Mamdani Floats First NYC Property Tax Hike in Decades

A proposed 9.5% property tax hike could raise $3.7B next year as NYC closes a $5B gap.

Good morning. A $5B budget gap has City Hall weighing higher property taxes and tapping reserves. The potential ripple effects could reshape New York’s real estate landscape.

Today’s issue is sponsored by 1031 Crowdfunding—helping investors access investment-grade real estate through tax-advantaged vehicles.

🎙️Can’t Miss Episode: Alex Samoylovich explains how CEDARst turned overlooked, complex development deals into a scalable institutional platform.

CRE Trivia 🧠

Which U.S. president signed the legislation creating REITs into law?

(Answer at the bottom of the newsletter)

Market Snapshot

|

|

||||

|

|

*Data as of 2/18/2026 market close.

Tax Hike

Mamdani Floats First NYC Property Tax Hike in Decades

Mayor Zohran Mamdani is proposing a nearly 10% property tax hike while reshaping the city’s rent board, escalating fiscal and housing tensions in New York.

First hike in decades: Mamdani’s $127B preliminary budget proposes a 9.5% property tax hike projected to raise $3.7B next fiscal year. The increase would hit all property classes—more than 3M residential units and 100,000 commercial properties—and mark the city’s first rate hike in over 20 years.

Albany standoff: Governor Kathy Hochul has offered $1.5B in near-term aid and $510M in future support, but opposes a property tax hike. Mamdani says without more state funding, the city may have to raise taxes or tap reserves. Any increase would need City Council approval, where resistance is already emerging.

Deficit narrows: Mamdani first projected a $12.6B two-year deficit, but stronger tax revenues—fueled by Wall Street bonuses—cut the gap by $5B. Still, the city faces a multibillion-dollar shortfall. Property taxes generated more than $33B in fiscal 2025, highlighting their outsized role in the budget.

Rent freeze in motion: The mayor appointed six new members to the Rent Guidelines Board, paving the way for a freeze on roughly 1M stabilized units. Landlords warn a freeze—paired with higher property taxes—could deepen distress for aging multifamily properties, with up to $1B potentially needed to stabilize affordable housing.

➥ THE TAKEAWAY

The pressure point: Owners warn that pairing a 9.5% tax hike with a rent freeze could accelerate distress and foreclosures in rent-stabilized buildings, creating ripple effects for already pressured lenders and banks.

TOGETHER WITH 1031 CROWDFUNDING

Access Tax-Advantaged Real Estate Investments

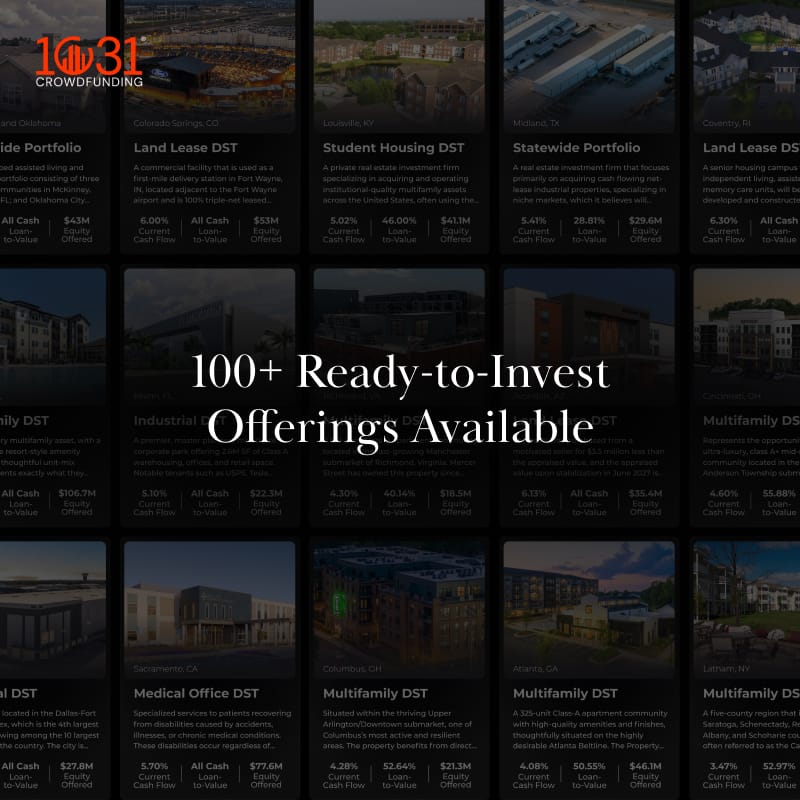

1031 Crowdfunding is a one-stop-shop for real estate investments, offering a diverse range of investments that prioritize tax deferral and non-correlated market returns. We are uniquely positioned to offer expertise, a diverse inventory, and proprietary tools to help you create a portfolio tailored to your financial goals.

Why invest with 1031 Crowdfunding?

-

100+ ready-to-invest offerings: Explore a broad marketplace of tax-advantaged vehicles such as Delaware Statutory Trusts (DSTs), REITs, Opportunity Zone Funds, and more.

-

Due Diligence at Your Fingertips: Every offering on our platform is vetted through a proprietary model designed to help you invest with confidence.

-

Comprehensive Real Estate Documentation: Review detailed offering materials, financials, and property information so you can conduct your own independent due diligence and ensure the right fit for your portfolio.

-

White-Glove Service: From helping you select the right investment to providing ongoing support after closing, our management team delivers personalized guidance at every step of your investment journey.

Register for free today to explore our full range of offerings.

*Investments offered by Capulent LLC, member FINRA/SIPC. This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

-

GP playbook shift: Choosy LPs and high rates are forcing sponsors to rethink deal structures. Here are five that are actually closing right now. (sponsored)

-

Basel reset: U.S. regulators are advancing stricter Basel capital rules that would require large banks to hold more capital against certain mortgage and CRE loans.

-

Heading south: Palantir is relocating its headquarters to Miami, continuing corporate migration to Sun Belt markets.

-

Structured equity: RXR and the North Carolina Investment Authority are partnering to deploy structured equity solutions amid tighter traditional lending.

-

Funding restored: A reversal of proposed NIH funding cuts preserves critical research dollars that underpin demand for life sciences real estate.

-

Cooling cash: All-cash home purchases fell to a five-year low in December 2025 as lower rates and rising inventory reduced buyers’ urgency to pay cash.

🏘️ MULTIFAMILY

-

Deal momentum: U.S. apartment transaction volume accelerated in 4Q25 as improving fundamentals and pricing clarity revived investor activity.

-

Portfolio losses: JBG Smith reported widening losses in its apartment portfolio, reflecting continued pressure from supply and soft leasing conditions.

-

Strategic exit: Armada Hoffler is exiting the multifamily and construction businesses to streamline its focus and strengthen its balance sheet.

-

Urban strength: Apartment sales reached $166B in 2025, driven largely by renewed demand in Northeast and West urban markets.

-

Denver demand: Despite slowing population growth, Denver’s multifamily demand remains supported by high single-family home prices.

🏭 Industrial

-

Portfolio refi: Ares and Makarora secured $1.5B in CMBS financing to refinance Plymouth Industrial’s portfolio, signaling renewed strength in securitized debt markets.

-

Meta Midwest: Meta is developing a major data center campus in Indiana, underscoring hyperscalers’ aggressive expansion into secondary markets.

-

Cycle transition: Industrial real estate is entering a more balanced phase as supply growth cools and market dynamics normalize.

🏬 RETAIL

-

Mall distress: Mall owner CBL Properties is negotiating with lenders to return certain assets as financial pressures persist.

-

Traffic trends: Retail foot traffic remained resilient in December 2025, particularly in necessity and experiential categories.

-

QSR repricing: Quick-service restaurant cap rates appear stable, but investors are increasingly differentiating based on tenant credit and location quality.

🏢 OFFICE

-

Conversion boost: San Francisco approved legislation to accelerate office-to-residential conversions and help revive downtown vacancies.

-

K-shaped: The office market is splitting between thriving trophy assets and struggling commodity buildings, mirroring broader economic divides.

-

Sales rebound: Office investment sales volume is rising as pricing resets attract opportunistic buyers back into the market.

🏨 HOSPITALITY

-

AMC refi: AMC refinanced debt on select theaters, extending maturities as the exhibition industry works toward stabilization.

-

Premium debut: IHG introduced Noted Collection™, a new premium conversion brand targeting upscale independent hotels worldwide.

A MESSAGE FROM VINTAGE CAPITAL

Where Multifamily Capital Is Going Next

Join Brad Johnson, CIO of Vintage Capital for a data-driven breakdown of why investors are reallocating from traditional multifamily to manufactured housing.

Learn how operating fundamentals, NOI performance, and risk profiles compare — and what it means for portfolios in today’s market.

Register to attend live or get the recording.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

📈 CHART OF THE DAY

A handful of U.S. markets stand out for yield-focused investors, posting notably higher multifamily cap rates than the broader peer set and signaling stronger income potential.

CRE Trivia (Answer)🧠

President Dwight D. Eisenhower signed the REIT Act into law on September 14, 1960.

More from CRE Daily

-

📬 Newsletters: Stay ahead of the market with local insights from CRE Daily Texas and CRE Daily New York.

-

🎙️Podcast: No Cap by CRE Daily delivers an unfiltered look at the biggest trends—and the money game behind them.

-

🗓️ CRE Events Calendar: The largest searchable calendar of commercial real estate events—filter by city or sector.

-

📊 Market Reports: A centralized hub for brokerage research and market intelligence, all in one place.

-

📈 Fear & Greed Index: A fully interactive sentiment tracker on the pulse of CRE built in partnership with John Burns Research & Consulting.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |