CRE Prices Surge to Highest Annual Growth in Three Years

CRE prices posted a 4.2% annual gain as investors show surprising confidence in key sectors.

Good morning. The latest data from MSCI shows CRE values climbing across the board. After a long cooldown, pricing momentum is picking up speed.

Today’s issue is brought to you by Delve—compliance done fast, so you can focus on your next big win.

🎙️This Week on No Cap: Jack and Alex talk with Lev founder & CEO Yaakov Zar about turning mortgage frustration into a leading CRE tech platform, and how AI is transforming the future of CRE financing.

Market Snapshot

|

|

||||

|

|

*Data as of 11/21/2025 market close.

Market Momentum

CRE Prices Surge to Highest Annual Growth in Three Years

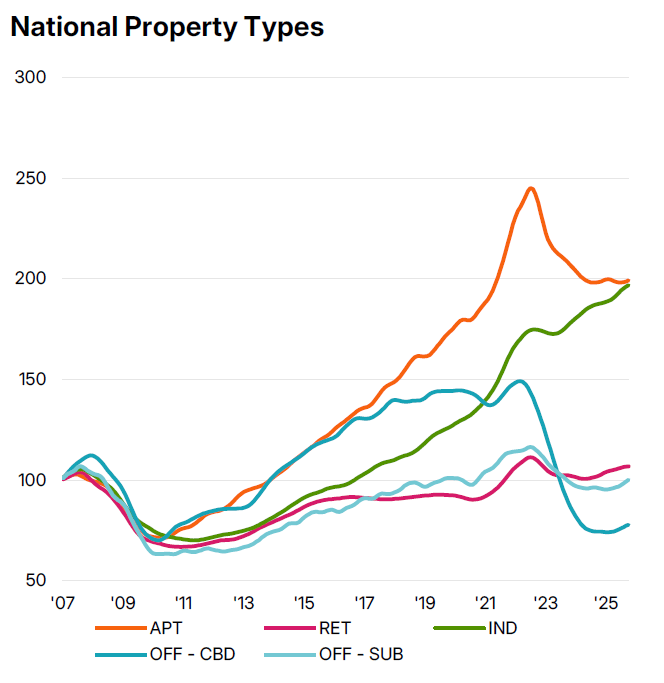

U.S. commercial property prices notched their strongest annual gain in three years in October, signaling resilience amid lingering investor caution.

Prices up across the board: CRE prices climbed 4.2% YoY in October 2025, according to MSCI’s RCA CPPI report, marking the largest annual gain in three years. On a monthly basis, prices rose 0.8%, which implies a 10.7% annualized rate, signaling accelerating momentum even as transaction volume dropped.

Leading the pack: Industrial properties led the growth, up 4.9% Y-O-Y, though slightly down from last year’s 6% pace. Retail followed closely with a 4.7% bump, its 17th straight month of gains, albeit at a slowing pace—just 0.1% month-over-month.

Source: MSCI

Office claws back: Office assets—both in CBDs and suburbs—showed surprising strength. CBD office prices rose 4.6% Y-O-Y, while suburban prices climbed 4.2%. When annualized from September's numbers, both exceeded 7% growth, with suburban hitting a double-digit rate.

Apartments exit the red: Multifamily pricing posted its third straight annual increase after nearly three years of losses, rising 0.5% YoY. The sector is rebounding cautiously, with an annualized 3.6% growth rate from September, stronger than the actual year-over-year figure.

Transaction volume drops: Despite improving financing conditions earlier in the year, investor sentiment has cooled recently. October deal volume fell 22% YoY, attributed in part to uncertainty following the federal government shutdown and a lack of fresh economic data.

➥ THE TAKEAWAY

Big picture: The data paints a cautiously optimistic picture: despite soft deal flow and macroeconomic jitters, pricing momentum is clearly back. Investors are betting on resilience, and for now, the market is backing them up.

TOGETHER WITH DELVE

🦃 Get SOC 2 Compliant & Stuff Your Pipeline

This Thanksgiving, we’re serving up more than turkey, we’re helping you stuff your pipeline.

Get $1,500 off compliance + a $500 Visa gift card when you become SOC 2 compliant with Delve before November 27th.

Because while your sales team is feasting, your deals shouldn’t be starving.

Delve’s AI agents handle all the heavy lifting: automating your SOC 2 evidence, risk checks, and audits in record time. No spreadsheets. No manual madness. Just compliance done fast, so you can focus on your next big win.The results speak for themselves:

-

Lovable → SOC 2 in 20 hours.

-

Wisprflow → Signed Mercury & Superhuman in 1mo

-

11x → $1.2M ARR unlocked.

Use code THANKSGIVING before 11/27 at 11:59 PM PST.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

-

Cycle stuck: U.S. commercial real estate is in early recovery, with cautious capital, limited new supply, and growing focus on value-add and credit plays, per PGIM.

-

AWS footprint: Amazon has acquired 189 acres in Northern Virginia for $700M to develop the future Devlin Technology Park.

-

Jobs shock: September’s surprise job gains complicate expectations for a December rate cut, raising short-term uncertainty for rental housing and construction.

-

Vacancy wave: Construction has ground to a halt in D.C., leaving a flood of entitled but idle sites hitting the market.

-

Palisades push: TJH landed $400M in financing from AscentDS to expand its single-lot homebuilding across California’s high-demand infill neighborhoods.

-

CLO comeback: CRE CLO issuance has surged 152% YoY, powering a 9% rise in total 2025 CRE securitizations.

🏘️ MULTIFAMILY

-

Public exit: Strained by weak rent growth and high supply, smaller multifamily REITs are liquidating or exploring exits as private buyers move in.

-

Fee crackdown: States are stepping in to curb landlord-imposed junk fees, filling the gap left by stalled federal action.

-

Aging upside: Senior housing leads all CRE sectors in 2025 returns, driven by strong demand, rising occupancy, and limited new supply.

-

Sunbelt sale: Bell Partners sold a 249-unit Pompano Beach apartment complex to Advenir for $60.9M.

-

Soft climb: Multifamily rent growth slowed in October 2025, with gains lagging inflation and the national year-over-year rate dropping to its lowest point since April 2024.

🏭 Industrial

-

Share your insights: Early rate cuts have lifted sentiment but market uncertainty lingers; share your take in our Q4 2025 CRE sentiment survey.

-

Storage ambitions: Blue Vista is teaming up with Unified Global in a $600M bid to dominate U.S. self-storage.

-

Regulatory reprieve: Equinix is off the hook after the SEC concluded its investigation into alleged accounting manipulation without pursuing enforcement action.

-

Debt reset: Brookfield has closed a $1.1B recapitalization of its U.S. logistics portfolio, refinancing with both CMBS and balance sheet loans.

-

Mega campus: Prologis will develop a 400MW data center and 100MW manufacturing campus on city-owned land in San Jose.

-

Capital hunt: Merritt Properties is seeking a $620M refinance for its 58-building industrial portfolio in the Baltimore region.

-

Asset evolution: Renewables, power, and digital infrastructure have overtaken transport as the top drivers of private infrastructure returns.

-

Industrial exit: EQT Real Estate sold 4.2M SF of U.S. logistics assets across 33 properties in two deals.

🏬 RETAIL

-

Retail reset: Luxury retail rents are stabilizing after years of surging growth, with Manhattan leading the evolution.

-

Chicago surge: Suburban Chicago retail centers are drawing investor interest again, as Barings, Core Acquisitions, and Core Equity Partners close over $120M in shopping center deals.

-

Mall makeover: San Francisco’s largest mall is being marketed as a mixed-use redevelopment opportunity amid a downtown revival and ongoing retail decline.

-

Retail catalyst: H-E-B is kickstarting a $10B Denton development with a new store, leading 9,000 planned homes and major commercial growth.

-

Balance sheet boost: Retailers are increasingly using sale-leasebacks to unlock capital for growth, debt reduction, and acquisitions amid tight credit markets.

🏢 OFFICE

-

Office drift: U.S. office markets remain sluggish with 18.6% vacancy and cautious construction, as hybrid work and regional shifts stall recovery.

-

AI anchor: Nvidia has leased an entire floor at San Francisco’s Mission Rock, extending its real estate push amid booming AI sector demand.

-

Celebrity commitment: UTA renewed its full-building lease at Beverly Hills’ UTA Plaza, signaling confidence in top-tier office space despite broader LA challenges.

-

District dynamics: Midtown Manhattan and NYC’s Financial District top a new global ranking of business districts.

-

Flatiron focus: Olmstead Properties has returned to acquisitions with a $104M purchase of two Park Avenue South office buildings, its first buy since 2016.

🏨 HOSPITALITY

-

Laugh land: Comedian Nate Bargatze is scouting investors and land for a family-friendly theme park in Nashville.

-

Deep discounts: A wave of Manhattan luxury hotel sales—many at steep discounts—is being driven by debt pressure, rising costs, and limited refinancing options.

A MESSAGE FROM JBREC & CRE DAILY

What’s your Q4 Outlook?

Early rate cuts have boosted sentiment, but uncertainty remains around pricing, leasing, and credit availability. As the macro picture evolves, we want to hear your perspective in our Q4 2025 Fear & Greed CRE Survey.

It only takes a few minutes, and as always, your responses are completely anonymous.

As a thank-you, we’ll send you a full breakdown of the results—so you can stay a step ahead of shifting market sentiment. You’ll also get our Hold vs. Sell Deal Analyzer. It's a quick tool that helps owners decide whether to hold or sell, cutting out guesswork, delays, and costly consultants.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

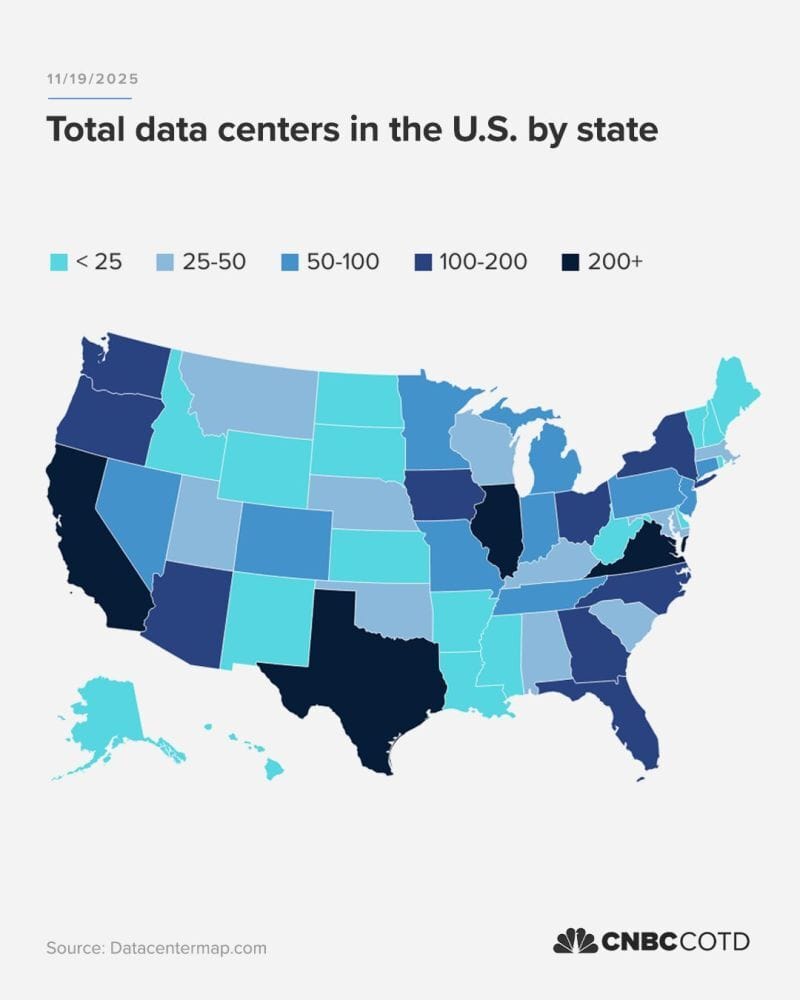

📈 CHART OF THE DAY

Data centers are heavily concentrated in Virginia, Texas, and California, with Virginia leading by a wide margin—home to the highest number in the U.S. and even the world.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |