Job Growth Loses Predictive Power in Multifamily Rent Trends

Multifamily investors can no longer rely solely on job data. A deeper shift is reshaping rent performance.

Good morning. For years, job growth was a reliable signal for apartment rent gains. But new data suggests that the relationship is fading fast, thanks to shifting market fundamentals and a wave of new supply.

Today’s issue is sponsored by QC Capital—helping investors capture stable returns in one of CRE’s fastest-growing sectors.

📊Our Q4 2025 Burns + CRE Daily Fear & Greed Index is now available. Explore investor sentiment, capital access, and sector-level outlooks shaping the 2026 CRE landscape.

CRE Trivia 🧠

Which CRE sectors historically recover first following a Fed rate-cutting cycle?

(Answer at the bottom of the newsletter)

Market Snapshot

|

|

||||

|

|

*Data as of 12/26/2025 market close.

Market Shift

Job Growth Loses Predictive Power in Multifamily Rent Trends

A once-reliable link between job growth and apartment rent trends is now less dependable, complicating investment strategies in a supply-heavy, post-pandemic market.

Old rulebook, new market: Strong job growth once meant rising rents—but that equation is breaking down. Chris Bruen of NMHC notes a weakening link between employment gains and multifamily rent trends.

Labor market cools: Job growth in Q3 slowed sharply to 187,000—down 53% YoY—with unemployment ticking up to 4.4%. Normally, such a slowdown would curb apartment demand, but the response in rent trends has become less predictable, with timing more erratic than in previous cycles.

Supply takes the wheel: Effective asking rents were flat in 2025. CoStar posted a 0.6% Q3 increase, while RealPage saw a 0.1% decline, as new apartment supply outpaced demand, pushing many markets into negative rent growth.

Delivery rates still matter: Bruen’s analysis of 99 quarters revealed two clear trends: more apartment deliveries meant weaker rent growth, while faster job growth boosted rents when adjusted for supply. But both patterns are starting to crack under current market pressures.

Remote work ripple: The pandemic disrupted the rent-employment link, with 2020’s simultaneous drop in jobs and rents marking a shift. Since then, remote work, demographic shifts, and uneven office returns have added new layers of complexity.

➥ THE TAKEAWAY

New normal emerges: Job growth is no longer a reliable guide for rent trends. Oversupply, shifting demographics, and post-pandemic behaviors are redrawing the map. Demand still matters, but timing and location matter more.

TOGETHER WITH QC CAPITAL

Discover the Power of Passive Flex Space Investing

Looking for an investment that delivers stability and long-term growth?

QC Capital’s Flex Space Fund is designed for accredited investors seeking passive income and strategic upside.

✅ 8% Preferred Return – Consistent income backed by fully leased assets.

✅ 70% Back-End Equity Kicker – Offers immediate cash flow and long-term value.

✅ Hands-Off Investing – Zero operational responsibility through NNN leases.

✅ Exposure to a Fast-Growing Asset Class – Flex space is in high demand nationwide.

This isn’t just about passive income, it’s about investing in one of the most resilient and scalable asset classes in commercial real estate.

Round 2 Commit Date Deadline: January 5th. Spots are first come, first serve.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

-

Due diligence made simple: Blew’s in-house survey team ensures your deals meet 2026 ALTA/NSPS requirements with reliable, nationwide due diligence support across every asset and market. (sponsored)

-

Mamdani myth: Despite dire warnings from NYC’s real estate elite, the election of democratic socialist Zohran Mamdani hasn’t triggered the industry exodus many feared.

-

Year in review: A year marked by cooling demand, canceled deals, and candid commentary, 2025 kept the hotel sector on edge.

-

Mega moves: New York’s biggest project filings of 2025 weren’t glitzy towers but a casino, two jails, a hospital, and a handful of strategic resi plays.

-

Penalty trap: A 40-year-old NYC tax law is hitting small owners and nonprofits with big fines over missed or misunderstood RPIE filings.

-

Market mood: RCLCO’s year-end survey shows rising confidence in the CRE outlook for 2026, with recession fears easing, interest rate expectations improving, and most sectors.

🏘️ MULTIFAMILY

-

Late but loyal: On-time rent payments in small, independently owned rentals rose to 83.7% in December—still below 2024 levels, but signs of recovery are building.

-

Concession creep: Rising rent concessions amid record supply are cutting into multifamily cash flows and exposing growing credit risk, especially in high-growth Sunbelt markets.

-

First move: Dallas-based S2 Capital made its Chicago debut with the purchase of the 344-unit Ovaltine Apartments in Villa Park.

-

Luxury default: Witkoff and PIMCO have defaulted on over $400M tied to a Santa Monica luxury apartment project, with PIMCO holding nearly full control of the equity and investment decisions.

-

Aging upside: Senior housing cap rates are falling as investor demand grows, with most expecting further compression in 2026 amid strong rent growth and tight new supply.

🏭 Industrial

-

Queens trade: Wholesaler My Sales sold its Ridgewood, Queens industrial property at 75 Onderdonk Avenue for $28M, four years after acquiring it.

-

Portfolio refi: Seagis Property Group refinanced a six-property, 1.2M SF industrial portfolio in New Jersey and Florida with an $176M, eight-year fixed-rate loan.

-

Storage deal: BlackRock provided Basis Industrial with a $101.5M refinancing loan for a seven-property, climate-controlled self-storage portfolio across six states.

-

Houston buildout: Constellation Real Estate Partners is developing two speculative industrial projects in Houston totaling 658K SF across 49 acres.

🏬 RETAIL

-

Bourbon blues: Jim Beam is halting production at its flagship Kentucky distillery due to site upgrades and tariff-related export declines.

-

Holiday sales: Visa reports U.S. holiday retail spending rose 4.2% YoY, with 73% of purchases made in-store.

-

Mall markdown: The Solomon Pond Mall in Marlborough, MA, once valued at $200M, has sold for just $8.5M, the latest in a string of deep-discount mall sales across New England.

-

Retail resilience: Investor confidence in retail remains strong heading into 2026, supported by stable vacancies, limited construction, and resilient consumer spending.

-

Turnaround trouble: Red Lobster cut 10% of corporate staff as it struggles to renegotiate costly legacy leases that continue to weigh on profitability after bankruptcy.

🏢 OFFICE

-

Global footprint: ING Group renewed and expanded its Manhattan lease at 1133 Avenue of the Americas, growing its footprint to nearly 154K SF.

-

Wall Street wins: In a banner year for CMBS, NYC office towers led the rebound with $14B in securitized loans, as lenders zeroed in on trophy assets.

-

CEO stays: BXP extended CEO Owen Thomas’s contract through 2029, with bonuses tied to stock gains, to ensure leadership stability during the office sector rebound.

-

Trophy target: McKinsey & Co. is in talks to sublease 72K SF in Chicago’s Salesforce Tower, signaling continued demand for top-tier office space.

🏨 HOSPITALITY

-

On strike: Over the weekend, Colorado’s Telluride Ski Resort closed after ski patrollers walked off the job Saturday, following months of failed contract negotiations over pay

-

French acquisition: French hotelier Philippe Le Guennec snapped up Miami Beach’s Kimpton Angler’s Hotel for $43.5M.

📈 CHART OF THE DAY

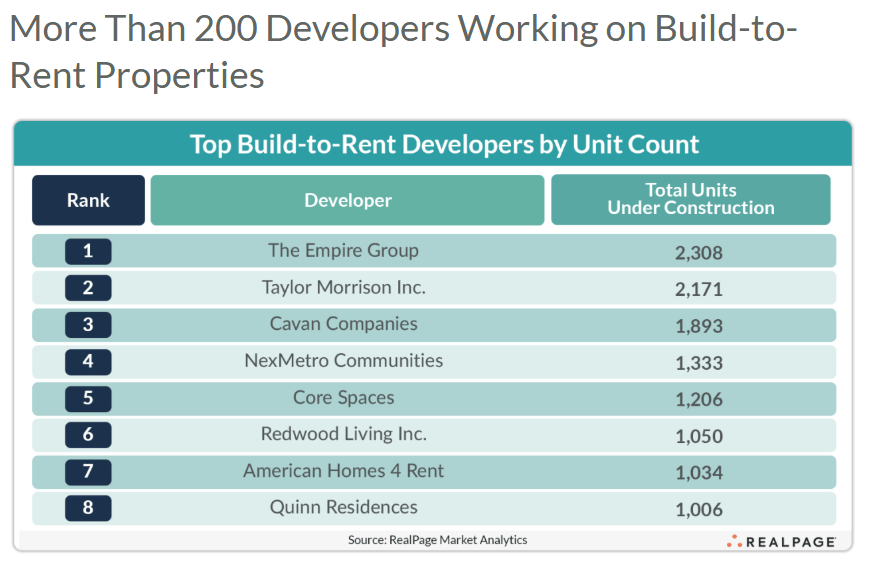

Over 200 developers are building 64,000+ BTR units, led by Empire Group and Taylor Morrison with 2,000+ units each.

CRE Trivia (Answer)🧠

Multifamily and industrial, which benefit fastest from lower borrowing costs and renewed investment activity.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |