Sunbelt Overbuilding Sparks Wave of Free Rent Offers

Concessions are rising fast as landlords work to absorb pandemic-era inventory.

Good morning. Landlords are holding the line on rents—by giving away months of them upfront. In oversupplied markets like Phoenix, concessions have become the tool of choice to preserve asset values.

Today’s issue is sponsored by InvestNext. Learn how top firms move beyond accreditation to attract investors who actually commit capital.

🎙️No Cap is back for Season 5, and we’re kicking things off with Bridge Investment Group’s Colin Apple on how institutional investors are underwriting multifamily, managing risk, and positioning for the next cycle.

CRE Trivia 🧠

According to Zillow, which U.S. city is projected to be the hottest housing market in 2026 based on fast sales, strong price growth, and ultra-low inventory?

(Answer at the bottom of the newsletter)

Market Snapshot

|

|

||||

|

|

*Data as of 1/12/2026 market close.

Free Rent

Sunbelt Overbuilding Sparks Wave of Free Rent Offers

A pandemic-era luxury building boom has turned Sunbelt cities like Phoenix into playgrounds for deal-hunting renters.

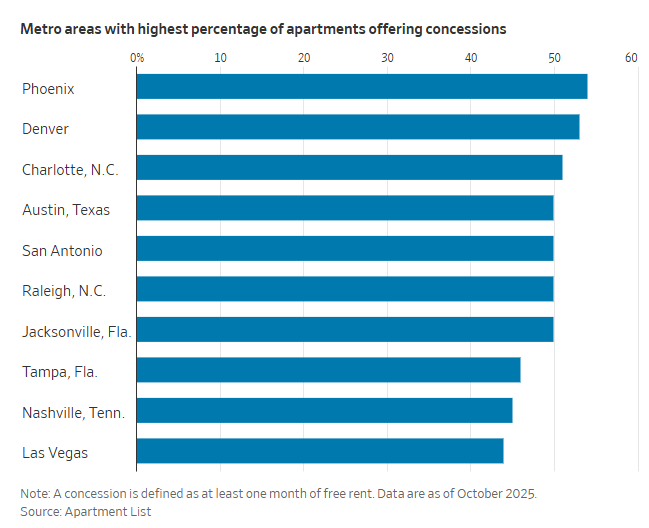

Concessions take over: Over half of Phoenix apartment listings now offer at least one month free—the highest rate in the U.S.—with some going up to 3.5 months plus perks like gift cards and sports tickets, all due to a glut of luxury units built during the remote work boom.

Not enough renters: During the pandemic, developers rushed to meet demand from remote workers leaving pricey cities, but now many luxury units sit empty. Properties like Pique Residences, with pickleball courts and “resort-style” pools, are offering steep incentives to fill vacancies.

Avoiding price cuts: Concessions help landlords maintain advertised rents, but Phoenix’s median rent still fell 4% in 2025—well above the 1.3% national dip. Discounts mainly target new luxury units, while tighter supply in affordable housing has pushed rents higher.

The inequity of incentives: Older, more affordable buildings rarely offer freebies, since lower-income renters have fewer options, giving landlords more leverage. Some have even raised rents by up to 7.9%, widening the renter gap.

Developers hit the brakes: With vacancies high, developers in Phoenix and the Sunbelt are pausing new projects to let oversupply ease. Executives expect pricing power to return in 12–18 months, but renters like Da Joo are already expecting hikes at renewal.

➥ THE TAKEAWAY

Free rent, for now: The pandemic-era building spree is now a renter’s windfall in the Sunbelt's luxury sector. But with construction slowing and supply set to normalize, today’s deep discounts could vanish as quickly as they appeared.

TOGETHER WITH INVESTNEXT

Beyond Accreditation: Acquire Investors Who Actually Commit

What separates investors who commit from those who waste your time?

How do you identify prospects who will invest capital to your specific asset class, deal structure, and investment timeline?

Our expert panel shares real-world examples of successful investor acquisition strategies that have helped firms scale from 20 to 200+ qualified investors in Connect, Commit, Close: The Modern Investor Acquisition Playbook.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

-

2026 Global Investment Outlook: Why does Hines Research think real estate is cleared for takeoff in 2026? Read the report for the latest views on how the ongoing recovery is playing out – and where. (sponsored)

-

Housing intervention: President Trump’s $200 billion directive for Fannie Mae and Freddie Mac to buy mortgage bonds marks a bold move to boost housing affordability.

-

Liquidity lift: Easing inflation and rising lender participation are setting the stage for improved CRE debt liquidity and potentially lower borrowing costs in 2026.

-

Underwrite deals in minutes: Eliminate hours of manual modeling — AI underwriting that helps you parse, analyze, and identify the most promising multifamily deals in record time. (sponsored)

-

Hard hat halt: The U.S. construction industry lost 11,000 jobs in December, capping off its weakest year for job growth since 2011 (excluding the pandemic).

-

Premium relief: After a hurricane-free 2025, U.S. property insurance premiums are finally falling, with double-digit declines expected in early 2026.

-

Audit averted: The IRS’s effort to audit large real estate and private equity partnerships has stalled, with leadership exits and layoffs slashing audit activity by up to 90%.

🏘️ MULTIFAMILY

-

Rental record: U.S. multifamily rental households hit a record 22.4M in 2025, driven by high completions, limited affordability in homeownership, and steady urban rental demand.

-

Pinnacle purchase: Summit Properties won a $451M auction to acquire Pinnacle Group’s 5,100-unit rent-stabilized NYC portfolio.

-

Claim divide: After the Palisades fire, two identical L.A. condo communities took separate paths—one sold to developers, the other chose to rebuild—driven by differences in insurance coverage.

-

Growth play: Trammell Crow Residential opened new offices in Phoenix and Nashville to tap into strong rental demand and deepen its presence in high-growth multifamily markets.

🏭 Industrial

-

AI future: JLL projects global data center capacity will double to 200 GW by 2030, fueling a $3T investment “supercycle.”

-

Funding flex: Lincoln Equities secured a $106M bridge loan from Apollo and CenterSquare to refinance its newly built industrial property in Brewster, NY.

-

On the border: GreenPower Motor Co. will build a 135K SF EV manufacturing plant and U.S. headquarters in Santa Teresa, NM.

-

Data driven: Chicago’s industrial market stabilized in late 2025, with data centers driving a rebound in construction to 13M SF, still well below pandemic-era peaks.

-

Cross border logistics: Realty Income and GIC formed a $1.5B joint venture to develop pre-leased logistics assets, marking Realty Income’s first move into Mexico.

🏬 RETAIL

-

Split sector: In December, mall foot traffic surged on last-minute holiday demand, while downtown retail districts lagged due to weak tourism and tighter consumer budgets.

-

Drone delivery: Walmart is expanding its drone delivery service to 150 more stores nationwide in 2026, aiming to reach over 40M Americans.

-

Plaza purchase: DJM Capital and Arc Capital sold the Village Del Amo shopping center in Torrance, CA for $108.3M to buyers completing a 1031 exchange.

-

Landlord leverage: Strong tenant demand and limited retail space are driving rent growth and giving landlords more pricing power in 2026.

🏢 OFFICE

-

REIT takeover: MCME Carell, a joint venture of Elliott Investment Management and Morning Calm Management, acquired City Office REIT for $1B to expand their Sun Belt office portfolio.

-

Historic flip: Blackstone’s Perform Properties sold a fully leased SoHo office-retail building to Vertex for $53M—just under its 2024 purchase price.

-

Occupancy shift: Office REITs are seeing improved occupancy in newer, high-quality buildings, signaling early signs of sector stabilization despite ongoing challenges from remote work and weak returns.

-

Transit appeal: DivcoWest bought a Redwood City office building and leased most of it to law firm Paul Hastings, signaling rising demand in the Bay Area office market.

🏨 HOSPITALITY

-

Quiet reboot: Hoteliers are rethinking luxury, revenue strategy, and development expectations in 2026 as design trends shift, interest rates linger, and the World Cup looms.

-

Extended elegance: Set to open in early 2026, the Apiary Hotel will bring Denver’s Belleview Station its first lifestyle extended-stay concept.

📈 CHART OF THE DAY

In 2025, just 18 of the 150 largest U.S. metros saw 3%+ rent growth, a sharp drop from roughly half during 2015–2019, reflecting a market where “average” performance has become rare.

CRE Trivia (Answer)🧠

Zillow ranked Hartford, CT #1 after inventory fell 63% from pre-pandemic levels, homes sold in about one week on average, and more than two-thirds of sales closed above list in 2025.

More from CRE Daily

-

📬 Newsletters: Stay ahead of the market with local insights from CRE Daily Texas and CRE Daily New York.

-

🎙️Podcast: No Cap by CRE Daily delivers an unfiltered look at the biggest trends—and the money game behind them.

-

🗓️ CRE Events Calendar: The largest searchable calendar of commercial real estate events—filter by city or sector.

-

📊 Market Reports: A centralized hub for brokerage research and market intelligence, all in one place.

-

📈 Fear & Greed Index: A fully interactive sentiment tracker on the pulse of CRE built in partnership with John Burns Research & Consulting.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |