2026 Underwriting Tightens as Lenders Get Ruthless About Refinancing

Refinancing is back, but only for the strong, as 2026 ushers in a ruthless underwriting reset.

Good morning. 2026 is shaping up to be a make-or-break year for CRE refinancing. Lenders are active again, but only for deals that meet a much tougher standard.

📥 Craving more local insights in your inbox? Subscribe to CRE Daily Texas and CRE Daily New York for a weekly roundup of the latest news, trends, and transactions.

CRE Trivia 🧠

Which U.S. location is home to the most expensive ZIP code?

(Answer at the bottom of the newsletter)

Market Snapshot

|

|

||||

|

|

*Data as of 1/5/2026 market close.

Debt Test

2026 Underwriting Tightens as Lenders Get Ruthless About Refinancing

Welcome to CRE’s new reality: if you’re not bringing strong cash flow, fresh equity, and a believable business plan, you may be out of luck in 2026.

CRE’s sorting year: Trepp sees 2026 a year of measured momentum with more loan resolutions, but ongoing stress. As debt maturities pile up, lenders are growing more selective, using tougher underwriting to decide which assets remain financeable. It’s no longer about asset type or market—it’s about surviving in a high-rate world.

Low-rate hangover: Many maturing loans were underwritten in 2021’s low-rate boom with bullish rent growth baked in. In 2026, those assumptions are failing. Lenders are stress-testing DSCRs under flat or declining rents, and deals that can’t cover at current coupons are getting sidelined.

Equity talks: Strong sponsorship is separating winners from the rest. Borrowers who can put in fresh equity are being prioritized, as banks, CMBS servicers, and private lenders increasingly require new capital for extensions, restructures, or loan-to-own strategies.

Capex is king: Lenders are zeroing in on capex runway, especially for transitional office and value-add assets. They want funded renovations and realistic leasing assumptions. The $30B-plus in CRE CLO issuance in 2025 shows capital is available—but only for deals with credible business plans and solid reserves.

Sharper lending lines: Bank lending is picking up slightly, but with tighter terms and stronger protections. CMBS is pushing toward $100B+ in issuance, mostly backed by top-tier assets. Private credit will still finance complex deals—but at a price, and with clear control rights.

➥ THE TAKEAWAY

Earn your refi: Refinancing in 2026 isn’t about waiting for rate cuts—it’s about proving you’re worth the paper. Sponsors need real cash, real plans, and real resilience, or risk getting sorted out of the market.

✍️ Editor’s Picks

-

Free & effortless: Simplify how you manage your rentals for free with a closer look at TurboTenant’s streamlined rental workflow. (sponsored)

-

Labor lags: Job growth is slowing, but CRE demand remains positive, though rising vacancies loom as new supply outpaces absorption.

-

Tariff timeout: Trump is delaying planned tariff hikes on furniture and cabinets until 2027, keeping the current 25% rate to allow for ongoing trade talks.

-

Small wins: Smaller and mid-sized U.S. metros are outpacing major cities in workforce quality, adaptability, and economic strength, reshaping where businesses invest and grow.

-

Slow motion: The U.S. housing market is stabilizing post-2025, but affordability challenges, rising non-mortgage costs, and regional imbalances are slowing its path to full recovery.

-

Real returns: REITs face mixed returns in 2026, with strength in data centers, NYC offices, and industrials driven by AI and economic trends.

🏘️ MULTIFAMILY

-

Growth cluster: A handful of major developers now dominate the U.S. build-to-rent pipeline, signaling a shift toward more selective, scaled growth through 2027.

-

Midwest is best: Americans are flocking to the Midwest for affordable housing, lower living costs, and rising wages.

-

Syndication spiral: Ex-hedge funder Jon Venetos’ multifamily empire has collapsed under $700M in loan defaults, fraud allegations, and widespread foreclosures.

-

Renter pool: Rejection rates for apartment applicants in California are climbing post-pandemic, pushing landlords to adopt alternative screening methods and rent guarantees to fill units.

-

Miami luxury : Rilea Group landed $150M—led by Florida’s largest C-PACE deal—to fund its 300-unit luxury project in Miami’s Wynwood district.

🏭 Industrial

-

Power play: Logistics real estate is shifting focus from location to energy, as power-ready facilities become essential for electrification, automation, and resilience.

-

Land grab: Amazon is adding 45 acres on Florida’s Space Coast to fuel delivery, robotics, and AI data center expansion.

-

Utility pivot: Despite massive delays and cost overruns, Georgia’s Vogtle plant shows nuclear’s potential to power AI-fueled data centers.

-

Tenant tactics: Industrial tenants are moving from coastal megacenters to regional hubs, prioritizing resilience, speed, and power access.

-

Florida freight: CenterPoint Properties acquired a 467,722 SF industrial campus in Pompano Beach for $125M.

🏬 RETAIL

-

Agentic everywhere: In 2026, agentic AI, workforce automation, and ultrafast delivery are reshaping retail, separating fast adopters from those left behind..

-

Hartford buy: Brand Street and Barings bought The Shops at Evergreen Walk for $98.25M, expanding on its repositioning with top retail tenants.

-

Value add: Intercontinental and SKB acquired Washington Square II near Portland for $25.25M, with plans to renovate and re-lease the 86,636 SF retail center.

🏢 OFFICE

-

Flight to quality: Manhattan office leasing surged in 2025, rising 25% year-over-year to 41.9M SF, its best since 2019.

-

Legal expansion: The New York State Attorney General’s Office renewed its 342K SF lease and added nearly 36K SF at 28 Liberty Street.

-

Urban jewel: REALM and HP Investors bought Portland’s fully leased 300 Building, aiming to boost value with upgrades and lease adjustments.

-

Seattle stabilizing: Seattle office vacancies hit a record 33.4%, but stabilizing trends and stronger leasing activity signal a potential rebound in 2026.

🏨 HOSPITALITY

-

ULA workaround: LA’s top hotel sales in 2025 dodged Measure ULA taxes by trading outside city limits or through foreclosure.

-

Profit pinch: With hotel revenues growing slowly and labor costs rising, U.S. hotel owners in 2026 face tightening margins and reduced returns.

-

Hotel upgrade: Driftwood Capital completed an $11M renovation of the Marriott Raleigh-Durham RTP, enhancing rooms, adding amenities, and expanding meeting space to attract business travelers.

A MESSAGE FROM PROPRISE

The Fastest Way to Prep a Deal

Stop spending hours manually spreading and re-formatting messy data.

Primer turns deal documents for any asset class into your proprietary Excel model in minutes.

-

Follows Your Logic: Instruct Primer to prioritize sources (e.g., "Use CoStar over OM") to match your specific underwriting process.

-

Normalizes Chaos: Merges varying formats and data into your exact template without breaking your formulas.

-

Verify Everything: Every extracted number is cited back to the source for instant verification.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

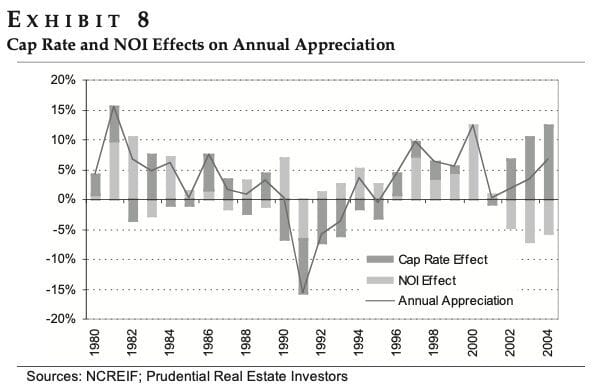

📈 CHART OF THE DAY

Cap rate compression and NOI growth are the two key drivers of price appreciation in CRE, offering a simple yet powerful framework for breaking down total investment returns.

CRE Trivia (Answer)🧠

Atherton, California, is home to ZIP code 94027, the most expensive in the country. Redfin reports the median home price reached about $12M in 2025.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |