Chrysler Building May Return to Former Owner Tishman Speyer

The Chrysler Building could return to its former owner as Tishman Speyer moves to take back the iconic tower.

Good morning. One of New York’s most iconic office towers may soon have a familiar landlord. Tishman Speyer is in talks to retake the Chrysler Building, if it can navigate soaring ground rent and a distressed asset.

🎯 Interested in sponsoring CRE Daily NY? Reach thousands of active owners, investors, and operators across the five boroughs. Get in touch here.

Market Snapshot

|

|

||||

|

|

||||

|

|

*Office metrics courtesy of CompStak; data from 10/31/25 to 12/31/25. Sales metrics courtesy of Actovia; NYC properties reported sold during the week of 1/23/26–1/29/26.

Landmark Deal

Chrysler Building May Return to Former Owner Tishman Speyer

The Chrysler Building. Getty Images

The iconic Manhattan tower may soon return to familiar hands as Tishman Speyer emerges as the lead bidder for its troubled ground lease.

Back to the future: Tishman Speyer, which originally acquired the Chrysler Building in 1997, is now in advanced talks to reclaim its ground lease. The firm had gradually sold off its stake, fully exiting in 2019.

Failed takeover: The 2019 buyers—RFR and Austria’s Signa Holding—acquired the landmark for $150M, a sharp discount from previous valuations. But the partnership collapsed after Signa went bankrupt and RFR was removed for failing to pay $21M in ground rent.

The dealbreaker: The biggest hurdle is Cooper Union’s ground lease, with rent set to hit $41M by 2028—a steep ask for any buyer. The school, repped by Savills, has quietly marketed the lease for over a year.

Property in decline: The Chrysler Building is 14% vacant, home to tenants like Moses & Singer and CAA, but plagued by deferred maintenance, elevator outages, and rodent issues. Revitalizing the 1M SF tower won’t be easy.

Other suitors cooled: SL Green's Marc Holliday had reportedly expressed interest in the property, but that interest faded. Midtown landlord Savanna also explored the deal, but it appears Tishman Speyer is now in pole position.

➥ THE TAKEAWAY

Veteran advantage: With history at the property and deep pockets, Tishman may be well-positioned to bring the landmark back to life.

INVESTOR SENTIMENT

Is CRE Turning Cautious or Leaning Back In?

Where is CRE sentiment heading next? Take our 5-minute Fear & Greed Survey and help shape the data investors are watching across sectors.

Responses are 100% anonymous, and you’ll get early access to the results.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

Around New York

➥ Deloitte signed the priciest office lease in NYC since the pandemic, anchoring RXR’s 5 Times Square in a 20-year, $1.2B deal that signals a return of big-ticket leasing.

➥ Foreign investors remain bullish on NYC real estate, with SL Green reporting over $2B in cross-border interest, particularly from Asia and the Middle East.

➥ Flagstar Bank reversed a two-year losing streak with a Q4 profit, thanks in part to branch closures and expense cuts following its merger with New York Community Bank.

➥ NYC leads the nation in self-storage conversions, with over 1.6M square feet completed in 2023—more than double the next closest market.

➥ A bold new housing "peace plan" proposes pragmatic reforms to break NYC’s rent regulation deadlock by restoring incentives for landlords while preserving protections for tenants.

➥ The Mandarin Oriental Residences in Manhattan is slashing some condo prices by up to 20% as high-end units linger unsold.

➥ The David N. Dinkins Manhattan Municipal Building is set for a $274M renovation to modernize infrastructure, improve energy efficiency, and preserve its historic architectural features.

Follow the Money

| SELF-STORAGEMANHATTAN StorageMart’s $1.3B acquisition of Manhattan Mini Storage marks the second-largest self-storage deal in NYC history, underscoring investor confidence in the asset class. |

| OFFICEMIDTOWN A New York judge has cleared the way for Gary Barnett to move forward with a UCC foreclosure sale of Worldwide Plaza, intensifying the battle for control of the Midtown office tower. |

| RESIDENTIALCHELSEA Ares and JPMorgan are leading a $290M construction loan for a 10-story luxury condo project along Manhattan’s High Line by Witkoff and Access Industries. |

| RETAILMIDTOWN SOUTH Burlington Stores is adding 35K more SF in its fourth expansion at 1400 Broadway, bringing its Midtown South footprint to over 206K SF through a lease. |

| OFFICEMIDTOWN Raymond James is expanding its NYC presence with a major lease at 280 Park Avenue, signaling a long-term bet on the city’s financial sector real estate. |

| MULTIFAMILYQUEENS Carlyle and JFK&M secured $224M in construction financing for a 46-story, 544-unit mixed-use residential tower in Long Island City. |

| MULTIFAMILYUPPER WEST SIDE Developers struck a $96M deal with a church on Manhattan’s Upper West Side to redevelop part of the site into housing. |

| AFFORDABLE HOUSINGHARLEM Rockefeller Group and Mount Hope Housing are launching a $100M Harlem project to develop 180 affordable units and community space on a long-vacant city site. |

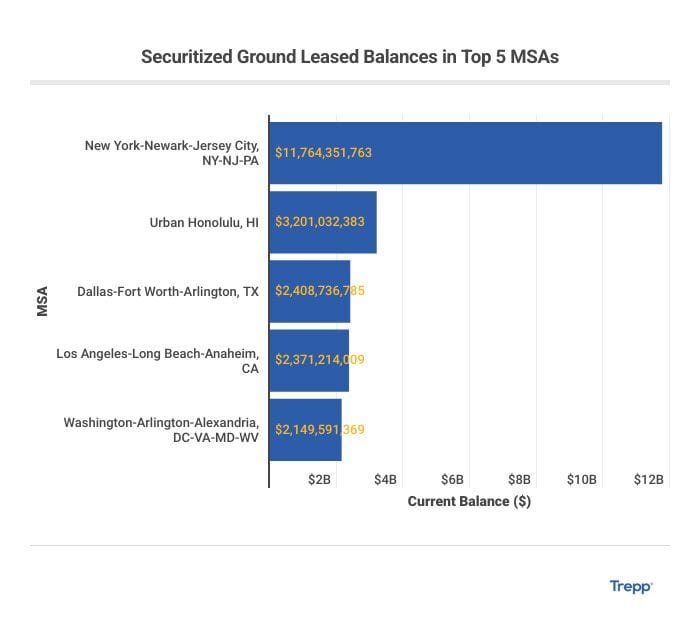

📈 CHART OF THE WEEK

Ground lease exposure totals $42.2B in securitized balance, led by NYC at 27.9%.

-

📬 Newsletters: Stay ahead of the market with our national CRE Daily newsletter — or get hyper-local insights from CRE Daily Texas.

-

🎙️Podcast: No Cap by CRE Daily delivers an unfiltered look at the biggest trends—and the money game behind them.

-

🗓️ CRE Events Calendar: The largest searchable calendar of commercial real estate events—filter by city or sector.

-

📊 Market Reports: A centralized hub for brokerage research and market intelligence, all in one place.

-

📈 Fear & Greed Index: A fully interactive sentiment tracker on the pulse of CRE built in partnership with John Burns Research & Consulting.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |