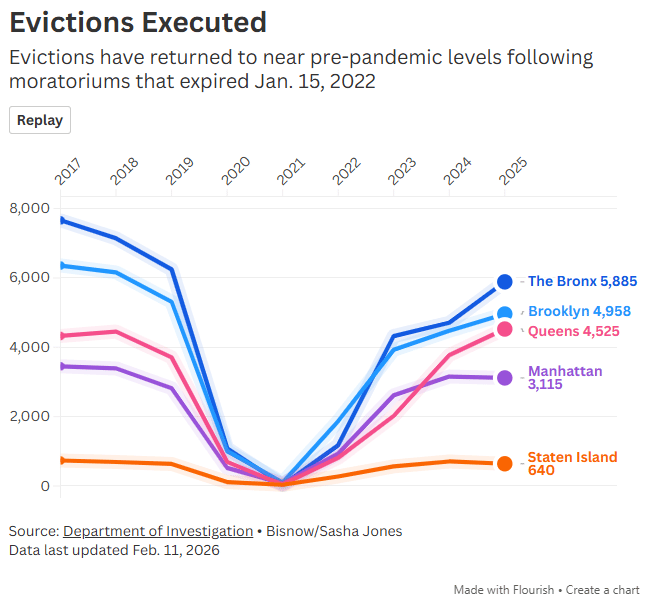

NYC’s busiest housing court has become ground zero for eviction gridlock, where cases now stretch months — sometimes more than a year — beyond legal targets.

Under pressure: On a recent morning, a Bronx judge faced nearly 60 cases before noon — part of what the state bar calls “cattle-call justice.” About 3% of residents face eviction filings each year, and while cases are meant to wrap in a month, it can take five months just to see a judge.

Pandemic aftershocks: Pandemic moratoriums and a 440% surge in filings afterward overwhelmed the courts. Right to Counsel has helped — nearly 9 in 10 represented tenants stayed housed in 2024 — but staffing shortages have cut representation to about 30%. Rental assistance that once took weeks now takes nearly a year, driving frequent adjournments.

Mounting financial strain: Delays are squeezing both sides. Affordable housing owners collected about 90% of rent in 2024, pushing many properties into negative cash flow. Meanwhile, 1 in 5 renters are severely rent-burdened, making arrears — and new filings — more common.

Fixing the bottleneck: Experts suggest adding judges, expanding fast-track options for small landlords and embedding social services at first appearances to speed aid. Prevention programs are growing, but the gap between rising costs and tenant incomes remains.

➥ THE TAKEAWAY

Costly delays: Bronx Housing Court reflects a broader imbalance: stronger tenant protections layered onto an under-resourced, high-cost system. Until capacity and housing economics align, delays will continue to shape NYC’s eviction landscape.

TOGETHER WITH COVERCY

Your Property Data Deserves Better

If you're running property management and investment management separately, you're wasting hours on manual exports and data reconciliation.

Covercy changes that.

Our Rent Manager integration syncs property data automatically so your investor reports, distributions, and waterfalls are always accurate and up-to-date.

✓ Real-time data sync

✓ Eliminate manual exports

✓ Reporting investors actually trust

Hundreds of real estate firms already use Covercy. Ready to upgrade your stack?

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

Around New York

➥ Manhattan’s shortage of large, top-tier office space is driving tenants to lock in renewals and preleases years early, solidifying the city’s strongest landlord market in decades.

➥ NYC sued Extra Space Storage, alleging the company used deceptive teaser rates and steep rent hikes that harmed customers, particularly those facing housing instability.

➥ After completing a roughly $4B renovation, the owners of the Waldorf Astoria are exploring a potential sale that could test investor appetite for trophy hospitality assets.

➥ Stronger Wall Street bonuses and proposed tax hikes are expected to cut NYC’s projected two-year budget gap from $12B to $7B, per Mayor Mamdani.

➥ Financial distress is rising among owners of NY’s rent-stabilized properties as higher expenses and capped rent increases squeeze cash flow and property values.

➥ Lower Manhattan’s office market is kicking off 2026 with leasing volume more than doubling quarter-over-quarter, led by Jane Street’s 1 MSF expansion.

➥ NYC-based Gregorys Coffee is rolling out a franchise program to fuel national expansion as the brand looks to scale beyond its core urban markets.

➥ Southern chicken chain Zaxby’s signed a lease at 1267 First Avenue for its first NYC outpost, marking its entry into one of the nation’s most competitive retail markets.

Follow the Money

| OFFICEMIDTOWN RXR completed a major renovation of 450 Lexington Avenue, repositioning the Midtown office tower with modern amenities and upgraded infrastructure to attract top-tier tenants. |

| OFFICEMANHATTAN Vornado Realty Trust plans to begin construction on three major NYC developments this year, signaling renewed confidence in the city’s office and mixed-use pipeline. |

| OFFICEMIDTOWN Citadel founder Ken Griffin acquired a 60% equity stake in a 1.9 MSF Park Avenue office redevelopment, underscoring continued investor appetite for premier Manhattan assets. |

| RETAILWEST NYACK The 2.3M SF Palisades Center sold for $175M after foreclosure, giving Black Diamond control of the distressed supermall at a steep discount. |

| MULTIFAMILYBROOKLYN Lendlease landed a $450M refi for its 834-unit Brooklyn geothermal apartment project, even as it prepares to scale back its U.S. development footprint. |

| OFFICEMANHATTAN Flexible office provider Mindspace is expanding its NYC footprint with additional space, signaling steady demand for boutique coworking options in prime submarkets. |

| RESIDENTIALQUEENS Maxim Capital is backing a new condominium development in Long Island City, Queens, betting on continued buyer demand in the rapidly evolving neighborhood. |

| DEVELOPMENTSEAPORT Tavros acquired 250 Water Street at a roughly 17% discount, highlighting pricing resets and opportunistic buying in NY’s shifting investment sales market. |

| RETAILUPPER EAST SIDE Acadia Realty Trust purchased a retail property on the Upper East Side from Naftali Group, reinforcing investor interest in well-located Manhattan street retail. |

📈 CHART OF THE WEEK

-

📬 Newsletters: Stay ahead of the market with our national CRE Daily newsletter — or get hyper-local insights from CRE Daily Texas.

-

🎙️Podcast: No Cap by CRE Daily delivers an unfiltered look at the biggest trends—and the money game behind them.

-

🗓️ CRE Events Calendar: The largest searchable calendar of commercial real estate events—filter by city or sector.

-

📊 Market Reports: A centralized hub for brokerage research and market intelligence, all in one place.

-

📈 Fear & Greed Index: A fully interactive sentiment tracker on the pulse of CRE built in partnership with John Burns Research & Consulting.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |