Late Rent Payments Climb as Renters Struggle to Keep Up

On-time collections are slipping, but most renters are still managing to pay—just not right away.

Good morning. Late rent is piling up, and while most renters are still managing to pay, the growing delays reveal deeper financial pressures beneath the surface.

Today’s issue is brought to you by Wall Street Prep—position yourself for the next step in your real estate investing career.

🎙️This week on No Cap: Brookfield’s Ben Brown reveals how he navigated the GFC, led $10B+ takeovers like GGP and Forest City, and where he’s betting big today.

Market Snapshot

|

|

||||

|

|

*Data as of 08/25/2025 market close.

Payment Delays

Late Rent Payments Climb as Renters Struggle to Keep Up

A growing number of renters are falling behind on rent, and the usual seasonal relief hasn’t shown up this year.

Payments under pressure: Apartment renters have been paying rent later and later since April 2023. While there was a small improvement in August 2025, on-time rent collections are still down sharply year-over-year—indicating persistent stress on renter finances, even in the face of modest economic growth.

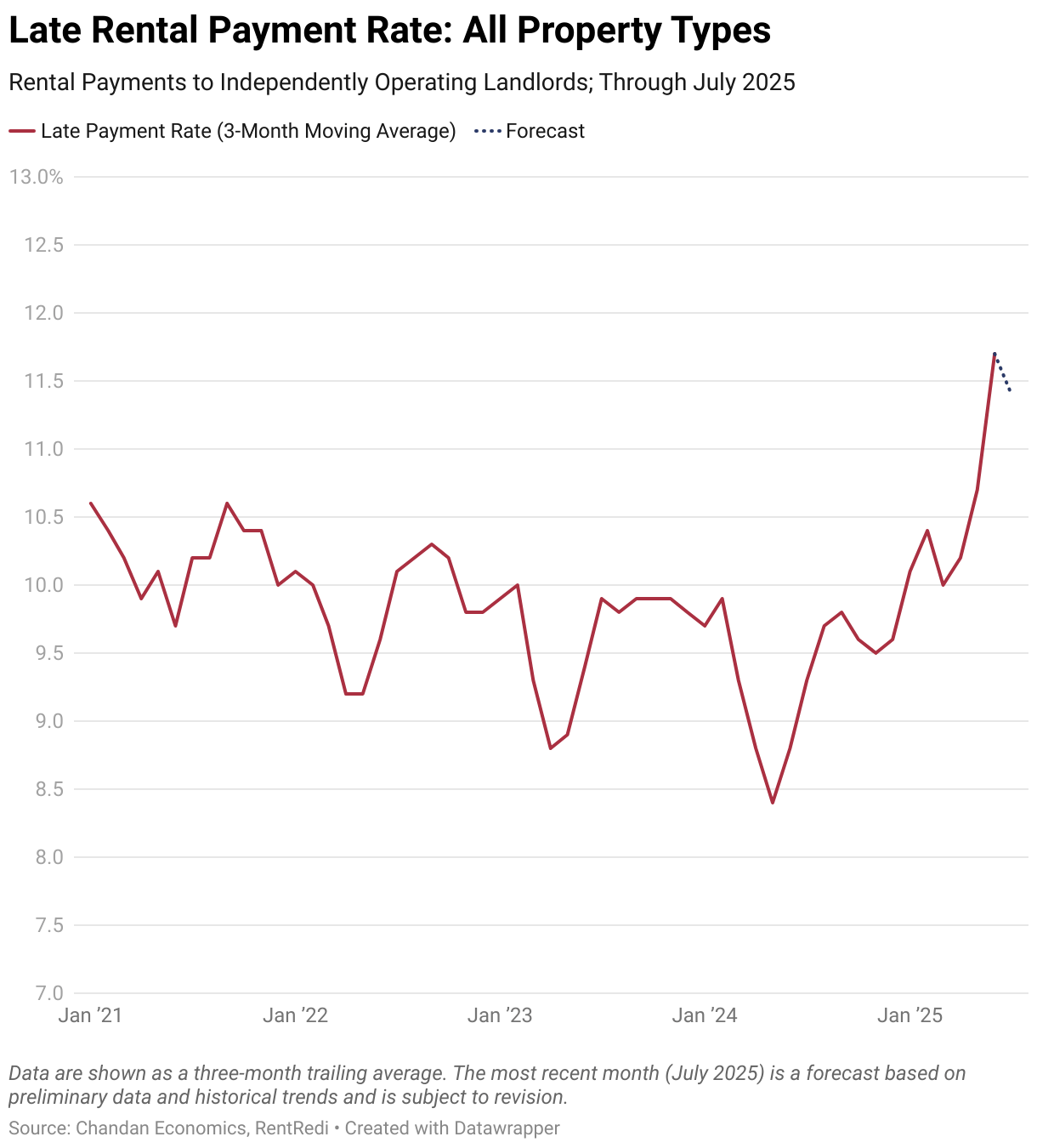

The new norm: Full rent collections—which include both on-time and late payments—have held up better than expected. But that’s not necessarily good news: the increase is being driven by more renters paying late, not by a boost in financial health. The three-month average of late payments in independently owned rentals hit 11.7% in June 2025, up from a 2024 low of 8.8%.

Seasonal relief fades: In recent years, late payments would typically dip in spring as renters used tax refunds to get current. But in 2025, that drop never came. This suggests a deeper misalignment between when renters earn and when rent is due—hinting that more households are relying on mid-month paychecks to make ends meet.

Wages lag behind expenses: After a brief reprieve in 2023 when incomes outpaced inflation, the trend has reversed. Since early 2024, household expenses have again been growing faster than earnings, squeezing renters' budgets. Still, layoffs remain low, which may explain why most tenants eventually catch up—even if it takes them longer.

The Elephant in the room: Rising debt levels are an increasingly urgent headwind. The NY Fed reports that non-housing debt rose by $40 billion in Q2 2025—rebounding after a dip in Q1. More worrying: debt that’s 90+ days delinquent is climbing across all age groups, potentially crowding out renters’ ability to cover essential expenses like housing.

➥ THE TAKEAWAY

Warning signs ahead: The rent is still getting paid—but later and with more financial juggling. As household debt grows and incomes fall behind expenses, renters are walking a financial tightrope. The real test will come if economic growth slows or inflation ticks back up—because many households are already out of slack.

TOGETHER WITH WALL STREET PREP

Position yourself for the next step in your real estate investing career.

The Wharton Online + Wall Street Prep Real Estate Investing & Analysis Certificate Program is an immersive 8-week experience that gives you the same training used inside the world’s leading real estate investment firms.

-

Analyze, underwrite, and evaluate real estate deals through real case studies

-

Learn directly from industry leaders at firms like Blackstone, KKR, Ares, and more

-

Earn a certificate from a top business school and join a 5,000+ graduate network

P.S. Save $300 with code CREDAILY + an extra $200 with early enrollment by September 8.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

-

Parking rage is real: AirGarage uncovers the top frustrations drivers face—and the smarter systems turning complaints into revenue. (sponsored)

-

Transaction trends: CRE volume hit $115B in Q2, up 3.8% YOY, driven by multifamily and office, even as total deal count dropped 7.4%.

-

Happening this Thursday at Noon PST online: 6 operators pitch their best deals in just 5 minutes each. A live, high-energy session exclusively for accredited investors, fund managers, and family offices. (sponsored)

-

Labor lag: Dallas dropped to #12 in July job gains, hit by layoffs in manufacturing and professional services, as other metros surged.

-

Market rebound: More US CRE markets are now in recovery than recession, driven by demand for high-quality, well-located assets.

-

Retirement capital: Trump’s executive order could open $12T in 401(k) funds to private real estate, but regulatory hurdles and transparency concerns may limit early access.

-

Rate watch: Key economic indicators like GDP, CPI, and Treasury yields are stabilizing ahead of the Fed’s September meeting, where markets are pricing in a likely rate cut.

🏘️ MULTIFAMILY

-

Deal rebound: US apartment sales rose 11% quarter-over-quarter to $35.1B in Q2, but remained 14% below last year.

-

Small and mighty: Valuations rose for small multifamily, marking the first annual gain since 2023 amid stronger lending and stable cap rates.

-

Stalled starts: San Francisco is falling far short of its housing goals, with over 20K apartment units delayed or derailed by rising costs, fees, and development hurdles.

-

Big refi: PGIM Real Estate provided $619M in agency-backed loans to refinance a 15-property multifamily portfolio across the Southeast.

-

Empty plates: Seven in ten Gen Z and millennial renters struggle to pay housing costs, with many cutting dining, vacations, or even meals to make rent.

🏭 Industrial

-

Storage stability: Self-storage rents and demand leveled off in July, signaling early signs of recovery.

-

Warehouse arrests: Federal agents detained 29 immigrant workers at a Prologis warehouse in New Jersey.

-

Refinery reborn: Developers plan to turn a 406-acre Phillips 66 refinery in LA into a massive logistics and retail hub, one of CA’s largest brownfield redevelopments.

-

AI investment: Wistron is investing $761M in two Nvidia-linked AI plants at AllianceTexas, bringing 800 jobs to Fort Worth.

-

Desert build: Newcastle Partners broke ground on a 406K SF speculative industrial project in Hesperia, slated for delivery in 2026.

🏬 RETAIL

-

Mall move: While most department stores exit malls, Dillard’s paid $34M for the Longview Mall in Texas, signaling a contrarian real estate play.

-

Dining decline: New York food halls keep shuttering as high rents, hybrid work, and weak beverage sales undercut their economics despite the city’s booming restaurant scene.

-

Auction delayed: The foreclosure sale of San Francisco Centre mall—now up to 80% vacant after anchor exits and plunging foot traffic—has been postponed for the seventh time.

-

Strong sector: Newmark’s Brandon Isner says limited new supply, reinvestment in strong centers, and tech-driven multi-channel strategies position retail for a new era of productivity.

-

California snub: As part of its relaunch, Bed Bath & Beyond will reopen stores nationwide but exclude California, calling the state too costly and overregulated for business.

🏢 OFFICE

-

Discount wave: Office sector distress is fueling more discounted sales as maturing loans pressure owners and reshape deal flow.

-

Vacancy play: Vornado Realty Trust is acquiring 623 Fifth Avenue for $218M, betting it can revive the 75% vacant office tower with a full redevelopment.

-

Tenant backed: RXR sold the ground lease at 470 Clermont Avenue in Fort Greene for $70M to Lincoln Property Company and Cross Ocean Partners, with city agencies as anchor tenants.

-

Bargain buy: Investor David Werner paid $100M cash for 440 Ninth Avenue near Hudson Yards, snapping up the distressed office tower at a steep markdown.

🏨 HOSPITALITY

-

Cheaper stays: Hotel rates for Labor Day weekend are down 11% from last year, with lower flight and rental car costs also easing travel budgets.

-

Travel strains: Geopolitical tensions and tariffs are cutting into US hotel demand, with Canadian travel down sharply and inbound recovery now delayed until 2029.

A MESSAGE FROM RSN PROPERTY GROUP

Invest Alongside RSN & Monday Properties

Last week, we hosted a webinar on The Rise of Hybrid Multifamily Deals, where RSN & Monday Properties broke down how they’re opening institutional-quality multifamily investments to individuals.

They’re now extending a special offer to accredited investors: co-invest in their latest deal—The Summit on 401 (291 units in Fayetteville, NC)—with a reduced $250K minimum for enhanced Class C terms (normally $500K+).

With strong fundamentals and early operational wins (lower property taxes, higher cash flow, 92% pre-leased), the project is targeting ~19.9% IRR and ~8.1% average CoC.

⏳ Offer valid through this week or until fully capitalized.

*This is a paid advertisement. CRE Daily is not a registered broker-dealer or investment adviser. This content is provided for informational purposes only and does not constitute an offer or solicitation to buy or sell any securities. All investments carry risk, including potential loss of principal. Please conduct your own due diligence or consult with a licensed financial professional before making any investment decisions.

📈 CHART OF THE DAY

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |