Mom-and-Pop Rent Collections Show Signs of Recovery in November

On-time payments hit 83.7% in November, up for the third month straight, but late payments continue to weigh down overall performance.

Good morning. November's rental data shows progress, with on-time payments hitting 83.7%. It's the third straight month of gains, though late payments continue to cloud the picture.

Today’s issue is brought to you by AirGarage—get a clearer view of your parking operations so you keep more of what your asset earns.

🎙️This Sunday on No Cap: Jack and Alex chat with Jon Schultz, Co-Founder and Managing Principal of Onyx Equities.

CRE Trivia 🧠

Which Southern markets made their first appearance in the renter-engagement top 30 in Q3 2025, reflecting rising interest in secondary cities?

(Answer at the bottom of the newsletter)

Market Snapshot

|

|

||||

|

|

*Data as of 11/26/2025 market close.

Collection Trends

Mom-and-Pop Rent Collections Show Signs of Recovery in November

While still below pre-pandemic levels, on-time rent payments among independent landlords improved for a third straight month — hinting at a slow but steady rebound.

Modest momentum: In November 2025, 83.7% of independently operated rentals paid rent on time, up 65 bps from October and 130 bps above August’s low. While still trailing 2024 levels by over two points, the steady monthly gains offer cautious optimism for mom-and-pop landlords.

Recovery in process: Even with more tenants paying late, the full-payment rate — including late payments — averaged 96.1% YTD, above 2024’s 95.3%. November’s preliminary rate was 94.9%, just below October's, showing tenants remain committed to paying, even if behind schedule.

The main drag: Late payments remain the key challenge. After rising steadily since mid-2024 and peaking at 13.2% in August, the rate eased to 11.3% in November. While less harmful than missed payments, persistent delays still strain landlords who depend on timely income.

The West continues to lead: South Dakota (95.1%), Utah (94.5%), and Alaska (93.3%) top the on-time payments list. New Hampshire was the only East Coast state in the top 10. These regional gaps reflect differing economic stability and market dynamics nationwide.

Labor supports payments: A cooler labor market may slow future rent growth, but it’s supporting income stability. With job growth at 684,000 through September (down from 1.4 million last year), steady employment is helping tenants keep up with rent — even if sometimes late.

➥ THE TAKEAWAY

Tide is turning: Independent landlords are still navigating challenges, but the tide is slowly turning. Barring major labor market setbacks, rent collections are trending in a healthier direction heading into 2026.

TOGETHER WITH AIRGARAGE

What’s Really in Your Parking Agreement

Most owners assume their parking agreement is straightforward — until they realize how much revenue disappears in the fine print.

Hidden fees, vague expense pass-throughs, and misaligned incentives can quietly drain NOI year after year.

Our Parking Agreements Guide reveals:

-

The 3 most common contract types — and how each impacts your returns

-

Hidden costs and red flags that quietly eat into performance

-

Real-world examples showing where owners lose profit

-

A step-by-step framework to evaluate operators and negotiate better terms

If parking contributes to your property’s income, this short guide could save you thousands — and years of lost NOI.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

-

Shrinking deduction window: With the Section 179D deduction set to expire for new builds after June 30, 2026, savvy owners and designers are racing to lock in their tax savings now. (sponsored)

-

Free speech: RealPage is suing New York, arguing a new law banning rent pricing advice from its software violates free speech rights.

-

Steady upside: REITs look set for steady 2026 gains, driven by strong fundamentals, easing rates, and sector-specific opportunities.

-

Stale supply: Sellers are delisting homes at a record pace as weak demand and price drops make waiting more appealing than selling at a loss.

-

Wealth shift: Luxury home prices soared in Sun Belt cities over the past decade, far outpacing gains in traditional markets like New York.

-

Rate stalemate: The Fed may hit a historic tie on rate cuts next month amid growing internal division.

-

Degree distress: College grads now make up a record share of the unemployed, as layoffs, outsourcing, and AI reshape the job market.

🏘️ MULTIFAMILY

-

Increased caps: FHFA raised 2026 multifamily loan caps for Fannie and Freddie by 20% to $176B, reinforcing affordable housing goals while keeping workforce housing loans exempt.

-

Housing boost: Hunt Capital’s $277M Tax Credit Fund 52 will create or preserve 1,540 affordable homes across 10 states.

-

Shared space: Outpost and June Homes merged to create the nation’s largest coliving operator, with 4,000 units and a focus on sustainable growth.

🏭 Industrial

-

R&D growth: Nokia is investing $4B in U.S. manufacturing and R&D to fuel its AI and connectivity growth.

-

Yield compression: Industrial CRE loan spreads hit a new 2025 low, signaling lender confidence despite tight margins and broader economic uncertainty.

-

Strategic selloff: EQT sold an 8.7M SF industrial portfolio in 2025’s largest U.S. deal, signaling a strategic shift toward logistics.

-

Data disruption: A $10B data center near Waco promises major growth but alarms locals over environmental and community impact.

-

Refi of the day: Crow Holdings and Constellation Real Estate secured a $74M refi for their 799K SF El Paso industrial campus.

-

Desert demand: Phoenix leads in industrial builds with 17.2M SF underway, even as deliveries slow and vacancy ticks up.

🏬 RETAIL

-

Holiday inflation: PNC’s Christmas Price Index rose 4.5% in 2025, with labor costs and gold prices pushing festive gift totals to over $218K.

-

Redevelopment strategy: A 100-acre redevelopment of Gaithersburg’s former Lakeforest Mall moves ahead with 1,600 units, 1.2M SF of commercial space.

-

Modern malls: Modern malls with diverse tenants, experiences, and events are thriving as holiday spending is set to exceed $1T for the first time.

-

Tenant targeting: Landlords are using data and storytelling to attract ideal retail tenants and boost leasing success.

-

Investment dip: Dallas retail investment fell by half in Q3, but steady fundamentals and rising absorption suggest underlying market stability.

-

Closures coming: Dick’s Sporting Goods plans to close underperforming Foot Locker stores as part of a $2.5B turnaround effort following its recent acquisition.

-

Creative reuse: Zero Empty Spaces is turning vacant retail into affordable artist studios, revitalizing malls, and drawing new foot traffic for landlords.

🏢 OFFICE

-

Leasing lift: Rising demand and limited new supply are fueling a U.S. office market recovery, though gains vary sharply by city.

-

Midtown footprint: EQT has expanded its footprint to 115K SF at SL Green’s redevelopment of 245 Park Avenue.

-

Investor return: Los Angeles office sales hit $2.6B YTD, the strongest pace since 2022, as investors jump on deep discounts, some up to 80%.

-

Industrious growth: Industrious is expanding in San Francisco with a new 17K sf lease, betting on rising office demand.

-

Development revival: NYC office development is surging as demand climbs and investor confidence returns.

🏨 HOSPITALITY

-

Wild investment: Billionaire Larry Ellison bought South Florida’s only drive-thru safari for $30M, adding to his growing real estate and conservation-focused portfolio.

-

Golden collapse: Jack Nicklaus’ golf course company filed for bankruptcy after a $50M judgment, aiming to protect its brand and operations amid ongoing legal battles.

📈 CHART OF THE DAY

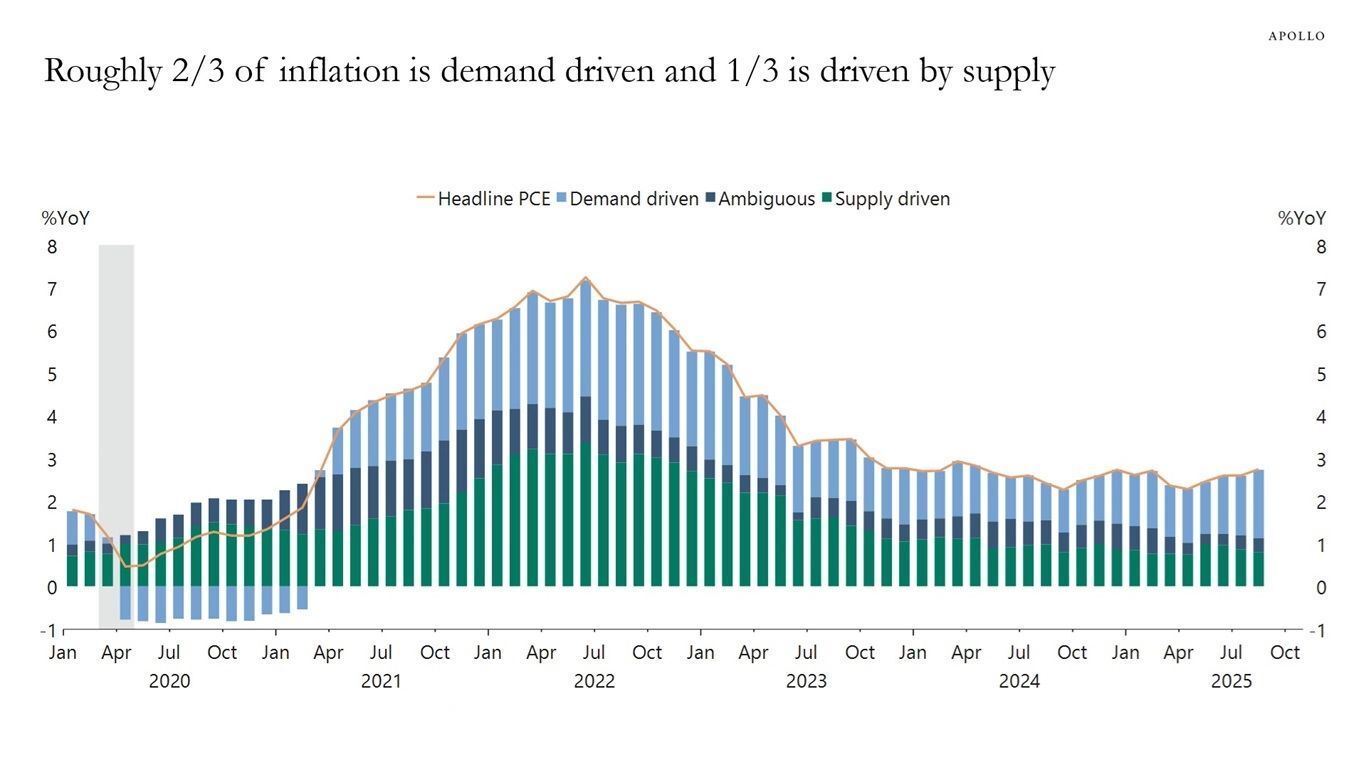

Two-thirds of current U.S. inflation is being driven by strong consumer demand rather than supply shocks, complicating the Fed’s path to rate cuts and signaling a "higher for longer" interest rate environment.

CRE Trivia (Answer)🧠

According to RentCafe, Birmingham and Knoxville both broke into the top 30 for the first time, highlighting growing renter demand in more affordable Southern metros.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |