Fannie, Freddie Tighten Lending Rules to Fight Mortgage Fraud

New regulations from Fannie Mae and Freddie Mac aim to combat rising mortgage fraud in commercial property lending.

Good morning. New regulations from Fannie Mae and Freddie Mac aim to combat rising mortgage fraud in commercial property lending. Plus, a new report found that Miami’s traffic mess costs the city $3.1B annually.

Today’s issue is sponsored by Neutral—align your investments with a sustainable future.

🖥️ Webinar: Join Travis Watts (Ashcroft Capital) and CRE Daily for a LIVE webinar on the “Mark-to-Market Value-Add Approach” to learn why value-add strategies are not limited to older properties and how Class A assets can be prime investment opportunities.

Market Snapshot

|

|

||||

|

|

*Data as of 8/5/2024 market close.

FIGHTING FRAUD

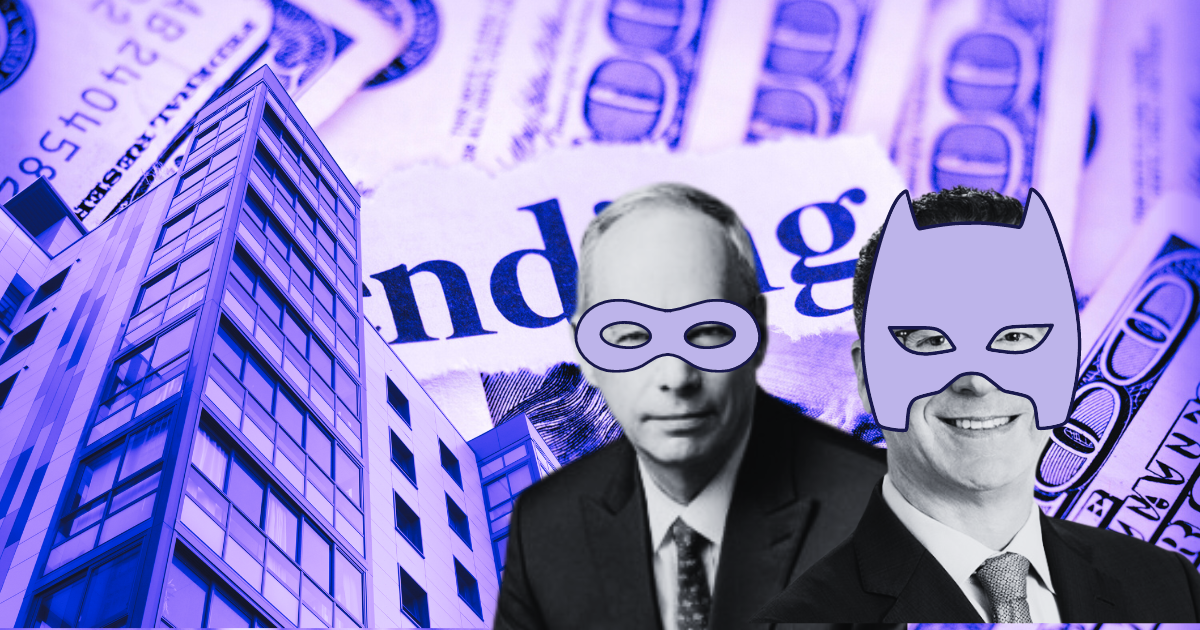

Fannie and Freddie Tighten Rules to Combat Multifamily Mortgage Fraud

Fannie Mae and Freddie Mac are set to introduce stricter lending rules in response to a federal crackdown on commercial mortgage fraud.

Stricter requirements: The new guidelines will mandate lenders independently verify financial information and sources of funds for borrowers of multifamily properties. This includes thorough due diligence on property valuations and financial performance, aiming to curb the current lax verification processes that rely heavily on unverified borrower-provided data.

A perfect storm: Rising interest rates have led to a decline in property values, exposing more fraudulent mortgage schemes. This regulatory shift, spearheaded by federal authorities like the FHFA, aims to curb fraud in commercial real estate. Fannie Mae and Freddie Mac, which guarantee about 40% of the $2.2 trillion in multifamily mortgage debt, are leading these efforts.

Zoom in: The crackdown has led to Fannie and Freddie effectively blacklisting brokerage firms like Meridian Capital Group, which had been implicated in falsifying client financials to secure larger loans. Additionally, major brokers are tightening their practice, preferring direct business over brokered deals.

➥ THE TAKEAWAY

Why it matters: Experts say regulations, still in their early stages, could be introduced as soon as this summer. If implemented, the new rules would mark significant changes in Fannie and Freddie’s loan monitoring practices, potentially slowing down multifamily deal activity in the market.

TOGETHER WITH NEUTRAL

Build a Better World and Stronger Portfolio

Neutral is pioneering a new standard in sustainable living, seamlessly integrating innovation, sustainability, community, and design into every aspect of the resident experience. Explore our portfolio of real estate projects, all designed for a sustainable future.

✍️ Editor’s Picks

-

Real estate resilience: New Western revealed that 91% of real estate investors predict more growth in 2H24, while 80% plan to flip 1–5 single-family homes for the year.

-

Gridlock gambit: A recent analysis estimates that Miami’s traffic mess costs the city $3.1B annually, with an average of 70 hours lost per commuter per year.

-

Shifting sands: Texas and Florida have emerged as top destinations for corporate relocations thanks to tax benefits and growth opportunities.

-

Monday’s sell-off: S&P 500 futures are up after the index’s worst day in nearly two years, buoyed by a significant rebound in Japanese stocks.

-

Shiny Big Apple: KPG Funds predicts a 50–60% rise in NYC’s commercial property pricing as interest rates fall.

-

Goldman shrugs: Goldman Sachs (GS) economists raised their US recession risk chance to 25% but admit the current data looks ‘fine,’ with the Fed expected to cut rates soon.

🏘️ MULTIFAMILY

-

Reviving apartments: Large apartment owners are resuming acquisitions, driven by strong renter demand and reduced construction starts, with second-quarter transactions reaching $23 billion—a 40% increase from Q1.

-

Housing heroics: The Atlanta Housing Board approved financing for 1,039 new units, including 903 affordable homes, and the preservation of 140 units.

-

Record construction: South Florida developers are building a record number of multifamily units amid slowing rent growth and declining occupancy rates.

-

Seattle surprises: Greystar paid $109M in Renton for a 357-unit complex, while Goldman Sachs (GS) invested $175M in a 338-unit tower in South Lake Union.

-

Record renters: The number of renter households across America grew 1.9% YoY to 45.2M, easily outpacing the rate of homeowner growth.

-

Growing pains: The University of Texas at San Antonio seeks a developer for a mixed-use project on 28 acres near its Park West campus to accommodate rising enrollment and demand for amenities.

🏭 Industrial

-

The empire reigns: California’s Inland Empire once again leads the nation in large industrial leases, accounting for 15 of the top 100 leases totaling 13.5MSF in 1H24.

-

Small but mighty: In Kansas City, small industrial properties (under 10 KSF) made up over 50% of metro sales through June 2024, up 22% YoY.

-

Storage splurge: Zenith IOS forms a $700M JV with J.P. Morgan (JPM) to create a $1.5B institutional-quality industrial outdoor storage portfolio across the US.

🏬 RETAIL

-

Drugstore revolution: Walgreens (WBA) and CVS Health (CVS) are leading a national drugstore transformation with smaller store formats and primary care clinics to compete with Amazon et al.

-

Haunted ghost kitchens: Reef Technology, a ghost kitchen company, is closing its 3 NYC facilities, laying off 53 workers as the niche retail sector struggles.

-

Budding success: In a recent crackdown on unlicensed cannabis stores in NYC, 779 locations were sealed, with over $65.6M in penalties issued.

🏢 OFFICE

-

Office leasing surge: Colliers reported a 32% increase in office leasing in the Americas last quarter, alongside a 6% revenue growth, driven by a rebound in confidence and a significant acquisition in Canada.

-

Leasing leaders: Boston-based BXP signed 1.3 MSF of leases in Q2, totaling 2.2 MSF for the year, with a respectable lease term average of 9 years.

-

Office evolution: 50% of 1H24 development sales in Manhattan are office-to-residential conversions, with overall development sales in the city doubling to $1.12B.

🏨 HOSPITALITY

-

Waldorf woes: DC’s Waldorf Astoria was sold at a foreclosure auction for $100M to lender BDT & MSD Partners, although previous owner CGI is still fighting to keep it.

-

Sky-high luxury: Cain International and Oko Group are seeking up to $5.25B to build the ultra-luxury One Beverly Hills, which will include two of the tallest towers in the area.

A MESSAGE FROM ASHCROFT CAPITAL

Join Travis Watts, Director of Investor Development at Ashcroft Capital, as he explores the “Mark-to-Market Value-Add Approach” in Class A multifamily properties. This webinar covers how aligning rents to market rates can enhance property value and boost investor returns.

📈 CHART OF THE DAY

MSCI Real Estate Market Size report

Despite a 0.9% decline in the global real estate market size to $13.2 trillion in 2023, the U.S. market remained the largest, though it contracted significantly due to high interest rates and pricing uncertainties, with office and residential sectors continuing to dominate.

You currently have 0 referrals, only 1 away from receiving B.O.T.N Multifamily Deal Screener .

What did you think of today’s newsletter? |