Debt Funds Are Reshaping Commercial Real Estate Distress

Distressed CRE sales are lagging past cycles, with mezzanine debt showing the clearest signs of stress.

Good morning. While CRE prices have dropped since 2022, distressed sales haven’t followed the same pattern seen after the GFC. A closer look at debt fund performance—especially in mezz positions—reveals where the real pressure is building.

Today’s issue is sponsored by Terrakotta. Purpose-built AI that turns CRE prompts into live owner, tenant, and contact data—so you can find deals faster.

🎙️No Cap is back for Season 5, and we’re kicking things off with Bridge Investment Group’s Colin Apple on how institutional investors are underwriting multifamily, managing risk, and positioning for the next cycle.

CRE Trivia 🧠

What metric often gives investors an earlier signal of market recovery than closed transaction volume?

(Answer at the bottom of the newsletter)

Market Snapshot

|

|

||||

|

|

*Data as of 1/9/2026 market close.

Distress Rewritten

Debt Funds Are Reshaping Commercial Real Estate Distress

Distressed commercial property sales haven’t surged like they did post-2008, and private debt funds, particularly those active in mezzanine lending, could be a big reason why.

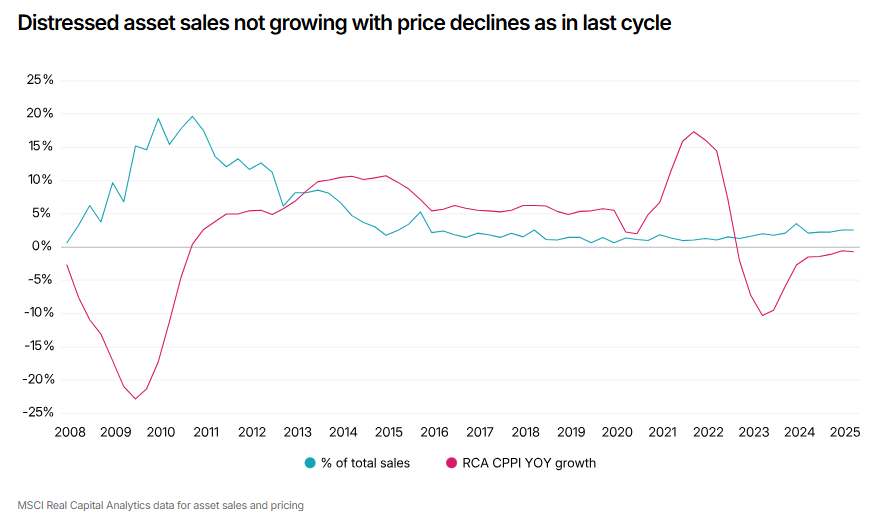

A different downturn: Following the GFC, distressed CRE assets peaked at 20% of total sales by 2010. By mid-2025, they’ve only reached 3%. Property values have fallen just 10% this cycle, versus a 23% YoY drop in 2009. Despite broad pricing resets, large-scale fire sales haven’t materialized.

Rise of debt funds: Since the GFC, private debt funds have steadily taken over lending roles once held by banks. Institutional capital surged into these vehicles after regulations like HVCRE, boosting their market share. MSCI began tracking these “investor-driven lenders” in 2016, noting a clear link between rising dry powder and lending activity.

Risk in the stack: Unlike equity investments, CRE debt risk depends on position in the capital stack. Senior loans stayed stable, with 113% of 2020–2025 returns from income. Mezzanine debt saw losses push income returns to 210%, revealing deeper distress in this riskier layer.

Delaying foreclosure tactics: After the GFC, distressed assets often ended in court battles. Today, borrowers turn to mezzanine lenders to add capital and delay foreclosure. With control rights upon default, mezz lenders can drive outcomes more efficiently, avoiding drawn-out disputes and aiding recovery.

➥ THE TAKEAWAY

Distress via mezz: Skip the foreclosures — mezzanine debt may offer faster access to distressed assets. As losses rise, investors can step in and gain control without the courtroom battles.

TOGETHER WITH TERRAKOTTA

76% of CRE teams say 'AI is not there yet'

AI is everywhere in CRE right now, but for a lot of teams, it hasn’t actually changed how deals get done.

Here’s where most AI tools help and where they quietly fall apart…

Level 1: General AI (ChatGPT, Claude, NotebookLM)

Great for drafting emails and documents, but it can't answer simple, practical questions like: Who owns this building? Who’s the tenant? How do I reach them?

Level 2: Business integrated AI (Microsoft Copilot, GSuite + Gemini)

Helpful for decks and admin tasks, but still requires stitching together data, sources, and context.

Level 3: Purpose-built AI for CRE

This is where AI starts to feel useful. Instead of writing about deals, it helps you find them.

Terrakotta closes the gap through a CRE-specific GPT that lets you describe exactly who you want to connect with (owners or tenants), and turns that prompt into live property data and verified contact information in seconds.

No more prompting and re-prompting only to give up and go back to doing things manually the old-fashioned way. Just the data and info you need to get the deal done.

For a limited time only, try TerrakottaGPT now for free.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

-

Work smarter: Turn static documents into a searchable deal database, making it easier to source new opportunities, analyze lease terms, and connect with owners. Brokers can go from discovery to discussion in minutes with DealGround. (sponsored)

-

Mortgage maneuver: Trump says he's directing a $200B mortgage bond buy to cut rates and revive housing affordability, though who's doing the buying and how remains unclear.

-

Lending power: Benefit Street raised $3B for its latest real estate debt fund, targeting $10B in lending as private credit demand grows.

-

Key multifamily trends and outlook: Multifamily remained resilient in 2025, with strong occupancy, moderating rent growth, steady cap rates, and stabilizing capital markets—supporting continued demand for passive investment strategies into 2026. (sponsored)

-

Money misuse: The SEC is investigating GVA founder Alan Stalcup over allegations he misused up to $100M in investor funds.

-

Tax trap: California's proposed Billionaire Tax would retroactively hit residents as of Jan. 1, 2026, giving ultra-wealthy taxpayers little time to relocate.

-

Hiring slump: U.S. payrolls rose just 50,000 in December while unemployment dipped to 4.4%, fueling uncertainty around Fed rate cuts.

🏘️ MULTIFAMILY

-

Price pullback: U.S. apartment rents fell 1.7% in Q4 —twice the usual seasonal drop—as demand cooled and occupancy dipped below 95%.

-

BTR boom: Build-to-rent has gone mainstream, evolving from a niche product to a major force in housing as affordability challenges push more Americans to rent single-family homes.

-

Housing strain: Nearly 60% of U.S. renters now spend 40% of their income on housing, reshaping long-term plans, homeownership goals, and migration patterns.

-

Measure milestone: LA’s Measure ULA has generated over $1B for affordable housing and homelessness programs, but mounting political pressure and legal challenges threaten its future.

-

Deal flurry: Multifamily investors ended 2025 with a burst of acquisitions and sales, led by JRK, Bell Partners, and Aimco across key U.S. markets.

🏭 Industrial

-

Factory forecast: In 2026, manufacturers face tariff uncertainty, embrace AI, and invest in domestic production while tackling a deepening workforce skills gap.

-

Deal volume: January 2026 kicked off with a flurry of self-storage deals nationwide, as investors—from REITs to private equity—acquired facilities across Texas, New York, Arizona, and beyond.

-

Fremont find: Tishman Speyer acquired a fully leased 253K SF industrial property in Fremont, CA for $93M, capitalizing on strong tenant demand and limited supply in the Bay Area industrial market.

🏬 RETAIL

-

Anchor advantage: Grocery-anchored retail continues to drive record-high occupancy in Dallas-Fort Worth, with Weitzman projecting a fourth straight year of gains.

-

Drive-thru deal: A newly built Chick-fil-A in Placentia, CA sold for a record $7.9M, marking Orange County’s highest-priced QSR ground lease in two years.

-

High hopes: Massachusetts has approved cannabis lounges, but real estate hurdles, regulatory delays, and local resistance mean the first shops may not open for over a year.

🏢 OFFICE

-

D.C. demand: D.C.'s office market is stabilizing, with tech and higher education driving new-to-market leasing growth led by AI firms, defense tech, and university expansions.

-

AI anchor: AI startup RillaVoice signed a 10-year, 57K SF lease for the penthouse at 25 Kent in Williamsburg, the neighborhood’s largest office deal in over a year.

-

Trophy transformation: 1540 Broadway is undergoing a $150M upgrade to attract larger tenants with expanded floor plates and high-end amenities.

-

Wellness works: Employers are redesigning offices with wellness-focused features like quiet rooms and on-site healthcare to boost employee health, satisfaction, and retention.

🏨 HOSPITALITY

-

Key discount: Blackstone sold a 248-room Residence Inn in Torrance, CA to Capital Insight for $54M amid a soft LA hospitality market.

-

Deal doubts: Soho House’s $2.7B privatization is in jeopardy after MCR Hotels said it can't meet its $200M funding commitment.

-

Founder fallout: Brian Ferdinand, founder of collapsed LuxUrban Hotels, filed for personal bankruptcy with $98M in liabilities, following lawsuits, bounced payments, and the company’s chaotic shutdown.

📈 CHART OF THE DAY

Investor-driven home price growth is largely a thing of the past. Today's high prices and low rental yields have pushed large landlords to the sidelines, leaving the market to flippers, second-home buyers, and the occasional bargain hunter scooping up builder leftovers in the suburbs.

CRE Trivia (Answer)🧠

Bid intensity tracks the volume and competitiveness of offers being submitted on deals, which tends to improve before transactions actually close.

More from CRE Daily

-

📬 Newsletters: Stay ahead of the market with local insights from CRE Daily Texas and CRE Daily New York.

-

🎙️Podcast: No Cap by CRE Daily delivers an unfiltered look at the biggest trends—and the money game behind them.

-

🗓️ CRE Events Calendar: The largest searchable calendar of commercial real estate events—filter by city or sector.

-

📊 Market Reports: A centralized hub for brokerage research and market intelligence, all in one place.

-

📈 Fear & Greed Index: A fully interactive sentiment tracker on the pulse of CRE built in partnership with John Burns Research & Consulting.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |