CRE Lenders Shift From Extensions to Enforcement

As loan maturities mount, lenders are demanding fresh equity and faster paydowns — and not everyone is ready.

Good morning. CRE’s refinancing pressure is no longer theoretical. Lenders are tightening terms, requiring equity injections and forcing tough decisions as a wave of maturities collides with higher rates, insurance costs and cautious underwriting.

Today’s issue is sponsored by Henry—turn your underwriting model into a polished, on-brand presentation in minutes.

🎙️Must Listen: Why Alex Samoylovich built CEDARst around the deals most developers avoid, and how that strategy scaled.

CRE Trivia 🧠

Which iconic Alpine resort is hosting most of the alpine skiing events in the 2026 Olympics?

(Answer at the bottom of the newsletter)

Market Snapshot

|

|

||||

|

|

*Data as of 2/17/2026 market close.

Maturity Squeeze

CRE Lenders Shift From Extensions to Enforcement

After years of “extend and pretend,” CRE lenders are pulling the plug—triggering a surge in defaults, especially in office.

By the numbers: Office CMBS delinquencies hit a record 12.34% in January, the highest since 2000. About $25B in loans are past maturity, and more than half of the nearly $100B coming due this year are unlikely to refi on time, per Morningstar DBRS.

Why now: Since rates jumped in 2022, many lenders extended ultra-low-rate loans, betting conditions would improve. That wager is fading. Refinancing costs are often 300+ bps higher, leaving some borrowers unable to close the gap—and opting to walk away.

Structural shift: Lenders now see office distress as structural, not cyclical. Hybrid work has reduced demand, dragging down values and rents in cities like Portland and St. Louis, leading to more foreclosures, “zombie” buildings, and deferred investment.

Case in point: Brookfield’s $515M loan on part of the former New York Times building—extended five times since 2020—has moved to special servicing after missing maturity, as the property prepares to lose a major tenant.

Banks in the crosshairs: U.S. CRE debt totals nearly $5T, with banks holding about 36%. While major banks have sidestepped major fallout, regional lenders are entering what some call the “peak of distress.”

Not all doom and gloom: Industrial assets and grocery-anchored retail continue to show resilience, supported by steadier demand. CMBS issuance also rebounded to $125.6B in 2025, up 21% YoY—the strongest annual volume since before the financial crisis.

➥ THE TAKEAWAY

Reality check: The patience phase is over. As lenders move from extensions to enforcement, 2026 is becoming a price-discovery year, forcing the office market to confront a structural reset.

TOGETHER WITH HENRY

Your Deck Shouldn’t Take Longer Than Your Deal

You’ve got buyers ready, capital lined up, and momentum on your side — but the deck is still stuck in formatting hell.

Henry turns your underwriting model into a polished, on-brand presentation in minutes. OMs, BOVs, loan packages, and flyers built directly from your data, reviewed by real humans before delivery.

Send faster. Close sooner.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

-

Overpaying for multifamily insurance? Strategic Insurance Group helps owners lower premiums and boost NOI. Get an instant online quote today and see your savings. (sponsored)

-

Activist pressure: A lawsuit alleges Bill Ackman pressured the Howard Hughes board into approving a $900M investment, igniting fresh scrutiny over governance and shareholder influence.

-

Tax divide: Northeast states levy the nation’s highest property taxes while parts of the South and West remain far more affordable.

-

Management buyout: Kennedy-Wilson agreed to a $1.5 billion take-private deal led by its CEO and Fairfax Financial at $10.90/share, a 10% premium.

-

Crypto capital: Crypto-backed real estate fundraising is gaining traction, but investors are raising red flags about due diligence and regulatory clarity.

-

CLO partnership: Carlyle and Sixth Street are launching a $600M joint venture through their BDCs to capitalize on opportunities in the CLO market.

🏘️ MULTIFAMILY

-

Renter hotspots: Sun Belt and Midwest metros are emerging as top rental markets to watch, driven by affordability, job growth and steady demand.

-

Power imbalance: Just six U.S. apartment metros still favor landlords, as rising supply and cooling rents tilt negotiating power toward renters nationwide.

-

Aging amenities: South Florida developers are designing multifamily projects with wellness-focused amenities aimed at keeping residents in place longer.

-

Campus demand: Strong preleasing and rent growth are buoying the student housing sector, even as new supply tests select university markets.

🏭 Industrial

-

Civic stance: A North Texas landlord says it will neither sell nor lease properties for use as detention facilities, taking a public stance amid political debate.

-

Distribution bet: Lincoln Property secured $77M in financing to advance a Denver industrial development, underscoring lender appetite for well-located logistics assets.

-

Niche expansion: Go Store It is expanding its niche footprint through a $250M joint venture to acquire boat and RV storage properties.

🏬 RETAIL

-

Mall markdown: New York’s Palisades Center megamall sold at auction for $175M, a steep discount that reflects ongoing distress in large-format retail.

-

Sales slump: Wendy’s plans to shutter more than 300 underperforming stores as it works to stabilize sales and streamline operations.

-

Land grab: Walmart’s latest expansion strategy centers on acquiring more land to strengthen long-term logistics and development flexibility—not just adding stores.

-

Global ambitions: Jollibee posted record sales and is eyeing Chicago expansion as it explores a potential global spinoff to fuel further growth.

🏢 OFFICE

-

Risk reset: An approaching wave of office loan maturities is colliding with higher insurance costs, compounding refinancing challenges for property owners.

-

Tenant timing: Tight availability of top-tier office space in key markets is prompting tenants to expand early and fueling a measured new development wave.

-

In-office momentum: Return-to-office momentum is holding steady, with more companies formalizing in-person policies and boosting office utilization rates.

🏨 HOSPITALITY

-

Gaming upgrade: Atlantic City’s Tropicana and Hard Rock are investing heavily in renovations to modernize properties and capture renewed gaming demand.

-

Location debate: Virginia lawmakers advanced a bill that could broaden potential casino locations in Fairfax County beyond Tysons, reshaping regional gaming prospects.

-

Reputation risk: Hyatt Chairman Tom Pritzker faces renewed scrutiny over past ties to Jeffrey Epstein as critics push to unseat him from the company’s board.

A MESSAGE FROM ONDECK

Are your numbers a headache?

“I would be willing to bet a lot of money that the vast majority of financials that come from real estate syndicators are wrong.”

That's a quote from ReSeed's co-founder, Rhett Bennett.

ReSeed had strong reporting, but standardizing financials from several different managers was taxing the leadership team.

OnDeck surfaced two fractional controllers, and ReSeed hired Alex. He immediately started adding value, and the ReSeed team could focus on growth.

Need a CRE accountant? We have you covered.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

📈 CHART OF THE DAY

Renting is cheaper than owning across all 100 largest U.S. metros, with the biggest gaps in New York and San Francisco and the smallest in Sun Belt markets like Phoenix and Las Vegas.

CRE Trivia (Answer)🧠

Cortina d'Ampezzo, located in the heart of Italy's Dolomites, which previously hosted the 1956 Winter Olympics.

More from CRE Daily

-

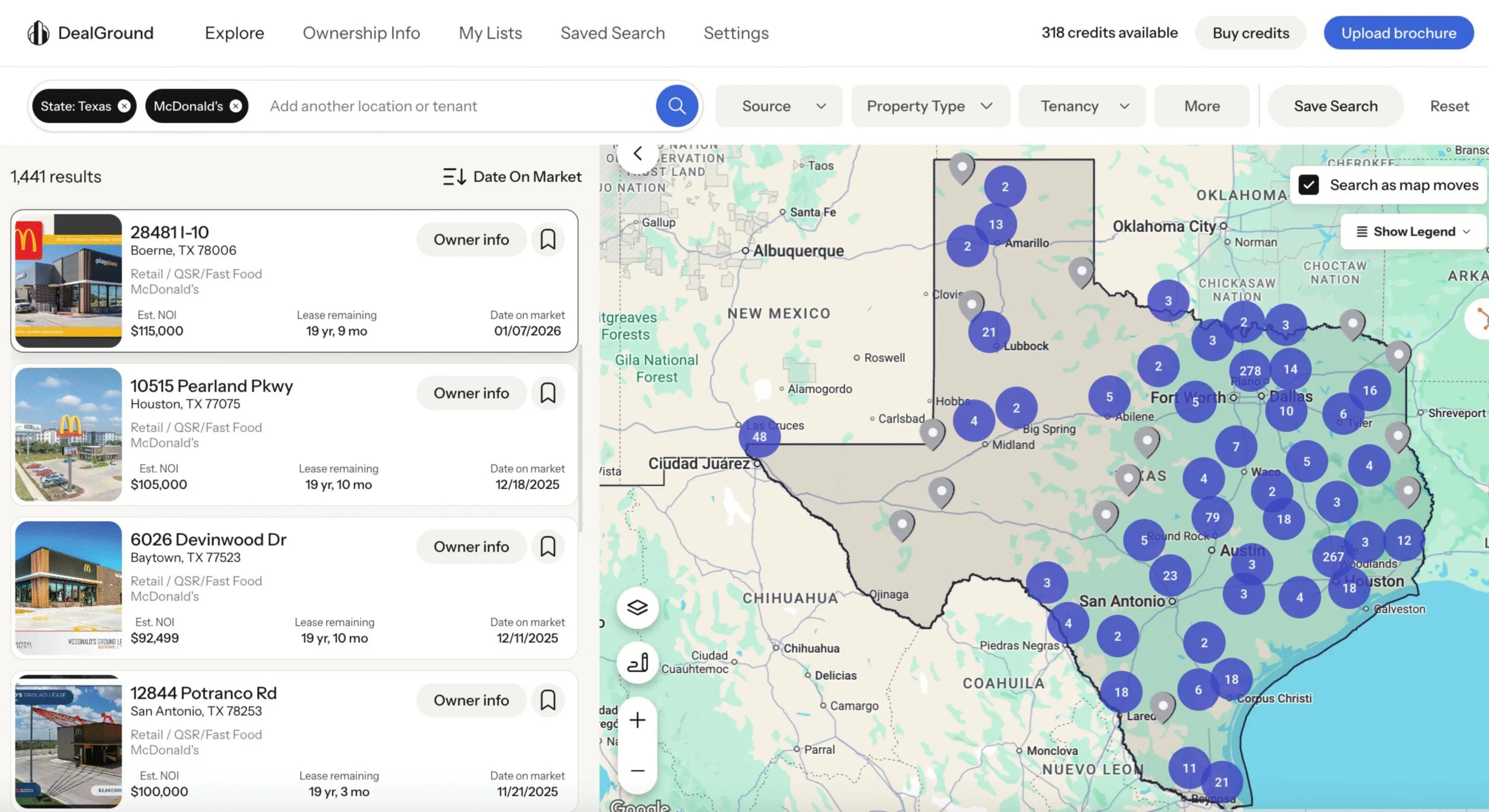

📬 Newsletters: Stay ahead of the market with local insights from CRE Daily Texas and CRE Daily New York.

-

🎙️Podcast: No Cap by CRE Daily delivers an unfiltered look at the biggest trends—and the money game behind them.

-

🗓️ CRE Events Calendar: The largest searchable calendar of commercial real estate events—filter by city or sector.

-

📊 Market Reports: A centralized hub for brokerage research and market intelligence, all in one place.

-

📈 Fear & Greed Index: A fully interactive sentiment tracker on the pulse of CRE built in partnership with John Burns Research & Consulting.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |