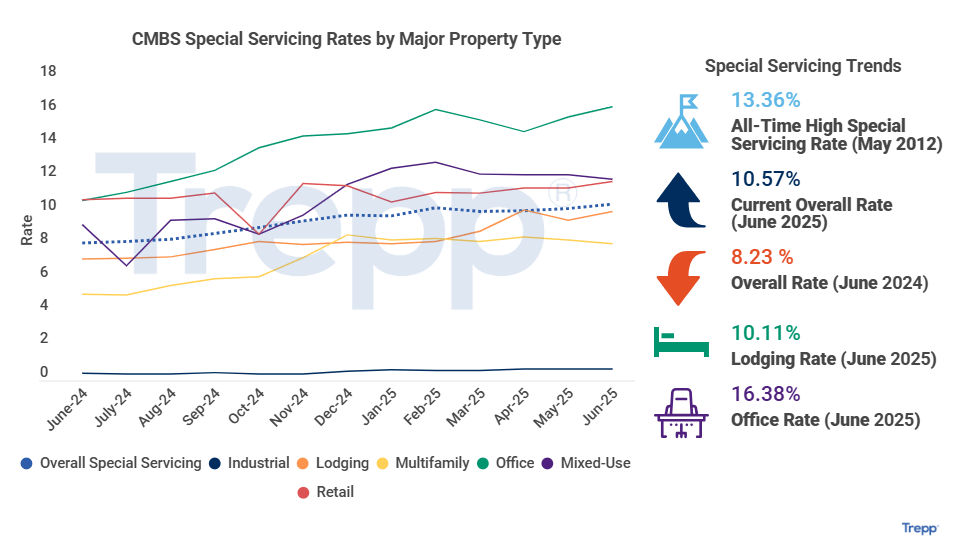

CMBS Special Servicing Rate Surges to Highest Level Since 2013

The overall special servicing rate rose by 27 bps MoM, marking the third consecutive monthly increase and a 225 bps surge YoY.

Good morning. Special servicing rates are on the rise again, hitting their highest level since 2013. Trepp’s latest report reveals which property types are under the most stress—and why the office sector continues to drag the market down.

Today’s issue is brought to you by Agora—one solution for all your investment management needs.

🎙️This week on No Cap Podcast, RockStep Capital CEO Andy Weiner breaks down why the retail apocalypse was overblown and how his team is turning forgotten malls into durable cash flow machines.

Market Snapshot

|

|

||||

|

|

*Data as of 07/10/2025 market close.

SPECIAL SERVICING

CMBS Special Servicing Rate Surges to Highest Level Since 2013

June’s figures from Trepp show the CMBS special servicing rate continuing its upward trajectory, hitting 10.57%—a level not seen in over a decade.

Distress leaders: Special servicing rose 27 bps in June—its third straight monthly increase and up 225 bps YoY. Office led with a 62 bp jump to a record 16.38%, followed by retail (+41 bps to 11.93%) and lodging (+54 bps to 10.11%).

Rare bright spots: Multifamily and mixed-use were the only two property types to see improvement. Multifamily dropped 25 bps to 8.18%, while mixed-use fell 28 bps to 12.05%, offering modest signs of resilience amid broader distress.

Office dominates: June saw $2.9B in new transfers to special servicing across 70 loans, led by $1.7B in office debt. Lodging ($712M) and retail ($361M) followed. Two large loans made up over $1B, including the $590.3M Ashford Highland lodging portfolio and NYC’s 1440 Broadway office loan with a 0.15x DSCR and 59% occupancy.

A tale of two vintages: CMBS 1.0 loans—issued before the 2008 financial crisis—are faring significantly worse, with a staggering 67.28% in special servicing. In contrast, CMBS 2.0+ loans sit at a more manageable (but rising) 10.46%. The contrast highlights the improvements in underwriting and structural reforms implemented following the crisis.

➥ THE TAKEAWAY

Mixed outlook: Office stress continues to dominate CMBS distress headlines, and the outlook for legacy assets looks grim. However, multifamily’s minor recovery and the stability of post-2008 CMBS vintages suggest that disciplined underwriting and diversified portfolios remain critical to weathering the turbulence ahead.

TOGETHER WITH AGORA

Hundreds of real estate firms trust Agora. See why.

Hundreds of real estate investment firms rely on Agora to streamline operations, automate workflows, and scale effortlessly. Outdated systems and manual processes create inefficiencies, Agora eliminates these barriers, providing firms with everything they need to operate smarter and grow faster.

With Agora, you can:

-

Automate back-office processes to improve operational efficiency

-

Strengthen investor relationships with the best investor experience

-

Streamline financial operations with automated reporting, distributions, and tax solutions

-

Simplify investment management with CRM, data rooms, and investor onboarding tools

Experience the future of real estate investment management.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

-

High-yield farmland: Landmark Mandarin Grove, an 80-acre California citrus property, is now accepting investments from accredited investors. Target net IRR: 11.1%. Target net cash yield: 9.4%. (sponsored)

-

Fed focus: Despite rising CMBS delinquencies, the Fed sees stabilizing CRE markets with steady loan growth and tightening credit spreads.

-

Price support: Builder-funded mortgage buydowns are propping up US home prices, with Morgan Stanley estimating homes could be up to 12% cheaper without them.

-

Rent rebound: SFR rents edged up 1.7% in early 2025, led by sharp increases in the Midwest and Northeast, even as vacancy rates hit a nine-year high.

-

Inflation uptick: Inflation rose to 2.7% in June as tariffs began pushing up prices on goods like furniture and clothing.

-

Style snapshot: An analysis of active US home listings reveals clear trends in how architectural styles differ by price, size, location, age, and appreciation.

-

Energy auction: BLM will auction 13 geothermal parcels in California this August to boost clean energy development.

-

Million dollar divide: What $1M buys varies wildly, from sprawling barns in the Midwest to modest condos in pricey coastal cities.

🏘️ MULTIFAMILY

-

TOPA tension: DC Council postponed a vote on rental reform amid disputes over tenant rights and eviction changes.

-

Eastward expansion: Cityview is entering East Coast markets like Boston, Atlanta, and Orlando with a focus on workforce housing.

-

Housing overhaul: California will establish a standalone housing agency with a new Affordable Housing Finance Committee, aiming to streamline development processes.

-

Austin in balance: Home listings in Austin have jumped nearly 70% since 2019, signaling a shift toward a more balanced housing market.

🏭 Industrial

-

Supply bet: Brookfield bought 53 light industrial buildings for $428M, betting on demand from US onshoring.

-

Urban revival: Cities are easing zoning rules to welcome small-scale manufacturers back into urban neighborhoods.

-

AI arms race: Meta plans to spend hundreds of billions on AI infrastructure, building multiple Manhattan-sized data center campuses.

-

Build boom: Avison Young says Trump’s new tax and funding law could spark a surge in U.S. industrial development.

-

Chicago conversion: Bridge Industrial plans to buy and demolish Chicago’s Ford City Mall, replacing it with a $150M, 913K SF logistics campus.

🏬 RETAIL

-

Vacancy uptick: Vacancy ticked up to 4.3% in Q2 as leasing slowed and rents edged down, but supply remains tight.

-

Asset chase: Retail real estate investment is surging, with $24.6B in sales through May and institutional capital returning aggressively, especially for grocery-anchored and value-add centers.

-

Maker movement: Zoning changes are fueling a rise in artisan businesses, reshaping urban retail and industrial space.

-

Securitized subs: Jersey Mike’s is issuing $400M in asset-backed securities tied to franchise fees and trademarks, aiming to return capital to majority owner Blackstone.

🏢 OFFICE

-

AI disruption: AI is driving companies to lease less space, favor flexibility, and prioritize high-quality, collaborative offices.

-

Tall ambitions: Hines is planning the West Coast’s tallest tower in San Francisco, signaling optimism despite high office vacancies.

-

Distress watch: Savanna missed the maturity deadline on a $463M loan tied to 5 Bryant Park, as rising costs and falling income put the Midtown tower’s debt underwater.

-

Leadership tension: The White House is ramping up efforts to oust Jerome Powell, citing the Fed’s $2.5B HQ renovation as potential cause.

🏨 HOSPITALITY

-

Hotel hotspot: New York City’s hotel market continues to outperform the nation with high occupancy and strong revenue.

A MESSAGE FROM WARESPACE

We’re deploying $500M to acquire industrial properties.

WareSpace is the next generation of small-bay industrial—co-warehousing designed for small and growing businesses. One simple monthly payment covers everything: property tax, utilities, equipment, racking, shared-kitchens, conference rooms, etc. The kind of features small businesses actually want.

We’re actively acquiring flex, industrial, office, and big box retail properties (50K–250K SF) with $500M in capital ready to deploy.

We’re targeting:

-

Immediate or near-term vacancies

-

Class A–C assets with loading docks or drive-ins

-

Transitional properties that need capex

All-cash closings. Fast timelines. And now offering a $1/SF broker bonus on every deal.

Yes, you read that right—$1 per square foot as a direct broker incentive, on top of standard market commissions. Offer valid for all deals closed before 12/31/25.

Have a deal? Send it to VP of Acquisitions, Jeff Jenkins at [email protected].

We close fast, pay cash, and move quickly. Let’s make a deal!

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

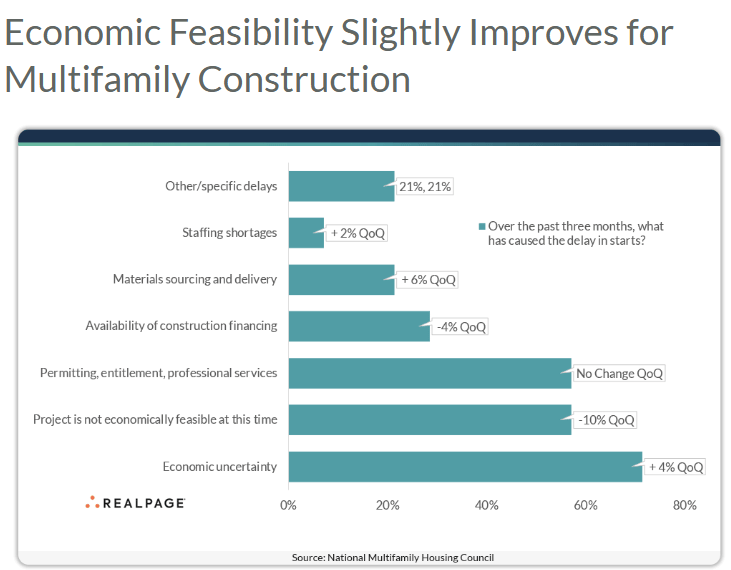

📈 CHART OF THE DAY

Economic feasibility for multifamily construction showed modest improvement in June 2025, with fewer developers citing delays, though economic uncertainty and permitting hurdles remain significant roadblocks.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |