Commercial Real Estate Poised for Cautious Recovery in 2026

CRE heads into 2026 with tempered optimism as capital flows return, office demand stabilizes, and industrial rebounds.

Good morning. Happy New Year! Here's to a 2026 filled with fresh opportunities, smart deals, and continued growth in CRE. Let’s hit the ground running! 🥂

Today’s issue is sponsored by Agora—the platform hundreds of real estate firms trust to automate operations and scale smarter.

📊 Our Q4 2025 Burns + CRE Daily Fear & Greed Index is now available. Explore investor sentiment, capital access, and sector-level outlooks shaping the 2026 CRE landscape.

CRE Trivia 🧠

What are the very last places in the world to ring in the New Year?

(Answer at the bottom of the newsletter)

Market Snapshot

|

|

||||

|

|

*Data as of 12/31/2025 market close.

2026 Outlook

Commercial Real Estate Poised for Cautious Recovery in 2026

After a bumpy 2025 marked by higher costs, a soft economy, and muted activity, commercial real estate is poised for a more stable—if not spectacular—year ahead.

Stabilizing fundamentals: The economy slowed in 2025, but falling interest rates are starting to unlock capital. CRE leaders expect modest revenue growth in 2026, despite rising costs. Analysts see the market entering a “new equilibrium” with firmer fundamentals.

Capital markets reawakening: Capital is returning to CRE as rates fall and investor confidence improves. Sales volumes are rising, cap rates are softening, and lenders are easing back in. With pricing largely reset, conditions are ripening for renewed deal activity in 2026.

Office signs of life: Office demand is ticking up, with vacancies expected to fall below 18% as tenants seek quality space. Construction is at a 30-year low, and top-tier buildings in major markets are nearly full. Cushman warns: premium space is limited—move quickly.

Industrial tightens up: Construction is down 63% since 2022, but demand is surging from reshoring, manufacturing, and data centers. Absorption could reach 220 million square feet in 2026 as vacancies peak, tightening the market.

Retail rethinks space: Retail is shifting into mixed-use settings, with smaller footprints and 26M SF leased in nontraditional spaces in 2025. Tariffs remain a threat, as rising costs could force price hikes and strain consumer spending.

Multifamily cools: Rent growth is slowing amid a flood of new supply. Multifamily remains a top asset, but may lose share in 2026 as capital shifts to other sectors.

Growth meets resistance: Data centers were the breakout star of 2025. Pre-leasing hit 100% in many markets in 2025, but community resistance and infrastructure hurdles are starting to stall future growth. Some projects are already being scrapped.

REITs set to rebound: After lagging in 2025, REITs may outperform in 2026 amid M&A activity and narrowing valuation gaps. AI-driven efficiencies and scale could boost momentum.

➥ THE TAKEAWAY

Navigating what’s next: CRE enters 2026 with clearer expectations and fresh capital momentum. Investors who stay agile and focus on data, quality, and AI-driven assets will be best positioned to benefit.

TOGETHER WITH AGORA

Hundreds of real estate firms trust Agora. See why.

Hundreds of real estate investment firms rely on Agora to streamline operations, automate workflows, and scale effortlessly. Outdated systems and manual processes create inefficiencies, Agora eliminates these barriers, providing firms with everything they need to operate smarter and grow faster.

With Agora, you can:

– Automate back-office processes to improve operational efficiency

– Strengthen investor relationships with the best investor experience

– Streamline financial operations with automated reporting, distributions, and tax solutions

– Simplify investment management with CRM, data rooms, and investor onboarding tools

Experience the future of real estate investment management.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

-

Level up in 2026: From fast-track analyst programs to elite university certificates, these top CRE courses will sharpen your skills and elevate your career in the year ahead.

-

Regional revival: Slowing job shifts and income gains set the stage for a more balanced, affordable housing market in 2026, with non-traditional cities like Detroit and Buffalo poised for a comeback.

-

Materials mess: Copper prices are soaring to decade highs as tariffs, supply shocks, and rising demand converge.

-

Foggy forecast: Conflicting signals from GDP and labor market reports have economists, including former White House adviser Jason Furman, unsure whether the U.S. is heading for a recession or riding a boom.

-

Ball drop destination: Jamestown unveiled a $550M revamp of One Times Square, transforming the historic New Year’s Eve tower into a year-round tourist destination.

🏘️ MULTIFAMILY

-

Rent control: Los Angeles enacted its first rent-control overhaul in 40 years, capping hikes at 4% to curb housing costs.

-

British buy-in: UK-based Legal & General continues its U.S. multifamily push with a $97M acquisition in suburban Denver, marking its fourth major apartment purchase in a year.

-

Bankruptcy buyout: Summit Properties agrees to acquire 5,000 distressed, rent-stabilized NYC apartments for $451M in a court-driven sale.

-

District debut: CEDARst Cos. broke ground on an $82M multifamily project in the Las Vegas Medical District, marking the first residential development in the neighborhood.

🏭 Industrial

-

Warehouse woes: U.S. industrial construction starts plummeted 62% YoY in November, as a once-hot sector cools rapidly under rising costs, tight financing, and cautious developer sentiment.

-

Tech takeover: SoftBank will acquire data center investor DigitalBridge for $4B in cash, doubling down on AI infrastructure as global tech giants pour hundreds of billions into data center development.

-

Queens claim: Terreno Realty has leased its revamped 48K SF Long Island City industrial site—formerly owned by UPS—to a rigging contractor.

-

Postal property: Westfield and RGA sold a 450K SF USPS-leased warehouse in Avondale, AZ, for $89.8M, as Phoenix industrial investment remains red-hot.

🏬 RETAIL

-

Borrowed time: Consumers are still spending, but credit reliance, weak confidence, and rising costs suggest the momentum may not last.

-

Deal collapse: The $947M sale of 117 JCPenney stores to Onyx Partners has collapsed after a missed deadline, triggering a legal battle and forcing Copper Property Trust to restart its liquidation process.

-

Snack attack: Japanese snack chain Onigilly is plotting a major U.S. mall expansion, betting its 300 SF Onigiri kiosks can win over American shoppers.

-

Untapped potential: Gen X, though under-marketed, leads in per-trip and luxury retail spending, offering untapped short-term potential for retailers.

🏢 OFFICE

-

Billionaire buyers: Amancio Ortega’s $274M cash purchase of a Brickell tower led South Florida’s 2025 office deals in a year defined by distress, discounts, and debt-free buyers.

-

Growth spurt: AI firms drove a 2025 office rebound, with major leases fueling demand and reviving markets like San Francisco.

-

Suburban steal: Tryperion Holdings snagged the well-leased Mid America Plaza near Chicago for $59M, nearly 25% below its 2016 sale price.

🏨 HOSPITALITY

-

Deal detour: The 2025 U.S. hotel transaction market fell short of early optimism, as pricing gaps and economic uncertainty slowed activity.

-

Market mismatch: The 2025 U.S. hotel deal market stumbled midyear due to tariffs and slow Fed cuts but rebounded as buyer-seller price gaps narrowed, liquidity returned, and investors like Gencom closed big-ticket transactions.

-

Resort rejected: A long-contested 100-acre waterfront site in Aquebogue, once eyed for a 500-room resort, is now permanently protected after New York State secured an $11M conservation easement to block future development.

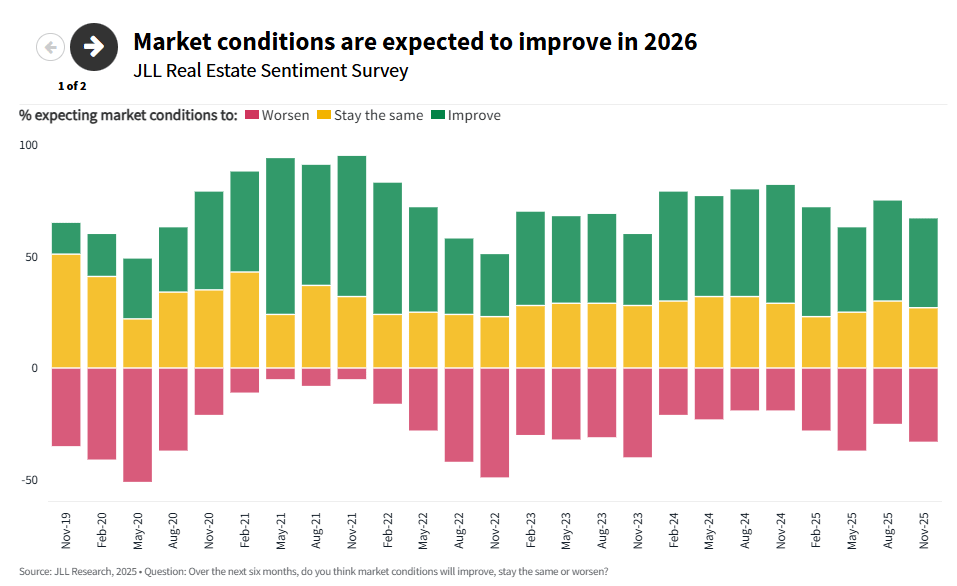

📈 CHART OF THE DAY

Source: JBREC and CRE Daily

JLL expects CRE conditions to improve in 2026, driven by lower interest rates, stronger leasing demand, limited new supply, and rising investor activity across key global sectors.

CRE Trivia (Answer)🧠

The uninhabited U.S. territories of Baker Island and Howland Island are the last places to ring in the New Year due to their location near the International Date Line.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |