CRE Prices Hold Steady in Q2 as Market Finds Its Balance

Flat prices and a surge in transaction volume signal that commercial real estate is finally regaining its balance.

Good morning. After years of volatility, the commercial real estate market is showing signs of settling—prices held steady in June and sector trends hint at a return to normalcy.

Today’s issue is brought to you by FarmTogether—diversify your portfolio with income-producing farmland.

🎙️This week on No Cap Podcast, Sage Realty CEO Jonathan Kaufman Iger joins us for a deep dive into how he’s transforming a century-old legacy into a modern CRE brand.

Market Snapshot

|

|

||||

|

|

*Data as of 07/25/2025 market close.

Hard Costs

CRE Market Finds Its Footing with Flat Prices and Rising Deal Volume

Stability may not grab headlines, but in Q2, flat prices and a surge in transaction volume signal that commercial real estate is finally regaining its balance.

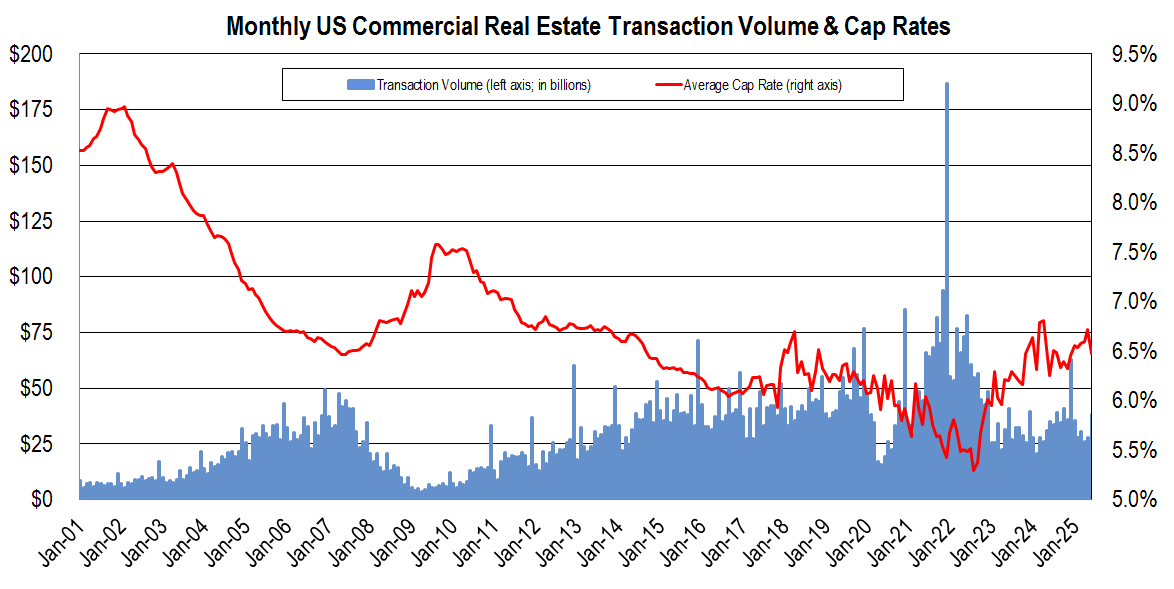

Holding the line: According to MSCI’s Q2 report, the RCA CPPI US National All-Property Index showed no movement from May to June and just a 0.7% drop year-over-year. While not a dramatic recovery, analysts say the stability suggests CRE may finally be adjusting to higher interest rates and moving past pandemic-driven disruptions.

Deals getting done: CRE deal volume surged in Q2, with revised data pointing to a potential 29.6% YoY gain—well above expectations—driven by strong activity in retail, industrial, and office. Average cap rates dipped to 6.48% in June, with notable compression in office (-32bps) and apartments (-18bps).

MSCI

Multifamily on the rebound: Multifamily properties saw their first annual price increase since 2022—albeit just 0.1%. The segment's value held flat from May, dipped 0.2% since March, and remains 18.5% below its 2022 peak. MSCI credits recent stabilization to last year's rate cuts, which eased some pricing pressures.

Office market remains sluggish: Prices dropped 1.9% from June 2024, with central business district (CBD) offices falling 4.2%—double the 2.1% drop in suburban markets. However, the narrowing spread between CBD and suburban office losses marks the closest performance alignment since mid-2022.

Retail and Industrial remain resilient: Retail led all sectors with 3.5% annual price growth, holding steady month-over-month and up 0.1% since March. Industrial followed with a 1.6% annual increase, gaining 0.3% from May and 0.5% from March. Despite broader economic headwinds, both sectors continue to show staying power.

➥ THE TAKEAWAY

The big picture: Flat isn’t flashy—but in today’s market, it's a win. As interest rates stabilize and select sectors regain footing, the market appears to be finding its balance—albeit slowly and unevenly.

TOGETHER WITH FARMTOGETHER

A Diversified Farmland Fund Built for Long-Term Income and Stability

In today’s uncertain real estate landscape, more investors are turning to real assets with long-term income potential and low correlation to traditional CRE.

FarmTogether’s Sustainable Farmland Fund provides diversified exposure to U.S. farmland across regions, crops, and operators—all through a single investment. The fund targets:

-

8–10% Net IRR

-

4–6% Net Annual Distributions

-

20–30% Target Leverage (50% cap)

-

Evergreen structure for ongoing access and broader liquidity

The fund is built for accredited investors seeking to complement their CRE portfolio with a stable, inflation-resilient hard asset historically under-allocated in most portfolios.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

-

Top CRE podcasts: Stay ahead in CRE with this curated list of the best industry podcasts every investor should be listening to. (sponsored)

-

Cost overrun: The Fed’s renovation of its DC headquarters has ballooned from $1.9B to $2.5B, driven by groundwater issues, historic preservation demands, and inflation.

-

Tipping point: Blackstone’s Q2 CRE investments shrank 37% year-over-year, but executives say market fundamentals are aligning for a recovery.

-

Wildfire toll: January's Palisades and Eaton fires caused nearly $52B in residential damage across 11K properties in LA.

-

Reshoring boom: Texas leads the US in reshoring jobs with over 40K positions added, as high-profile investments and trade policies drive industrial growth.

-

Zoning reform: A new bipartisan bill aims to increase the housing supply by requiring communities that receive federal grants to report or plan for reducing restrictive zoning.

-

Tariff burden: Corporate America is absorbing most of the $55B in new US tariffs, with companies like GM, Nike, and Walmart holding off price hikes.

🏘️ MULTIFAMILY

-

Rental shift: Houston’s rental market is seeing a surge in single-family leases—up 5% YoY—while aging Class B and C apartments lose tenants.

-

Fee clarity: Greystar has launched a redesigned website featuring a new tool to calculate total monthly leasing costs, aiming to boost transparency amid regulatory scrutiny.

-

Juicy revival: IMT Residential redeveloped the former Sunkist HQ in Sherman Oaks into Citrus Commons, a mixed-use hub with 249 luxury apartments, office space, and two Trader Joe’s stores.

-

Refi lifeline: Despite high interest rates and political uncertainty, Chicago multifamily landlords secured $250M in refinancing deals.

-

Record fine: Bronx landlord Karan Singh has been hit with a $10M penalty—one of NYC’s largest-ever housing court judgments—for hazardous conditions and repeated tenant neglect.

🏭 Industrial

-

Surprising strength: Miami, Houston, and Minneapolis defy industrial forecasts with tight vacancies and rent growth, while oversupplied markets like Phoenix and San Diego lag.

-

Power play: Trump’s AI plan aims to supercharge U.S. data center development by slashing environmental reviews and promoting on-site natural gas power.

-

Factory frontier: Backed by Silicon Valley investors, California Forever is planning a 2,100-acre advanced manufacturing hub in Solano County, set to become the largest in the US.

-

Mexico milestone: Fibra Next, a logistics-heavy REIT spun off from Fibra Uno, raised $431M in Mexico’s largest IPO since 2018.

🏬 RETAIL

-

Forecast factor: Retailers and logistics players are turning to AI to forecast climate impacts and fine-tune supply chains.

-

Retail bet: Regency Centers dropped $357M on SoCal retail, betting big on strong demand and near-full occupancy.

-

Rural growth: Tractor Supply will open 100 new stores in 2026 after a record Q2 driven by strong demand and domestic sourcing.

🏢 OFFICE

-

Suburban edge: Suburban office loans are outperforming urban deals on credit metrics in 2025, with lower leverage, stronger DSCRs, and higher cap rates.

-

Fifth footprint: JAB Holding Co., owner of Krispy Kreme, has leased 11,600 SF at Manhattan’s new 520 Fifth Ave tower.

-

USDA downsizing: The USDA will relocate 2,500 employees out of D.C. and vacate three major facilities, including its 2.2M SF South Building.

-

Office buyout: Hedge fund affiliate MCME Carell is taking City Office REIT private in a $1.1B all-cash deal.

-

Mixed market: Recent office sales reveal a bifurcated landscape, with trophy assets still landing big deals while distressed properties trade at steep discounts.

🏨 HOSPITALITY

-

Brand exit: Virgin Hotel Chicago sold for $77M, a steep discount, hinting at a potential timeshare conversion by new owner Accelerated Assets.

-

App evolution: Airbnb is doubling down on “Experiences and Services” to become a full-trip platform, but scaling the model remains slow.

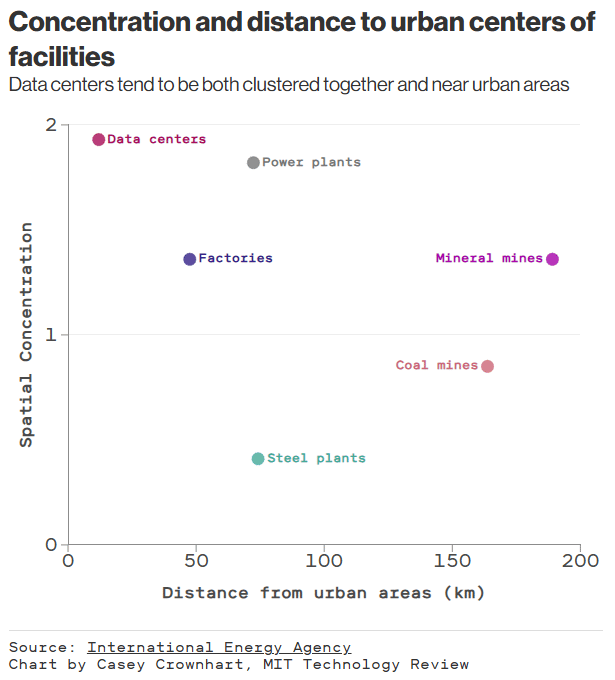

📈 CHART OF THE DAY

Data centers cluster near cities and each other, consuming large amounts of power and straining local grids, which account for up to 25% of electricity use in some regions.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |